Bitcoin (BTC) remains the dominant digital asset in the market, with its behavior dictated by economic factors, institutional adoption, and on-chain metrics. According to data from Glassnode, BTC’s long-term dynamics point to a promising outlook, but with challenges.

This article analyzes how these factors could influence the price of the largest cryptocurrency through 2025.

Bitcoin’s recent action: resistance and opportunities

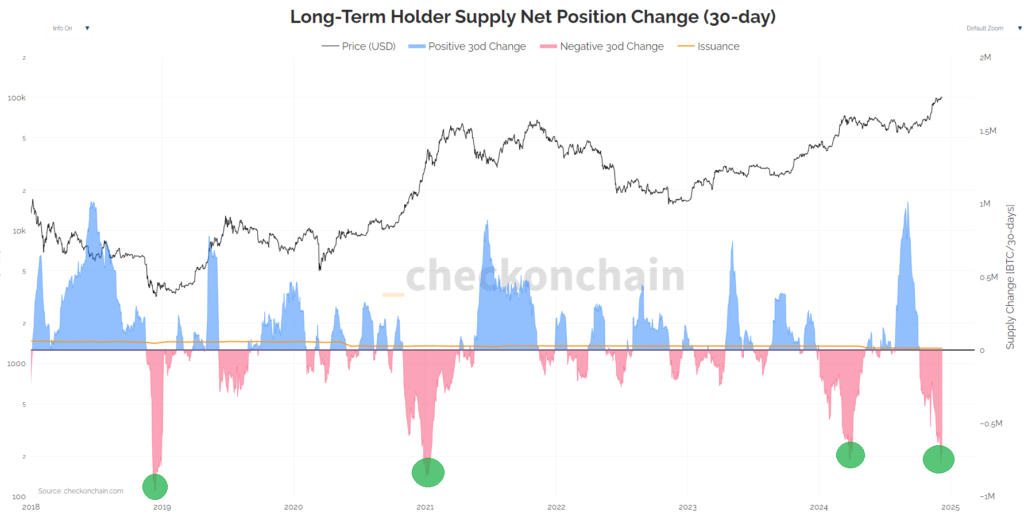

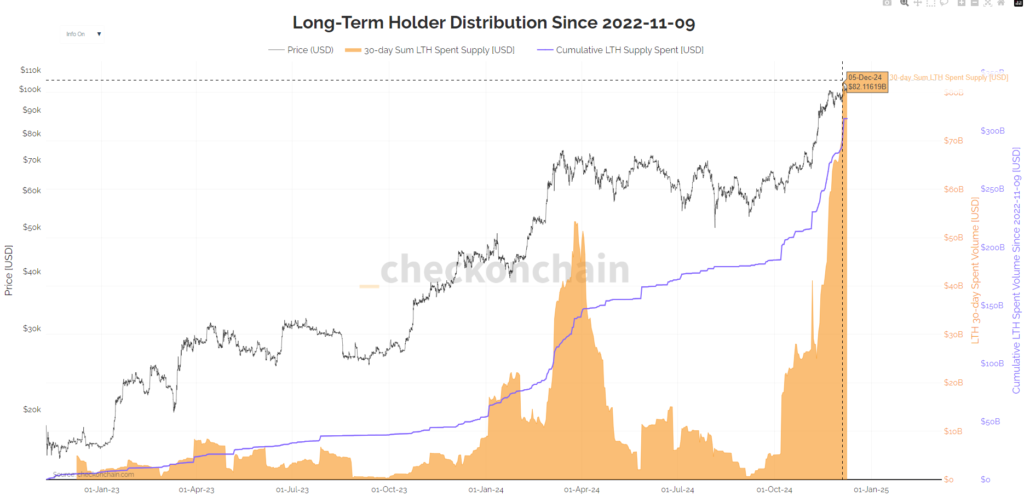

After reaching new all-time highs in late 2024, Bitcoin is facing significant pressure from long-term sellers (LTHs). On-chain data shows an increase in monthly sales from these wallets, especially above the $95,000 mark. This suggests that many long-term holders are capitalizing on their profits, which could generate temporary downward pressure.

Since the beginning of November, long-term holders have sold 827,783 BTC at an average price of $99,200, totaling $82.6 billion.

However, high on-chain activity and growing global adoption are reinforcing the bullishness on Bitcoin. Wallets with balances greater than 1 BTC continue to grow, reflecting increased interest from retail investors. This is relevant as an increase in retail participation could provide additional support to the price, mitigating the selling pressure of LTHs.

Bitcoin fundamentals remain strong

In addition, the halving, which took place in April 2024, has maintained its significant impact on the supply of new Bitcoin. Historically, halvings have resulted in bullish cycles in the price of Bitcoin, with peaks observed in the following 12-18 months.

However, the halving issuance, which increases scarcity, has been compounded by the approval of spot Bitcoin ETFs that have sparked an institutional rush into the asset.

Financial institutions such as BlackRock and Fidelity continue to expand their Bitcoin-related products. These vehicles increase the accessibility of BTC for traditional investors, increasing liquidity and demand.

Furthermore, the continued involvement of large institutional players tends to stabilize the market. This reduces volatility and reinforces Bitcoin as a reliable store of value.

Could $100,000 be the top of this cycle?

However, CryptoQuant analyst Maartuun warns of signs of the end of the cycle. In his X account, he presented some data that supports his thesis. Thus, the analyst believes that Bitcoin is already in the “musical chairs” phase, and warns:

“Enjoy the ride, but be prepared when the music stops.”

Maartuun noted that MicroStrategy’s recent purchases represent only 30% of what LTHs have sold. He also suggested that retail demand has resisted the current selling pressure, as these investors are also involved in futures trading. Data indicates that Bitcoin’s Open Interest (OI) is above $60 billion.

Bitcoin Price Prediction for 2025

Finally, based on fundamentals, Bitcoin has the potential to surpass the $150,000 mark by the end of 2025. This forecast assumes continued institutional adoption, reduced supply post-halving, and growing retail interest.

However, traders should closely monitor the movements of long-term holders and macroeconomic indicators. Bitcoin may face resistance in the short term, but the medium to long-term outlook remains bullish, with 2025 promising to be another transformative year for the world’s largest cryptocurrency.

News

News  December 9, 2024

December 9, 2024  5 min.

5 min.