The delisting of Tether (USDT) from European exchanges is accelerating with the enforcement of the Markets in Crypto-Assets (MiCA) regulation. Crypto.com is among the first platforms to confirm the removal, scheduled for January 31. Along with USDT, nine other cryptocurrencies will also be delisted, affecting investors and traders who rely on these stablecoins.

Coinbase had already delisted USDT in October 2024 due to regulatory concerns. Now, as compliance with MiCA becomes mandatory, other exchanges are following suit. This trend signals an uncertain future for stablecoins that do not meet European regulatory standards.

Exchanges Delist USDT to Comply with MiCA

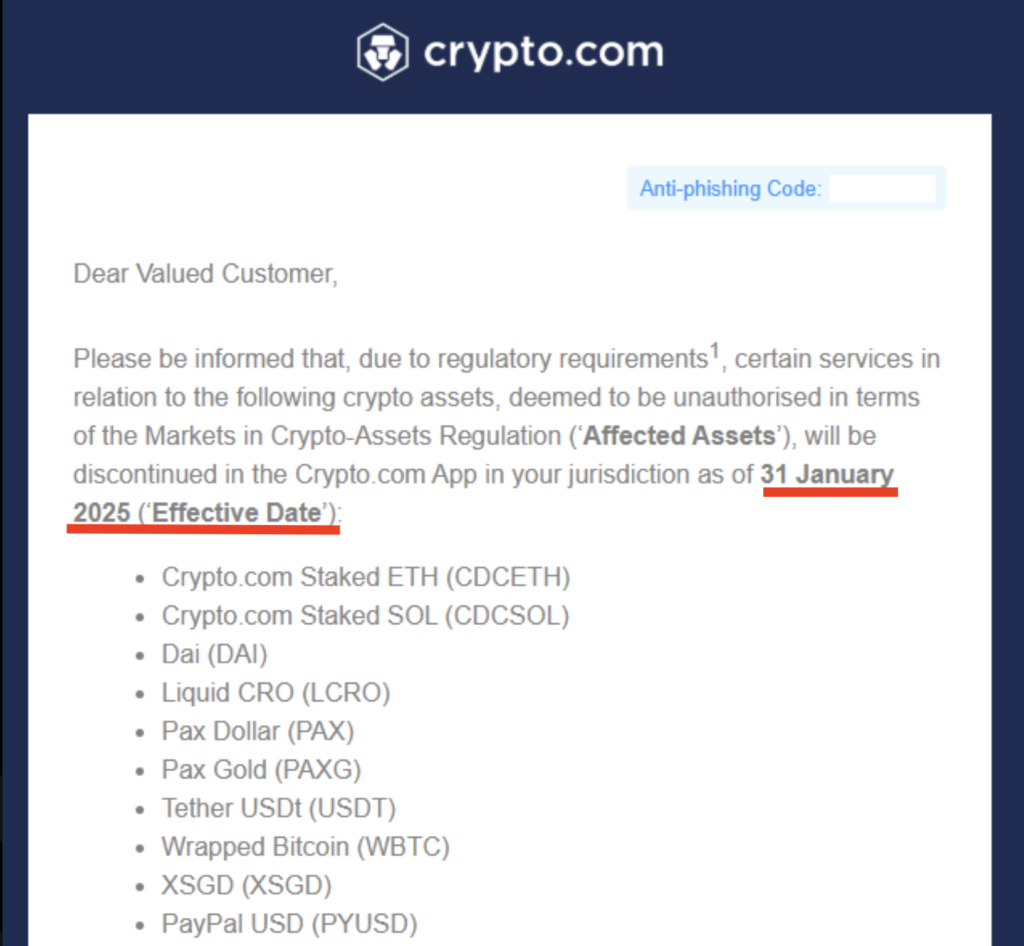

Crypto.com has announced that it will suspend USDT purchases and deposits starting January 31. However, withdrawals will remain available until the end of Q1 2025. After this period, the delisting will be final, and any remaining balances will be automatically converted into MiCA-compliant stablecoins.

Besides USDT, the delisting list includes Wrapped Bitcoin (WBTC), Dai (DAI), Pax Dollar (PAX), Pax Gold (PAXG), PayPal USD (PYUSD), Crypto.com Staked ETH (CDCETH), Crypto.com Staked SOL (CDCSOL), Liquid CRO (LCRO), and XSGD (XSGD). This move aligns with guidelines set by the European Securities and Markets Authority (ESMA), which requires crypto service providers (CASPs) to eliminate non-compliant stablecoins.

The Impact of Regulation on Stablecoins

The removal of USDT has raised concerns in the market, as it is the world’s largest stablecoin, with a market capitalization of $139 billion, according to CoinGecko. Its main competitor, USD Coin (USDC), was approved as MiCA-compliant in July 2024 and currently has a market cap of $52 billion.

Coinbase had already removed USDT in December 2025, offering customers the option to convert their holdings into regulated stablecoins. Now, with Crypto.com following suit, other exchanges are expected to adopt similar measures, solidifying USDC’s position as the leading stablecoin in the European market.

The Future of USDT in Europe

Since MiCA came into effect on December 30, 2024, several crypto exchanges have been seeking licenses to operate in Europe. While some have already received approval, others, including Crypto.com, are still undergoing regulatory review.

On January 17, Juan Ignacio Ibañez, a member of the MiCA Crypto Alliance Technical Committee, emphasized that EU-based CASPs should phase out non-compliant stablecoins. He stated that by March 31, “no trace of USDT should remain, not even in sell orders.”

The crypto market is closely monitoring regulatory developments and how platforms adapt to ensure MiCA compliance. Decisions made in the coming months will shape the future role of stablecoins within the European ecosystem.

News

News  January 29, 2025

January 29, 2025  4 min.

4 min.