Money is the cornerstone of survival for everyone. Be it an individual, business or government, financial matters have always been essential. Today, we have a cash and digital finance system. That includes cryptocurrency, stablecoins, and CBDC meaning Central Bank Digital Currencies.

Cryptocurrency and stablecoin go parallel with a specific difference. Stablecoins are pegged or balanced with fiat currency, such as the US Dollar bill. However, what is a Central Bank Digital Currency?

As the name implies, CBDC is a currency that a central bank of a country offers just like cash. Though it comes with several benefits and drawbacks. In this guide, you will read about multiple aspects of digital currencies, which are:

- Central Bank Digital Currency (CBDC)

- Cryptocurrency and stablecoins,

- Key differences between CBDC and cryptocurrency

- Digital currency in modern finance,

- What do CBDC and cryptocurrency mean for the future?

Continue reading and you will end up understanding these topics in detail.

Digital Currency in the Modern Age

Digital currencies have transformed the ecosystem of money. In 2009 when Satoshi Nakamoto developed Bitcoin, financial experts forecasted cryptocurrency as the biggest competitor to fiat currency.

Some also labeled cryptocurrency as the crusher of the cash system. However, it is not the same. Cryptocurrency exists alongside fiat currency as well as other digital financial systems.

What are the benefits of digital currency in the modern financial ecosystem? There are multiple perks of introducing digital financial instruments. We’ve covered them down below:

- Faster Payments: In everyday life, we come across different deals and product exchanges. Payments are an essential component of business deals. With digital currency going mainstream, payments and transactions have become effortless for everyone. Statista suggests that digital payments have reached up to $11.53 trillion so far. From cryptocurrency to CBDC, many global enterprises accept digital payments for the exchange of products.

- Cost-Effective International Transactions: International transactions through banks are costly and time-consuming processes. It takes ages for banks to verify and approve transactions. Consequently, users have to pay high fees for this pursuit. On the contrary, the digital currency has transformed borderless transactions with instant payments and cost-effective transactions due to blockchain technology.

- Round-the-Clock Operations: Digital currency is integral for effective financial matters. Since banks don’t operate 24/7, it becomes hectic for consumers to indulge in financial transactions all the time. Digital payments burn the bridges for consistent and restless business.

- Blur the Line Between Banked and Unbanked Users: A bank account is the primary requirement for a person to perform any sort of financial matter. The number of unbanked and underbanked users is exceptionally high around the world. According to the World Economic Forum, around 1.7 billion of the global population is unbanked.

- Efficient Institutional Payments: Government payments are essential as well. For instance, tax filing, children’s benefits, educational payments, etc., are pivotal and inevitable. In this case, CBDC opens the right pathway for everyone to embrace comfort in financial means. Be it a banked and unbanked population, everyone requires an effortless financial system.

What is CBDC?

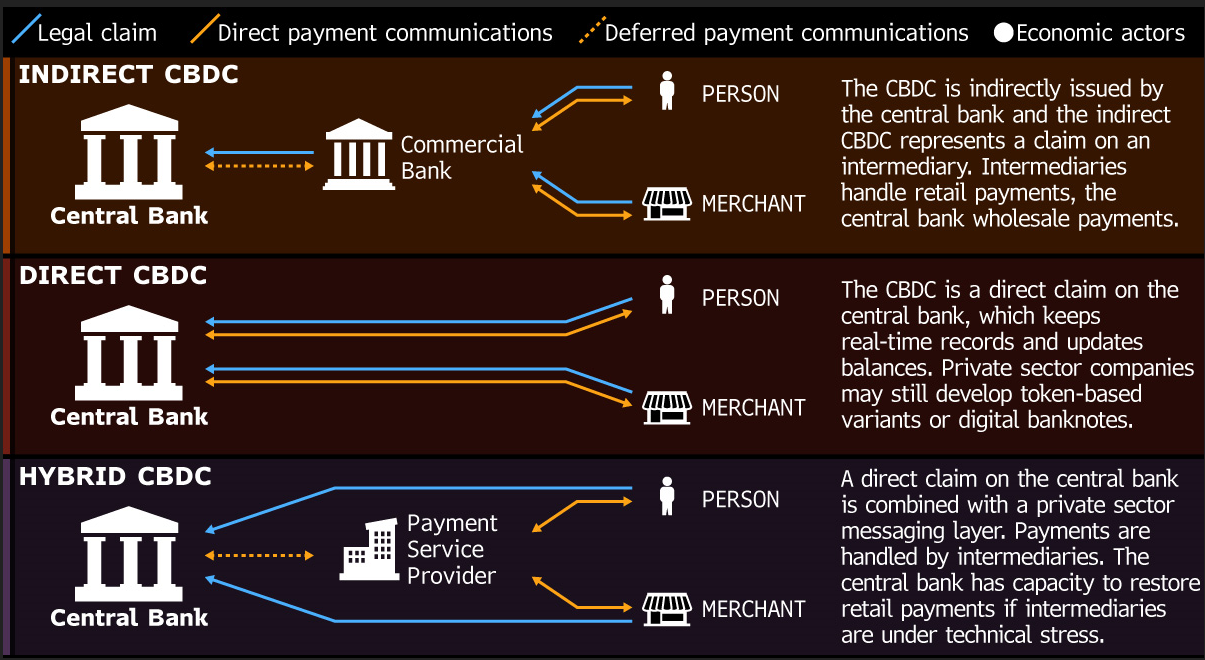

Central Bank Digital Currency (CBDC) is one of the most innovative forms of financial means. CBDC is centralized and involves censorship from the central bank. The central bank of a country issues CBDC, inviting the public and authorities to be involved in financial matters, such as trading, transactions, etc.

It functions similarly to fiat currency like dollar bills, cash, and many more. However, CBDC is effective in improving the speed of transactions, minimizing the cost of payments, and backing up physical money.

You can understand CBDC much better by imagining it this way. Suppose Bitcoin exists and a country’s central bank is backing it up and regulating it on the backend. However, this is not the reality as Bitcoin is a cryptocurrency, which is completely decentralized and censorship-resistance. But CBDC is completely centralized with features of cryptocurrency.

Read about Smart Contracts.

How Does It Work?

CBDC is a digital currency which is different from electronic payments, such as PayPal or ACH transfers. The working of CBDC is simple. When you have physical cash like a US dollar bill, you can keep it or spend it the way you want. On the other hand, electronic payments are merely a promise with PayPal.

You transfer a certain amount of electronic money to another person’s account. However, it is not an instant transfer. It is the promise between two different banks or payment gateways to make the transfer.

How does Central Bank Digital Currency work? CBDC is just like real money. A dollar bill has specific reserves in the bank that the US government issues. The same goes for CBDC as well. The US bank will keep reserves in the central bank against the US CBDC that the US central bank will issue to the public. The public can use it for any purpose, including payments, transactions, trading, etc.

CBDC vs. Fiat Currency

Before we talk about the difference between CBDC and fiat currency, be mindful that you can’t revoke the CBDC payment once you make it. Fiat currency is the normal means of payment in today’s world.

Due to several reasons, fiat currency is no longer a reliable payment option in many places, especially in the modern business ecosystem. Fiat currency like cash is difficult to carry and hectic for making transactions. Fiat currency is also associated with inflation, which is the devaluation of money over time.

Central Bank Digital Currency is the innovation in the financial landscape that modernizes payment infrastructure. CBDC streamlines digital transactions by speeding up the payment options. Moreover, it reduces dependency on fiat currency.

CBDC and Banks: How Banks Look at CBDC?

Money supply and inflation are a headache for banks and central authorities. Banks are in constant efforts to bring changes to the financial protocols. CBDC is effective in stabilizing the economy.

Banks love centralized digital currencies, including CBDC, electronic payments, etc. CBDC improves and refines the functionality of banks. It helps in smoothing monetary policy, money supply, interest rates, and many more economical sides.

This way, banks get an edge over finances. Thus, they can bring tighter and more efficient regulatory policies. As users and businesses need reduced transaction costs and time, they fancy CBDC due to centralization and regulation.

Types of CBDC

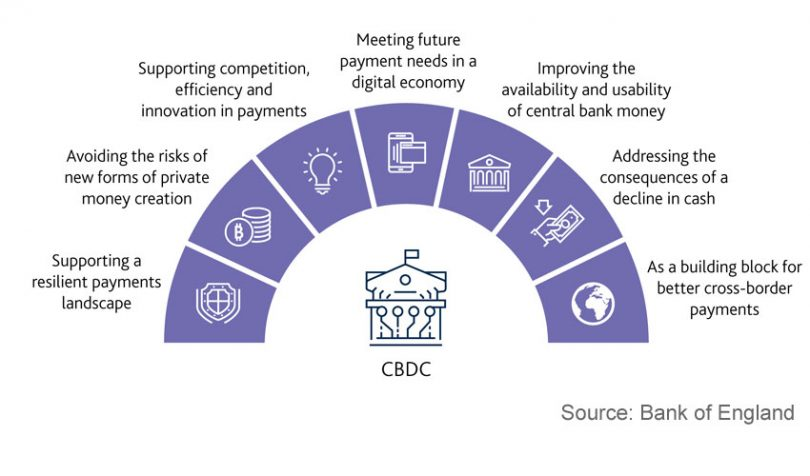

Central Bank Digital Currency paves the way to ensure stability, economic growth and control inflation. You can understand the utility of CBDC when you explore its types. They are as follows:

- Retail: So far, we have covered everything about Retail CBDC. In simple terms, a retail CBDC is the central bank’s issued coin or currency for the public to engage in exchange and trade. Retail CBDC can be of two types, including Token-based retail and account-based retail CBDC. Token-based retail means anonymous transactions while account-based retail CBDC necessitates digital ID for transactions.

- Wholesale: As the name suggests, wholesale CBDC refers to buying reserves in a central bank and holding them. The more you hold, the higher you will earn from your assets. Central banks can benefit by allowing institutions to open an account for wholesale CBDC holdings. They earn by implementing monetary policies, such as interest and influence lending.

What Is Cryptocurrency?

Cryptocurrency is the most volatile and fully decentralized virtual currency. Blockchain is the core of crypto and web3 technology, including non-fungible tokens (NFTs). Due to a lack of centralization and authority interference, crypto users enjoy anonymity and privacy.

According to Statista, the cryptocurrency market is around $56.7 billion with an 11.05% user penetration rate. This rate implies that crypto is growing exponentially and going mainstream. Since global businesses are stepping forward to accept crypto as a payment option, its market size will reach a whopping value.

Today, there are hundreds of cryptocurrencies. As the number of blockchain developers increases, crypto projects or tokens also go up over time. Bitcoin is the largest crypto token, followed by Ethereum and others. However, small tokens or new coins offer the most lucrative opportunity to day traders and investors.

How Does It Work?

Cryptocurrency is built on top of a blockchain. To understand how cryptocurrency works, let’s explore how a blockchain functions. Blockchain is a decentralized ledger that stores information and data securely.

With the addition of further data, a new block is created on top of a blockchain to keep the chain of record. Therefore, a blockchain stores the record of transactions without missing a single entity.

Cryptocurrency leverages the power of blockchain’s decentralization and tamper-proof transactions for payments. When a user invests in cryptocurrency or buys a crypto token, such as Bitcoin (BTC), it will be transferred to a crypto wallet that utilizes blockchain decentralized ledger. Thus, its transactions are faster, more reliable, and cost-effective.

Explore a complete guide about Decentralized Apps (dApps).

How Is CBDC Different from Cryptocurrency?

|

Central Bank Digital Currency |

Cryptocurrency | |

|---|---|---|

|

Features |

Centralized currency of a government’s central bank |

Decentralized and censorship-free virtual currency on blockchain technology |

|

Perks |

Effortless digital transactions and stable financial asset |

The best option for peer-to-peer transactions, free from intermediaries, and a lucrative option for trade and investment |

|

Adversaries |

Target for cyber criminals and limited to highly digitalized areas |

Risk of financial loss due to high volatility and restrictions from governments and authorities |

|

Examples |

|

|

We all know that both CBDC and cryptocurrency are digital currencies. A central bank controls the former while there is no such control and regulation in cryptocurrency. It creates a sense of similarity between these financial instruments but they have multiple contrasts.

They are contrasting in terms of underlying principles and use cases. Among the modern digital currencies, cryptocurrency and stablecoins are the most famous and widespread. But it doesn’t mean that Central Bank Digital Currency is any less in value and functionality than crypto.

Let’s quickly overview the main differences between cryptocurrency and CBDC.

1. Centralized and Decentralized Finance

Centralization refers to handing control and authority to a specific organization or institution to look after a specific coin. Since the Central Bank is responsible for the issuance and regulation of CBDC, it is centralized and censored.

On the other hand, cryptocurrency is a completely decentralized financial method that restricts any financial or government body from intervening in its affairs. In other words, the person who mines and creates a crypto token is the owner and controller of the created asset.

Bitcoin, Ethereum, Litecoin, and any other cryptocurrency are decentralized. Be mindful that some crypto projects have also considered bringing centralized aspects into their creation. For instance, Exchange-Traded Funds (ETFs) of a crypto, such as Ethereum ETFs are centralized up to some extent.

2. Stable and Valuable Finance

Stability and value are essential to determine the value of a specific financial tool. We can compare CBDC and cryptocurrency in terms of stability and value to find out the contrast. Stability refers to a reduced price fluctuation or market performance of an asset.

Given this definition, we can conclude that CBDC is highly stable. Since the CBDC relies on the central bank of a country to determine its value, the collateral reserves on the back of that CBDC will forecast its value. Usually, a country secures its reserves for a stable economic atmosphere. Consequently, CBDC will also be secure without any sudden price fluctuation.

On the contrary, cryptocurrency is a highly volatile asset. It is due to the lack of pegged reserves in a specific institution. Cryptocurrency is free from organizational interference and control, it lacks guarantee in price and value. Sometimes, the price may go higher with a quick plummet in the next moment.

3. Public and Private Money

The core reason for the creation of CBDC is to contradict the uncontrolled performance of cryptocurrency. Though cryptocurrency is a whole new ecosystem, CBDC design doesn’t support what crypto does.

The design of CBDC can offer various levels of privacy. Since different countries issue varying CBDCs as per their central banks’ design, the extent of privacy features can change from bank to bank. Some may offer privacy on transactions while others will allow audits for regulatory oversight.

In this regard, cryptocurrency is entirely the opposite of CBDC. Anonymity and pseudonymity are the top features of crypto tokens. Blockchain is famous for anonymous transactions. Therefore, governments and banking institutions revolt against crypto because of anonymity, calling it the leading source of cyber crimes.

4. Market Usability

Use cases of applications clarify the functionality of an innovation. It is clear that CBDC offers utility in improving and strengthening the monetary policies of a country. CBDC will be the right addition for any economy to fight against inflation, low money supply and slow transactions.

On the other hand, the sole purpose of creating crypto was to cut off the dependency on traditional financial systems, such as fiat currency. Though traditional finance is still in mainstream usage, cryptocurrency has offered multiple applications and benefits.

That includes crypto trading and investing for profits and income. On top of that, it has streamlined international and borderless transactions at minimal costs. Cryptocurrency has also eased digital ownership via NFTs, web3, etc.

5. Scalability

The speed and higher rate of transaction is scalability. Moreover, scalability is the expansion of a product or service in terms of users. Scalability in cryptocurrency varies from blockchain to blockchain. For instance, Ethereum 2.0 is highly scalable due to its 100,000 transactions per second.

In this regard, cryptocurrency is more scalable than CBDC. However, CBDC has a higher global acceptance due to support from the central bank. This cements the idea of regulation and safety among users, which is absent in the case of cryptocurrency.

6. Regulatory Concerns

In terms of regulatory approaches, cryptocurrency is the most targeted financial asset in almost every area of the world. Since it poses a huge threat to the centralized financial ecosystem of the world, banks and government institutions are against crypto.

Therefore, crypto projects will come under the regulatory oversight of an authoritative body. It is also essential to note that a crypto token is never under regulatory concern, but the crypto exchange may bear the consequences of lawsuits and regulatory actions.

On the contrary, Central Bank Digital Currency (CBDC) may not face such strict actions. Be mindful that this statement is different for various jurisdictions or countries. For instance, China, the Caribbean, and other countries have embraced the potential of both crypto and CBDC. Many nations have yet to offer their support for these innovative technological assets.

7. Monetary Policy Control

The economic atmosphere is prone to swift and sudden changes. Inflation and other monetary activities can adversely impact a nation’s financial well-being. In this regard, central banks have an additional tool to rectify these shifts through CBDC.

For instance, CBDC offers liquidity and negative interest rates to an economy. Central banks can utilize these features to improve their economy by getting out of the financial crisis. On top of that, direct stimulus provision and direct access to financial data are other features of CBDC that facilitate banks to a greater extent.

Cryptocurrency lacks these features due to decentralization, making it a liability for governments and central banks. Therefore, crypto projects face consistent backlash from the government and central authorities.

CBDC vs Stablecoins

Stablecoin is another form of digital currency. A stablecoin comes with a mixture of centralization and decentralization. Let’s say Tether as our example for stablecoin. Tether (USDT) is a stablecoin and a cryptocurrency. It has every feature that other crypto tokens have.

The most important point of Tether is its centralized feature, which is its pegging or matching value to a fiat currency. Since Tether is pegged with a USD, its value stays consistent with the US dollar.

The main difference between a CBDC and stablecoin is the mixed and centralized nature. CBDC is completely centralized while a stablecoin is decentralized with a flair of fiat currency. Other examples of stablecoins are:

- USDC

- Dai

- FDUSD

- Frax Finance

- PAXG

- TUSD

Pros and Cons of CBDC

Pros

- Minimal Liquidity Risks: Liquidity and credit risks are common with cryptocurrency and other digital currencies. Liquidity risk means the extent to which a company converts its assets to cash for the cash flow cycle. CBDC reduces that risk so that you never lose your assets.

- Lower Fees on International Payments: CBDC brings global access to the table for its users. You can make international trades and transactions on the go without going into deep pockets.

- Supports Monetary Policies: CBDC is the best option to transform a country’s financial policies and fight against economic crises, such as inflation, monetary deficit, etc.

- Finance for the Public: CBDC has converged its operation for the public. It means that anyone can access CBDC if their country’s central bank has issued CBDC. Be it banked or unbanked individuals, anyone can buy or own CBDC assets.

Cons

- Cyber Threats: With the rise of digital resources, cybercriminal activities have reached new heights. Crypto projects have faced multiple attempts from social engineers and hackers. The same can happen for CBDC which is a weaker security infrastructure than blockchain.

- Drastic Change in the Financial System: The direct change from fiat currency to CBDC means a pool of financial problems and crises. For instance, if a large group of people convert to CBDC, the central bank will run out of resources to facilitate withdrawals and transactions.

Conclusion: The Future of CBDC and Cryptocurrency

Though cryptocurrency and CBDC are key innovations, what does it mean for the future of finance? The future of finance depicts the image of fast, reliable, and effective payments and transactions.

Since CBDC is all set to offer improved financial and monetary policies to the government, it will be key to transforming the economic landscape of a country. Cryptocurrency is also a futuristic innovation.

Crypto is not just a tool of finance but a complete suite of tools for financial excellence. The comfort and savings it offers in international transactions are an addition to the economic growth of a country. Therefore, we and central authorities should acknowledge these financial instruments and benefit extensively from their use cases.

FAQs

Will CBDC replace cryptocurrency?

CBDC and cryptocurrency are both innovative solutions. Financial experts suggest that CBDC can’t replace crypto because crypto is one of the most popular and lucrative digital currencies.

What are the drawbacks of Central Bank Digital Currencies?

CBDC can be the leading target for cybercriminals due to its digital functionality. Furthermore, it can create an issue for the government if a huge crowd embraces it at the same time.

Is cryptocurrency the future of finance?

Cryptocurrency can become the future of finance due to its security, scalability and other features. However, the consistent backlash from regulatory authorities is the leading barrier that crypto has to tackle.

What are the benefits of digital currency?

Digital currency eases transactions and payments. Moreover, cross-border payments are more comfortable with digital currencies than traditional financial assets.

How many types of digital currencies are there?

Digital currencies can be cryptocurrency, CBDC, stablecoins, or electronic payments of fiat currency. Central Bank Digital Currency (CBDC) is the favorite choice for banks, governments, etc., due to support from the central bank.

Educational

Educational  November 6, 2024

November 6, 2024  27 min.

27 min.