Predicting the price of Bitcoin can be tricky due to its volatile nature, but there are several approaches and tools that can help you make a more informed prediction. One such tool is on-chain data, which analyzes activity on the Bitcoin blockchain to provide insights into the market.

What is Bitcoin Cycle Extreme Oscillators?

Bitcoin Cycle Extreme Oscillators is an on-chain analysis tool developed by Glassnode. This tool combines four popular on-chain indicators to identify extreme conditions in the Bitcoin market, helping you determine whether the market is at a top or bottom.

The Four Key Indicators:

- MVRV Ratio:

- Measures the relationship between the market value and the realized value of Bitcoin.

- A high value may indicate that Bitcoin is overvalued (ready for a correction), while a low value may suggest that it is undervalued (buying opportunity).

- aSOPR (Adjusted Spent Output Profit Ratio):

- Measures the profit or loss realized by Bitcoin transactions.

- High values indicate that investors are taking profits, while low values indicate that they are taking losses.

- Puell Multiple:

- Measures the revenue of Bitcoin miners relative to the historical average.

- A high value may indicate selling pressure from miners, while a low value suggests that miners are holding on to their coins.

- Reserve Risk:

- Measures the confidence of long-term investors in the current price of Bitcoin.

- A low value indicates high confidence and potential for upside in the price, while a high value suggests low confidence and downside risk.

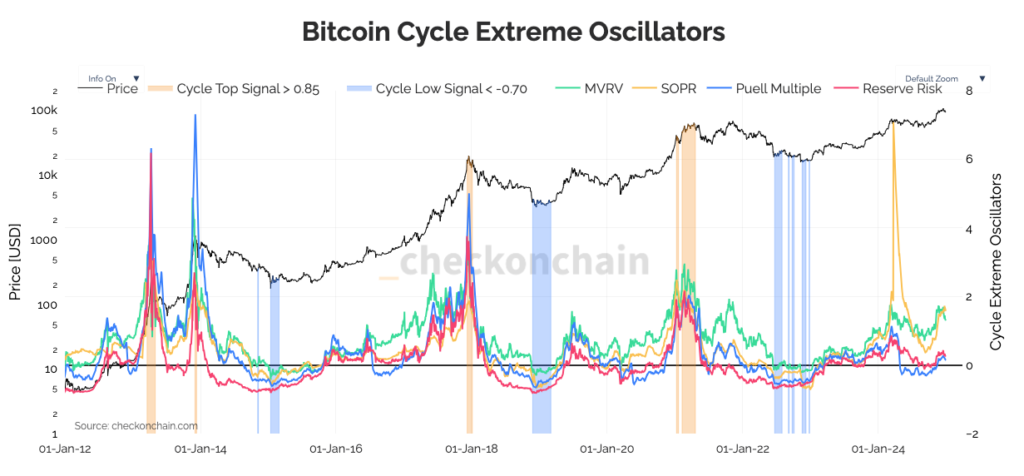

How Does It Work?

The Bitcoin Cycle Extreme Oscillators tool signals when at least three of the four indicators are in extreme conditions. This helps provide a more robust and reliable view of the current state of the Bitcoin market, indicating possible reversal points or continuation of trends.

Using Bitcoin Cycle Extreme Oscillators:

- Identifying Peaks: When most indicators show extreme bullish conditions, it could be a sign that Bitcoin is at a peak and ready for a correction.

- Identifying Bottoms: When most indicators show extreme bearish conditions, it could be a sign that Bitcoin is at a bottom and ready for a recovery.

Conclusion

Predicting Bitcoin price is not an exact science, but on-chain analysis tools like Bitcoin Cycle Extreme Oscillators can provide valuable insights. By combining this data with technical analysis and market fundamentals, investors can make more informed decisions.