This BDSwiss review is here to tell you how well this platform is doing on the global scale. It is actually a trading platform that allows users to trade a variety of assets like forex, commodities, stocks and cryptocurrencies. It was founded in 2012 and now serves a million clients all over the world.

This platform is regulated by several financial authorities which ensures a secure trading environment. In this BDSwiss broker review, we’ll explore a platform that has become a favorite among traders. So, keep reading.

What is BDSwiss?

BDSwiss is an online financial trading platform that enables users to buy and sell various asset types. Headquartered in Switzerland, BDSwiss has grown significantly over the years and now offers services in over 180 countries.

For added security, BDSwiss is regulated by multiple financial authorities which also increases its credibility. These regulatory institutions include the Financial Services Commission (FSC) in Mauritius and the Securities & Commodities Authority (SCA) in UAE.

BDSwiss trading platform caters to different trading styles and experience levels which means it’s perfect for both beginners and experienced traders. It also offers different account types such as Classic account, which is ideal for beginners. We’ll talk about the other two types in a while.

This trading broker also provides a range of trading platforms from which the customers can pick the one that suits them the best. They offer platforms like the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms that offer advanced charting tools and technical analysis options.

BDSwiss also offers an extensive library of educational resources. These include webinars, video tutorials, market analysis and more. For those new to trading these resources can be of great help in where the market will go next.

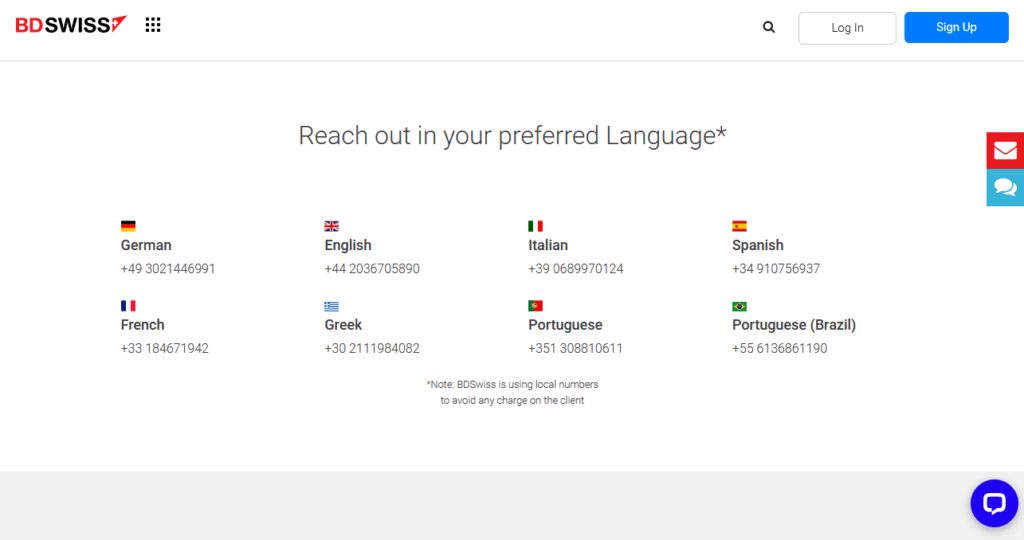

If you’re from a region where English isn’t one of the languages, BDSwiss assists them with Multilingual support so that people from all over the world can use the platform with ease. Traders can easily reach out to the support team via email, phone or live chat.

Key Features of BDSwiss Trading Platform

There are tons of great features that this brokerage offers to its users. Here are the best features that you can leverage while using this platform:

1. CFD Trading Options

BDSwiss offers over 250 Contract for Different (CFD) trading options which cover five main asset classes:

- Forex (currency pairs)

- Shares

- Indices

- Commodities

- Cryptocurrencies

These CFDs allow traders to speculate on the price movements of these assets without actually owning them. This range of options means that traders can have a diversified portfolio of investments. It’s great for spreading their risk-to-reward ratio across different markets and benefiting from the various market conditions.

2. Multiple Trading Platforms

BDSwiss offers several trading platforms for different trading preferences. These include:

- MetaReader 4 (MT4): This one is popular because it’s easy to use and has powerful analysis tools. It has a simple interface with various charting options and technical indicators which traders can use to understand the market.

- MetaTrader 5 (MT5): It is the upgraded version of MT4 and provides additional features of course. This platform has more timeframes which traders can use to analyze data over different time periods. It is ideal for traders who want advanced options for detailed market analysis.

- BDSwiss WebTrader: This one is the browser-based platform built by BDSwiss. It requires no downloads and can be accessed from any device with internet connection. Best for traders who like to trade directly from their browser.

- BDSwiss Mobile App: The mobile app of BDSwiss allows traders to manage their accounts and trade from anywhere. It offers full functionality so that users can easily deposit and withdraw funds, view market analysis and make trades from their smartphones.

3. Variety of Account Types

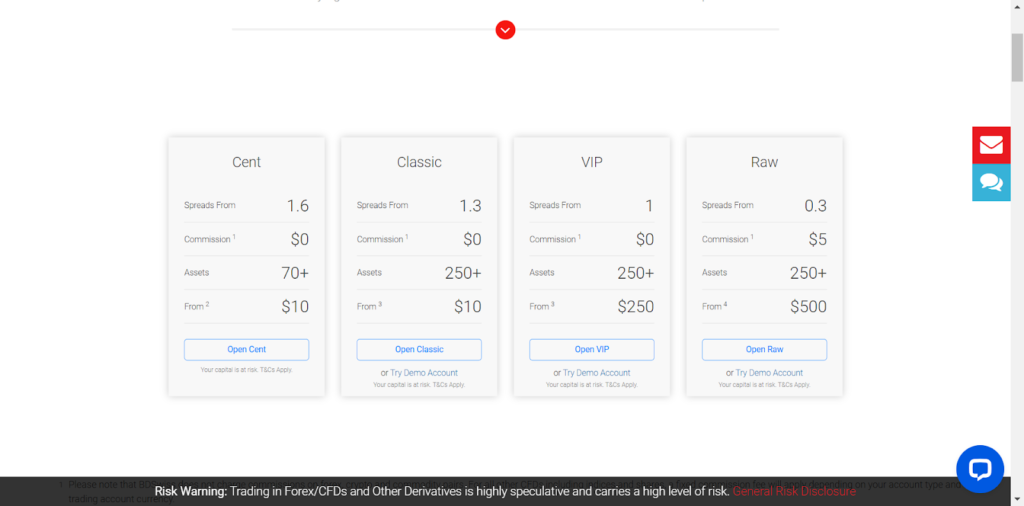

There are over a million users on BDSwiss which offer different account types so that every trader can have the best trading experience. These account types are:

- Cent Account: It is the lowest form of account available on the platform with only 70+ assets and is not recommended to any traders, not even beginners.

- Classic Account: This account is suitable for beginners. It has competitive spreads and doesn’t charge commissions on trades which makes it budget-friendly and straightforward.

- VIP Account: This other account type is designed for more active or experienced traders. It offers lower spreads than the Classic account and comes with additional features, like access to exclusive analysis and market insights.

- Raw Account: Ideal for professional traders, the Raw account offers raw spreads which means users get actual market price. This account charges a small commission per trade which is perfect for traders making larger or frequent trades.

4. Educational Resources

For beginners and experienced traders educational resources are valuable for learning and refining trading skills. These resources include:

- Webinars: Live online sessions where experts discuss market trends, trading strategies and platform features.

- Tutorials: Step-by-step guides to help beginners learn how to trade and understand the platform.

- Market Analysis: Daily and weekly insights into financial markets which help traders stay updated on the latest trends and make better trading decisions.

5. Regulatory Compliance

BDSwiss is under the regulation of multiple financial authorities which is why they follow strict guidelines to ensure security and transparency. For traders, this means that BDSwiss is required to follow certain standards that protect users’ funds and personal information.

The financial authorities include:

- Financial Services Commission (FSC) Mauritius

- Financial Services Authority (FSA) Seychelles

- International Services Authority (MISA)

- Securities & Commodities Authority (SCA) UAE

6. Customer Support

This trading platform provides customer support in over 20 languages and is available 24 hours a day but only 5 days a week. Support is provided through live chat, email and phone which makes it easy for users to reach out if they have any issues.

This global, multilingual support system helps BDSwiss offer services to a range of traders from different countries.

7. Ultra-Fast Execution

BDSwiss is also known for its ultra-fast trade execution speeds which means the trades are completed as quickly as 0.008 seconds. Fast execution is especially important in the financial markets where prices can change in seconds. By having trades executed almost instantly BDSwiss helps traders get the price they want without unexpected changes.

8. Flexible Leverage Options

Leverage at BDSwiss can go up to 1:2000 which means that for every dollar you invest, you can control up to 2000 dollars in the market. This increases the profits and even the losses so make sure to use leverage with care.

Taking high leverage is beneficial but it is high risk as well. If you’re a beginner we suggest you don’t use leverage until you’re experienced enough.

9. Partner Program

There’s also a partnership program where individuals or businesses can refer new traders to the platform and earn a commission based on their trading activity. Partners can easily earn up to $28 per lot traded.

Through this programme people can earn extra income which makes it ideal for affiliates, influencers and anyone with a network interested in trading.

10. BDSwiss Mobile App

The BDSwiss mobile app is a convenient way for traders to access their accounts and manage trades anytime, anywhere. Through this app, traders can deposit and withdraw funds, open and close positions and view market analysis on the go.

BDSwiss Fees and Commission Structure

Next up in this BDSwiss broker review is an overview of the commissions and fees this platform charges from the users. Let’s check out what those are.

1. Spreads and Commissions

BDSwiss offers variable spreads across different account types which also impacts the cost per trade. The starting spreads for major account types are as follows:

- Cent Account: Spreads start from 1.6 pips.

- Classic Account: Spreads start from 1.3 pips.

- VIP Account: Spreads start from as low as 0.1 pips.

- Zero-Spread Account: Offers spreads starting at 0.0 pips but includes a commission of $6 per trade on forex pairs and commodities.

2. Trading Fees for Forex and Cryptocurrencies

On forex trades, BDSwiss clients can trade major, minor and exotic pairs with tight spreads which start from 0.0 pips in the Zero-Spread Account. Major forex pairs have competitive spread averages such as 0.00015 for EUR/USD and 0.016 for USD/JPY. It all depends on the account type.

However, for cryptocurrencies, the spread varies according to asset liquidity. For instance, BTCUSD has an average spread of 34.23.

3. Overnight Charges (Swaps)

An overnight or swap fee applies to positions left open after the trading day. This fee depends on the size of the position and the asset. Islamic (swap-free) accounts are also available for Muslim traders so they can avoid interest-based fees, in compliance with Sharia law.

4. Inactivity Fees

If no trading activity takes place for more than 90 days, a monthly inactivity fee of EUR 30 applies until the account balance reaches zero. This encourages account holders to maintain active engagement on the platform.

5. Currency Conversion Fees

Now, if the currency of your account is different from the deposit currency, you’ll have to pay currency conversion fees. However, no additional fees or makeups are added for conversions.

6. Withdrawal Fees

There are no fees for deposits or withdrawals made via credit card. But for bank wire a withdrawal fee of EUR 10 is charged. For withdrawals higher than EUR 100, BDSwiss typically does not charge additional fees although there might be some third-party fees according to the payment provider.

Is BDSwiss Trustworthy?

BDSwiss is a reputable online trading platform for its reliability and user-friendly experience. As we have discussed before as well, this broker offers multiple trading platforms perfect for different trading styles. These include the MT4 and MT5 which are already discussed above.

As for Proof-of-Reserves, BDSwiss does not publicly provide it yet. For those who don’t know, it is a method used by some financial institutions especially in the cryptocurrency sector to show they hold an adequate amount of assets to cover all their client balances.

While BDSwiss doesn’t offer this specific proof, it operates under strict regulations which surely makes this platform safe and highly trustworthy. If you’re a trader, you can blindly trust the trading practices on this platform.

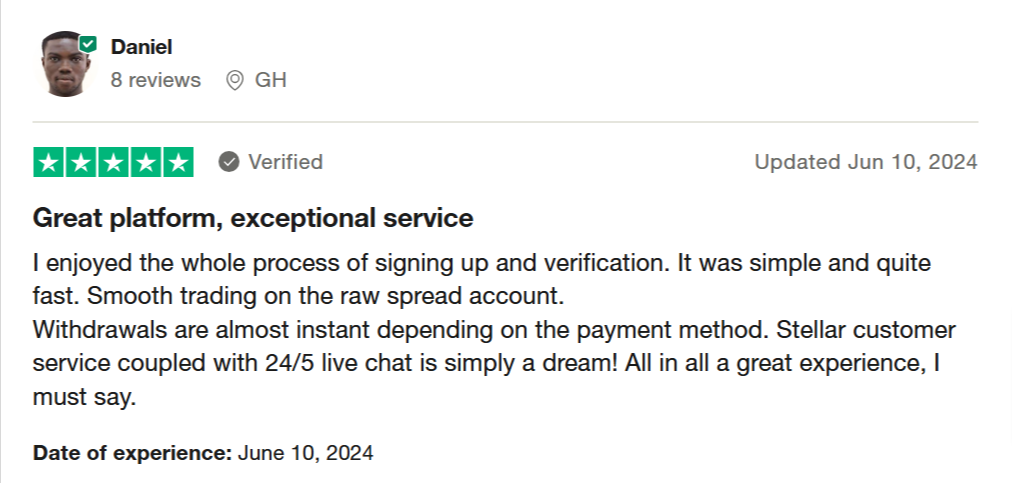

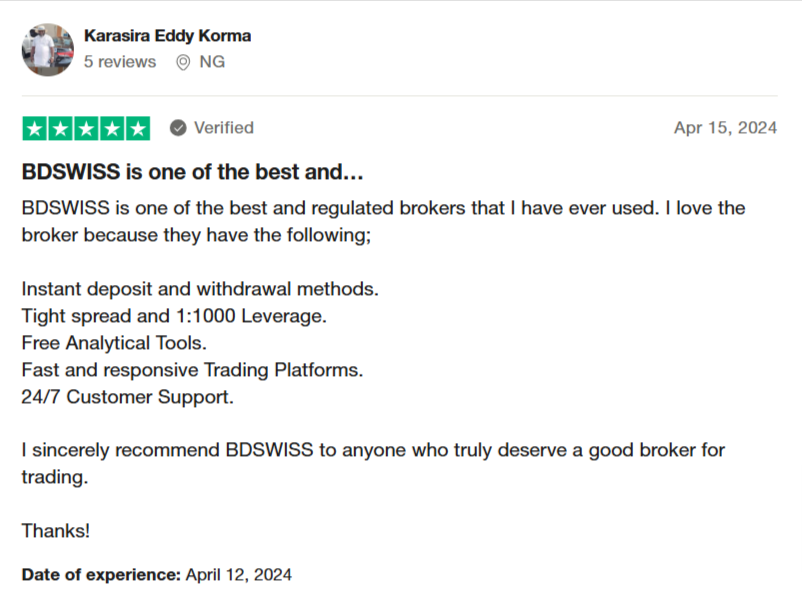

Now, this isn’t just us but a large number of traders have also given positive feedback to BDSwiss on TrustPilot which is one of the most reliable sites for authentic reviews. A couple of these reviews are:

Even BrokerView has some really positive reviews about the platform which you can read here.

BDSwiss Review: Pros and Cons

The pros and cons of using BDSwiss as your primary trading platform are:

| Pros | Cons |

| Regulated by reputable bodies like the FSC in Mauritius and SCA in UAE. | Limited cryptocurrency selection as compared to specialized crypto exchanges. |

| Provides access to over 350 assets including forex, commodities, stocks and crypto. | Accounts inactive for 90 days or more have to pay $30 per month as a fee. |

| Traders can choose between MT4, MT5, WebTrader and Mobile app. | Have to pay 10 EUR for withdrawals of 100 EUR or less. |

| Offers webinars, tutorials, and daily market analysis. | All BDSwiss accounts have variable spreads which are not suitable for some traders. |

| 24/5 multilingual customer support in over 20 languages via live chat, email, and phone. | Does not accept clients from specific countries like the U.S. and UK. |

| Offers account types like Cent, Classic, VIP and Raw with competitive spreads. | Has a higher minimum deposit for some accounts. |

| Advanced tools like Autochartist and Trading Central for traders. | No 24/7 support as they are not available on weekends. |

| Ultra-fast trade execution in only 0.08 seconds. | WebTrader and Mobile app lacks some advanced features compared to MetaTrader. |

| Client funds are held in segregated accounts separate from company funds. | Charges a fee for positions that remain open overnight. |

Trading and Investment Tools on BDSwiss

To complete this BDSwiss review, it’s important to talk about the trading and investment tools which include:

- LIVE Webinars: Interactive sessions with experts covering market trends, strategies, and platform features.

- Economic Calendar: Tracks upcoming economic events that could impact the markets.

- Trends Analysis: Highlights market trends to help traders spot potential opportunities.

- Trading Central: Provides technical analysis and trading ideas based on in-depth research.

- Autochartist: A tool that identifies trading opportunities by scanning the markets for patterns.

- Trading Alerts: Real-time alerts for significant price movements or trend shifts.

- Currency Heatmap: Shows currency strengths and weaknesses in real-time to help traders assess market sentiment.

- Trading Calculators: Useful calculators for risk assessment, position sizing, and margin calculation.

Getting Started with BDSwiss – Quick Steps

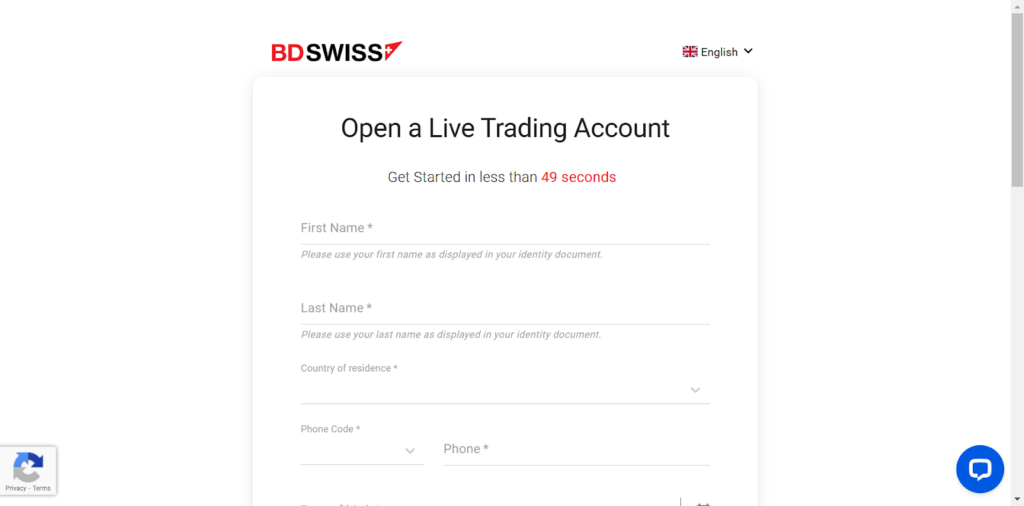

It’s extremely easy to sign up on BDSwiss and get started. It only takes around 49 seconds, according to the broker, to open a live trading account. Here’s how you can do it:

1. Register an Account

For this first step, head over to the sign-up page of BDSwiss and enter your personal information. These details include your name, email address and phone number.

After that choose a strong password which you can remember, choose the type of leverage you want to use and the trading platform you prefer (MT4 or MT5). Now agree to their terms and conditions and press “Submit”.

2. Verify Email Address

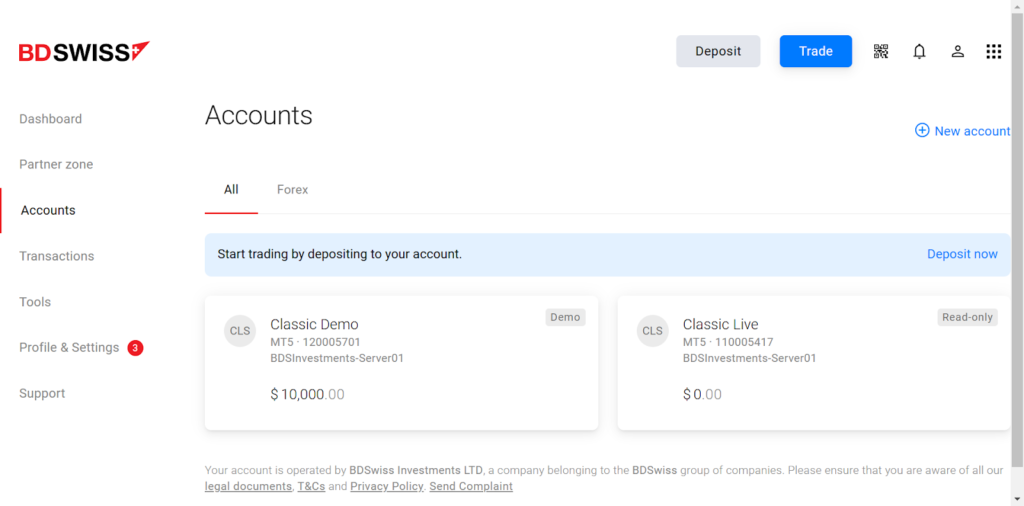

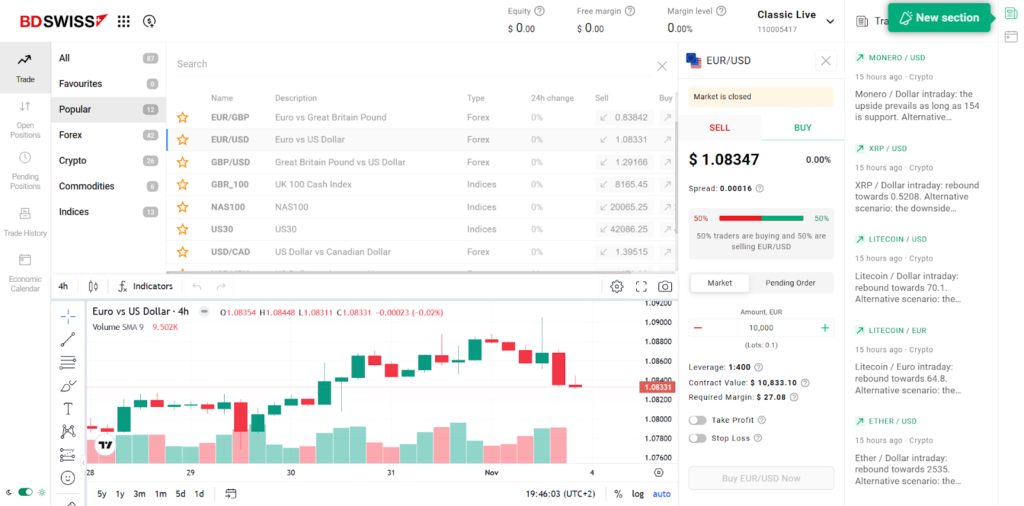

After you submit your details, the platform will send a 6-digit code to the email address you provided. Enter this code to proceed and secure your account. The image below shows how your dashboard will look when you sign up for the first time.

3. Verify Your Identity

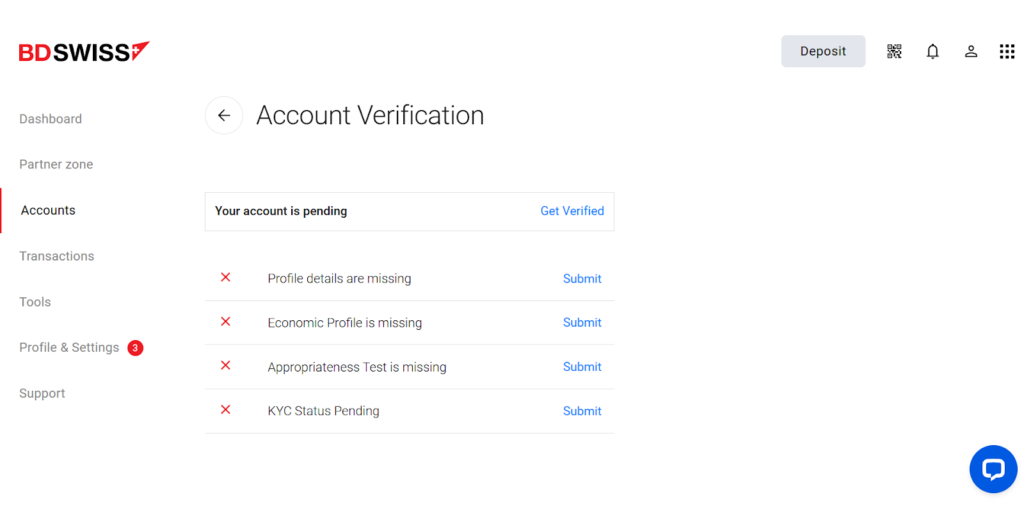

Now, before you can start trading, you need to verify your identity on the platform. For this, you need to add profile details, add your Economic profile, give an Appropriateness Test and complete your KYC.

Upload all the required documents such as proof of identity (ID card, passport) and proof of residence.

4. Fund Your Account

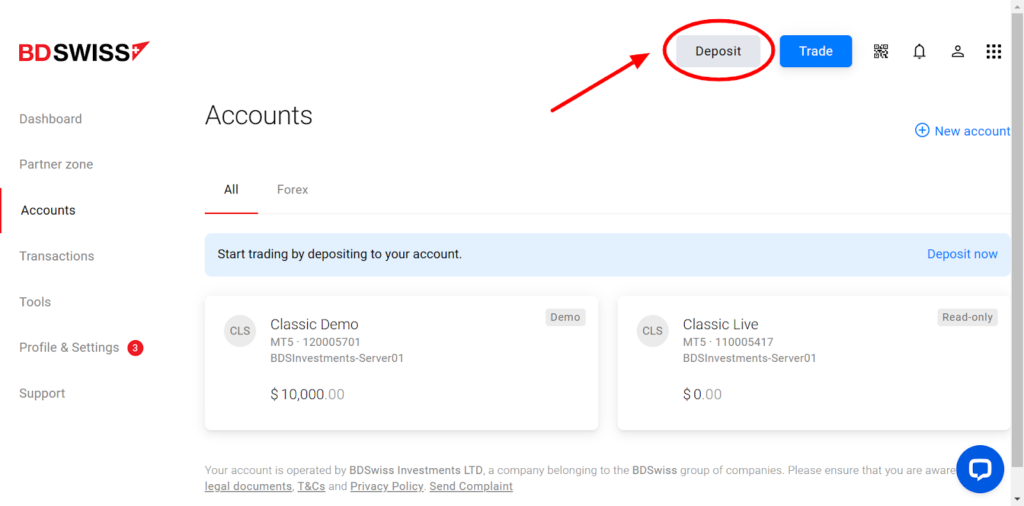

For you to start trading after all the hard work of verifying yourself, you need to fund your account according to the account type. Click on the Deposit button on the top of the screen like in the image below.

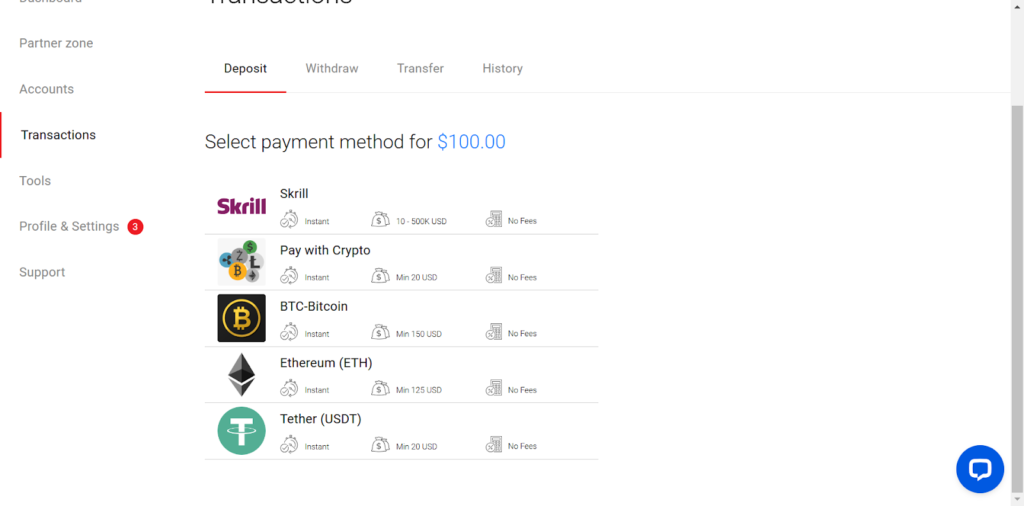

Now select the amount you want to add in your Classic account and choose a payment method from the options below. Each of the options have a minimum criteria which you can checkout yourself.

For example, let’s pay via crypto. For that, once you tap on Pay with Crypto it will open up a box for you to accept that you are the rightful owner of the wallet you’re going to be using for the deposit.

After that click on “Get Wallet Address” and transfer a minimum of 20 USD in crypto to the given deposit number. All of these methods are quick so you can choose the one that works best for you.

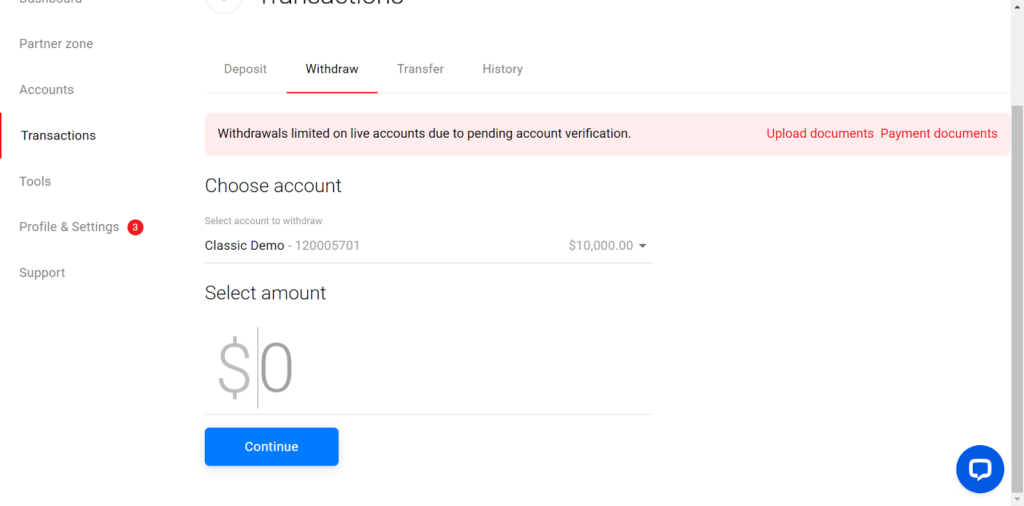

The same method is followed for withdrawals where you enter the amount you want to withdraw, enter the deposit wallet and done.

5. Start Trading

Once you receive your funds in the broker wallet, you can start trading instantly. There are multiple markets that you can explore here. We recommend reading the guides on their platform if you don’t already know how to trade.

It’s a bit complex so use it carefully as these digital assets come with risks. Start by using a Demo account so you can be familiar with how the platform works.

BDSwiss Copy Trading Platform

With over 20,000+ registered partners across 180+ countries, BDSwiss offers a copy trading platform which is useful for both beginner and experienced traders. It’s a great opportunity for experienced traders to earn commission and for beginners to copy the winning strategies of those traders.

For Master Traders: How It Works

To become a master trader, follow these steps:

Step #1: Register as a Partner on BDSwiss

For this, visit the Partners page and choose the programme you want to enroll in. BDSwiss currency offers two programmes which are:

- Affiliates: Perfect for those who have a strong online presence and earn competitive commission for referring new traders to the platform.

- Introducing Brokers: Best for those who are working closely with clients and grow your earnings by referring new Brokers.

There’s no setup fee for both of these and you can easily get started with it in a few minutes.

Step #2: Start Offering Your Strategy

After you’re in your dashboard, active Copy Trading on your live MT4 or MT5 trading account. Now the users can copy your strategies and make profits according to how well your strategies will perform.

Step #3: Earn Beyond Commissions

Once your clients start copying your trades you also earn performance fees on top of the commissions from your affiliate referrals. This means double the earning potential for successful trades.

As a Copy Trader

If you’re new to trading or just want an easy way to get started, this platform will help you out. You can simply follow and copy the trades of experienced Master Traders and make some profit. Here’s how it works:

Step #1: Choose a Master Trader

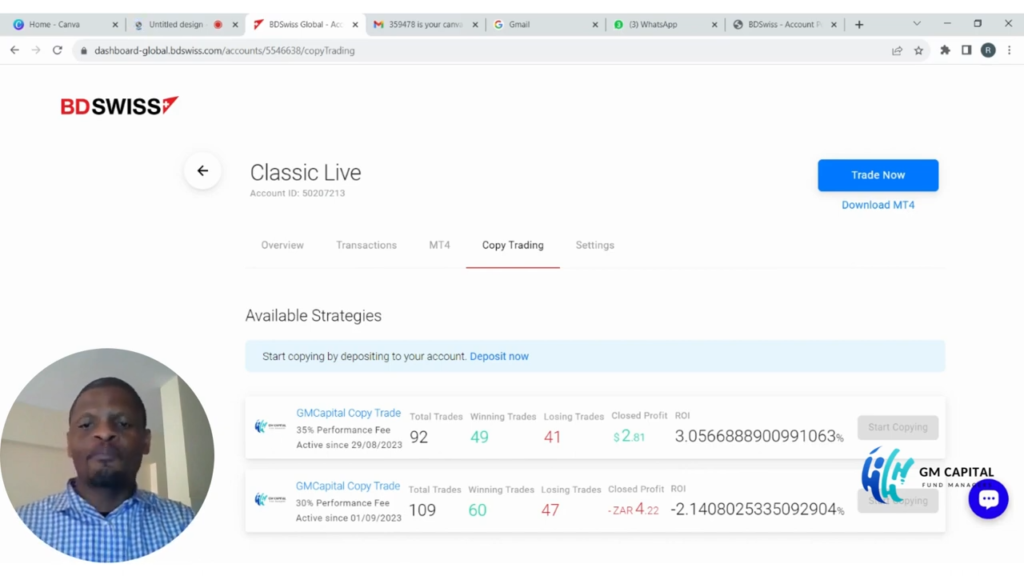

Once you’re set up on BDSwiss and have deposited the minimum required amount in your live account, you can start copying trades. In your Live account section, you’ll see the option of “Copy Trading”.

Click on it and it will open up a list of Master Traders that you can copy. You can check each trader’s track record and decide which one matches your goals and trading style.

Step #2: Start Copying Trades

Click on “Start Copying” and specify an amount you want to use for the trades. Now you can sit on your couch while your money makes you more money automatically.

You can also check the progress of each trade in the dashboard and even stop copying if you feel like the Master trader’s strategies are not working as per expectations.

Fee Structure

Currently, there’s no specific information on the fees that copiers have to pay for copying trades. However, a small percentage is cut from their profits as commissions for the Master Traders. On average, BDSwiss pays around $2.7 million in partners’ payments with an average conversion rate of 36%.

Control and Customization Options

BDSwiss provides various control and customization options to its users which include:

- Trader Selection: Users can browse and select from a range of Master TRaders based on performance metrics, risk levels, trading styles, and past results.

- Investment Allocation: As a user, you can allocate a certain amount that you want to invest in each trade.

- Adjustable Copying Settings: The platform allows users to set limits on the number of trades to be copied at any given time. You can also set how the trades should be executed (e.g., percentage of account balance or fixed amounts).

- Manual Intervention: While trades are copied automatically, users still have the ability to close any positions or stop copying whenever they want. This is like a safety net which allows you and other users to manage their investments.

Risk Management Features

As it is risky to invest in any financial market due to volatility and sudden price movements, BDSwiss offers risk management features, which users can use to protect their funds in case of any issues. Here are some of those features:

- Stop Loss Orders: Users can set a stop-loss level on their positions to automatically close trades if the market starts to move against their prediction. This minimizes potential losses.

- Take Profit Orders: This option allows traders to set a price at which they want their trades to automatically close to secure the profit.

- Negative Balance Protection: By using this feature users cannot lose more funds than they have available in their account. This is crucial for managing risk properly.

- Trailing Stop: This advanced order adjusts itself based on how well the market is performing. It helps to lock in profits while still limiting losses if the market reverses.

- Margin Call Alerts: BDSwiss sends alerts to traders if their equity falls below a certain threshold. This gives users a chance to take action before facing a margin call.

BDSwiss Review: What Happened to it in the UK?

To make this BDSwiss review more reliable and authentic, it’s important to talk about what happened to this broker in the UK in 2021. Basically, the FCA in the UK issued a warning and took action against the platform for violating marketing rules.

The FCA found that BDSwiss’s affiliates and social media influencers were promoting the platform to UK residents in ways that were not compliant with the regulations. Which is why they had to stop the platform from operating within the region.

Why Did the FCA Take Action?

The FCA has strict rules to protect retail consumers, especially regarding high-risk financial products like CFDs. These rules limit how CFDs can be marketed and sold to regular customers. FCA found that BDSwiss broke the rules and encouraged UK clients to sign up on the platform’s overseas entities.

Due to this, they misled the users from the UK to think that they were trading on a FCA-regulated broker which wasn’t actually true.

Overseas Referrals and Missing Consumer Protections

According to the FCA, nearly 99% of UK clients who signed up through BDSwiss’s affiliates were directed to its overseas branches. Because of this, those users couldn’t get the key protection that would have been provided to them if they had dealt with a firm regulated by FCA.

Misleading Marketing of Trading Signals

Another issue that was raised by FCA was the way trading signals were promoted. Affiliates often advertised trading signals to potential clients but failed to mention that the products being recommended were CFDs which are quite complex and carry high risk.

Conclusion – Is It Worth Investing with BDSwiss?

In this BDSwiss review, we talked about how this platform is perfect for both beginners and experienced traders due to the extensive features it offers. We also talked about how you can create an account here and start trading with a minimum deposit of 100 USD.

It is a solid platform for traders looking for regulated diverse and well-supported trading options. However, there are a few drawbacks as well such as they don’t offer support on weekends which can be frustrating.

Now for the million-dollar question, is it worth investing your hard-earned money with BDSwiss? For sure. Mostly because it gives you the option to diversify your portfolio which comes in handy when one of the markets isn’t performing too well. So if you’re looking for a platform that offers almost every investment opportunity, this is where you need to sign up.

Learn

Learn  January 2, 2025

January 2, 2025  38 min.

38 min.