How to Avoid Crypto Scams is a common question most newbies ask. As the world of digital finance grows at breakneck speed, the temptation cryptocurrency gives is not only to investors and traders but also to a growing army of scammers who seek to exploit this relatively unregulated space. Further into 2024, with the crypto-scamming landscape in a continuous flux, it has become critical for any dealings in digital currencies to stay vigilant and informed.

This cannot be emphasized enough: it is essential to know the tricks of avoiding crypto scams. As fraudsters are getting advanced daily, the possibility of losing your financial information or data increases.

This article aims to arm you with knowledge on how to identify crypto exchange scams and ensure secure crypto trade and safety in choosing crypto exchanges.

Be more aware and adopt cautious practices to keep your investments and personal information off the hands of cybercriminals. Join us in going through some key strategies and tips on safeguarding your crypto activities in 2024 so that getting into cryptocurrency finally goes safe and rewarding.

Top 10 Secure Crypto Exchanges to Avoid Crypto Scams for 2024

As the cryptocurrency market grows, security remains salient for crypto exchanges. However, one has to opt only for those with unassailable security features that spell credibility through positive user reviews. This article pits a list of the top 10 secure crypto exchanges in 2024, featuring their stand-out security features and overall user ratings.

| Exchange Name | Security Features | CTA |

| Binance | 2FA, SSL/TLS encryption, real-time monitoring | Trade on Binance |

| Coinbase | Biometric fingerprint logins, AES-256 encryption for digital wallets | Trade on Coinbase |

| Kraken | Cold storage, Global Settings Lock, PGP/GPG encryption | Trade on Kraken |

| Bitfinex | Withdrawal protections, Two-factor authentication, DDoS protection | Trade on Bitfinex |

| Gemini | SOC 1 Type 2 and SOC 2 Type 2 compliant, Hardware security keys | Trade on Gemini |

| Huobi | Multi-factor security system, Advanced threat detection | Trade on Huobi |

| Bittrex | Blockchain forensics, Multi-stage wallet strategy | Trade on Bittrex |

| KuCoin | Multilayer encryption, Dynamic multifactor authentication | Trade on KuCoin |

| OKEx | Hot and cold wallet system, SSL encryption | Trade on OKEx |

| Crypto.com | ISO/IEC 27001:2013 certification, PCI3.2.1, Level 1 compliance | Trade on Crypto.com |

All these were acknowledged to be able to provide safe exchanges of crypto. They all have implemented all the advanced technology security features in place and maintained high operating standards. These features put them among the best secure crypto exchanges available today, thus trusted cryptocurrency platforms to search forward to engage in the trade-off of digital currency in 2024. Before choosing the exchange to deal with, consideration should be made to involve personal research based on the specific trading needs and security advantages.

Common Types of Crypto Exchange Scams

While it offers many ways to benefit from investment significantly, the cryptocurrency market is also highly infested with various scams. Knowing them will help one understand how to protect their assets and perform more secure crypto trading. Here are some of the most common types of crypto exchange scams:

Phishing Scams:

In this kind of scam, the scammer creates a replica site or emails that mimic the original transaction to extract the login information of general sites. This, in essence, is a scam meant to coerce the user into feeding in their private information, which may be used to access the accurate account information later in time.

Ponzi Schemes:

In this investment scheme, returns are paid to earlier investors from the capital of newer investors. These return schemes are generally seen as collapsing as soon as the operators find no way to get hold of new investors, and vast numbers of investors demand returns.

Fake Exchanges:

Some fraudsters set up and run entirely phony trading platforms. These fake exchanges may offer great market prices, but those who interact with them often can’t make a withdrawal, or they have to pay very high and unreasonable withdrawal fees.

Pump and Dump Schemes:

In this type of fraud, the pumpers increase the price of a poorly performing or little-known cryptocurrency so that less cautious investors can be lured by it. After the target price point is achieved, the defrauders dump their tokens in the market, consequently crashing the price and leaving others at a loss.

For more insights on how to navigate the crypto world, explore our detailed guides on:

- How to Buy Bitcoin on Different Exchanges

- Comparing Fees: Finding the Low Fee Crypto Exchange

- An Introduction to Altcoins and Where to Trade Them

- How to Trade Bitcoin: Tips and Strategies

- Secure Your Crypto 2024: Top Crypto Exchange Security Tips

- How to Trade Crypto Anonymously in 2024: The Ultimate Guide for Beginners

- How to Avoid Crypto Exchange Scams in 2024: The Only Guide You Need

How to Identify a Legitimate and Safe Crypto Exchange?

One needs to identify a legitimate and safe crypto exchange to protect oneself from being conned and to do safe transactions and crypto trading. Here are some things to look for in a secure, trustworthy exchange:

Regulatory Compliance:

A safe crypto exchange must comply with appropriate rules and regulations. Usually, this means being registered with a financial authority and having procedures for anti-money laundering and know-your-customer rules in place.

Transparent Fee Structures:

Fee structures of authentic exchanges are clearly laid down with no hidden charges. By other things required to be offered, they will soon be fair.

User Reviews and Reputation:

Search for what other users say about the exchange. Legitimate exchanges will have a lot of positive reviews from their users and a high overall rating within the crypto community.

Features:

Strong security measures are a hallmark of a safe exchange. Features like 2FA, cold storage facilities for customer funds, and encryption methods with periodic security reviews should be looked out for.

User Interface and Support:

The user interface must be professional, and customer support must respond. For legitimate exchanges, the interface backs an investment in infrastructure and customer service to enable a good user experience and sense of security.

By familiarizing yourself with these aspects, you can more effectively navigate the complex landscape of crypto trading and choose platforms that offer secure crypto trading and a higher degree of safety.

How to Avoid Crypto Exchange Scam?

Trading crypto means you always have to stay vigilant, mainly to protect your investments and personal information against scams. Below are some practical things you can do to help ensure a safer trading experience.

Verify the legitimacy of an exchange before creating an account:

In particular, it would check if the exchange is registered with any relevant regulator—like the SEC or CFTC in the United States—and verify the license status. Trustworthy exchanges usually make information on this very accessible, which includes on their websites.

Educate yourself on phishing tactics:

Be aware of common phishing methods that include e-mails, fake websites, and fraudulent links. Always double-check the URL of the site you are using and never click on unsolicited links in emails or messages.

Protect Your Personal Information:

Be sure to use robust and unique passwords for your crypto accounts, and if possible, enable 2FA. Consider a hardware security key when you get the chance.

Use Trusted Networks:

Avoid trading or logging into your crypto accounts from public or unsecured Wi-Fi networks. For every trade you enter, you would want a secure and, better yet, private internet connection.

Regularly monitor accounts:

Be very aware of all your account activities. Set up alerts to your phone, email, or whatever other means for account activities that can be construed as suspicious in nature or unauthorized access to your account.

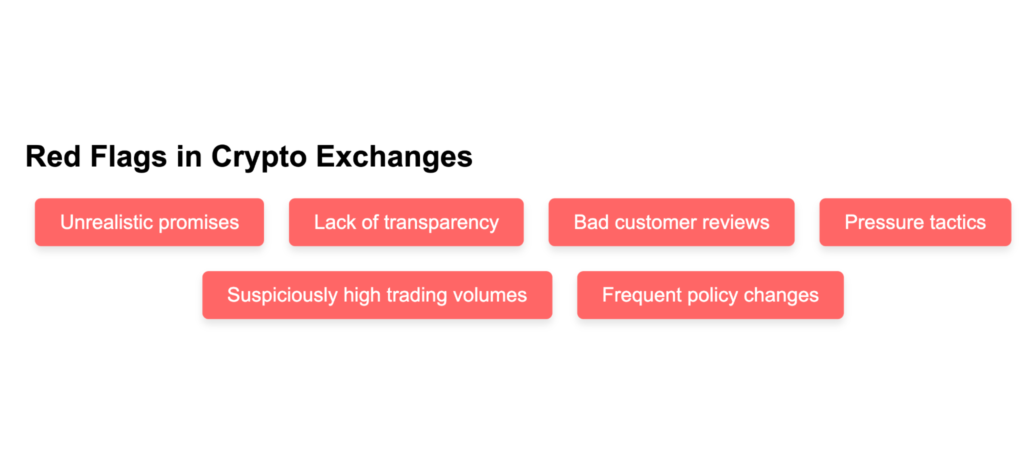

Red Flags to Look Out for in Crypto Exchanges

You should be able to see the red flags on the cryptocurrency platforms, which would most likely keep you away from them, at the same time protecting your very investments. Here are some warning signs of caution:

Unrealistic promises:

Be mindful of platforms that make unrealistic promises to provide you with guaranteed returns or excessively high profits at very low or without risk. In the volatile crypto market, this just can’t be realistic; these guarantees could be a sign of a scam.

Lack of transparency:

Proper exchanges will provide information about charges made, the company’s origin, adherence to any regulations, and the security measures put in place. Without such information, it is a typical red flag.

Lousy Customer Reviews:

Research what other users are talking about that exchange. Suppose there are numerous complaints—whether about customer service, issues with withdrawing money, or breaches in security—those platforms are to be viewed cautiously. Platforms with largely negative reviews may be approached with both trepidation and tenderness.

Pressure Tactics:

If an exchange or its representatives use high-pressure tactics to secure you large sums of money quickly, that’s a possible signal of fraud.

Trading Volumes are Suspiciously High:

Be very suspicious when high volumes come from an unknown or very new exchange—these are mainly manufactured to lure new users into a pretend sense of legitimacy and vibrancy.

Changes in Terms and Policies:

Frequent, unexplained changes in terms and policies, especially those concerning withdrawal procedures, indicate instability or, in some cases, the potential for fraud.

How to recover from a crypto scam?

Though falling victim to a crypto scam can be pretty distressing financially and emotionally, there are still some proactive measures one can take to recover from it and prevent it from reoccurring. These are the main steps you should take if you become a victim of a cryptocurrency scam.

Immediate Action:

Disconnect Connected Accounts: Instantly disconnect connected accounts or any mode of payment to prevent further losses. This would involve disassociating your bank accounts and credit cards from the platform that has been compromised.

Personalize: Secure Your Accounts: Change all passwords you noted, and activate two factors for all possible accounts, not only crypto wallets.

Report the Scam:

Crypto Exchanges: The crypto exchange or wallet provider on which the fraud took place must be informed. Some platforms have measures in place that might help to freeze transactions or track stolen funds.

Regulatory Agencies:

File a report with all the relevant financial regulatory agencies or bodies within your jurisdiction. For U.S. residents, these would include the Federal Trade Commission at ReportFraud.ftc.gov, the Commodity Futures Trading Commission, and the Securities Exchange Commission.

Law Enforcement:

Contact your local police to file a report and follow up on any special cybercrime units, such as IC3 in the United States (Internet Crime Complaint Center).

Seek Legal Advice:

Speak to an Expert: Consult with a cybercrime or financial fraud lawyer who can properly give you advice concerning your rights and any legal remedies that may be available in seeking justice or your recovery of funds.

Explore Recovery Services:

Digital Currency Monitoring: These companies provide highly specialized monitoring services for the digital footprints of stolen cryptocurrencies or assets on the blockchain. These services probably go as far as interfacing with law enforcement to recover the funds involved.

Public Awareness:

Share Your Experience: Share your story on social media sites and cryptocurrency forums. In no time, other people can be alerted regarding the same, saving them from being prey to this scam, and perhaps, in the process connecting you with others who have been in a similar predicament and can also offer more advice/guidance and advice/support.

The Regulatory Role in the Prevention of Crypto Scams

Regulatory bodies form the very basis through which the cryptocurrency market is streamlined in terms of security. The standardization and regulation of activities, coupled with measures against fraudulent activities, could not be possible without regulatory involvement. Here’s how these organizations contribute:

Establishing Regulations:

Rule enforcement: In the United States, it matters of the Securities and Exchange Commission; in the United Kingdom, it involves the Financial Conduct Authority; in other countries, different bodies are working and setting up regulations for crypto exchanges and ICOs to follow. Defining the rules and making trading equal to make it according to the protection of investors from fraudulent activities.

Monitoring and Enforcement:

Active Oversight: These agencies actively monitor the cryptocurrency market for illegal activities and have the authority to investigate and prosecute fraudulent schemes, thus acting as a deterrent to potential scammers.

Consumer Education:

Educating Resources: Most regulators offer their clients educational materials that help them acquaint themselves with the operations of the cryptocurrency world and to know the signs of fraud. These educational tools are of great essence in fraud prevention.

International Collaboration:

Cross-Border Collaboration: Regulatory bodies, due to the global nature of crypto, often try to work with their overseas counterparts to track and close down cross-country border scams in a bid to increase the international response to the fraud.

Setting Compliance Standards:

Security and Transparency: The regulator demands that crypto guarantee compliance by meeting some standards of protection that include protective measures, ensuring security, enabling the carrying out of routine audits, and being clear on what transparency with their clients entails.

Understanding the role of the regulatory bodies, and how to recover from scams, may empower victims to take some informed action to mitigate the damage and perhaps recover some of the lost assets.

Future Trends in Crypto Security

Just as the cryptocurrency marketplace first matures, so do the technologies and strategies designed to improve its security. Looking further out, a few critical trends and technological improvements are likely to inflect on really strengthening the security framework of the crypto space:

Improvement in Blockchain Technology:

Blockchain, being decentralized and having cryptographic hash functions, embed security in the fabric of the design. Further development is expected to introduce even more robust consensus mechanisms and better principles of encryption, which are both set to better harden these blockchain networks against attacks.

AI in fraud detection entails using artificial intelligence to detect anomalies and patterns associated with fraud. It can sift through enormous volumes of transactional data in real-time, ensuring a reduction in time windows for potential fraudsters.

More Detailed and Improved Regulatory Frameworks:

Improved and more detailed regulatory frameworks would no doubt be constructed shortly by the respective regulating bodies regarding crypto transactions. This could encompass more concise AML measures, KYC protocols, and measures of regulatory intervention applicable to the protection of consumers.

Decentralized Identity Verification Systems:

This is another method through which decentralizied identity verification will reduce fraudulent activities in the space. This system will ensure the data of the user is held in a way that allows it to verify transaction information on the user but ensures that both the privacy and supply of the user increase.

Quantum-Resistant Cryptography:

With the future potential threat of quantum computers, the crypto industry is starting to plan for quantum-resistant cryptographic methods to hold up against new computational powers.

Smart Contract Auditing and Security:

The more complex a smart contract will be, the higher its attack surface and room for bugs. As intelligent contracts get more intricate, there is a need for the enhancement of logic and for the processes of automated and manual auditing to grow.

Conclusion: Safety in the Cryptocurrency Space

In crypto space, there are several options for investors. Simultaneously, there are myriad scams and fraudulent activities, too, that require a very vigilant and informed approach. This article informed its readers about major scams to avoid by verifying the legitimacy of exchanges and understanding the common types since these are important in the steps taken if one finds themselves gullible to such schemes.

In future, this comes with a lot more on blockchain technology, AI in fraud detection, and a much more robust regulatory framework that will improve crypto safety.

The key lies in staying informed, careful, and attuned to new developments so that this evolving space can be navigated safely. In this way, participants of the crypto market are able to protect their investments while taking advantage of the unique opportunities cryptocurrencies have to offer. Indeed, within crypto space, your security is as strong as your vigilance.

FAQs

Here are some FAQs on how to avoid crypto scams and navigate safely but confidently in cryptocurrency.

What are the most common crypto scams?

The most widespread include phishing attacks, Ponzi schemes, fake exchanges, pump-and-dump scams, and giveaway scams. All these scams are designed to steal either your funds or personal information.

How do I know an exchange is safe for crypto?

A good and safe crypto exchange should, in general, have mechanisms for two-factor authentication, encryption, and storage of funds in cold storage. It should conform to the regulatory requirements, with transparent fee structures and positive user reviews.

What to do if somebody has scammed me with my crypto?

Secure your remaining assets with new passwords and two-factor authentication. Make a report with the crypto exchange, local authorities, and financial regulatory bodies, but keep an eye out for the lawyer contact if needed.

How Do I Protect Myself from Crypto Scams?

Always check whether the website/email is genuine before providing them with personal details. Always use secure and credible crypto exchanges and look out for those offers that appear too good to be true. Always do your research on new scamming methods to protect your crypto.

What are some of the signs that a crypto investment is fraudulent?

Yes, they are: if the returns are guaranteed with high amount and there is low or less risk involved then it might be a scam, demands to pay for goods or services by crypto, and very negligible details concerning the investment or the investment entity.

Learn

Learn  November 6, 2024

November 6, 2024  25 min.

25 min.