If you’re getting started with crypto, one of the first questions that comes up is: Where should I trade? Naturally, the largest crypto exchanges are always recommended, but they aren’t considered the best just by their market size or popularity.

Instead, these best trade platforms stand out for their high trading volumes, which means deep liquidity—for scalable and smooth trading. You should know the impact of the exchange’s scale whether you’re trading your first bitcoin or a seasoned trader.

The size of your trading platform influences everything from the number of coins to transaction speed and even the security actions of that platform. Generally, large crypto platforms tend to offer you better market access, more trading pairs, and fast order execution speed.

This gives you an edge in volatile market conditions and helps maximize your trade profitability for better opportunities. So, let’s break down the leading crypto exchanges and why they are trusted by millions of traders globally.

Largest Crypto Exchanges Comparison

| Total Users | Trading Volume | Supported Cryptos | Trading Pairs | Market Share | |

| Binance | 200 million | $30.8 billion | 430 | 1648 | 36.6% |

| Coinbase | 110 million | $4.95 billion | 262 | 408 | 6.1% |

| Bybit | 50 million | $6.9 billion | 680 | 1035 | 16% |

| OKX | 50 million | $5.4 billion | 307 | 771 | 0.31% |

| Upbit | 10 million | $3.94 billion | 217 | 377 | 5% |

| Kraken | 10 million | $2.9 billion | 365 | 1009 | 0.02% |

| HTX | 46 million | $2.7 billion | 726 | 864 | 0.20% |

The Top 7 largest crypto exchanges

Here’s a list of the largest crypto exchanges:

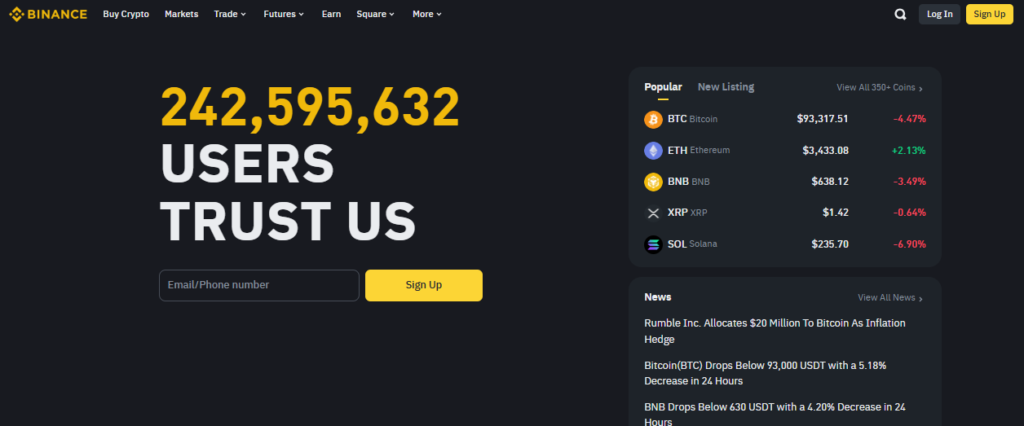

1. Binance

First up, we have Binance on our list. Founded in 2017 by Changpeng Zhao (CZ), Binance was started in China but later expanded globally.

According to CoinMarketCap, Binance has a 24-hour trading volume of $30.82 billion with a total of 380 cryptocurrencies listed. It has a total of 200 million users, signifying its big market position.

This crypto exchange offers multiple trading options like spot trading, futures trading, options trading, and margin trading. All of them have a significant impact on the platform’s size and user base.

Other features that set this exchange apart include staking, lending, Launchpad, and DeFi integration, which attract a broad range of traders, from beginners to professionals.

However, Binance is secured with 2FA (Two-factor authentication), and most of the assets are stored in cold storage to prevent theft. Binance also has an SAFU security protocol that’s basically an insurance policy for the users in case of security breaches.

Binance also has a competitive fee structure of 0.1% for regular users. This fee can even be further reduced with Binance Coin (BNB) holdings or high trading volume up to 25%. This platform doesn’t charge any deposit fee.

Binance also has a VIP-level system for traders based on their 30-day trading volume and BNB balance. If you’re at level 0, you’ll have the usual 0.1% maker/take fee. But as the trading tiers increase, your fee will decrease.

For example, if you reach VIP level 9 (the highest tier level), the maker fee is reduced to 0.02%, and the taker fee is 0.04%.

Additionally, here are the pros and cons of using Binance you should consider.

Pros

- Scalability: It’s a highly scalable platform. Binance handles millions of trades daily without any downtime.

- Reliability: It consistently offers high liquidity with wide trading pair choices.

- Trading options: Binance offers spot trading, futures trading, options trading, and margin trading.

- Binance referral ID: bonus for new users.

Cons

- Regulatory Issues: It’s not available worldwide due to regulatory management.

- UI: Beginners often complain about its interface and initially find it overwhelming due to its many advanced features.

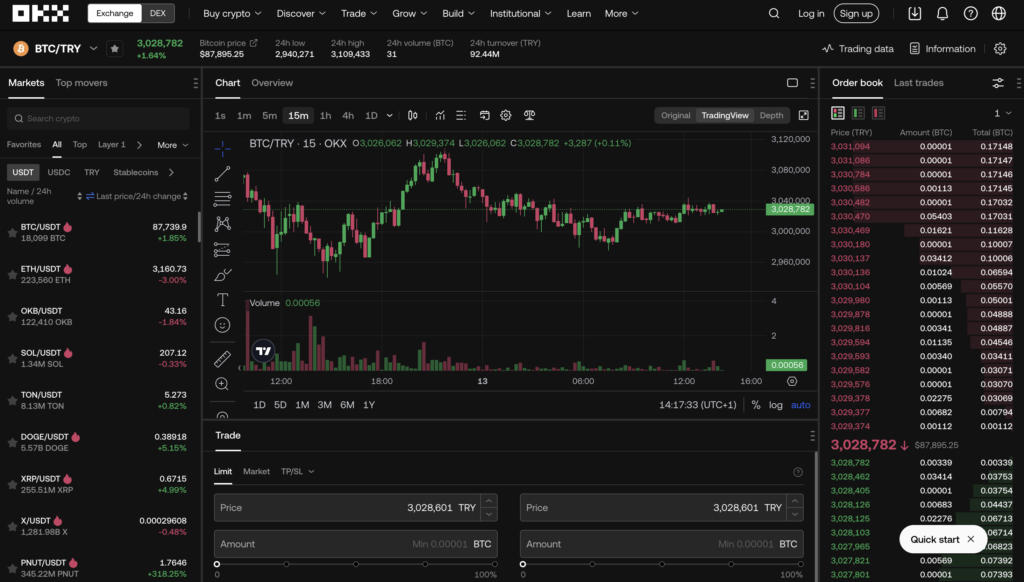

2. OKX

OKX was founded in 2017 by Star Xu in China and has expanded its ties to Asian markets ever since. This crypto exchange has a strong market reach considering it has a $5.4 billion trading volume per 24 hours and a user base of 50 million.

OKX’s features always stand out among its competitive exchanges. It offers you a complete derivative market. OKX mainly focuses on futures, perpetual swaps, and options on major cryptocurrencies like Bitcoin, Ethereum, etc.

This global crypto exchange has interest-earning products through staking, DeFi integrations, and flexible savings—giving you a full edge to grow your crypto assets indefinitely. Nevertheless, there are also flash sales and dual investments that pay out based on changes in the value of assets.

Moving ahead to security, OKX stores 95% of assets in cold wallets. It also has an MFA and anti-phishing features for enhanced security.

This platform charges you good prices. For spot trading, it starts from 0.08% for makers and 0.1% for takers and reduces up to 0.02% for makers and 0.05% for takers, depending on trading volume. For derivative trading, the prices are 0.02% for makers and 0.05% for takers.

Pros

- Derivatives market: OKX’s diverse derivatives market and advanced products attract experienced traders.

- Accessibility: OKX is highly accessible to local markets and fully functional in Asia, Europe, and Latin America.

Cons

- Regulatory compliance: OKX doesn’t meet the regulatory standards of the United States, thus missing out on a potential user base.

- UI: It has a quite complex interface for newcomers.

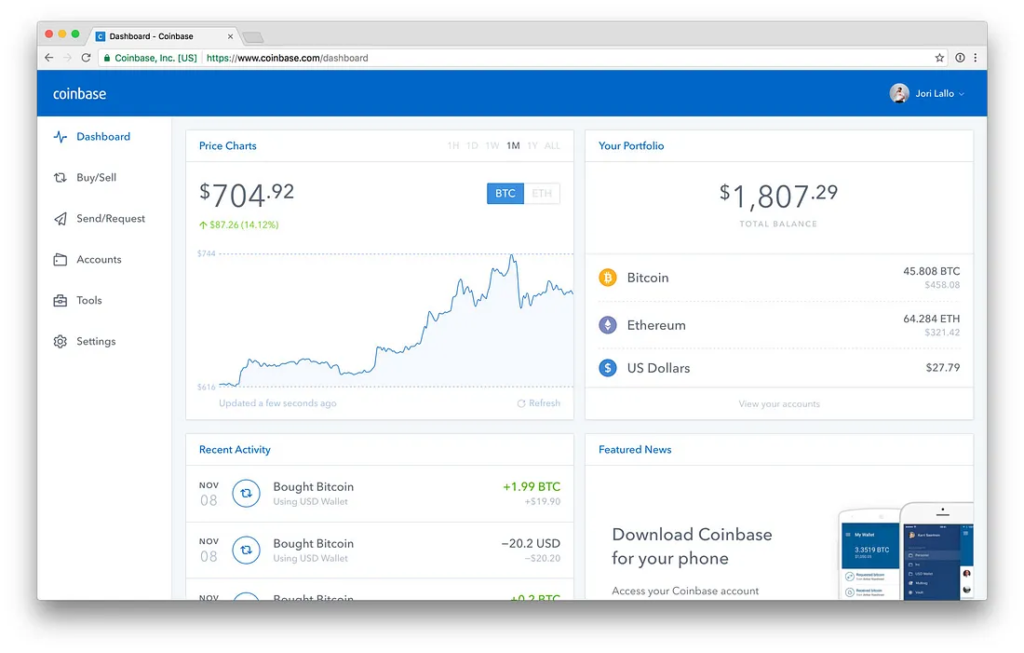

3. Coinbase

Coinbase was developed to simplify cryptocurrency trading and make it accessible to all users. As of 2024, this crypto exchange has a total user base of 110 million verified users and has expanded to 100+ countries.

According to CoinMarketCap, Coinbase has a strong market position with a $3.9 trading volume and a total of 262 cryptocurrencies listed online.

This leading crypto exchange offers spot trading and staking along with rewards for holding certain cryptocurrencies. For experienced traders, Coinbase Pro is available with lower fees and more advanced tools for high-frequency traders.

Coinbase has recently launched a marketplace that offers NFT growth and has a program that rewards users for learning about specific tokens.

It has 2FA, biometric logins, and hardware security key support. 98% of its funds are stored in cold storage to prevent online theft. Moreover, this crypto exchange also has a $255 million insurance policy to protect funds in hot wallets.

This crypto exchange has a competitive price structure. For retailers, it has a regular fee of 0.5% per transaction for small trades. However, Coinbase Pro has a tiered fee volume based on the 30-day trading volume.

For trading volume under $10,000, you will be charged 0.5%. As the trading volume increases, the fee rate decreases. For example:

- $10,000-$50,000: 0.35% taker fee and 0.25% maker fee.

- $50,000-$100,000: 0.25% taker fee and 0.15% maker fee.

- Volume exceeds $1 billion: 0.04% taker fee and 0% taker fee.

Following are the pros and cons of using Coinbase:

Pros

- Security: Much protection against theft using 2FA, biometric login, and cold storage.

- UI: Coinbase has the easiest-to-use interface.

- Regulatory compliance: It’s approved by the USA regulation check.

Cons

- Fees: Coinbase has a high fee for retail users.

- Trading pairs: It has limited altcoins and trading pairs that may not be suitable for most users.

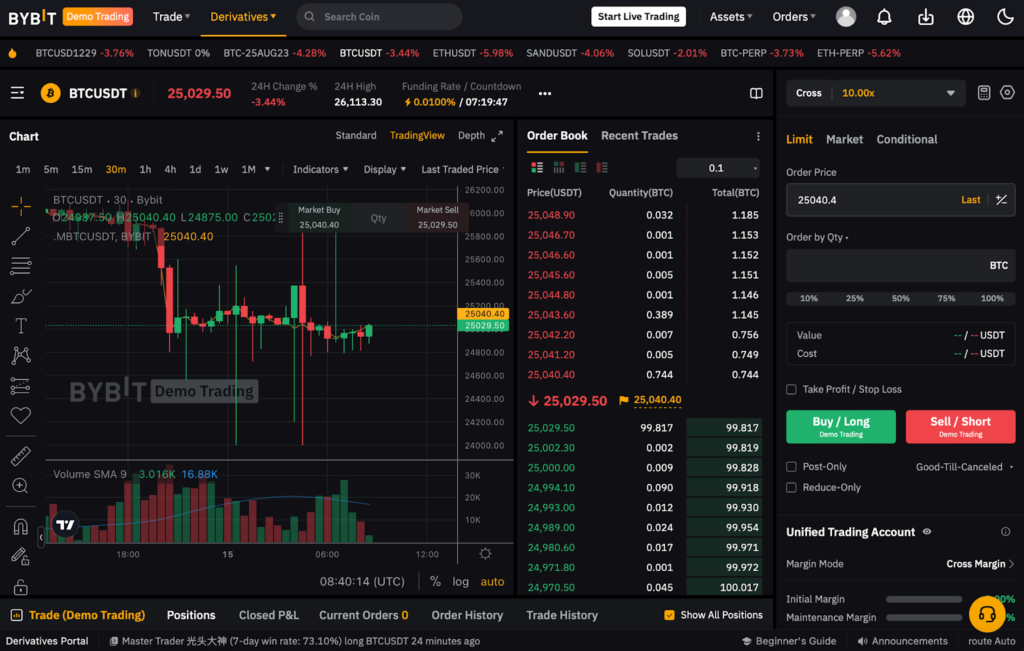

4. Bybit

Bybit has a trading volume of $6.9 billion and 680 cryptocurrencies. Its strong user base of 50 million includes experienced traders, as it focuses on leveraged trading.

Bybit’s key features are quite commendable. It lets users trade cryptocurrencies with 100x leverage, considering it offers you perceptual contracts and futures. Bybit also has inverse perceptual contracts for Bitcoin, Ethereum, and other top cryptocurrencies.

Though this exchange mainly focuses on derivatives trading, it also has a simple fiat on-ramp for spot trading users who prefer to hold assets directly.

From a security perspective, this platform also stands out. It has cold wallet storage, 2FA, and user SSL encryption. Bybit also provides an insurance policy in case any funds are damaged.

The fee structure highlights the benefits of placing limit orders rather than market orders to boost liquidity. You’ll be charged a 0.025% maker fee and a 0.075% taker fee. This platform also provides discounts on high trade volumes if you choose the VIP program.

Pros

- High Liquidity: Its liquidity and trading volume in derivatives trading are beneficial for professional traders.

- Tools: Bybit’s has advanced tools for trading, order types, and charting features.

- Global reach: It’s highly adaptable globally, considering the multilingual support it offers.

Cons

- Spot Trading: Bybit doesn’t offer many features for spot trading users.

- US accessibility: It’s not available in the US, which limits its potential user base.

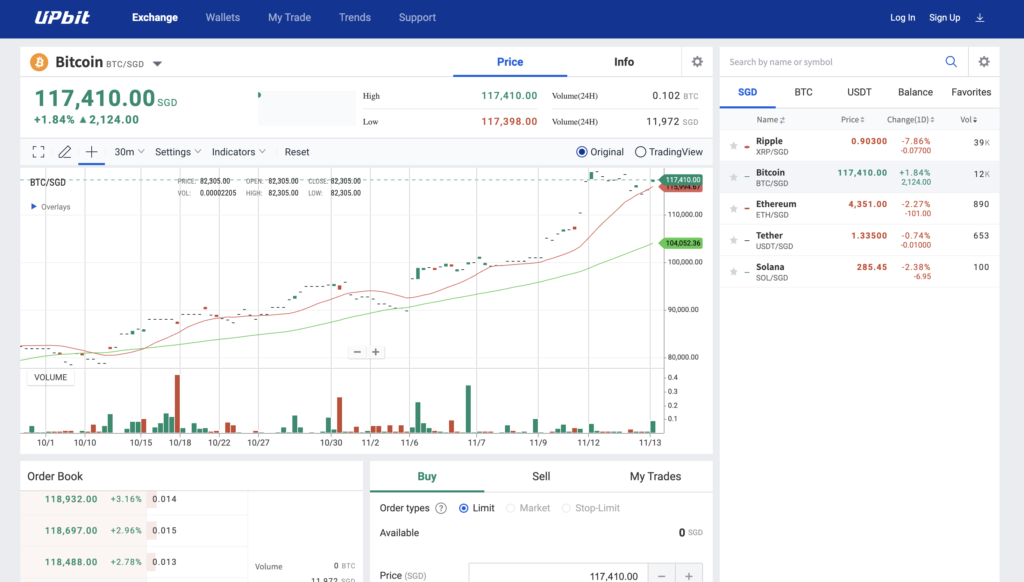

5. Upbit

It’s one of the best trade platforms in South Korea that ranks among the top leading crypto exchanges. It has a user base of 10 million, typically from Korea, Singapore, Indonesia, and Thailand.

Upbit has a trading volume of $3.9 billion per 24 hours. It has 217 cryptocurrencies and 377 trading pairs available, like BTC/KRW, ETH/KRW, and others, which has made it the go-to platform for South Korean traders.

Upbit’s key characteristics include smooth trading in South Korean won (KRW) and support of fiat-to-crypto trading pairs. It also offers spot trading along with trading pairs in KRW, BTC, and USDT.

Despite these, Upbit’s insurance-backed systems add more security for Korean traders. It strictly follows KYC and AML security protocols to prevent theft.

From a pricing perspective, Upbit has a simple fee structure. It charges a flat 0.25% trading fee for both makers and takers. However, it doesn’t offer any discounts on high trading volume. Upbit also charges withdrawal fees based on the asset.

Pros

- Safety: Upbit is in regulatory compliance with South Korean security adherence, which makes it a highly safe trading platform.

- Reliability: It’s a highly reliable exchange for local traders, as you can trade directly in KRW.

Cons

- Reach: Upbit is highly limited outside Asia. It mainly focuses on only the South Korean market.

- Lack of options: Upbit doesn’t have derivatives and advanced trading options.

- High fee: Its flat fee of $0.25 can be high for many local traders.

6. Kraken

Next, we have Kraken as the 6th leading crypto exchange. It was founded in 2011 and has expanded across the U.S., Canada, Europe, and Asia. Kraken has a strong market position among its peers with a $1.85 billion trading volume per day. It has a user base of $10 million users globally.

Experienced traders will have an edge using Kraken as its features are quite advanced. It offers futures, options, and margin trading. Kraken enables users to do futures trading with multiple pairs and leverage positions up to 50x.

It has secure staking options that help provide an annual yield of up to 4-20% depending on the asset. You’ll also find advanced order types like limit, stop-loss, take-profit, etc. for effective risk management.

Despite this, Kraken’s security standards included cold wallet storage, 2FA, insurance coverage, and GSL protocols to prevent theft. It’s also regarded as a safe crypto exchange.

The fee structure is also pretty simple. Maker fees start from 0.16% for volumes under $50,000, scaling down to 0.00% for volumes over $10 million. However, the taker fee starts at 0.26% and goes down to 0.10% for high-volume traders.

Pros

- Safe: Kraken is a highly safe platform considering 2FA, GSL, and cold wallet.

- Features: Kraken has enhanced features for experienced traders like multiple trading options, staking, etc.

- Kraken referral: bonus for new users.

Cons

- Fee: Its fee can be high for small-volume traders or newcomers.

- Complexity: The advanced trading feature makes the interface complex and overwhelming for beginners.

7. HTX

This is the 7th leading crypto exchange founded back in 2013 in China and gained huge popularity in Asia. HTX features cater to both new and professional traders. Its characteristics make it a pretty competitive platform for advanced trading strategies.

According to CoinMarketCap, this global exchange has a solid market position with a 7th ranking and a $2.7 trading volume per day. It has a total of 46 million verified users.

HTX offers derivatives trading along with perceptual swaps and futures contracts for top cryptocurrencies. This exchange even has its own token, HT, that comes with many benefits, such as trading fee discounts, VIP access, and staking opportunities.

You’ll also have options for spot and margin trading. HTX also has fiat-to-crypto services for multiple cryptos. From security standards, HTX is 2FA protected along with IP whitelisting. 98% of funds are secured in cold wallet storage.

It also has insurance funds to cover security breaches and has partnered with cybersecurity firms for regular security audits. HTX has a tiered fee structure for high-volume traders.

For regular spot trading users, it’s 0.20% with further discounts on HT tokens. However, for futures and derivatives trading, the maker fee is as low as 0.02% and the taker fee is at 0.04%. These traders can have more discounts on trading volume or HT holdings.

Pros

- Extensive options: HTX has spot, futures, and margin trading pair options that appeal to many users.

- Security: HTX security funds make it among the safest exchanges.

Cons

- Regulatory Compliance: HTX isn’t available in the US, which limits its user base.

What Should You Look for in Large Crypto Exchanges?

You have to measure trading liquidity, volume, platform interface, asset coverage, scalability, and much more to see what makes a large crypto exchange the best. However, some basic parameters can help you ensure that your trades are made smoothly. The following are these:

1. Volume and Liquidity

Trading volume is the total number of coins traded on a platform. Thus, the higher the volume, the more trading activity, which means the exchange is operating continuously and can handle more big orders without price fluctuations.

However, liquidity means processing the transaction without affecting market prices. It’s to avoid slippage to offer better prices to traders. Binance handles over $39million in trading volume per day, which shows how successfully trades get executed without any downtime.

See this example. Let’s say you want to trade $10,000 worth of Bitcoin. Since Binance has active users and a very high trading volume, your large trade will fit into the existing trades, and you won’t have to lower the price to meet buyers.

But if you want to sell $10,000 Bitcoin on some low-volume trading platform, you’ll have to lower this current price to find enough people to buy. This means losing out on potential profits—a scenario called slippage.

2. User Interface

No one likes navigating complex interfaces. It’s quite overwhelming to understand and scroll through. However, a simple and beginner-friendly design is always preferred, as they make crypto trading far easier. Also, it’s said that during highly volatile market conditions, exchanges with advanced UI tend to face crashes that are a potential loss for traders.

Thus, Gemini, a crypto exchange, is mostly recommended to beginner-level traders, considering its easy interface that makes trading less intimidating for newbies. Though it might seem small, but user interface always plays a big role in increasing the user base for exchanges. In 2021, Coinbase said 56% of its users were beginners to emphasize how it’s a user-friendly platform for all traders.

3. Asset Coverage

The largest the exchange, the more they’ll have the cryptocurrencies listed. You’ll find hundreds of assets from Bitcoin, Ethereum, XRP, and BnB to altcoins and DeFi tokens available on the best trade platform.

We have a prime example of Binance. It has almost 432 cryptocurrencies with 1652 trading pairs, meaning you can trade many coin combinations on one platform.

Also, see Coinbase. It’s more inclined towards regulatory standards. This exchange supports 200 assets and makes sure each asset meets US regulatory standards to make it a trustworthy trading platform for big investors.

For example, you want to diversify your holdings. You trade Ethereum, but you are also interested in experimenting with smaller, new tokens.

Binance gives you this facility. You can add coins like Cardano (ADA), Chainlink (LINK), or whatever coin you prefer. These trading pairs basically offer you flexibility. You don’t have to open multiple accounts in different exchanges, which helps keep your portfolio accessible in one place.

4. Regulatory Compliance

This is a mandatory factor in evaluating a crypto exchange. Regulatory standards tell you about a platform’s credibility, security, and reliability. Big investors mostly go for crypto exchanges that meet both local and international regulations and offer insurance policies for all users.

These exchanges follow KYC (Know Your Customers) and AML (Anti-Money Laundering) protocols to make sure all the traders are verified for a safe online environment.

If your exchange doesn’t meet these standards, you might face fines, shutdowns, and often downtime that basically puts your investment at risk.

You know Coinbase. It went public on NASDAQ in 2021 to emphasize its commitment to transparency and compliance. It’s linked with U.S. financial laws, which provide a higher level of trust for users and ultimately a greater fanbase.

Pros and Cons of Large Crypto Exchanges

Pros

- More Features: The bigger the trading platform, the more it’ll have to offer. Exchanges like Binance, Coinbase, Bybit, etc. have features beyond just spot trading that make them appealing to all traders. See Binance; it has 1652 trading pairs to offer along with services like futures contracts, earning programs, and a launchpad for new tokens. That’s why it’s the leading cryptocurrency exchange today.

- High liquidity: Large crypto exchanges always have high market liquidity. Traders can easily enter and exit the market without much pricing impact and slippage. See Coinbase. Its trading volume is $2.29 billion. This deep liquidity allows the Coinbase user to trade big amounts without worrying about the price drop.

- Security: With a huge user base, security always comes first. All the best trading platforms invest heavily in regulatory and security checks to make them trustworthy platforms. For instance, Coinbase holds 98% of assets in cold storage, whereas Binance strictly follows KYC protocols for greater security.

- Customer Service: Potential traders come with potential requests; that’s why large exchanges always have a robust customer support network to help. They also have educational guides available to make trading more accessible for their users.

Cons

- High Fees: The best trade platforms tend to have a competitive fee structure. For this reason, small-volume traders don’t always find them reliable. Just like Coinbase. It charges around 0.5% in trading fees for small-volume trades, which overwhelms beginners.

- Complex UI: Since large platforms come with more features, they often have a hard-to-navigate interface. For experts, Binance’s interface has a lot to offer, but it intimidates new users considering so many trading options and its respective UI available.

- Regulatory Restrictions: Big crypto exchanges follow strict protocols, which can result in regional restrictions and compliance demands. Just like Binance, it’s only available in 180 countries and has faced multiple compliance issues in the UK, Japan, and Canada, which resulted in the closing of its services there.

Conclusion: Which Largest Crypto Exchange is Best for You?

Choosing the right crypto trading exchange depends upon your trading volume, experience, and security concerns. All the top leading exchanges offer deep market liquidity, low pricing slippage, are highly secured, and often have a high trading volume. So you’ll have to evaluate what your main concerns are and select wisely.

However, if you’re an experienced trader, Binance and Bybit are most suitable. They have many trading options, high liquidity, greater market shares, and an advanced algorithm that helps execute significant trades without high price impact. These platforms also have a tiered fee structure, which will lower your fee based on trading volume.

But if you’re a newbie, Coinbase and Upbit are best. They have a user-friendly interface and offer multiple educational support to traders. Both of them prioritize security, offering insurance-backed funds and cold storage to protect your initial investments from theft.

However, keep in mind to check the global access restriction, as not all largest crypto exchanges are available worldwide. Go with what suits you the best. Happy Trading!

Learn

Learn  April 14, 2025

April 14, 2025  33 min.

33 min.