Decentralized exchanges have become increasingly popular. But why’s that? Because of their enhanced security, you have complete control over your assets. An exciting report revealed that in 2023, the trading volume of DEXs surpassed $1 trillion.

This shows how vital these decentralized exchanges are for crypto traders. These exchanges use smart contracts on blockchain to work. This allows traders to conduct P2P transactions without an intermediary.

But why is that beneficial? It offers lower fees, increased privacy, and a reduced risk of hacking.

In this guide, we’ll explore:

- Top 10 decentralized exchanges for 2024

- Comparing their features

- Things to consider before choosing a DEX

So, let’s dive right into our topic.

Top Decentralized Exchanges in 2024

Below is a table summarizing the top decentralized exchanges of 2024, their main features, supported blockchains, and fees.

| Exchange | Main Features | Supported Blockchains | Fees | Call to Action |

| Uniswap | Automated Market Maker, High Liquidity | Ethereum, Polygon, Optimism | 0.3% per trader | Start trading on Uniswap |

| PancakeSwap | Binance Smart Chain, Yield Farming | Binance Smart Chain (BSC) | 0.2% per trade | Join PancakeSwap |

| dYdX | Perpetual Trading, No Gas Fees | Ethereum, Layer 2 | 0.1% per trade | Trade with dYdX! |

| Curve Finance | Stablecoin Swaps, Low Slippage | Ethereum, Fantom, Avalanche | 0.04% per trade | Trade on Curve Finance! |

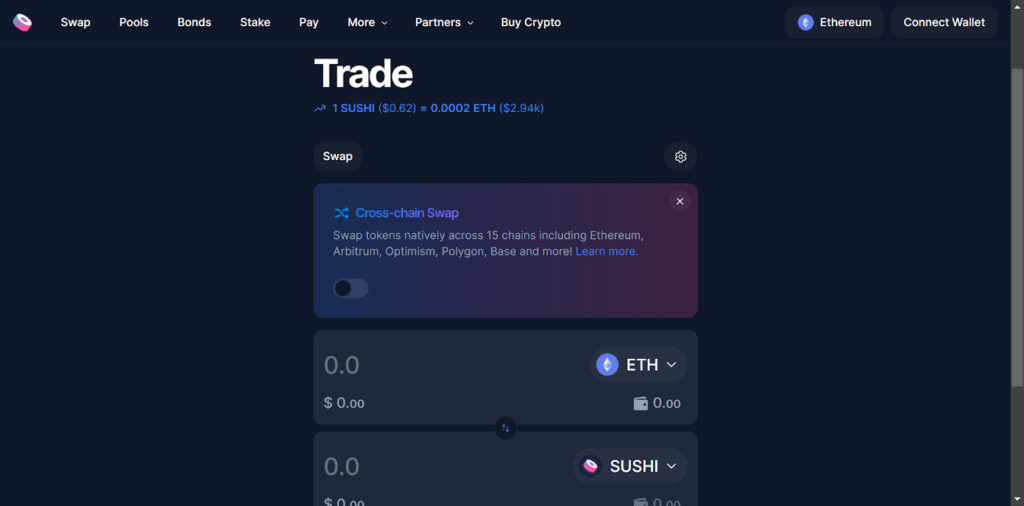

| SushiSwap | Multi-Chain, Staking Rewards | Ethereum, BSC, Polygon | 0.3% per trade | Explore SushiSwap! |

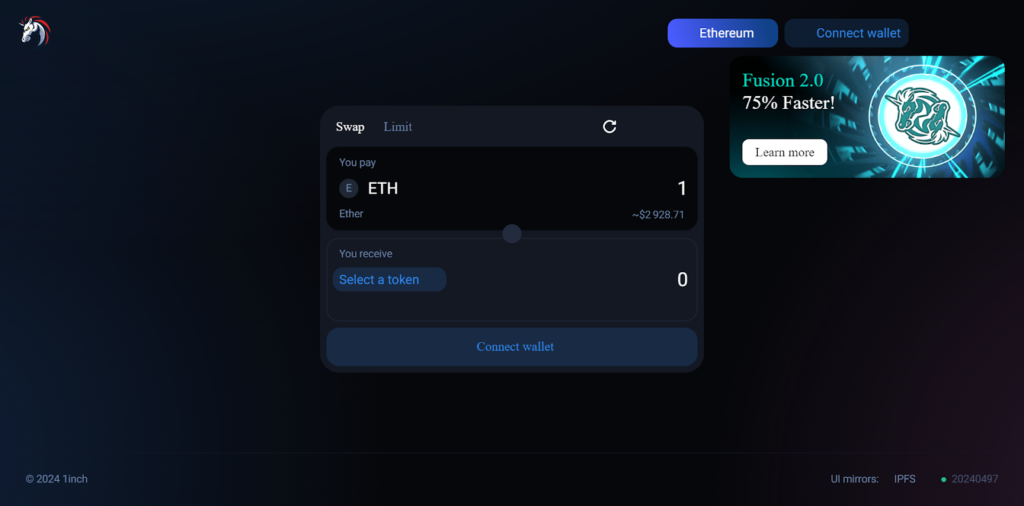

| 1inch | Aggregator, Best Prices | Ethereum, BSC, Polygon | Variable, based on protocol | Trade on 1inch! |

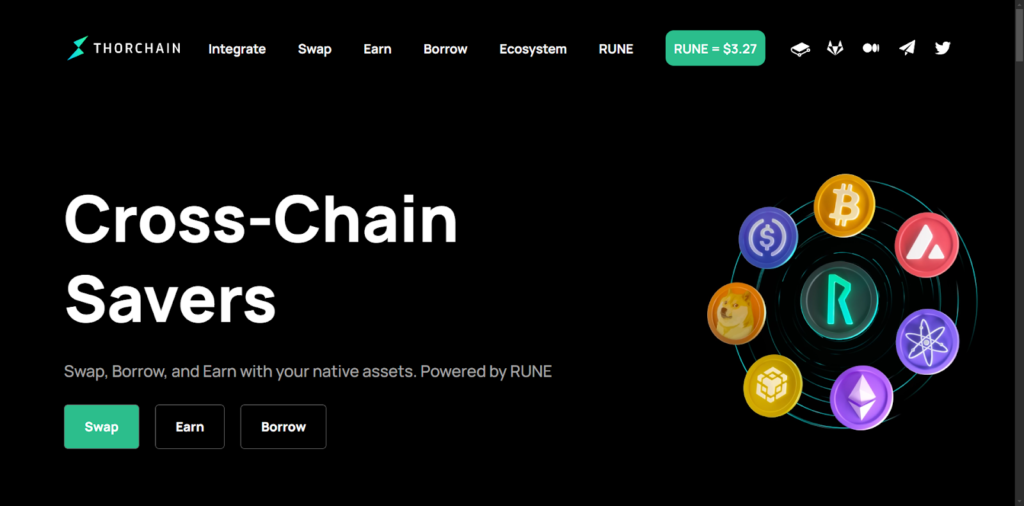

| Thorchain | Cross-Chain Swaps, Native Token | Thorchain Native | 0.3% per trade | Explore Thorchain! |

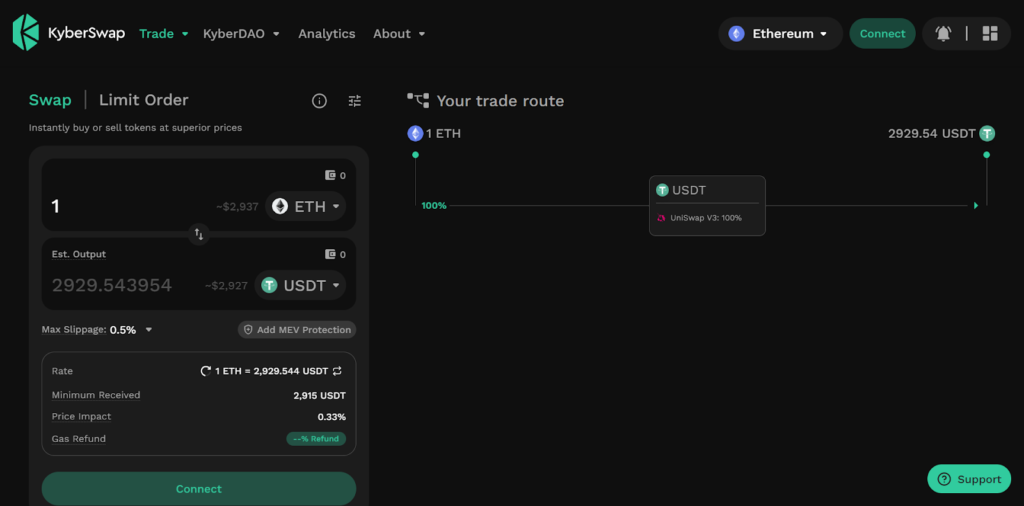

| KyberSwap | Dynamic Market Making, High Liquidity | Ethereum, Polygon, BSC | 0.2% per trade | Join KyberSwap! |

| OKX DEX | Hybrid DEX, High Security | Ethereum, BSC | 0.1% per trade | Trade on OKX DEX! |

| ApeX Pro | Perpetual Contracts, High Leverage | Ethereum, Polygon | 0.15% per trade | Explore ApeX Pro! |

Overview of the Best Decentralized Exchanges

Nowadays, traders don’t like the interference of a middleman in their trading activities. Because of this, they are now more inclined to engage in decentralized exchanges. Mainly because there’s no central authority looking over you at all times.

Let’s take a brief look at the top 10 DEXs.

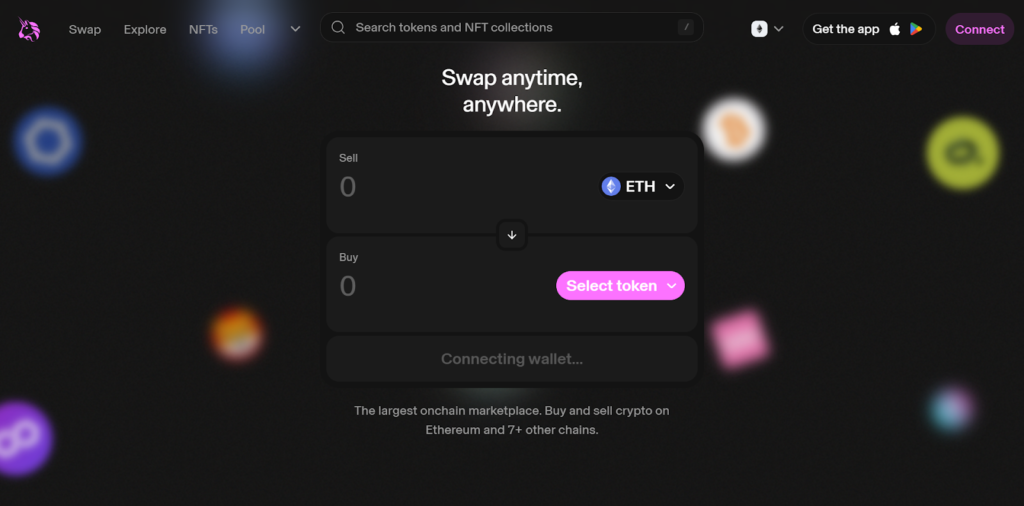

1. Uniswap

At No. We have Uniswap. It is the leader of the DEXs because of its automated market maker (AMM) model. This model ensures high liquidity and a wide range of tokens. It’s the best choice for traders who prefer Ethereum, Polygon, and Optimism chains.

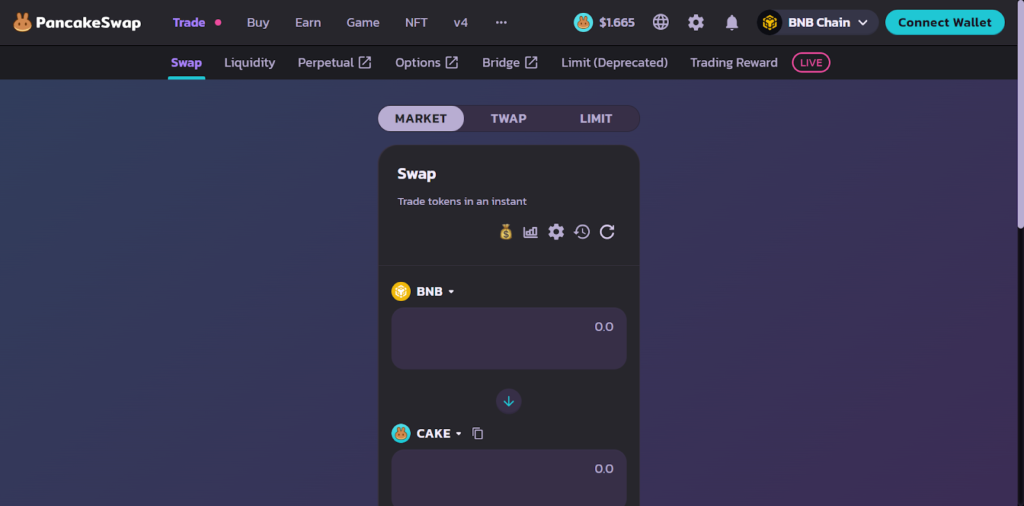

2. PancakeSwap

It is built on the Binance Smart Chain, which offers low fees and high-speed transactions. This makes it one of the top decentralized exchanges currently available in the cryptocurrency market. This exchange also provides various ways for traders to earn passive income, including yield farming and staking options.

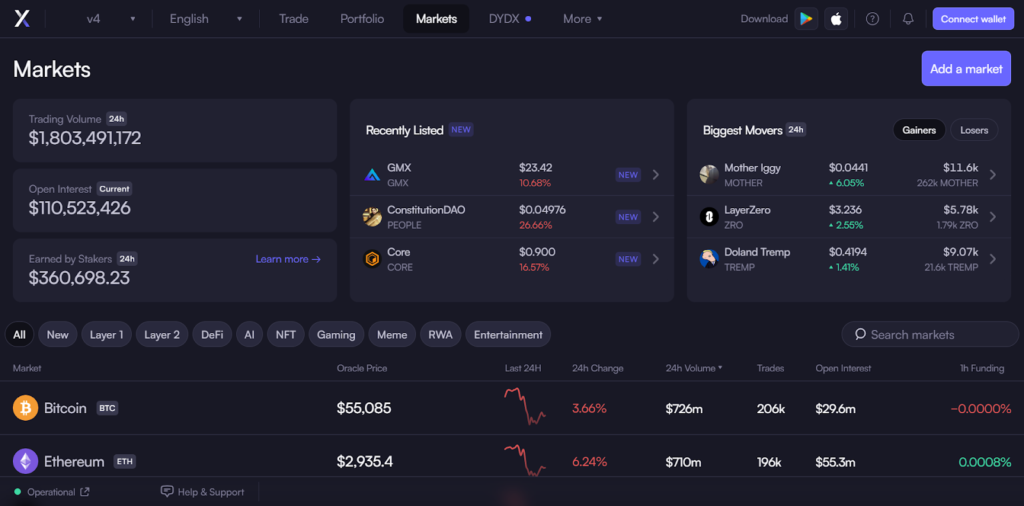

3. dYdX

The standout feature of the dYdX exchange is its gas-free perpetual trading on Layer 2. It is one of the best DeFi exchanges that offers advanced trading options without any gas fee. This feature makes it an interesting option for traders who want cost-effective and complex trading tools.

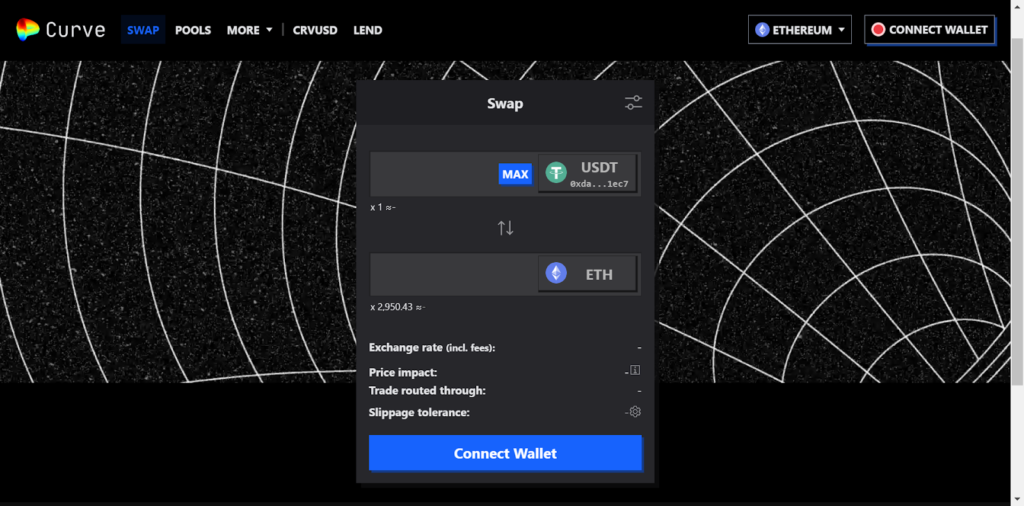

4. Curve Finance

Curve Finance’s primary specialty is stablecoin swaps. This exchange offers very low slippage and optimized trading fees. By providing support for Ethereum, Fantom, and Avalanche blockchains, this DEX ensures that users have multiple options for trading stablecoins.

5. SushiSwap

SushiSwap is a community-driven DEX made especially for traders and liquidity providers. This DEX combines AMM and order book functionalities. This feature makes it an innovative DEX for the users. SushiSwap supports multiple chains, including Ethereum, Binance Smart Chain and Polygon. Apart from that, it also offers rewards for staking tokens to its users.

6. 1inch

It is known as the DEX aggregator. This decentralized exchange’s main aim is to offer the best prices among all other exchanges. Combining this feature with its ability to support ETH, BSC, and Polygon chains will make it the No.1 choice for traders who want the best trading deals.

7. Thorchain

It is a network that offers native asset settlement between multiple chains, also known as native cross-chain swaps. Because of this, traders can seamlessly transact between multiple blockchains. This high-security DEX has its own Thorchain native blockchain, which provides the best cross-chain functionalities.

8. KyberSwap

KyberSwap is a multi-chain aggregator and a DeFi hub. It provides users with multiple ways to trade and control their assets. Two of its standout features include dynamic market making and high liquidity. This DEX supports ETH, Polygon, and BSC chains, which we have already mentioned in the table above.

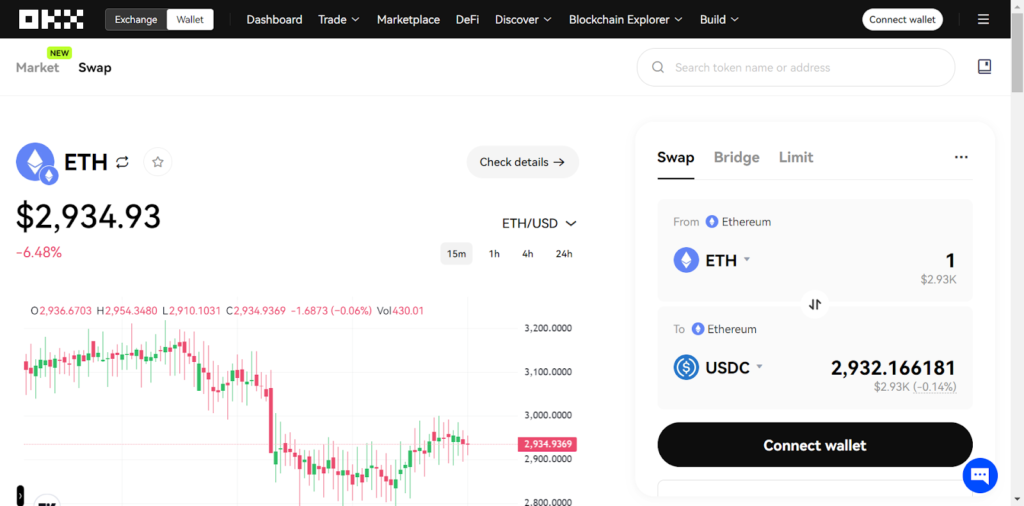

9. OKX DEX

OKX DEX is a hybrid DEX. it combines the benefits of decentralized and centralized exchanges. It is one of the most reliable decentralized exchanges because of its high security and user-friendly interface. It supports ETH and BSC chains, so you can trade on any of these.

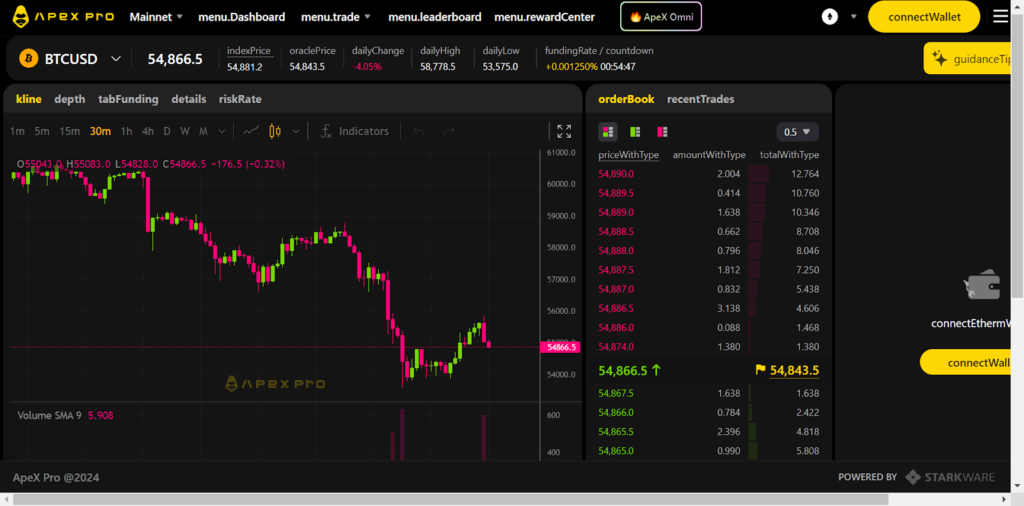

10. ApeX Pro

If you’re an advanced trader, Apex Pro is the best bet, as it offers perpetual contracts with high leverage. It’s a privacy-focused token that enhances your anonymity. This DEX also supports ETH and Polygon chains and provides complex trading options.

For more insights on how to navigate the crypto world, explore our detailed guides on:

- How to Buy Bitcoin on Different Exchanges

- Comparing Fees: Finding the Low Fee Crypto Exchange

- Advanced Crypto Trading Tools

- How to Trade Bitcoin: Tips and Strategies

- Secure Your Crypto 2024: Top Crypto Exchange Security Tips

- How to Trade Crypto Anonymously in 2024: The Ultimate Guide for Beginners

- How to Avoid Crypto Exchange Scams in 2024: The Only Guide You Need

Key Features to Consider in the Best Decentralized Exchanges

So now you’re a little familiar with the top 10 decentralized exchanges. So, before we move onto a detailed explanation, let’s look at the key features a DEX should have if you’re looking for one.

Liquidity

First, we have liquidity. The main question here is why liquidity is so important. If the exchange has high liquidity, you can easily make trades. However, if the liquidity is low, there will be sudden price movements whenever you make a trade. So only select a DEX with high liquidity, or else you might lose a lot of money.

User Experience

Next comes the user experience. If the exchange doesn’t provide a nice and user-friendly interface, users will face difficulties in making trades. They will remain confused as to where the buy or sell button is or from where they can make a trade. Having an interactive interface is crucial as it makes trading fun and easy.

Trading Fees

The lower the trading fee, the higher your profit will be. There are many decentralized exchanges that have a higher trading fee. Because of this the traders don’t make enough profit as a portion of it is eaten up by the different fees. To keep yourself safe and make tons of profit, make sure the DEX you’re selecting has lower trading fees as compared to the other options.

Supported Blockchains

You might wonder why supported blockchains are being considered a key feature. It’s because different blockchains have different tokens. So, if an exchange supports more blockchains, it means there will be a large number of tokens as well. This is usually achieved by using multi-chain support, which is offered by many DEXs nowadays.

Security and Privacy

When selecting the best decentralized exchange, you must consider security and privacy features. These privacy-focused features are essential. And why’s that? Because they protect your information. Two of these security and privacy features include anonymous trading options and minimal data collection.

Smart Contract Audits

DEXs use smart contracts to make it easy for users to trade. It can cause significant damage if there are even the slightest issues in these smart contracts. You should always look for how much a DEX performs regular audits. If a DEX undergoes audits now and then, it means you can trust them with your assets.

Top Decentralized Exchanges in 2024

Let’s take a detailed look at the best-decentralized exchanges for 2024.

1. Uniswap: The Market Leader

Key Features of Uniswap

Uniswap uses an Automated Market Maker (AMM) model, which has revolutionized the DeFi exchanges ecosystem. Uniswap allows users to trade directly against a liquidity pool, which is different from traditional exchanges that use order books. This pool contains the cryptocurrencies of people earning passive income or a part of the trading fees.

The AMM model ensures liquidity for traders, as otherwise, no trades will properly go through. It also reduces slippage and enhances your trading experience. Uniswap has many ERC-20 tokens, which makes this DEX extremely versatile and a preferred choice for traders.

How to Trade on Uniswap

To trade cryptocurrencies on Uniswap, you need to follow these steps:

- Assuming you already have a crypto wallet like MetaMask, WalletConnect, etc. Connect your wallet to Uniswap.

- Now select the token you want to swap from the drop-down menu.

- Enter the amount you wish to trade.

- Review the transaction details.

- Click “Swap” and confirm the transaction in your wallet.

- If you want to add liquidity, go to the “Pool” section.

- Here you need to select the tokens you want to provide.

- Lastly, enter the amount and simply confirm the transaction.

Benefits and Drawbacks of Using Uniswap

| Benefits | Drawbacks |

| High liquidity | High Ethereum gas fees during network congestion |

| User-friendly interface | It can be less economical for small trades |

| Wide range of supported ERC-20 tokens | Vulnerable to high slippage during extreme volatility |

| No registration or personal information required |

2. PancakeSwap: Best for BNB-Based Tokens

Overview of PancakeSwap

PancakeSwap is based on the Binance Smart Chain (BSC). As most traders know, the BSC chain is well-known for its low fees and fast transaction times. This is why PancakeSwap is an attractive option for many traders, especially those who like trading BNB-based tokens.

The platform has increased in popularity in the last few years, as evidenced by its growing trading volume. It is one of the best decentralized exchanges on BSC and offers many benefits for both new and old traders.

Features and Functionalities

| Features | Description |

| Staking | Users can earn rewards by locking their tokens. |

| Yield Farming | Users earn interest on their crypto holdings. |

| Cross-Chain Trading | Allows trading assets from different blockchains. |

| Crypto Lottery | Users can participate in lotteries to get a chance to win prizes. |

How to Start Trading on PancakeSwap

Follow these steps if you’re interested in trading on PancakeSwap.

- First, connect your crypto wallet to PancakeSwap. Use whichever wallet you might have.

- If you don’t have one, download MetaMask and register for a new wallet.

- Now that you’re connected, select the tokens you want to trade.

- Then, enter the amount you want to trade.

- Review the transaction details.

- Confirm the transaction.

- To be a liquidity provider, go to the “Liquidity” section.

- Select the tokens you want to liquidate in exchange for passive income.

- Enter the amounts and confirm the transaction. And you’re done.

3. dYdX: Advanced Derivatives Trading

Unique Selling Points of dYdX

The unique features of the dYdX exchange are advanced trading tools and high leverage options. It is best for experienced traders who want better and more complex trading options. This exchange also supports various crypto derivatives, including perpetual contracts and futures. By doing so, traders can see price movements without the need to buy them first.

dYdX also offers high leverage. This allows traders to leverage their positions by borrowing money directly from the exchange. If you’re looking for such advanced trading options within the DeFi space, dYdX is your best option.

Trading Derivatives on dYdX

Trading on dYdX is simple. Just follow these steps:

- Like before, connect your wallet to the dYdX platform.

- Select the derivative you want to trade.

- Then, set up your order by specifying the amount and leverage you want to take.

- Make sure to review the order details so your trade is profitable.

- After reviewing, confirm the transaction. And that’s it.

Pros and Cons of dYdX

| Pros | Cons |

| Low fees | Complexity for beginners |

| Deep liquidity | High leverage increases risk |

| Advanced trading tools | Requires understanding of derivatives |

| High leverage options |

4. Curve Finance: Low Fees and Stablecoin Focus

Why Choose Curve Finance?

You will always ask yourself this question whenever you try to select a DEX. Curve Finance is best for traders who like trading stablecoins. The central concept of Curve Finance revolves around stablecoins, which offer low slippage and high liquidity.

Curve Finance is designed to reduce the problem of impermanent loss that happens when traders provide liquidity. Due to this, Curve Finance has become very special and attractive for users who like to trade stablecoins in the DeFi ecosystem.

Trading and Earning on Curve Finance

There are multiple ways by which users can earn and trade on Curve Finance. They offer liquidity pools and yield farming for people interested in earning passive income. To trade on this DEX:

- Connect your wallet to the platform

- Then select your stablecoins and complete the transaction.

If you want to provide liquidity:

- Go to the “Deposit” section

- Choose the tokens you wish to offer and confirm the details.

Curve also has a governance model that allows users to vote on critical decisions using the CRV token. This approach allows the platform to make changes according to the needs of its community.

User Experience and Performance

Curve Finance is easy to use and works well. Its simple design makes it easy for beginners to navigate. The platform also offers extra features like yield farming and the CRV governance token. These features give the traders more ways to earn and participate.

Curve is known for low fees and minimal slippage, which makes it a favorite for stablecoin traders. Overall, Curve Finance mixes user-friendliness with high performance to provide a great trading experience.

5. SushiSwap: Versatile and Feature-Rich

Key Features of SushiSwap

SushiSwap has many features that appeal to many people. It allows users to stake, lend, and borrow, making it a complete DeFi platform. Users can also help make decisions by using the SUSHI token.

SushiSwap works on multiple blockchains, meaning users have many trading options. This DEX uses both AMM and order book models. But why’s that? mainly to compete against other decentralized exchanges and provide their users with various trading tools.

How SushiSwap Stands Out

SushiSwap stands out because it offers more than basic trading. It includes lending and borrowing, giving traders extra ways to use the platform. Its support for multiple blockchains means users can easily trade across different networks.

One of the brilliant features discussed above was the mix of AMM and order book models. This makes trading flexible and suitable for both beginners and experienced traders. These various features make SushiSwap a dynamic and user-friendly exchange.

Getting Started with SushiSwap

If you’re interested in trading on SushiSwap, follow these steps:

- Connect your wallet to the SushiSwap platform. Download MetaMask if you don’t have one already.

- Now, choose the tokens you want to trade.

- Then, enter the amount you wish to trade.

- Finally, Review the transaction details and confirm the transaction.

6. 1inch: Best for Finding Optimal Prices

How 1inch Aggregates Liquidity

1inch has features that allow it to find the best rates among all the exchanges. It analyzes all the prices and then comes up with the best one so the traders can choose their platform. Lower rates attract more traders which increases the liquidity of their platform. So, if we have to answer how 1Inch collects so much liquidity, it’s simply by offering low rates.

Ultimately, because of the high liquidity, slippage is reduced. This makes trading on 1inch very effective. The users don’t have to check the prices manually; they can simply trust 1inch and its rates.

Benefits of Using 1inch

The main benefits of using 1Inch are similar to those we discussed. They include lower transaction costs and low trading fees. These two things are enough to attract any trader because that’s what they live for.

Another benefit of this platform is that it supports many crypto wallets, making it accessible to a wide range of people. On top of all this, this DEX also has advanced features like limit orders and gas optimization, which certainly improve the trading experience.

Trading Process on 1inch

To trade on 1inch, all you need to do is:

- Connect your wallet to the 1inch platform, which we have also been doing for all other platforms.

- Then, choose a token you want to trade. It could be ETH, or any token you wish to.

- Enter the number of tokens you want to buy according to your budget.

- Finally, review the transaction details and confirm the transaction.

- It will also give you an option to choose the best rate, so don’t miss out on that.

7. Thorchain: Cross-Chain Compatibility

Features of Thorchain

Thorchain’s primary specialty is cross-chain trading, which allows you to trade multiple assets on different blockchains. This feature is what makes Thorchain unique. You can also swap your tokens from one chain to another, as it supports many chains. The leading liquidity provider to this exchange is its RUNE token, which makes the transactions smooth and secure.

How to Trade on Thorchain

If you want to trade on Thorchain, you need to:

- Connect your wallet to the Thorchain platform.

- Then, select a trading pair you want to trade.

- After confirming the tokens, enter the number of tokens you wish to purchase.

- Make sure to review the transaction details to see if everything is correct.

- Lastly, confirm the transaction, and you will now have new tokens.

Advantages and Limitations of Thorchain

| Advantages | Limitations |

| Cross-chain trading | Potential risks with multi-chain transactions |

| High liquidity | Complexity for new users |

| Supports multiple blockchains | |

| Uses native token RUNE for transactions |

8. KyberSwap: Cross-Chain Liquidity Strategies

Key Offerings of KyberSwap

KyberSwap offers many exciting features. Its main focus is on cross-chain liquidity, which allows traders to trade assets across different blockchains. You might be wondering if this is similar to Thorchain and how it is unique. The simple answer is that both exchanges support different blockchains.

KyberSwap also provides instant trading with minimal fees, which certainly appeals to many new and old traders. This DEX also has strong security measures and an easy-to-use interface.

Trading and Liquidity Provision on KyberSwap

If you like KyberSwap more than others and want to trade on it, do the following:

- Connect your wallet to the KyberSwap platform as you might have done for any other DEX.

- Then, choose a token that you want to buy. There’s a list that you can easily access.

- Once you’ve selected your favorite token, enter the amount you want to trade.

- In the end, review the transaction details and press the confirmation button.

Liquidity Provision on KyberSwap

| Liquidity | Description |

| Cross-Chain Liquidity | Allows trading and liquidity provision across multiple blockchains. |

| Instant Trading | Fast transaction processing with low fees. |

| Liquidity Pools | Users can provide liquidity to earn fees and rewards. |

| Concentrated Liquidity | Advanced strategies to maximize returns. |

9. OKX DEX: Low Fees and Seamless Experience

Overview of OKX DEX

OKX DEX is quite popular because it offers low fees and is available worldwide. This exchange provides a smooth and sleek trading experience and has many tokens for users to trade. The platform has robust security features, meaning your data and funds will be kept safe.

It’s one of the most favorite DEXs of traders worldwide because it offers affordable trading costs and is available to everyone worldwide.

Trading on OKX DEX

To start trading on OKX DEX, follow these steps:

- Connect your wallet to the OKX DEX platform. We hope you have already registered on MetaMask or any other crypto wallet.

- Now, select the tokens you want to trade.

- Now, enter the amount of tokens you want to buy.

- Don’t forget to review the transaction details.

- And then simply confirm the transaction.

Benefits and Drawbacks of OKX DEX

| Benefits | Drawbacks |

| Low trading fees | Lower trading volumes compared to larger exchanges |

| Seamless user experience | Limited to supported tokens |

| Global availability | |

| Robust security features |

10. ApeX Pro: Privacy-Focused Perpetual Contracts

Unique Features of ApeX Pro

The last DEX on our list is the ApeX Pro. One of its most unique features is that it offers non-custodial trading and high-leverage options. You don’t have to pass any KYC or anything. Just register on the platform and start trading. This way, you’ll also feel confident that your information is hidden.

This platform also offers perpetual contracts. This means that you can engage in long-term trading strategies without worrying about the extra fees or anything. If you’re someone for whom privacy is everything, ApeX Pro is your best option.

How to Use ApeX Pro for Trading

By now, you should know how to trade on various platforms. So, let’s recap it one last time for this article.

- The first thing that you need to do is connect your wallet to the ApeX Pro platform.

- Then, select the perpetual contract you want to trade.

- After that, enter the amount and leverage you wish to use.

- Make sure you review the transaction details.

- Once you’re satisfied, confirm the transaction.

- Use the demo account for practice if needed.

Pros and Cons of ApeX Pro

| Pros | Cons |

| High leverage options | Smart contract risks |

| Privacy-focused with no-KYC registration | Complexity for beginners |

| Non-custodial trading | |

| Perpetual contracts available |

How to Choose the Best Decentralized Exchange for You

So that was all from the top 10 DEXs. Now, it’s time to jump into the main factors influencing your selection. It’s essential that whichever exchange you choose is good for you. Nothing else matters. If you’re okay with a DEX, it’s perfect for you.

So, are you ready? Let’s go.

Security and Trust

Security and trust are critical when choosing a DEX. Since DEXs operate without a central authority, you must ensure the safety of your funds and data. Ensuring the security of your assets is crucial. Always check the security measures of the DEX you want to use. This will help protect your investments.

Non-Custodial Trading

You should always see if the DEX you’re choosing provides non-custodial trading. Non-custodial trading means you always keep control of your private keys. This reduces the risk of hacking since the platform never holds your funds. For example, Uniswap and SushiSwap are popular DEXs that use this model. They ensure that you only control your assets.

Platform Reputation

You should always check a DEX’s reputation to see if it is reliable and safe. Look for user reviews and independent security checks. Platforms like Uniswap and PancakeSwap have good reputations because they have strong security and work consistently well.

Smart Contract Audits

DEXs use smart contracts, which can sometimes have bugs and security problems. Always choose a DEX that auditors have carefully checked. These checks help find and fix any security issues. Ensure the DEX you’re considering has had these thorough security checks to ensure a safer trading environment.

Fees and Transaction Costs

Understanding a DEX’s fee structure is essential for getting the most out of your trades. Different DEXs have different fee models, impacting your overall trading costs. Always check the fees of the DEX you are considering to ensure it fits your budget and trading needs.

Trading Fees

Trading fees are the charges you pay to make trades on the platform. For example, Uniswap charges a standard 0.3% fee per trade. PancakeSwap charges 0.07% per trade, which can be reduced to 0.02% if you provide liquidity. Always check the trading fees of the DEX you’re considering to make sure you’re getting the best deal.

Network Fees

Network fees are also known as gas fees. You must pay this fee whenever you use the blockchain to make any transactions. The DEXs that are ETH-based often have a higher gas fee because there are already so many people making transactions on them. On the other hand, the DEXs that operate on the Binance Smart Chain usually have lower network fees. So before choosing a DEX, ensure the gas fee is minimal, or it will lower your profit.

Supported Tokens and Trading Pairs

So, next, we have the supported tokens and trading pairs. Now, whenever you choose a DEX, you should select the one that has a lot of tokens. You might use only a few of them, but it’s nice to have options. Ensure the trading pairs you are interested in are available on their platform.

Liquidity

Now, this is extremely important. We cannot emphasize it enough. It’s necessary to choose a decentralized exchange with high liquidity. This ensures that trades are made quickly and at a stable price. You should always check the liquidity and the 24-hour trading volume to ensure that DEX is perfect for trading.

Here’s a list of High-volume Crypto exchanges in 2024.

Cross-Chain Trading

There are very few DEXs that offer cross-chain trading. If you’ve read the article thoroughly, you might know that the only two DEXs that support this are Thorchain and KhyberSwap.

This feature allows you to trade assets from different blockchains with ease. If you are interested in this, you must choose a DEX that offers cross-chain trading.

Yield and Staking Options

Are you interested in earning passive income through DEXs? You can do this by providing liquidity and staking tokens. Go for a DEX that provides both Staking and Liquidity pools as passive income opportunities.

Staking Rewards

Decentralized Exchanges also offer particular rewards in return for staking specific tokens. SushiSwap and PancakeSwap provide this competitive staking. Their yield farming opportunities allow users to participate in liquidity pools and receive shares of trading fees.

Liquidity Mining

Providing liquidity to a DEX can earn you additional rewards. Check the DEX’s liquidity mining programs to understand the potential returns. For example, Uniswap allows users to earn a share of trading fees by contributing to liquidity pools.

Privacy and Anonymity

Privacy is always a primary concern for traders. They demand anonymity in their trading activities.

No KYC Requirements

Decentralized Exchanges maintain user privacy as they don’t work on a Know Your Customer policy. Platforms like Uniswap and SushiSwap allow anonymous trading. The No KYC policy is an advantage for users worried about privacy.

Data Protection

Ensure the DEX you selected works within the proper data protection policy. It must not collect excessive data from you, which reduces the risk of data breaches and protects your privacy. If you’re privacy-conscious, don’t forget to check this before using a DEX.

Why Choose a Decentralized Exchange Over a Centralized Exchange?

Choosing a DEX over a CEX is beneficial in various ways. Some of the key benefits are as follows:

Enhanced Security

The hacking risks are more significant in centralized exchanges, but user funds are not kept in DEXs, which is why hackers usually don’t target them. This risk is also more negligible with decentralized exchanges because users manage their assets without the involvement of intermediaries, which protects the transactions from cybercriminals.

Greater Privacy

Centralized exchanges work on the Know Your Customer (KYC) Policy and Anti-Money Laundering regulations. However, decentralized exchanges often do not ask for personal information, which enhances user privacy compared to centralized exchanges. It allows the user to trade without sharing personal information, decreasing scam threats.

Reduced Censorship Risk

DEXs are decentralized, making them more resistant to censorship and government intervention. Since they don’t have any central authority to control them, it is harder to shut down the exchange, giving clients the freedom to trade.

Conclusion

Do you want to select a proper decentralized exchange for your trade? Although this may not sound easy, with the appropriate guidance, you can do it easily. You just need to make an intelligent choice.

Firstly, you need to know which tokens are available on DEX. Check if the DEX interface is easy to understand. Research a few related DEXs to get an idea of what you want. Reviewing the advanced trading tools the DEX provides for extra flexibility is essential. Lastly, you should know about the exchange’s privacy policy and rules.

If you’re a beginner, read this guide on Top Crypto Exchanges for Beginners.

Knowing all of these is important for legal and safe trading. Look at the DEX’s growth potential. This information will help you pick the right DEX. All these tips will make your decentralized finance easier and safer.

FAQs About Decentralized Exchanges (DEXs)

Are Decentralized Exchanges Safe?

Most decentralized exchanges are safe. What makes them safe is the user’s control over their funds. But there are risks as well which you need to keep in mind. It is recommended to use secure wallets, stay alert in case of scams and do thorough background research on the DEX you are going to choose.

How Do I Start Using a DEX?

You can start using DEX with a cryptocurrency wallet. You can use MetaMask for this purpose, as it is beginner-friendly. After you install it and create a new wallet, connect it to your preferred DEX. Select the tokens you want to trade and confirm the transaction. You must ensure that your cryptocurrency is enough to cover the network fees. For more details, follow the instructions given on the exchange.

Can I Earn Passive Income with DEXs?

Yes, you can earn passive income with DEXs through staking or yield farming. DEXs provide incentives to help you grow your crypto holdings. You can also earn liquidity through DEXs. You can use the trading fees to add tokens to the liquidity pool.

What Are the Best Practices for Trading on a DEX?

To trade on a DEX, one must use a well-recognized wallet. The transaction details must be cross-checked, and market conditions must be considered. You must stay alert about the risks associated with DeFi. Make smart decisions and secure the private keys.

How Do Decentralized Exchanges Make Money?

The primary source of money for decentralized exchanges is transaction fees, but they don’t keep all the shares to themselves. This is shared with the developers and liquidity providers. Though some exchanges provide free services, others offer premium services as well, increasing their overall income. DEXs also generate revenue from trade facilitation.

Learn

Learn  November 6, 2024

November 6, 2024  50 min.

50 min.