Cryptocurrency is all great unless the volatility factor pops up. An incredibly unpredictable asset, crypto hikes and plummets its value in a matter of seconds. However, fiat currency doesn’t come with zero drawbacks. There comes DAI stablecoin with the stability of fiat currency and decentralization of crypto.

It makes no sense to discuss DAI crypto and neglect MakerDAO. If one is a product, the other is the source of that product. What is DAI and how does it work? DAI is a stablecoin in the Decentralized Finance (DeFi) ecosystem. And as the word ‘Stablecoin’ implies, it is a cryptocurrency that defies volatility and remains stable in the market.

If you are here reading this guide, let’s uncover what you can expect to find out. We will cover the following aspects of DAI in detail:

- Introduction to DAI and MakerDAO

- How they work

- Features and Role of DAI in DeFi

- Advantages of DAI for crypto investors and traders

- Challenges and the future of DAI

Understanding these areas will set you aside from the crowd, assisting you to be aware of the perks this stablecoin offers. Thus, you will be able to make educated decisions in your crypto investing or trading journey.

What Is DAI?

DAI is a form of cryptocurrency that remains stable and opposes uncontrolled price fluctuation. In other words, DAI is a stablecoin that maintains equilibrium with a centralized financial system or fiat currency, such as the US dollar.

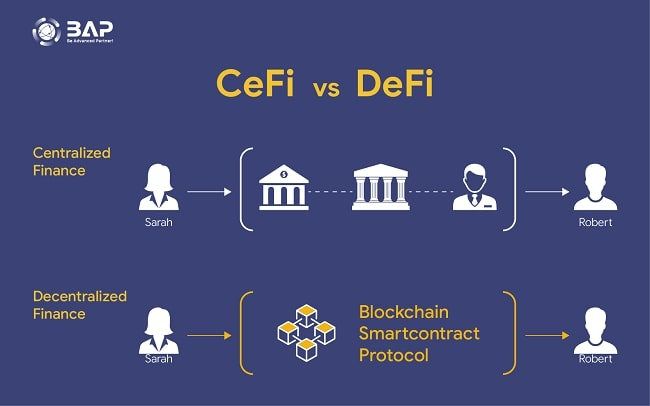

However, it is important to understand that DAI is not a centralized model. This means that regardless of its value in correlation with a fiat currency, there is complete censorship resistance in DAI crypto. Banks and governments do not control the value of DAI stablecoin.

If not them, who controls DAI? This is a common question that pops up in everyone’s mind when they read about Decentralized Finance (DeFi). Just like other cryptocurrencies in the DeFi ecosystem, the owners and the community of the crypto holders control and govern that cryptocurrency, such as DAI.

You will understand about the creation and working of DAI in the coming sections of this guide.

The Genesis of DAI

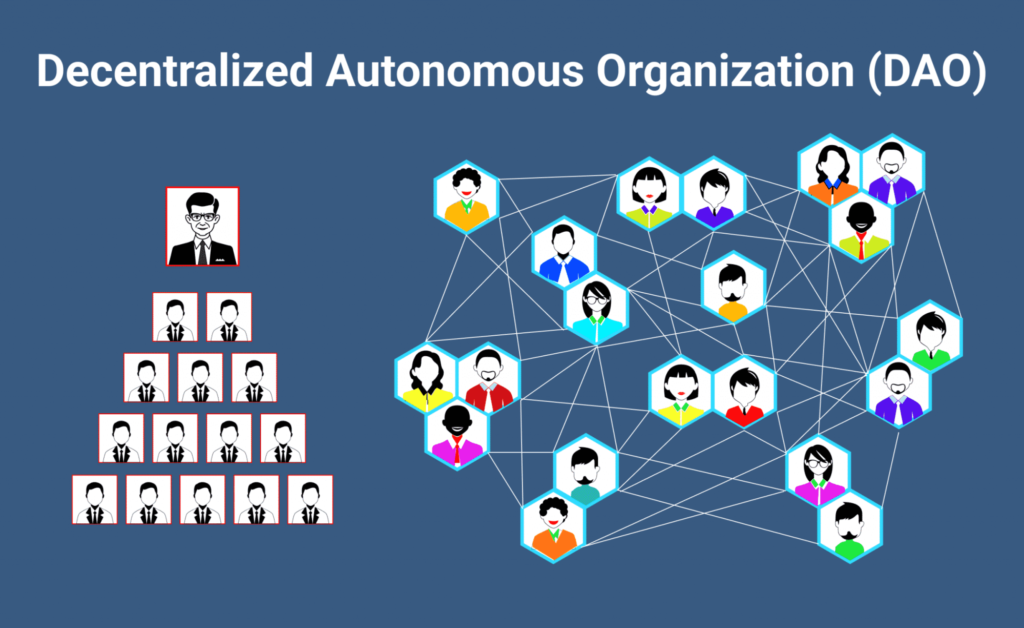

The start of DAI dates back to 2015 with the creation of MakerDAO. A decentralized Autonomous Organization (DAO) is an autonomous organization without organizational hierarchy and control. Rune Christensen started MakerDAO as an organization for a decentralized credit system to streamline lending and borrowing.

This was not possible without a decentralized crypto token. This was when MakerDAO’s developers built the first version of DAI in 2017. Ethereum was the core blockchain technology and ERC-20 was the decentralized protocol for DAI. The value of DAI and USD was similar. This way, MakerDAO came up with an idea to defy volatility.

The question is that Tether (USDT) is one of the most popular stablecoins, what was the need for another stablecoin? It is imperative to know that USDT and other stablecoins are centralized in terms of financial reserves just like fiat currency. DAI is different due to the concept of over-collateralization.

The Technology Behind DAI

As we just mentioned the term over-collateralization, it is a feature that separates DAI from other stablecoins in the crypto landscape. It has gained adequate fame, leading to a massive market capitalization. According to CoinMarketCap, the market cap of DAI is about 5.36 billion USD.

The excellence of DAI stablecoin is due to the technology behind it, its working mechanism, and its wonderful use cases. Below are the core technologies that make DAI function properly and benefit crypto enthusiasts:

- Ethereum Blockchain: It is unfair to discuss DAI and forget Ethereum blockchain. After Bitcoin, which is the king of the crypto ecosystem, Ethereum is the next big thing. Ethereum as a coin is significant but its blockchain technology is top-notch as well. It is the driving force for the creation of DAI tokens. Moreover, Ethereum is pivotal for the stability of DAI’s value in the market.

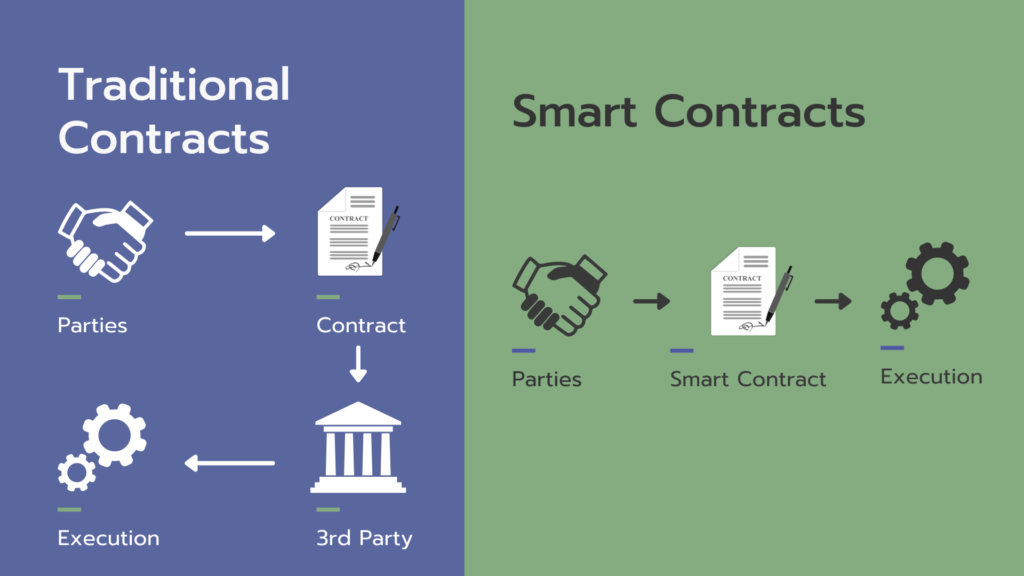

- Smart Contract: You might be tricked by the term smart contract. Smart contracts are just computer software or codebase. A software that is neither smart nor a contract, a smart contract automates the blockchain process. Ethereum’s smart contract fosters the excellence of DAI stablecoin as it manages complex tasks for the stability of DAI.

How Does DAI Work?

DAI is simply a stablecoin of MakerDAO, which is the medium of exchange for the organization as well as a token to keep as collateral and use for trades. How does DAI work? DAI working is a five-step process as covered below:

Over-Collateralization

Before discussing DAI, let’s talk about how other stablecoins work. Typically, fiat currency is the reserve maintained on the backend as collateral for stabilizing the value of the stablecoin. This is excellent with a catch – Centralization. As pure as the concept of cryptocurrency, DAI remains fully decentralized due to over-collateralization.

As the word implies, DAI has more extensive collaterals than the value of DAI generated on MakerDAO. The assets for collateralization are primarily Ethereum (ETH), Basic Attention Token (BAT), or any other ERC-20 token. ERC-20 tokens refer to crypto tokens built using Ethereum blockchain technology.

A user must deposit more ERC-20 tokens into the MakerDAO to create more DAI stablecoins. The collateral assets are completely transparent with an audit which is available to the public. Thus, there is no need for a centralized authority.

Creating Vault

Within the MakerDAO system, a built-in calculator offers the estimated DAI that you can generate once you deposit the desired ERC-20 tokens. In this step, you will create a vault and generate DAI stablecoins equivalent to the value of the collateral assets you deposited.

There is a determined minimum value of collaterals on MakerDAO for vault creation. Creating a vault will pave the way for you to get started with generating new DAI crypto for lending to borrowers and getting rewards.

Fee for Stability

Just like the platform fees, there is a stability fee of MakerDAO for creating DAI. MakerDAO has a native crypto token, MKR. This is the token of governance for MakerDAO users to vote and manage this platform.

The purpose of the stability fee is to maintain balance and avoid default. This fee varies based on the existing debt and DAI creation. Though the system calculates this fee in DAI, users must pay a stability fee in MKR.

Redeeming DAI

Once a user pays the stability fee, they can avail of the generated DAI. The rewards and other perks of the MakerDAO depend on the payment of stability fees. Therefore, redeeming DAI is not accessible without paying this fee.

Market Procedure

As we talked about Ethereum’s smart contract in DAI functioning, there is an automatic function known as liquidity. If a customer has a certain amount of DAI in the vault and the collateral price plummets below the set value, liquidity will take place.

This means that MakerDAO will liquidate the vault by selling the available collateral to pay for the decreased value. Thus, the stability of DAI remains intact against the US dollar.

MakerDAO – An Overview

Imagine you have reached a bank in the US and requested a loan. The bank will run certain checks to assess whether you can repay or not. Banks require a strong portfolio and collateral to lend you money in USD.

Now let’s look at MakerDAO. It is a decentralized autonomous organization that offers credits and loans in DAI stablecoins. Just like the bank manages the loan in USD, MakerDAO manages the loans in DAI. MakerDAO has MKR holders similar to banks having investors and savings account holders.

The difference between a bank and MakerDAO is decentralization and collateralization. According to the Federal Reserve Board, the reserve requirement ratio for banks in the US is no more than 10% but 0%. It means that they can offer loans even if the reserves are zero.

MakerDAO has an over-collateralization concept, meaning that users must deposit 150% of collateral assets to get a loan in the form of DAI. Moreover, the loan amount will be two-thirds (2 / 3) of the total collateral assets. This mechanism keeps MakerDAO and DAI free from central authorities and volatility.

Stablecoin in the Crypto Ecosystem

Is volatility always a bad thing? The answer is that day traders benefit from volatility due to their enhanced technical knowledge which helps them make educated decisions about the market.

For instance, Binance is the leading crypto exchange with a 24-hour trading volume of $12.32 billion. Bitcoin is the most traded cryptocurrency on Binance, accounting for 35.46% of the total trades. The fundamental reason behind these trades is volatility.

On the contrary, it can be risky for daily transactions. Therefore, stablecoins are essential with a stabilized and maintained value in the crypto market. Multiple stablecoins are available for traders, investors, and crypto enthusiasts. Some of the renowned ones are:

- DAI

- Tether (USDT)

- USD Coin (USDC)

- Ethena USDe (USDe)

- PayPal USD (PYUSD)

Importance of Stablecoin

Stablecoins are a problem solver in the cryptocurrency and DeFi ecosystems. They are incredible for economic well-being and financial policies. As there is a huge gap between traditional finances and decentralized finance, stablecoin acts as a bridge between the two.

Stablecoin like DAI, USDT, etc, allows users to deposit fiat currency into crypto wallets. Once done, users can benefit from endless features of the crypto market. That includes trading, investing, staking, lending and borrowing, and more.

Moreover, stablecoin cust the need for multiple bank accounts for international transactions. You just need a crypto wallet to transfer money from one nation to another and then another with fewer transaction fees in split seconds.

The Role of DAI in the DeFi Ecosystem

Decentralized Finance (DeFi) is the modern system for finance and development with blockchain as its core technology and cryptocurrency as its payment tool. Some may limit DeFi to cryptocurrency, but that’s not the case.

DeFi offers plenty of applications and use cases that range from asset management and decentralized Autonomous Organizations (DAOs) to metaverse and Web3. Simply put, DeFi is here to complement financial matters by cutting dependency on central bodies.

DAI is a key application in the DeFi ecosystem, thanks to MakerDAO’s Maker protocol. This offers numerous benefits to crypto aficionados. They are as follows:

1. Complete Decentralization

The top-notch contribution of DAI stablecoin is the issuance of a completely decentralized crypto. There are many stablecoins, such as USDT, Gemini Dollar (GUSD), etc. They are centralized because their assets are backed by a central authority or bank.

On the other hand, DAI’s MakerDAO has guaranteed decentralization and democratic governance. A single entity or central body can never control DAI and its platform. The control is in the hands of MKR holders who can participate in voting to bring changes like quantity of loans, amount of credits and fees.

2. Stabilized Value of Assets

Since MakerDAO is a decentralized credit organization, it must use a stable crypto asset to do so. The use of a regular crypto coin or token will adversely hike or plummet the value of the credit and loan. Thus, DAI offers stable value of assets.

Furthermore, DAI is highly useful in decentralized exchanges such as Uniswap. Uniswap does not allow users to buy or sell crypto assets in fiat currency. The reason for this is the safety and security of the platform as well as the crypto asset.

DAI solves this issue by allowing users to convert their fiat currency to DAI and then buy other crypto using DAI on decentralized exchanges.

3. Composability

In the DeFi architecture, composability is key to successful innovations. MakerDAO is composable because it is open-source. This means that its source code or program is transparent and available to the public.

An excellent developer can read, copy, and fork its source code and come up with a much better solution. This enhances the use cases of DAI and its relevant blockchain technology.

DAI vs USDT – Key Differences

DAI and USDT are both stablecoins. In terms of adoption and market capitalization, Tether (USDT) is the big name in the crypto industry. Each of these stablecoins offers distinguished pros and cons.

They are similar in some aspects while different in others. Therefore, we will look into the comparison of various features of DAI and Tether.

|

Dai (DAI) |

Tether (USDT) | |

|---|---|---|

|

Market Capitalization |

5.35 billion USD | $118.38 billion |

|

Centralization |

Completely decentralized with over-collateralization |

Tether Limited controls the entire infrastructure of USDT, making it centralized in some way |

|

Availability |

Available on both centralized and decentralized crypto exchanges. It can be used widely in DeFi applications. | Though available on both CEX and DEX, its most common use is in centralized exchanges and applications. |

|

Stability |

The stability mechanism of DAI is collateralized debt positions by keeping additional assets as collateral for stability. |

USDT offers stability due to its pegging or ties with the US dollar, which is in reserve with Tether Limited. |

|

Fees |

The stability fees of DAI are lower than USDT due to the complete decentralization. |

USDT also charges lower fees but not lower than DAI because of the centralized entity involved in its reserves and functionality. |

Use Cases of DAI

DAI and MakerDAO is an innovative development in the crypto world. The autonomy, democracy, censorship-resistance, and stability DAI has introduced are unmatched. This is the ultimate reason for its widespread adoption in the mainstream cryptocurrency ecosystem.

Furthermore, MakerDAO operates with a robust and vibrant community of like-minded people. They are available for DAI on symbiotic relationships. This implies that DAI positively impacts the lives of its community members and those members contribute to the propagation of DAI.

There are plenty of use cases and applications of DAI in the DeFi landscape. We will discuss those in the following sections so that you can evaluate the essence of DAI stablecoin and its Maker protocol.

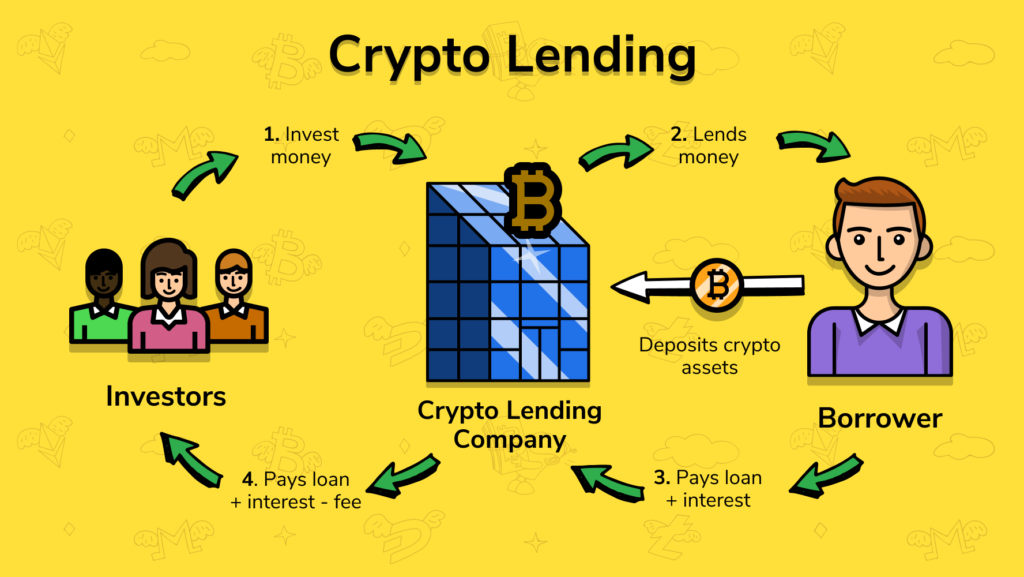

Crypto Lending

Emergencies are part of life for everyone. Anyone can face pressing issues in their personal or professional matters. Cryptocurrency offers the best way to leverage the power of compounding wealth. However, it can be a loss to prematurely withdraw money from an active trade.

Thus, crypto lending and borrowing are key to financial balance in an ecosystem. This can help you in emergency situations as well as facilitate you to level up your crypto trading or investing game. With some extra funds, your income can grow abruptly.

DAI is one of the most stable, trustworthy, and cost-effective borrowing options. With crypto assets as collateral, you can straighten up your financial matters hassle-free. That too without any hectic compliance and paperwork of central banks or other institutions.

Crypto Trading and Medium of Exchange

You have already read about the importance of volatility for day traders. Though stablecoin is not a direct way of making money off trading, it is the link between fiat currency and cryptocurrency. You can use DAI as a ticket to start a trade on a decentralized exchange like Binance or a centralized one, such as Uniswap.

Moreover, DAI is a convenient and speedy medium of exchange for international payments and remittances. It offers support for both peer-to-peer transactions and payment methods. So, you can buy products and services using DAI from those retailers and e-commerce stores that accept DAI.

Financial Uses of DAI

DAI has an equal value to the US dollar. It means that this is the most convenient digital method for payments globally. At this moment, cryptocurrency, as a whole, faces difficulty in mass adoption. The future appears to be in the favor of crypto payments.

The reason for that is the level of comfort, security, and speed of financial matters. For instance, you can pay for a product or service in national currency as well as stablecoin like DAI. However, using DAI opens a gateway to the crypto world, which includes trading, conversion to deflationary crypto coins, etc.

On top of that, DAI has multiple usability in the DeFi ecosystem. That includes:

- In-game currency,

- Non-fungible tokens (NFTs) platforms,

- Liquidity provisioning exchanges, etc.

Pros and Cons of DAI

Pros of DAI Stablecoin

- Decentralization: You have read about the decentralization of DAI comparatively to Tether (USDT). DAI is one of the few stablecoins with a different mechanism for stability without bringing centralized institutions to the table.

- Transparency: Though MakerDAO functions on collateralized debt positions, there is no chance of fraud or heist. It is because of the unmatched transparency and audit of transactions. Thus, the community of DAI trusts and relies on this stablecoin.

- Flexibility: One of the best perks of DAI is its flexibility. It has multiple use cases, making it a top choice for crypto enthusiasts. You can use it for payments, a medium of exchange for trading and investing. Additionally, the primary use of DAI is decentralized lending and borrowing.

- Governance: Unlike other stablecoin that a specific organization controls, DAI hands the control to a community of MKR holders. As MKR is the governance token of MakerDAO, every change that will take place in MakerDAO will be based on voting from the MKR holders.

Challenges for DAI Crypto

- Systematic Risk: The biggest drawback of DAI is its collateralization mechanism. It is in this sense that if a drastic change occurs in the value of the collateral asset, the stability of DAI will leave a major impact on the market.

- Regulatory Risks: Cryptocurrency is always exposed to regulatory or legal concerns. Stablecoins are also not safe regardless of stability. Chances are that DAI may go under the radar of regulatory authorities due to decentralization.

Conclusion

Stablecoins are key to the cryptocurrency landscape. It not only connects real-world applications with the virtual financial world but also paves the way for other DeFi applications.

DAI is a complete package of stable economy due to the MakerDAO’s Maker protocol. It is available on both centralized and decentralized exchanges for crypto enthusiasts. Moreover, its over-collateralization is the leading reason for its enhanced stability and trustworthiness.

FAQs

Is DAI a good investment?

Investing in DAI is lucrative because you can lend it at a lower stability fee and earn higher interest than its competitors. Furthermore, you can also invest in MKR to participate in the governance of the MakerDAO ecosystem.

How is DAI different from USDT?

DAI is different from USDT in multiple ways. DAI is a decentralized stablecoin while USDT has centralization, fees of DAI are lower than USDT, stability of DAI is due to collateralized debt position while USDT has USD reserves in its foundational company and more.

What is the role of smart contracts in DAI?

Smart contracts are responsible for maintaining the correct amount of collateral assets in the MakerDAO system. Since it is automated, lowering the value of collaterals will liquidate the credits to cover the loss.

How does DAI maintain its peg to the US dollar?

Since it is built on top of the Ethereum ERC-20 token protocol, over-collateralization and algorithmic settings enable DAI to maintain its tie with the USD.

Does DAI allow swapping to other crypto coins?

Yes, you can swap DAI for any crypto asset you want. The method of swapping depends on the crypto wallet or exchange you use because each one has a different user interface.