Do you want to know about a way to make your crypto work hard for you in 2024? This might sound like a scam but it definitely isn’t. There are so many options out there now which makes it confusing.

However there’s one option which stands out and that’s Compound. It’s simply a decentralized protocol that makes lending and borrowing more profitable for everyone. It allows users to lend their crypto assets to earn interest or borrow assets. And the best thing about it is that there’s no need for traditional banks in all of this.

Currently, compound has given out over $750 million dollars in loans which is backed by over $1.7 billion in collateral. This is not a small amount and is spread across 17 markets.

What sets Compound apart is its ability to automatically adjust interest rates based on supply and demand. This means you can earn higher interest on your holding without doing anything extra. Sounds crazy, right?

With that said, let’s find out how you can use Compound crypto to maximize your earnings in 2024.

What is Compound Crypto?

Compound is a decentralized finance (DeFi) protocol. It works under a fully decentralized system of smart contracts that are easily accessible. These smart contracts are produced using ethereum blockchain. Compound crypto provides lenders and borrowers in the smart contract.

This project was founded by veteran entrepreneurs Geoffrey Hayes and Robert Leshner in 2018. In the initial days because of their brilliant idea, they secured a funding of $8.2 million and that too from well-known venture capital firms Andreessen Horowitz and Bain Capital Ventures.

The lenders are allowed to render loans on the platform. These loans are provided to borrowers who take this amount. The mechanism of borrowing is carried out when borrowers lock their own respective crypto assets in protocol to take out a loan.

The Realm of Compound Crypto

The whole domain of compound is dependent upon the unique set of features. These features of compound, mainly the smart contracts, lenders, borrowers, developers and compound tokens make up the decentralized compound protocol.

As the significance of these features cover the whole shebang of DeFi protocol, you will encounter them in each topic.

Lenders and Borrowers

Lenders are the entities who lend and borrow the cryptocurrency in the compound. The lenders are responsible for lending money as well as giving loans to the users. The more they lend the money, the more will be the interest they receive. The lender’s balance in the liquidity pool works along with the interest rates.

While, borrowers are the ones who take the cryptocurrencies and stable coins from the lenders and pay interest for the borrowed amount. The more they borrow, the more they have to pay the interest. If they don’t pay back the loan, it will be automatically deducted from the collateral they have deposited.

Smart Contracts

As the name reflects, smart contracts are the contracts that allow exchanging cryptocurrencies as well as stable coins between the two respective parties. This contract is a significant feature that verifies each and every kind of transaction. These automated contracts can be accessed by the users easily.

There is no hindrance regarding third parties when money is lended or borrowed. These automated enforceable agreements keep a solid track of how much interest is earned. It also informs the users about verified transactions, controls calculations and makes adjustments about the ongoing supply and demand rates.

Developers

Developers are the entities who take care of the development codes. They work for the overall improvements related to compound crypto. If there are any signals they receive related to upcoming errors, they assist controlling and minimizing them.

As compound crypto is an open-source decentralized protocol, it allows developers to contribute to the system’s overall functionalities and well-being.

cTokens

The COMP or cTokens are the specialized tokens used in compound crypto currency. These tokens are specifically rewarded to users that are a source of accelerated growth and success.

Those users who benefit from the compound crypto and participate in the financial protocol are given the bounty of these ERC-20 tokens. They can effortlessly earn profits by earning COMP tokens in the peer-to-peer Defi protocol.

Working of Compound Protocol

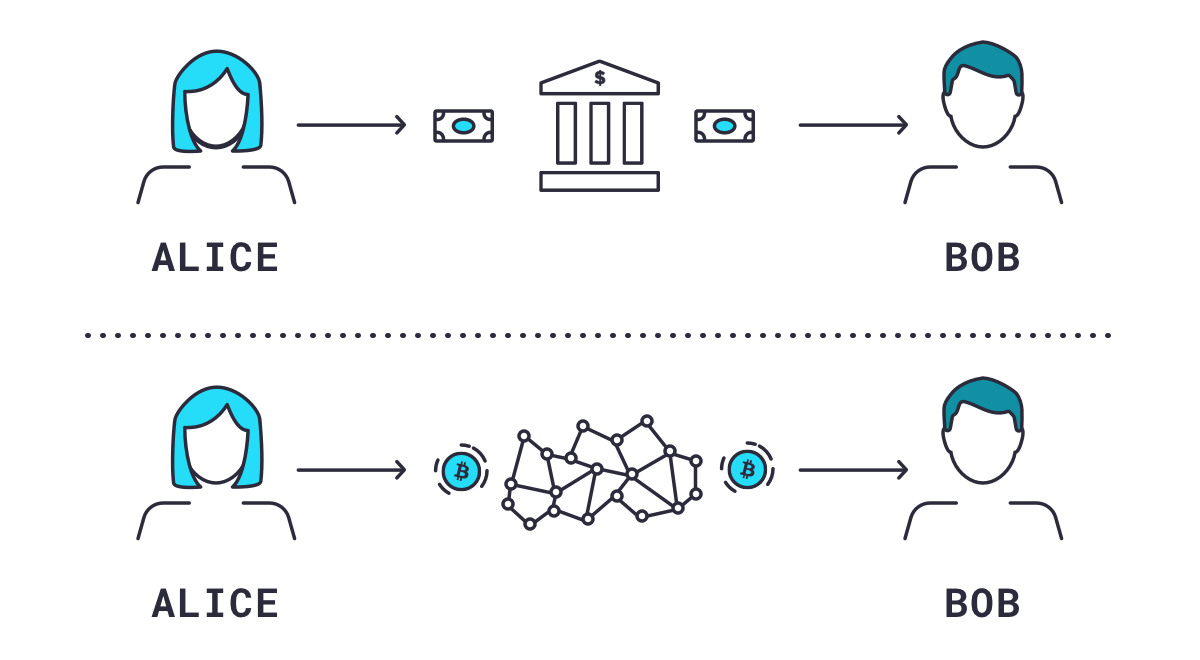

Compound protocol is a decentralized protocol for connecting lenders and borrowers. You must be thinking that the compound game ends here. Well, not so soon.

The smart contracts help establish a strong connection between the two parties. The Ethereum blockchain builds up a connection automatically, covering a smooth cryptocurrency trading.

Covering up the confusion, there is no intermediary or third party involved in this contact. It means the contract is end to end encrypted within the compound ecosystem. There is no intermediary system or person involved between lenders and borrowers. Thus, the compound protocol maintains security. This connection is established with the accuracy of a safe ethereum blockchain environment.

The process of lending is carried out when users who have a desire to lend their cryptocurrencies, send them to an ethereum address. The functionality related to ethereum addresses is the responsibility of the compound. Putting it into easy words, compound controls the process of lending from start to end.

While in the process of borrowing, borrowers borrow crypto currencies from lenders and pay them interest. That’s the point where smart contracts lie. The smart contract allows automatic deduction of interest amount from the borrower’s account. That’s how lenders are rewarded for lending their cryptocurrencies.

Compound Crypto Token and It’s Features

The native compound token, COMP, allows users to earn interest, trade and transfer their money. Every second a user deposits the crypto assets in the compound protocol, COMP tokens are formed.

While making a deposit, the users automatically receive the COMP token that is equal to the deposited currency as a collateral. Anyone has the right to make a COMP by utilizing an ethereum wallet or any crypto asset that the compound allows.

Earning Interest

These tokens automatically earn the user interests which can be redeemed for the corresponding crypto currency at any time. The interest rates are determined by ongoing supply and demand other than earning interest on your crypto assets. Thus, changing with each block that gets mined.

COMP as Rewards

COMP tokens are a source of gratifying users on the platform that helps them motivate their participation. Once the crypto currency is borrowed, the specific part of interest that the borrower pays is utilized to issue tokens.

COMP is generally a gift for users who participate in the protocol. These tokens are given as a reward to lenders and those people who help in maintaining the protocol codes and issues.

Encouraging Participation

The COMP tokens act as a sign of encouragement for the active participants. It is a driving force of compound crypto success and improvements in the domain of compound crypto currency. Additionally, you are rewarded with the ease of selling these tokens in the market. An open market allows users to buy and sell these tokens.

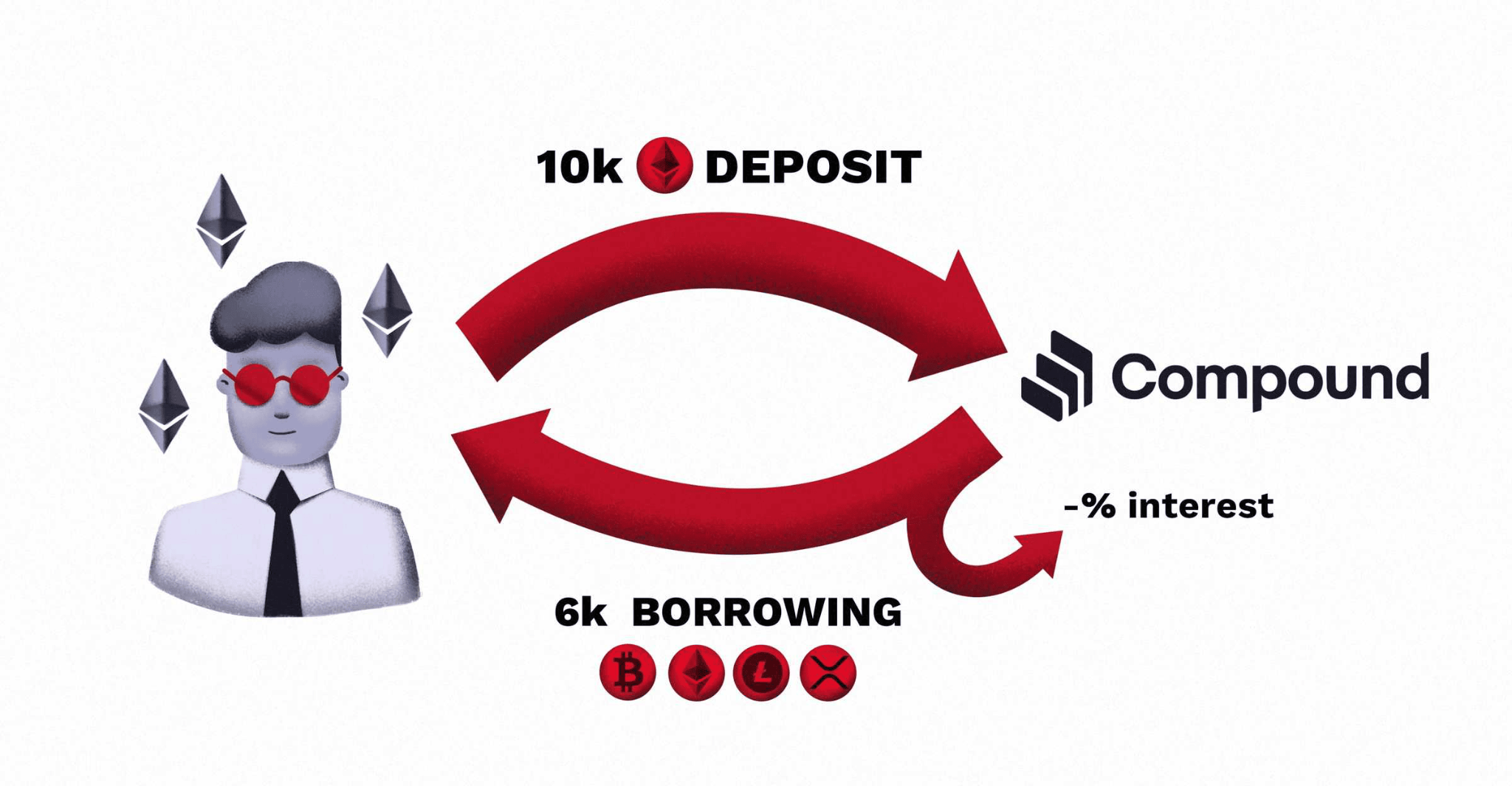

Borrowing and Collateral

Compound allows you to borrow crypto. You have to keep in mind that your collateral has to be more than a minimum amount while you borrow the assets. If you do not keep the collateral above the amount, compound will liquidate your collateral to repay the loan. Once loans get paid back, the locked assets can be withdrawn anytime.

ERC-20 Compatibility

When a user’s crypto assets are transferred to an ERC-20 compatible form, they are free to trade or move. They are also available for use in apps that operate as a decentralized protocol. This allows the ability to merge different protocols and building blocks.

Defi Protocol Feature

Lastly, the most significant feature of this platform is the Defi protocol feature. The compound focuses on giving users more control and comprehensive access to their own crypto assets. That’s the reason behind their smooth earning and saving assets.

The Efficient Compound Technology

Understanding crypto technology is one of the most comprehensive tasks to cover. However, we have tried our hardest to make you understand it. The compound technology works on the efficient and lucrative ethereum blockchain technology. This technology allows easy access to the smart contract between users.

It has already been mentioned above that smart contracts establish a secure connection between lenders and borrowers. In order to exchange cryptocurrency, ethereum blockchain verifies the transactions on each stage. So, it prevents the errors during transactions. Also, if errors occur or there is even a little possibility, it eventually detects it.

Ethereum blockchain is a form of digital legers. These digital ledgers can not be manipulated like physical ones. That is the fact why ethereum is considered the prime blockchain for keeping transaction records forever. The smart contract under the ethereum blockchain allows users to keep a record of currency available to lend or borrow.

The word “decentralized” has been mentioned several times because it delivers a thorough meaning of compound. So, it is understandable that compound crypto is not under control of a specific organization. It is a platform that is freely operated by the users who lend and borrow stablecoins in the compound. That’s how decentralization leads to neutrality so that users can balance their financial transactions under the protocol.

Working of Compound Interest

You must be wondering how the compound interest works? Does it share the same working mechanism just like banks where interests have a fixed rate? Let’s explore it.

So we all know banks have a fixed rate and the interest remains the same. If the interest is settled and decided to be 10% each year, nobody can change it. It is entirely opposite in compound interest. Compound interest works dynamically. A dynamic flow of interest allows the user to have an exponential rate of interest. The exponential growth in a dynamical fashion maximizes the interest and earning in compound crypto.

Let’s discuss how this whole process works and depends upon the liquidity pool. The amount in the liquidity pool allows the interest to change in a dynamic manner. So it’s understandable that the interest in a pool increases or decreases based upon its balance but the question is, how?

As some portion of the pool’s amount is either borrowed or withdrawn, the amount in the liquidity pool reduces. This amount reduction might cause the interest rate to shoot up.

Why does it happen? As the pool balance has been decreased, it tends to charge more interest rates from borrowers as there is less amount to lend. Putting it oppositely, if the pool balance increases, the interest rate decreases.

The pool balance can be increased due to more deposits or getting back the lended amount or loan. As there is more to lend, the interest for the borrowers might lessen. That’s how the amount in the liquidity pool alters the interest rates.

Compound Interest Formula

Do you have doubts if compound crypto interest formula is the same as bank interest? It has been discussed how it’s different from bank interest. As the bank interest formula is not flexible, it works on the same initial principle of interest. As compound interest works dynamically in a flow, the amount is compounded on a daily basis that works on an accelerated rate.

Another prominent difference between the two is that you have to wait for a long time to earn and withdraw the bank interest. In case of decentralized financial protocol, your interest is updated daily, so you don’t have to wait for a longer period.

As the compound interest happens at a relatively faster rate, so the amount of time it takes is also a few seconds long. In such a short time, compound growth rate is accelerated annually and your interest may be lifted speedily. However, the estimated time taken for ethereum block mining is up to 15 seconds maximum.

It’s a well known fact that compound crypto allows to have a decentralized independent system under user’s control. The cTokens are a significant working principle that works effectively in compound. These ERC-20 tokens are received when a lender lends money to the protocol. So, compound helps these ERC-20 tokens to grow in terms of their worth over the range of time.

The worth of cTokens with the help of compound crypto increases when the interest is earned on your tokens. This is just like a snowball that increases in size at an accelerated rate. Just like the snowball, your cTokens have a greater value when the earned interest is added to the balance that was originally present in the liquidity pool.

Earning Compound Crypto Interest

Let’s dive more deeply into the concepts of understanding how to earn maximum with compound crypto in steps. The initial earning with compound crypto needs consistency and patience and the other stage tends to be more strategic.

So, without wasting time, let’s discuss the correct way to earn.

1. Finding a Suitable Wallet

The first thing to do is saving the cryptocurrency in a wallet. So, you need to find some wallets suitable for compound cryptocurrency. These digital wallets are going to work with compounds.

Once you choose a wallet, set up the account and remember your passwords. So, feel free to use any of these E-wallets:

- MetaMask

- MyEtherWallet

- Trust Wallet

2. Fill-up Your Wallet

Once you have finalized the secure password and set up the account, it’s time to add the crypto currency in it. Cryptocurrency can be easily stored if you know which one goes compatible with the compound.

Before choosing currency, keep in mind that it should support compound. The crypto currencies that you can opt-for funding your wallet are:

- Ethereum

- DAI

- USD coins

- WBTC

3. Joining Wallet with Compound

The third step is joining your digital wallet with the compound protocol and running it. To earn interest and keep a track of receiving and lending, it is crucial to connect wallets with decentralized apps.

There is a decentralized app user interface that is provided within the wallet you choose. Once you find it, connect the pocket with the app for compound interests.

4. Choosing cryptocurrency

The next point is to choose the right cryptocurrency for lending purposes. It is entirely in your own hands which currency you want to use and how much you decide to offer. In order to move forward with it, you should be aware of the rules and regulations of interests related to each currency.

5. Transaction

Now when you have finalized all above 4 steps, it’s time to confirm your transaction. To finalize the process, you have to sign a blockchain transaction before confirming the transaction in your pocket.

It is necessary because it confirms that your cryptocurrency has been added to the compound. Once you pass this step, you start earning interest.

Benefits of Compound

Now, this question must be bothering you about what perks you can enjoy with compound crypto. We surely understand your confusion so we decided to make a list of profits you can earn with compound crypto.

Here are some of the most prominent benefits in this decentralized protocol:

1. Passive Earnings

You can have access to earning passively where you don’t have to put in any effort and you are going to earn. Regardless of what steps you choose to lend money, what cryptocurrency you use for it, you are gonna be rewarded anyways.

Thus, by putting in less effort, you can earn as much as you want by lending your liquidity pool balance and earning interest.

2. Secure Protocol

The compound financial protocol works on ethereum blockchain which means it is going to keep all your transactions safe.

There is no chance of any theft or error as the ethereum blockchain technology is quite solid to break. Hence your transactions are verified during each and every single step of transaction.

3. Decentralized System

The steps that are taken within account are decentralized while the process of lending and borrowing occurs. Just like a decentralized system is not governed by any special person or entity, the same goes for compound protocol.

Compound protocol allows a variety of users to lend and borrow cryptocurrency and pay interests. It allows many developers to make productive changes to this open-source protocol.

4. Third-Party Free Protocol

No one likes the third party’s disturbance especially when it comes to financial approach. Therefore, the digital compound protocol helps setting up smart contracts between users.

There is no risky lending and borrowing. You know that once the contract is signed there is nobody sitting in the corner as a third party to ruin your earnings.

5. Greater Interest Rates

With the improvement in lending a big amount, there is a possibility of earning a large amount of interest. The COMP tokens are a fine reward for those who are advantageous to the compound protocol.

So, there is a greater chance of maximizing your earnings and interests by participating in a number of activities. For people who love to earn and play with crypto currencies should opt for the compound protocol.

Wrapping Up

Compound crypto offers the best way through which you can maximize your earnings through DeFi. By lending your assets or borrowing against them, you can earn interest quickly and it’s all thanks to the protocol’s automatic adjustments based on supply and demand.

With features like smart contracts, cTokens, and flexible interest rates, Compound is an excellent way to make your crypto work harder for you in 2024. This is not financial advice so do your due diligence before investing in Compound or any other crypto project.

FAQS

Does compound interest work with crypto?

The compound is a financial protocol which helps in maintaining an exponential growth rate. It helps achieve an accelerated growth pattern by earning interests on already earned interests. Crypto defines the same concept as increasing interests on crypto assets. These interests are again invested in order to regenerate more interests.

Does compound interest go up?

The compound interest rises when the interest is earned on already earned interests. Which means that there would be profit and another profit over the previously earned profit, causing a sudden exponential earning rate. When you lend more crypto assets, there is a greater possibility that you will receive a greater amount of interest.

How can I earn interest on my crypto?

If you have either a savings account or a growth account mainly for crypto, you tend to attract more interest rates. Once you add your crypto assets in these accounts, you just need to wait for the assets to increase and earn interest over time. These accounts work in a similar manner just like the bank saving accounts

Is compound crypto a good investment?

Compound cryptocurrency is considered a prominent way of earning a greater amount of interest in decentralized protocol. It is also considered a good investment as users are rewarded in a continuous flow of regenerating interests. In the near future, investing in compounds can be the most beneficial investment to maximize financial growth.

How are interest rates set by compound?

The interest rates are based on how much money is available in the crypto market. These rates change in real time as supply and demand increases or decreases. When there’s plenty of money the interest rate is usually low. And when the market needs some extra bucks, the interest rates go up to encourage lending and repayment.