Do you know there’s an easier and safer way to invest in cryptocurrency? If you’re someone who doesn’t know how to manage risk or is afraid or making bold market decisions, then this is something that you should explore.

We’re talking about Crypto ETF. If you’ve never heard of this before, it’s your lucky day. ETF stands for Exchange-Traded Funds. These provide an innovative way for investors to buy digital assets without any apparent risk. It’s like a mix of traditional investment and cryptocurrency.

Crypto ETFs became official after a decade of regulatory challenges. In early 2024, the Securities and Exchange Commision (SEC) allowed or should we say, authorized, the first Crypto ETF that too under pressure from a 2023 D.C. Circuit Court of Appeals ruling.

Now, do you want to know how these Crypto ETFs work?

They basically track the performance of one or more cryptocurrencies and make profit from their price movement without actually buying them. This makes it easier for you to manage your portfolio and decreases the overall risk.

With that said, let’s take a deeper look at Crypto ETF.

What is Crypto ETF?

Cryptocurrency exchange-traded fund or otherwise known as Crypto ETF, is a type of investment that tracks the performance of a crypto asset like Bitcoin or Ethereum. In this you don’t have to directly buy or hold any cryptocurrency which significantly reduces the risks associated with it.

If you’re someone who wants to make the most out of crypto volatility but cannot buy one directly, Crypto ETFs is the way to go. A crypto ETF is traded on major stock exchanges similar to a traditional ETF. This means you can buy and sell shares of a Crypto ETF through your brokerage account. It’s extremely convenient and accessible for everyone.

How Cryptocurrency ETFs Work?

The first thing you need to know is Cryptocurrency ETFs are managed by professionals who know how to buy and sell underlying digital assets. These are mostly companies that charge a commission for handling a portfolio for you. This reduces the risks and complexities often associated with crypto investments.

The way these things work is they pool large amounts of funds from multiple investors to purchase and manage a portfolio of digital assets like Bitcoin, Ethereum and more. Their main goal is to see how the actual cryptocurrency is doing. When you purchase an ETF for crypto, you are essentially buying a stock share of a particular company that holds cryptocurrency.

Let’s take an example of how the price movements work. When the price of Bitcoin increases in the financial market, the price or stock also increases and vice versa. Remember, these ETFs are regulated by financial institutions which means they are more secure than the actual token.

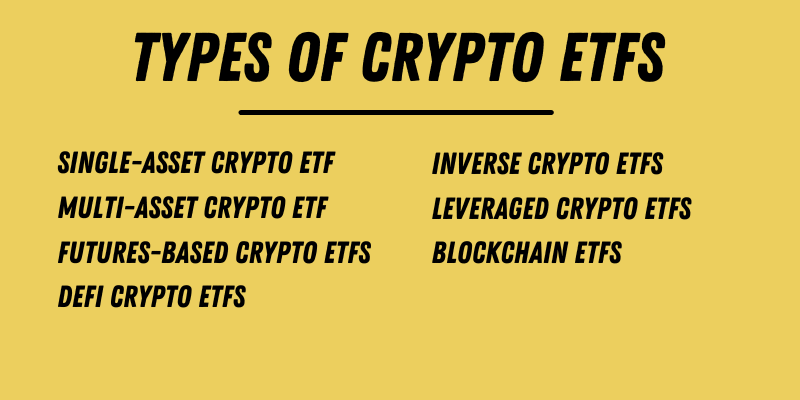

Types of Crypto ETFs

There are currently four types of Crypto ETFs in play. These include:

Single-asset Crypto ETF

In this type of Crypto ETFs, a company holds the funds of a particular cryptocurrency such as Bitcoin or Ethereum and tracks their performance to replicate it. This provides investors an easy way to gain exposure to the crypto market without directly holding them. It’s particularly appealing for people who want to do crypto trading but want it to be secure and regulated.

Example

Purpose Bitcoin ETF (BTCC) is one of the first Bitcoin spot ETFs that hold Bitcoin and replace it’s performance.

Multi-asset Crypto ETF

We think you might have already guessed what this will be. In multi-asset crypto ETFs the companies invest in multiple cryptocurrencies rather than just one. They hold a mix of many tokens which reduces the overall risk. It’s an attractive option for investors looking to have a diversified portfolio.

Example

Grayscale Digital Large Cap Fund (GDLC) provides exposure to a large number of cryptocurrencies in one share. It is done to capture and use the overall market growth.

Futures-Based Crypto ETFs

The companies that offer futures-based crypto ETFs invest in futures contracts of a particular cryptocurrency. These companies speculate on the future prices and provide even more profit. However, it is riskier as well.

Example

ProShares Bitcoin Strategy ETF (BITO) is one of the most famous types of futures-based crypto ETFs.

DeFi Crypto ETFs

These types of crypto ETFs focus on assets in the DeFi (Decentralized Finance) space. These companies invest in tokens and projects inside the DeFi ecosystem. The aim of this ecosystem is to replace the traditional financial services such as lending and trading with decentralized alternatives. It’s perfect for investors wanting to explore the DeFi space.

Example

One example is the Bitwise DeFi Crypto Index Fund. This fund includes the largest and most liquid DeFi assets.

Blockchain ETFs

Blockchain ETFs invest in companies that are involved in the improvement of blockchain technology. It’s not directly related to cryptocurrency but perhaps with the technology behind it.

Example

Amplify Transformational Data Sharing ETF (BLOK) is a type of blockchain ETF that invests in companies that work on blockchain technology.

Inverse Crypto ETFs

The next type of crypto ETFs is the Inverse crypto ETF. This ETF is designed to move in the opposite direction of a particular cryptocurrency. This means if a crypto is doing bad, you’ll be having the best day with loads of profit. It’s also used to hedge against declining crypto markets. These are usually used by experienced traders who know how to manage risk in such a volatile market.

Example

BetaPro Inverse Bitcoin ETF (BITI.TO) works opposite to the original price. This is perfect if you want to hedge against Bitcoin when the crypto market is in bear mode.

Leveraged Crypto ETFs

Lastly there are the Leveraged Crypto ETFs. These ETFs amplify the price of a certain token so you can earn double the amount of profit. These ETFs are typically used for short-term crypto trading. It’s quite risky which is why only experienced traders jump into this type of ETF.

Example

Direxion Daily Bitcoin Bull 2x Shares ETF is a newly proposed ETF and is not yet regulated but there’s a high chance it would. These ETFs aim to deliver 2x the daily performance of Bitcoin futures.

Different Kinds of Crypto ETFs

Crypto ETFs have become quite popular in 2024 as the government and courts have started to approve them. Some of the most prominent cryptocurrencies who’s ETFs are available in the stock market include:

Bitcoin ETF

The most common ETF in the entire market is the Bitcoin ETF as BTC is the largest token in the entire market. It tracks the price of Bitcoin in real-time and was the first ETF to be approved by the concerned institutions. Bitcoin ETFs offer an easy and regulated way to investors to put their money in Bitcoin without directly involving the token.

As all other ETFs, Bitcoin ETFs are also traded on traditional stock exchanges. This makes it more accessible to traders that are familiar with the stock market. Some popular Bitcoin ETFs include the ProShares Bitcoin Strategy ETF (BITO) and Purpose Bitcoin ETF (BTCC). Both of these are fully regulated in their respective countries.

Ethereum ETF

An Ethereum ETF is similar to the Bitcoin one. The only difference is it tracks the performance of Ethereum which is the second largest cryptocurrency by market cap. These ETFs allow investors to make some profit according to how ETH is performing. These funds are also traded on conventional stock exchanges just like any other ETF.

Examples of Ethereum ETFs include the Purpose Ether ETF (ETHH) and the CI Galaxy Ethereum ETF (ETHX). You can access the stock market and purchase shares of any of these to indirectly invest in Ethereum.

Bitcoin Miner ETF

The third form is the Bitcoin Miner ETF which is a bit different from the other two. This type of crypto fund shifts all its focus on companies mining Bitcoin on a large scale. These companies don’t hold Bitcoin, they mine it. They solve complex mathematical equations to mine Bitcoin and add them to the supply. Anyone who’s interested in Bitcoin mining can invest in these funds.

Two of the most famous Bitcoin Miner ETF include Valkyrie Bitcoin Miners ETF (WGMI) and the VanEck Digital Assets Mining ETF (DAM). Visit any stock market to trade these ETFs.

Advantages of Crypto ETFs

Crypto ETFs are highly beneficial for investors and the financial institutions took quite a lot of time to figure that out. Let’s see what advantages these ETFs offer to the investors.

Easy Access to Crypto Market

As discussed a few times before as well, crypto ETFs offer an easy way to invest in cryptocurrency without needing to understand the complexities of cryptocurrencies. You can buy a share of any crypto ETF from a stock exchange and profit from it when the price goes up. Most ETFs are related to Bitcoin and Ethereum to ensure safety and high market performance.

Increased Security and Regulations

Crypto ETFs are traded on stock exchanges which means they are more secure and regulated than cryptocurrency itself. Sometimes there’s no transparency while investing in a crypto directly. However there’s nothing like this here which makes it more secure. They also reduce the risk of fraud and malpractice which is common in the crypto market.

Liquidity and Ease of Crypto Trading

The companies that offer crypto ETFs have huge funds behind them which means higher liquidity for the investors. Because of this anyone can buy and sell shares of an ETF all day long. If you’ve invested in crypto directly you might be familiar with the liquidity issue that many smaller exchanges face. This is why people are moving towards crypto ETFs.

Lower Costs and Fees

If you are convinced and are thinking of buying a crypto ETF, it’s the best and most cost-effective way you can find right now. When you invest in an ETF, the company handles all the transactions which means you don’t have to pay that extra withdrawal and trading fee. Even the storage costs are cut down to 0 as you don’t have to store cryptocurrencies anymore.

Chance to Diversify

There are some types of crypto ETFs that hold funds for multiple cryptocurrencies or companies investing in blockchain technology. This way you, as an investor, can diversify your portfolio and make profit from the performance of the overall crypto market. This diversification spreads the risk and reduces the impact of volatility. This type of diversification is only available in multi-asset crypto ETFs.

Professional Management

Crypto ETFs are managed by professionals and financial companies who are experts in crypto trading. Knowing this you can rest assured that your funds are in safe hands as they know what they’re doing.

They monitor the market continuously to buy and sell a token so that you can earn maximum returns from your shares. It’s especially useful for people who don’t have any knowledge about the market or are not comfortable in jumping in such a volatile market.

Tax Efficiency

These ETFs also offer tax advantages which you won’t get from buying cryptocurrencies directly. In some regions if you sell crypto, you need to pay a capital gains tax to the government. And that’s on every transaction you make. However with ETFs the tax ratio becomes significantly low which means you’ll be saving money from all corners.

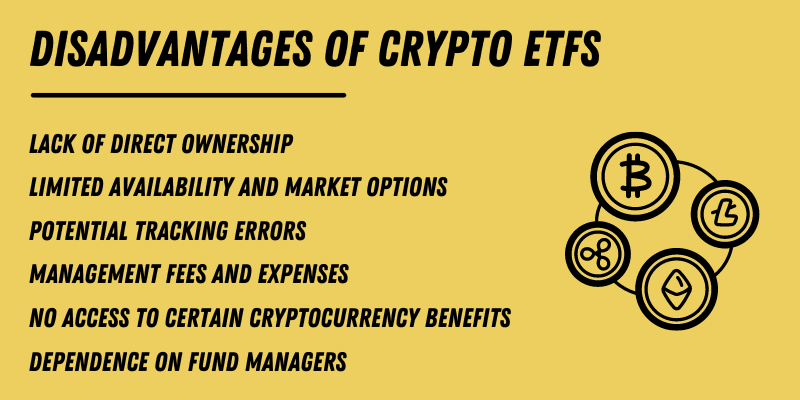

Disadvantages of Crypto ETFs

Apart from the numerous benefits, there are also some drawbacks of using crypto ETFs. These include:

Lack of Direct Ownership

The main disadvantage of investing in crypto ETFs for some people is that you don’t directly own the crypto for which you’re buying the shares. It’s also an advantage for some people who want to pay a little safer. However you don’t have any vote or right of selling the token even if the cryptocurrency starts to decline.

Limited Availability and Market Options

There are over 1000 cryptocurrencies but only 60 crypto ETFs currently. This shows the limited number of choices for investors. Out of that 60 ETFs, most of them are of Bitcoin and Ethereum only as others are not yet approved. Also, because of this limited selection it could be difficult for investors to find that perfect crypto ETF to invest in. Newer or less popular are not yet introduced as an ETF and it’s still years until they do.

Potential Tracking Errors

Sometimes tracking issues occur as well. It happens when the price or valuation of an ETF is not according to that of the underlying cryptocurrency. Thes tracking errors arise due to management fees, market liquidity or the use of futures contracts. Because of these errors the Investors might not get the expected returns. It’s a particularly significant issue and needs to be addressed as soon as it happens.

Management Fees and Expenses

As you know these exchange-traded funds are managed by asset managers which means there will be a management fee as well. This management fee and other expenses reduce the overall ROI. This fee is charged by firms to manage the cryptocurrencies they bought. It’s usually less but over time it can add up and become a significant issue for investors.

No Access to Certain Cryptocurrency Benefits

By investing in crypto ETFs, the investors might miss out on some benefits gained from holding cryptocurrency such as staking and lending. These can provide additional income to the investor. However there are some crypto EFTs that offer dividends but they’re just a few.

Dependence on Fund Managers

Digital asset ETFs such as the cryptocurrency ones are managed by asset or fund managers. This means that as an investor you need to rely on them at all times. Even if they make a bad decision, there’s nothing you can do about it. For investors who like control over their assets, this can be a considerable disadvantage.

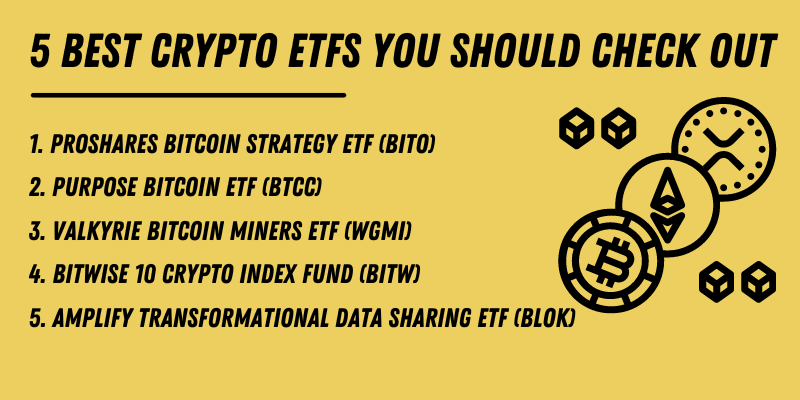

5 Best Crypto ETFs You Should Check Out

There are approximately 60 crypto ETFs but only a few of them are valuable and popular. The five of the best and most popular ones are:

It was the first Bitcoin futures ETF to be approved in the U.S. BITO invests in Bitcoin futures contracts to allow investors to speculate on its price movements and make significant profit. This ETF tracks Bitcoin performance, however it’s in the future so the price may vary from the actual price of Bitcoin at a particular moment.

2. Purpose Bitcoin ETF (BTCC)

This one is a spot Bitcoin ETF that directly holds Bitcoin. This was introduced in Canada and is the first-ever Bitcoin ETF to be approved. Investors can buy shares that represent the units of the actual Bitcoin tokens held in a cold storage. It replicates the price of Bitcoin but is without its complexities and security risks.

3. Valkyrie Bitcoin Miners ETF (WGMI)

Next up is the Valkyrie Bitcoin Miners ETF which focuses on companies that mine Bitcoin. Instead of investing directly in Bitcoin these companies mine Bitcoin to generate revenue. This ETF includes multiple companies that are heavily invested in Bitcoin mining and have the infrastructure to maintain it.

4. Bitwise 10 Crypto Index Fund (BITW)

This crypto Fund has a portfolio of top 10 cryptocurrencies by market cap. BITW follows a broader approach instead of just investing in a single crypto asset. Their basket includes Bitcoin, Ethereum and many other top crypto assets.

5. Amplify Transformational Data Sharing ETF (BLOK)

Lastly there’s the BLOK that invests in companies working to grow the blockchain sector. This Fund includes a variety of companies ranging from technology firms to financial services. If you’re a fan of blockchain technology and want to indirectly invest in it then BLOK is the perfect choice for you.

Summing Up

Crypto ETFs are a new term in the financial market. It has become extremely popular in such a short span mainly because they weren’t regulated for years. But now after careful consideration and seeing that people won’t back down from investing in cryptocurrency, it has finally been regulated.

We have only mentioned five cryptocurrency ETFs but there are a lot more than that. So don’t just rely on our suggestion, make sure to do your own research too and find the one that suits your needs and budget.

While there are some disadvantages of crypto ETFs, the benefits outweigh them. It’s a safe and regulated way to invest in cryptocurrency. However make sure to complete your due diligence before investing in any ETF or a cryptocurrency directly. These are highly volatile and come with risks.

FAQs

Are Crypto ETFs safe to invest in?

Crypto ETFs are generally safer than directly buying cryptocurrency. It’s because they are properly regulated by financial authorities. These EFTs also offer more protection against fraud and theft. However there are still a few risks associated which you can read above as well.

Can I buy Crypto ETFs through my regular brokerage account?

Yes. You can buy and sell most of the Most Crypto ETFs through your traditional brokerage account. They are traded on major stock exchanges which makes them more accessible to most investors. This makes the process a whole lot easier as compared to setting up a digital wallet and buying cryptocurrencies directly.

Do Crypto ETFs pay dividends?

Unfortunately No. Most Crypto ETFs do not pay dividends because cryptocurrencies themselves do not generate income like stocks or bonds. The returns from Crypto ETFs come from changes in the price of the underlying assets. However some funds might also pay out little dividends if they invest in yield-generating assets like staking cryptocurrencies. You’ll have to check in with the companies to know more.

Can I invest in multiple Crypto ETFs?

Yes. You can diversify your portfolio by investing in multiple Crypto ETFs. This allows you to spread risk across different assets or strategies. For instance you might want to invest in a Bitcoin ETF, an Ethereum ETF and a blockchain ETF to have a broader exposure to the crypto ecosystem.

Are there any alternatives to Crypto ETFs?

Definitely. There are a few that you can explore. These include direct cryptocurrency investments, blockchain ETFs and cryptocurrency mutual funds. Each of these have different exposure levels and risk profiles. Direct investments provide more control while ETFs and funds offer regulated and professionally managed options. You can choose whichever one fulfills your criteria.