Volume Profile is one of the most powerful tools in technical analysis, enabling traders to gain insights into market behavior. This article explores the concept, its components, and how to use it effectively in your trading strategies.

What is Volume Profile?

Volume Profile is a graphical representation that shows the volume traded at each price level over a specific period. Unlike traditional volume indicators, which display volume by time, Volume Profile highlights where transactions are concentrated across price levels.

How Does It Work?

- Horizontal Bars: Represent the volume traded at each price point.

- High Volume Areas: Indicate levels where market participants found balance between supply and demand.

- Low Volume Areas: Suggest levels of less market interest, often leading to rapid price movements.

Components of Volume Profile

Understanding the key elements of Volume Profile is crucial for leveraging its insights.

https://www.jumpstarttrading.com/volume-profile

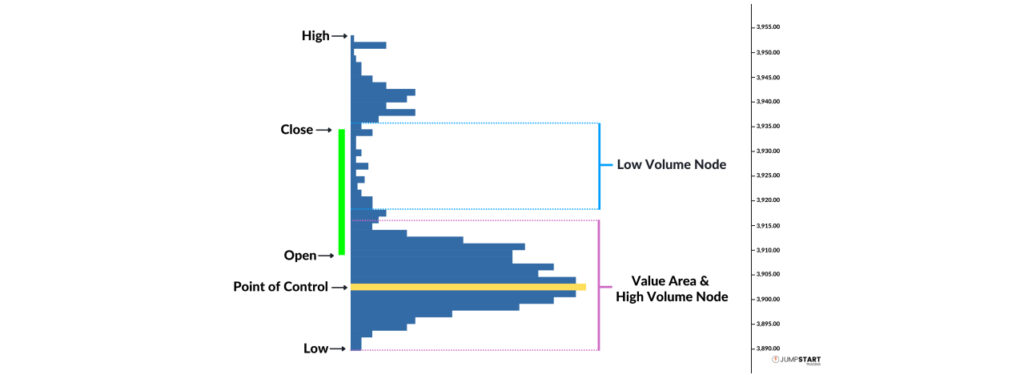

Point of Control (POC)

- Definition: The price level with the highest traded volume in a given period.

- Significance: Acts as a key support or resistance level due to the balance between buyers and sellers.

Value Area (VA)

- Definition: The range of prices where 70% of the total volume was traded.

- Use Case: Helps traders identify equilibrium zones and potential turning points.

High Volume Nodes (HVN) and Low Volume Nodes (LVN)

- HVNs: Areas of high traded volume, often acting as support or resistance.

- LVNs: Zones of low traded volume, indicating imbalances where price moves quickly.

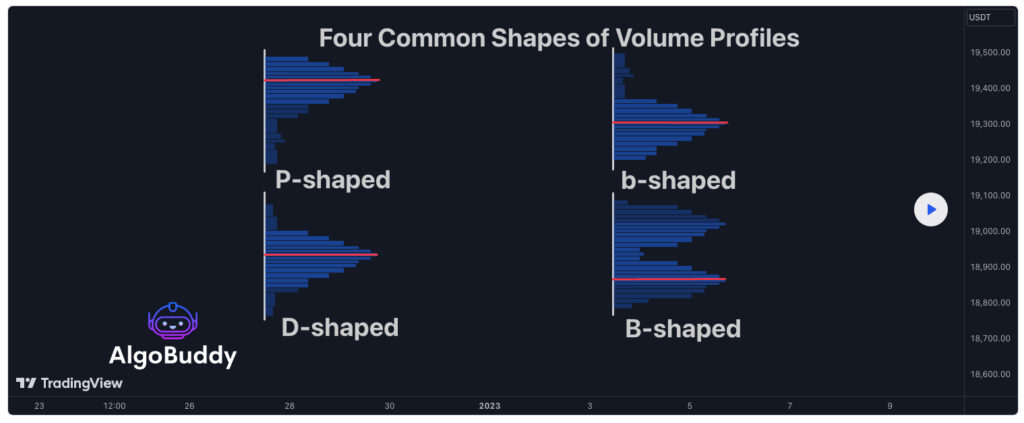

Typical Shapes of Volume Profile

Each shape provides valuable insights into market dynamics and trends.

“D” Shape

- Characteristics: Uniform volume distribution, suggesting market equilibrium.

- Market Context: Typically seen during consolidation phases.

“P” Shape

- Characteristics: High volume concentrated at the top of the profile.

- Market Context: Indicates bullish trends or the end of a bearish phase.

“b” Shape

- Characteristics: High volume concentrated at the bottom of the profile.

- Market Context: Suggests bearish trends or the end of a bullish phase.

How to Use Volume Profile in Trading

Volume Profile can be applied in various trading strategies to enhance decision-making.

Identifying Support and Resistance

- High Volume Areas: Act as strong support/resistance zones due to high market interest.

- Low Volume Areas: Represent potential breakouts or rapid price movements.

Trading Within the Value Area

- Strategy: Monitor the upper and lower bounds of the Value Area.

- Example: Look for reversals when the price exits and then re-enters the Value Area.

Breakouts and Retracements

- Low Volume Areas: Serve as signals for breakouts or fast price moves.

- High Volume Areas: Indicate zones where the price may pause or reverse.

Advanced Strategies with Volume Profile

Experienced traders can integrate Volume Profile into more complex strategies.

Identifying Accumulation and Distribution Phases

- Accumulation: High volume in a narrow range, suggesting institutional buying.

- Distribution: High volume in a narrow range, indicating institutional selling.

Spotting Institutional Interest

- High-Volume Areas: Often represent zones where institutions are active.

Combining with Other Indicators

- Use Volume Profile alongside tools like VWAP or static support/resistance levels to strengthen trading setups.

Limitations of Volume Profile

While powerful, Volume Profile has its limitations:

- Context-Dependent: Requires understanding the broader market conditions.

- Subjectivity: Different timeframes can lead to varying interpretations.

- No Direct Signals: Identifies areas of interest, not explicit buy/sell signals.

Conclusion

Volume Profile is a versatile tool for understanding market behavior and identifying key price levels. By analyzing volume at price levels, traders can gain deeper insights into support, resistance, and potential market moves.

To maximize its potential:

- Combine it with other tools.

- Experiment with different timeframes.

- Always align your analysis with the broader market context.

With practice and a solid understanding, Volume Profile can become a cornerstone of your trading strategy.