Did it ever cross your mind that there will be a future where no central authority will be controlling AI and they’ll be able to work in a decentralized network? That sounds terrific and scary at the same time.

Will it be a home invasion by AI? I guess that time is a little far so don’t stress about it (just yet). Jokes apart, the decentralized era of AI is just around the corner with AgentLayer leading the charge. With AgentLayer AI, you won’t have to rely on big computers and data servers as this network allows AI agents to work on their own and with freedom.

According to Statista, the global AI market size will reach US$826.70 billion by 2030. And a major portion of it will be due to decentralized AI.

Why do you think is AgentLayer so special? Because it gives AI the freedom to make its own decisions, share information and solve problems without depending on one central system. This reduces the risks of having everything controlled by one entity. It also allows AI to grow and improve without limits. This makes it much faster, more secure and easier to adapt.

With that said, let’s learn everything there is to know about AgentLayer.

What is AgentLayer?

In simple words, AgentLayer is an autonomous AI agent network that works for everyone globally. It’s basically a new and innovative way to decentralize AI agents around the world. By using AgentLayer AI, developers can create smart and independent agents that have the ability to work on an independent or in other words, decentralized network.

As you might know, the typical AI systems rely on a central authority for making decisions, which can be quite risky and limiting. Why’s that? Because if that central system fails, the entire network will shut down in a matter of seconds.

However, AgentLayer changes and makes all this better by distributing tasks and responsibilities across multiple agents. Each of these agents can perform tasks, make decisions and communicate with other ones without the need of a central entity.

This whole network opens up a lot of opportunities for industries that need fast, reliable and scalable AI solutions. AgentLayer offers a way to grow and adapt to different challenges and is best for many industries. Lastly, the decentralized nature of AgentLayer AI boosts performance and reduces the chances of failure.

What Makes AgentLayer’s Brain Different?

AgentLayer decentralized network stands out because it uses a unique open-source large language model (LLM) called TrustLLM. It’s not an ordinary LLM as it’s specifically created by the AgentLayer’s team to ensure top performance and strong security.

TrustLLM has the ability to focus on handling complex tasks within a decentralized network. And the best part, it does everything with high accuracy and reliability. This model offers a brilliant platform for AI agents to operate independently while staying aligned with strict security measures.

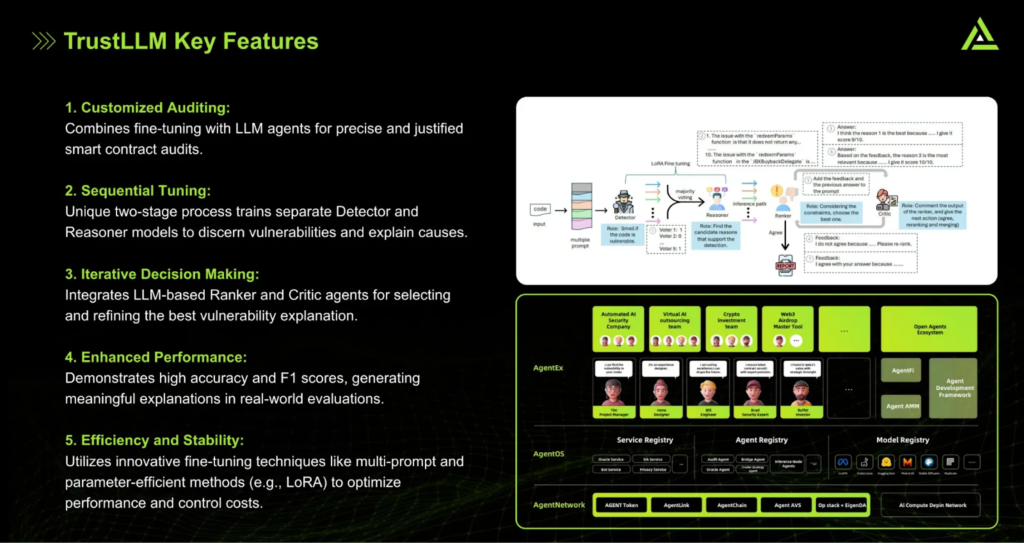

The TrustLLM’s key features include:

Customized Auditing

This smart tool combines fine-tuning with LLMs to provide highly accurate smart contract audit reports. This way the audits are detailed and justified. Apart from that it also improves the security of blockchain contracts.

Sequential Tuning

This next feature uses a unique two-step process. At first it detects vulnerabilities in the code (through a “Detector” model) and then explains the causes of these vulnerabilities (through a “Reasoner” model). This way anyone can easily identify and understand the issues.

Iterative Decision Making

TrustLLM uses AI agents called Ranker and Critic. These evaluate the explanations of vulnerabilities. Both of these work together to refine and select the most accurate and meaningful explanation for each of the vulnerabilities found. This helps in improving the system as well.

Enhanced Performance

After that this model delivers high accuracy by using performance measures. For instance it uses F1 scores that indicate how well the model is doing in real-world conditions. It also provides valuable explanations and not just throws a simple result at your face.

Efficiency and Stability

Lastly, TrustLLM uses fine-tuning techniques such as LoRA (Low-Rank Adaption) to optimize performance. Because of LoRA the systems remain flexible and efficient and reduce the need for heavy computing resources. This keeps the operational costs at a minimum and provides stability side by side.

AGENT Token: The Native Network Token

The AGENT token is the native cryptocurrency of the AgentLayer decentralized network. It’s created to handle transactions and anything else that happens on the network. This token is built on the ERC-6358 standard which means it is highly secure.

It also ensures interoperability of multiple networks for seamless communication between AI agents, developers and especially the community.

This token has a maximum supply of 1 billion and is absolutely necessary to keep the AgentLayer network stable.

Key Features of AGENT Token

Now let’s take a look at some of the key features of AGENT token.

AgentOS

The AgentOS is basically the operating system that developers use to create and deploy AI agents on the AgentLayer decentralized network. For doing so, the ecosystem rewards those developers by giving them AGENT tokens. This way the developers are encouraged to innovate more within the network.

AgentNetwork

As you know AgentLayer is a decentralized network that hosts AI agents without a single point of failure. But to keep the entire network stable and make the interactions between multiple agents as easy as possible, the AGENT tokens play a significant role there. Without it the network can also completely collapse.

AgentLink

This is a communication protocol within the AgentLayer network. It allows AI agents to exchange data and collaborate with ease. Inside this protocol, the AGENT tokens are used to cover the costs of interactions so the data exchange can remain as effortless as possible. There’s no other way on this platform to cover costs rather than the AGENT tokens themselves.

AgentFi

This is one of the most important features of AGENT tokens. They support different financial operations within the AgentLayer’s network. For instance, for liquidity mining, staking and revenue sharing, you need AGENT tokens in your wallet. We’ll talk about this in detail ahead so stay tuned.

AgentChain

In the end the AGENT tokens also play a central role in this AgentChain. It is a specialized layer-2 network that optimizes smart contract execution and also enables secure transactions. This protocol is the foundation on which transactions are being completed on the AgentLayer network.

Tokenomics and Distribution

As already mentioned, there will be a total supply of 1 billion AGENT tokens and will not increase anytime in the future. These tokens will be distributed across investors, contributors and ecosystem builders. The key allocations of AGENT include:

- Investors: 10%

- Advisors: 3%

- Core contributors: 20%

- Community building: 20%

- Ecosystem development: 39%

This distribution is done to make sure it remains sustainable for a long-time and all the shareholders benefit from it.

Incentives and Developer Compensation

The benefits that AGENT tokens offer doesn’t end just yet. These tokens also open multiple ways through which developers can monetize their innovations.

The developers can stake tokens for rewards, participate in governance via TAG DAO and use these tokens to access AgentLayer’s services. This overall network promotes development of AI agents and makes sure that developers are compensated well for their hard work.

What is AgentFi?

Now let’s talk about AgentFi in a little detail. It is basically the financial layer of the AgentLayer ecosystem. This platform integrates AI services with decentralized finance (DeFi) principles. It allows users to participate in multiple financial activities. For instance liquidity mining, staking and revenue sharing.

And all of this is only possible with the help of AGENT tokens. This platform also provides developers with multiple ways to monetize their contributions. The key and most important functions of this protocol include:

Staking and Yield Generation

The first function of this protocol is that users can stake AGENT tokens within the ecosystem. By doing so, they receive additional tokens as rewards. Now this is simple staking where you get rewards based on the quantity of tokens you stake and even the duration.

This gives the user an incentive to commit to long-term staking because they know they’ll be getting much more rewards that way. Staking is also beneficial for the overall ecosystem as it makes it more secure and aligns with internerts of the participants.

The AgentLayer staking is officially live now. You can simply visit their website and stake your AGENT tokens for high rewards.

Liquidity Mining

By using the AgentFi platform, you and other users can provide liquidity by contributing AGENT tokens to liquidity pools. These liquidity pools are necessary to keep transactions smooth and easy within the ecosystem.

In return, the users earn rewards based on how much they’ve contributed. It’s basically a percentage. Liquidity is important for keeping the token economy intact and keeping enough AGENT tokens circulating to keep up the daily trading volumes.

Revenue Sharing

AgentFi also facilitates revenue sharing between developers, users and anyone else who’s contributed to the ecosystem. The developers who create AI agents or services inside the ecosystem get to earn a portion of the revenue generated from what they create.

It can either be through subscriptions or direct sales. All of this is a self-sustaining system where developers are rewarded for their contributions to the platform.

DeFi Integration

The next best thing about AgentFi is that it allows the AGENT token to interact with various DeFi protocols. This also increases the AGENT token’s utility. Additionally, it opens up opportunities for staking, borrowing and trading.

Governance and Decision-Making

So lastly, AgentFi also plays a role in governance through the TAG DAO. By staking AGENT tokens, users get veAGENT tokens through which they can vote on decisions related to the overall ecosystem. The more tokens staked, the greater the voting power. It’s done so that major shareholders can have a say in developmental decisions of AgentLayer.

Apart from these revenue generating options, AgentFi also offers some much more advanced options. These include:

AgentSwap

AgentSwap is simply a decentralized exchange (DEX) that AgentLayer has built. It’s the same as the other exchanges that are built on a decentralized network. AgentLayer uses it to trade AGENT tokens and other assets automatically. However, it doesn’t rely on the traditional order book method that you might have seen in centralized exchanges like Binance, etc.

This platform uses Automated Market-Making (AMM) algorithms. What these algorithms do, they allow trades to happen instantly so there’s better liquidity and the transactions proceed smoothly. Additionally, liquidity providers also play a crucial role in keeping the platform more accessible and beneficial for the traders.

AgentList

Now AgentList is a decentralized launchpad like any other. The main aim of this launchpad is to support and grow other AI projects within the ecosystem. It helps projects raise funds by allowing them to stake tokens. Now the main purpose of staking these tokens is to enhance credibility of the project and make it more visible in the community.

This staking also shows that a certain project is committed to provide the best services. This will also encourage collaboration among community members and developers. This platform is set to be live in late 2024 or early 2025. So stay tuned because it will be here before we know it.

IAO (Initial Agent Offering)

The Initial Agent Offering (IAO) is AgentLayer’s tool for on-chain asset issuance and fundraising. What this does is, it gives new AI projects a way to raise funds by issuing tokens directly on the blockchain.

Through this platform the investors can buy these tokens to support the project. It’s also a great way to invest in upcoming AI projects that have the potential to make you a lot richer with their utility.

Features of AgentLayer

AgentLayer is a lot more than just a platform where anyone can create AI agents. It’s much more. It’s features include:

Beyond a Model Marketplace

If you’re a crypto enthusiast then you must know that traditional AI model marketplaces just provide pre-built tools. You just go and buy and it doesn’t even give you an option to make even the slightest of changes.

However, AgentLayer has made everything better by allowing developers to create whatever they want. If you can imagine something, it can be made on this platform. It literally goes beyond the basic AI tools and provides a complete system.

Here anyone can create, customize and deploy AI agents. It also makes AI-to-AI communication easier. If you’re a developer, you’ll surely love this platform and even earn a significant income from it.

Creating Autonomous AI Agents

Rather than just offering simple and static models, AgentLayer goes one step further to give users the power to create fully customizable AI agents.

These agents cooperate fully with you and can work together inside a decentralized system. This is entirely different from the AI models that need someone to fine-tune them every now and then and control them.

Decentralized AI Governance

As you might know, governance on AgentLayer is decentralized. The token holders have full authority over decision-making through a decentralized autonomous organization (DAO).

This makes sure that not one person controlling the project rather a group of people who are interested in the project are actually making decisions to make it a better place. You can also call it a community-driven project in simple words.

Collaborative AI Economy

AgentLayer is in full favor of collaborative AI economy. In such an economy, the users can mint, deploy and exchange AI assets on-chain. This way developers and AI agents can work together for greater benefits. If you’re a developer, head to their website and start making your AI agent by using a unique approach.

AgentLink Protocol

AgentLayer also has an AgentLink protocol which allows AI agents to work together on tasks that are highly complex. Because of this the tasks become way easier as the AI agents add their capabilities and perform much better.

This multi-agent interaction is such a standout feature for AgentLayer. Because if we compare it to other such marketplaces, their models operate in complete isolation which is much less efficient.

Human Oversight and AI

The best part about AgentLayer is that it integrates a level of human control through multi-signature wallets. This is entirely opposite to the traditional AI systems that completely eliminate human oversight.

Now because of human control on AgentLayer, the operations remain ethical and if the agent shows any unethical or irrelevant behavior, it can be stopped immediately. This maintains the integrity of AI agents in the long-run.

Latest AI Agents on AgentLayer

Now there are so many AI agents on the network and it keeps updating and increasing everyday. It currently has a strong community of over 3.5 million wallets and over 5.2 million overall page views. This shows how quickly the platform is growing.

Now let’s take a look at some of the latest AI agents and what they can do and then just wind up this article.

- CryptoRoast: It is a playful AI that humorously analyzes Ethereum wallet data and roasts the owner in a fun and spicy way. This AI agent scans transaction history and on-chain data for a humorous twist.

- AGIS: This next one is an advanced AI combining GPT and static analysis to detect logic vulnerabilities in smart contracts. It helps ensure the security of smart contracts by spotting potential issues.

- Sentinel: The Sentinel agent is a vigilant AI that monitors blockchain transactions and alerts users of any suspicious activity. It acts as a real-time security watch for your transactions.

- Tarot AI: After that there’s the Tarot card reader. It offers insights into the past, present and obviously the most important future. This AI agent provides detailed card readings for users seeking guidance or predictions.

- Astro AI: Up next is the mystical AI astrologist that provides personalized horoscope readings. It creates unique horoscopes based on celestial data.

- Wallet Checker: In the end, there’s the security-focused AI that scans wallets for vulnerabilities and offers recommendations. It helps users safeguard their crypto wallets by identifying security risks.

And done.

Summing Up

AI has become the talk of the town because of its amazing capabilities. It makes so many tasks so easy that every industry wants to use it. AgentLayer understands these demands, which is why they have created a platform that allows everyone to create AI agents and use them or sell them on a completely decentralized and permission-less platform.

During this article we’ve talked about multiple features of AgentLayer, especially its AGENT tokens that provide tons of real-world utilities. For developers it’s a great opportunity to have complete ownership of what they make and generate significant revenue as well.

If you’re a developer you should definitely check it out while it is still in its initial stages. Who knows you might become one of the biggest contributors on the platform.

FAQs

Can I trade assets other than AGENT tokens on AgentSwap?

Yes absolutely. AgentSwap is not limited to just AGENT tokens. It supports the trading of various digital assets within the decentralized AI ecosystem. This swap uses AMM algorithms to make trading much easier and accessible for everyone.

Can I participate in AgentLayer without technical knowledge?

If you’re interested then you surely can. There are multiple things that you can participate in. You can buy AGENT tokens and put them up for staking to earn passive income or add them to the liquidity pools for additional rewards. You can also use their DEX to trade different assets and make profit from it.

How secure is AgentLayer?

AgentLayer is built on blockchain technology with strong security measures like smart contracts and human oversight. Its decentralized nature and the ethical AI policies that are put in place by the team makes this platform secure and one of the most trustworthy ones in the market.

Can I create my own AI agent on AgentLayer?

Yes, that is the main purpose of this platform. It allows you to create, customize and deploy your own AI agents. These agents operate autonomously in the ecosystem and can be proposed by anyone. If someone buys your agent, you get an incentive as well.

How do I buy AGENT tokens?

You can purchase AGENT tokens from multiple decentralized exchanges like AgentSwap. After purchasing these tokens, you can stake them, trade them or even use them within the ecosystem for various purposes. Read this section again to know how AGENT tokens can be used.

Educational

Educational  November 6, 2024

November 6, 2024  28 min.

28 min.