WhatsApp controls your messaging. Twitter influences your privacy. Instagram controls your content whereas Facebook governs your user data. These tech giants have a big say in your digital life. No wonder why centralized applications are mostly explained as convenient but it has drawbacks as well. Centralized apps limit your controls, lack transparency, and expose you to security threats. That’s where DApps come in. Built on blockchain technology, the decentralized applications use features of the distributed ledger to provide a transparent value exchange platform to its users.

According to Virtue Market Research, the Decentralized Application Development (DApps) industry will grow by a CAGR of 56.1%, setting the total valuation of $70.82 billion.

They are software programs that operate on P2P networks without any central authority. Dapps develops for several uses. You can use decentralized applications for wallets, social media, exchanges, gaming, and even personal finance. DApps have win-win offers for their users – they are decentralized, fully secured, function autonomously, are transparent, and innovation-obsessed. Sounds cool, right?

Now, let’s move ahead and understand decentralized applications comprehensively.

What is a DApp?

Decentralized applications lie on distributed ledger technology, unlike traditional apps that are hosted on centralized servers. They have no single point of control that refrains from censorship and authoritative access. DApps are mainly built on blockchain which provides them with additional features that are immutable ledgers for transactions. This integration plays a big role in enhancing security and consumer trust since all the operations in this platform are recorded and traceable on the blockchain, and verified by all the users.

These apps run on a peer-to-peer network means all the apps directly connect with the user, without any intermediaries. There will be no one who’ll track your operations. A community of users is responsible for the functioning of DApps, not some company or single individuals. Whatever the program is, if its backend infrastructure is based on blockchain it can be qualified as Decentralized applications.

Additionally, DApps run on a network of computers called nodes. These nodes basically decide how they should function with a code called smart contracts. For any modification or updates, the majority of nodes are supposed to agree on the plan, otherwise it won’t execute.

Let’s understand the concepts of Dapps through an application known as Uniswap. It’s a Decentralized Finance (DeFi) exchange platform that gives users many potential benefits. Uniswap doesn’t work through any operators. It facilitates its users to trade cryptocurrencies directly from their wallets. No intermediaries like Binance and Coinbase instead operate through smart contracts that suggest all the functioning of fee distribution, liquidity provision, and trading relies on the blockchain code.

Other than Uniswap, we have Minds. It’s a decentralized social media platform. On Minds, users can control their data privacy and all their content will be recorded on blockchain.

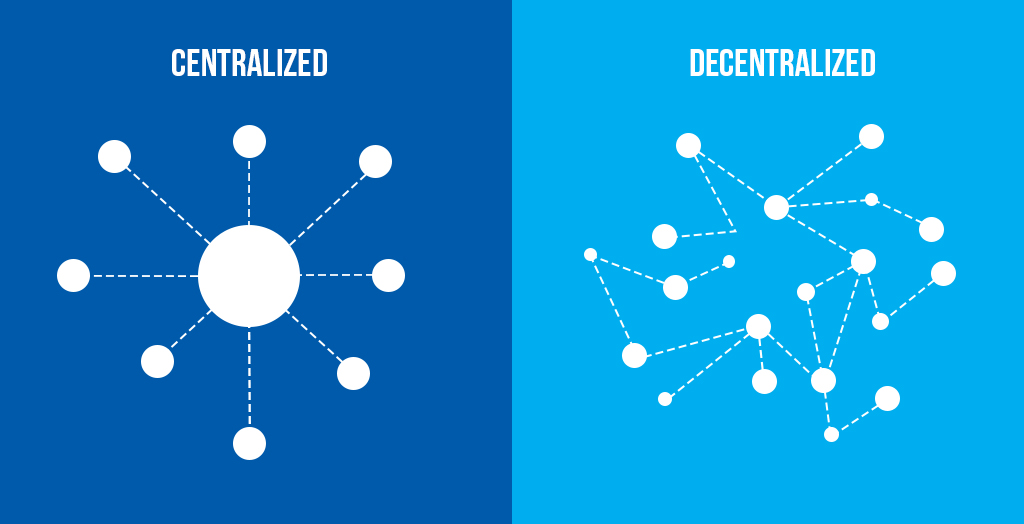

Centralized Vs Decentralized Application – Which’s best?

Centralized applications are considered convenient whereas DApps are more controlled. One offers security, while the other roams around privacy. But despite these factors, DApps are highly preferred as they don’t belong to any intermediaries. If your primary needs are access control, DeFi features, blockchain integration, etc, then decentralized applications would be the best choice for you. Look at the table below to see the complete difference.

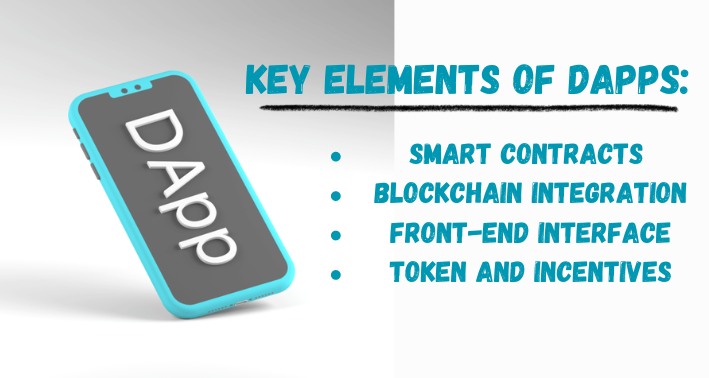

Key Building Elements of Decentralized Applications

1. Smart Contracts

First up, we have the smart contracts, the core component of decentralized applications. As we have seen above, what is a DApp? Now these key element integration will elaborate on how it works. Smart Contracts are a line of code that executes automatically once the pre-defined conditions become valid. They can run into blockchain-based platforms and can never be altered or temporarily deleted to ensure the rules are enforced equally to every user, suggesting this contract agreement is immutable.

According to research, Smart Contracts are estimated to grow from USD 236.40 million in 2023 to USD 1338.52 million by 2031.

These contracts are integrated into decentralized networks so DApps can inherit the security features. This reduces the risk of fraud, hacking, and data breaches. Smart Contracts can interact with other decentralized applications and blockchains, creating a network of open-source interconnected services. Just like a user can collect tokens on one DApp and use them as rewards on the other DApp, very similar to some game or lending applications. Automation powers are also bringing massive technological advancements to the finance, gaming, and supply chain industries, thanks to smart contracts.

Examples of Smart Contracts in Use

You might know about Uniswap. It’s a DeFi-integrated application that allows you to trade crypto directly from your wallets. Uniswap relies heavily on smart contracts to manage internal operations. All the trading, liquidity distribution, and finance management is operated with the help of these lines of code to ensure smooth transaction facilities for its users.

Compound, a decentralized finance exchange application, also deploys smart contracts to let them lend and borrow crypto autonomously. No third party is involved. The smart contracts will determine all the interest rates and other conditions for trading.

2. Blockchain Integration

How does Blockchain help with DApps’ infrastructure?

We have seen above decentralized applications are based on blockchain. Unlike traditional apps, no entity controls DApps. They are free from centralized authorities. This infrastructure is basically supported by Blockchain. It records the operations across every node (network of different servers) in a secure and immutable way. The cryptographic protocols of Blockchain ensure the scalability and proper integration of data. All the performing operations and transactions first require verification by multiple nodes through a consensus mechanism. This verification procedure makes the data nearly impossible to be altered or hacked once it’s deployed on Blockchain. This open-source system contributes a lot to the decentralized application’s infrastructure, making it safe, secure, and robust against downtime.

The global blockchain market size is predicted to grow from $20.1 billion in 2024 to $284.9 billion in 2029 with a CAGR of 65.5%, this report is suggested by MarketsandMarkets.

The economic impact is also very massive. Blockchain integration in DApps resulted in the growth of decentralized finance (DeFi) to some great extent. It was valued at around $22 billion in 2022 and approximately $24 billion in 2023 but it’s estimated that the DeFi industry will see a market value of a whopping $48.02 billion in 2031. This is so shocking, all thanks to the early rapid adoption of blockchain that promotes trust, autonomous operations, and access-controlled systems in decentralized applications.

Alternatives for Blockchain

However, blockchain is the best. But not all the DApps need to have it as the backbone. These are the following alternatives you can opt for while building your decentralized application:

- Distributed Hash Tables (DHT)

– Allows you to store and retrieve your data in a decentralized way.

– No need for central servers to manage operations.

– No trust and data integration facility.

– Doesn’t support consensus mechanism.

- Federation or Consortium Networks

– Control is distributed among entities.

– No access control for all the users.

– Less decentralized.

– Not very secure against downtime.

- Directed Acyclic Graph (DAG)

– Scalable and fast processing.

– Can be used in IoT or micro-transaction applications.

– Efficient than blockchain but failed in implementing the level of security.

– Less decentralized.

These alternatives have some drawbacks but in particular scenarios, they can give you the best possible outcome. Such as if you want a more efficient DApp, DAG is best, if you don’t want complete decentralization, Consortium Networks will help you, etc. Go with what suits you the best. Now let’s move toward the third core component of the decentralized application, the front-end interface.

3. Front-end Interface

How does the user interact with DApps?

The front end of decentralized apps is a bridge between the outside world and the hidden realm of blockchain. Users directly interact with the blockchain through web browsers or mobile programs, unlike traditional apps that host a central server for contacts. All the DApps users are required to have Web3 wallets like MetaMask, Trust Wallet, WalletConnect, etc to manage their digital assets, finance handling, sending transactions, support operations, and much more from browsers to devices.

However, user interaction with the front end requires a gas fee which is a compensation amount for nodes’ networks for processing transactions. Unlike traditional apps that we often download from the Apple Store or Google Play has a simple onboarding process, DApps asks the users to manage their own web3 wallet that’s quite a daunting task. This complexity often leads to 20% of users abandoning DApps due to a difficult usage process. Even a survey of ConsenSys showed that 35% of users had declared absolutely poor experience with DApps owing to its complex interface and transaction delays.

4. Token and Incentives

DApps have three kinds of tokens; utility, governance, and security tokens. All three of them have their own incentives. Starting from governance tokens, it allows the holders to contribute their part in the decision-making process of a DApp. According to a ConsenSys report, 40% of the DeFi projects launched in 2023 have incorporated governance tokens.

On the contrary, Utility tokens have a special purpose. They provide access to special features of DApps’ products and services. Utility tokens are vital for the functioning of decentralized applications. These tokens help make transactions easier, and faster, reward users, and grant premium access to additional features. Lastly, let’s see security tokens that are much like security deposits. It represents your stake in real-time assets such as bonds, equity, real estate, etc.

DApp users can have the following incentives using these tokens:

Staking:

You can lock up your token in a smart contract which will help support the blockchain’s operations such as liquidity provision, transaction validity, etc. In return, you’ll receive stake rewards, creating a sustainable passive income stream.

One of the prime examples of staking rewards is Ethereum. Due to their PoS mechanism, Ethereum supports staking to let their user earn some good bucks in return for locking up their tokens. Currently, almost 33.8 million ETH tokens are staked, setting a market cap of $92.7 billion.

Liquidity Mining:

This is another good way to earn using tokens. Liquidity mining is a process where you basically trade your crypto to a pool on a lending platform. In return for fund addition, you’ll earn some cool rewards. Liquidity mining is similar to bank programs. Instead of interest on a savings account, you’ll get additional tokens.

This helps run the platform smoothly as it overcomes the need for additional coins for others to trade or borrow. The more liquidity you’ll be able to provide, the more you can earn.

Types of Decentralized Applications

Until now, we’ve gone through how the decentralized applications work with their core components. Now, let’s discuss what types of decentralized applications are available in the industry. Do these DApps actually get used? Let’s see.

Based on Consensus Mechanism

This categorization helps to understand how the different layers within the decentralized ecosystem interconnect with each other to deliver services to users. First up, let’s see Foundational DApps.

Foundational DApps

These applications help robustly the underlying infrastructure of blockchain and enhance the parameters of the service so the other DApp runs smoothly on its platform. Foundational decentralized application seems to be responsible for data storage, consensus mechanisms, security, and communication protocols.

The best examples of such applications are Ethereum and Filecoin. Ethereum provides a platform for other DApps to be built, performed operations, and executed with accuracy. On the contrary, Filecoin is another great application. It allows the users to receive, host, and retrieve their data in a decentralized manner. It provides a platform for other DApps that require storage solutions.

Protocol-based DApps

They rely on foundational Dapps to function. Protocol refers to a set of rules and standards that allows these apps to interact within a blockchain network. Pancake swap is a good example of understanding protocol-based DApps. It uses blockchain technology for P2P token exchange. Ethereum is another great way to understand such DApps. It deploys the Uniswap protocol that enables automated token trading.

User-Facing DApps

They are built on Foundational and protocol-based infrastructure and re-owned for providing real-time solutions. The foundational layer of user-facing DApps helps it provide innovative services to users without letting them dive into the complexities of blockchain technology. For example, there’s a well-known application called OpenSea. It’s a mega store for non-fungible tokens (NFTs). OpenSea’s cross-chain compatibility is endless. It offers transaction services to multiple blockchain platforms including Ethereum, Klaytn, Polygon, etc. However, the main concern is that OpenSea relies on Ethereum protocols for smart contract execution for authenticating transactions. By following these protocols, users can have reliable services for global adoption and large-scale user engagement.

Based on Intended Purpose

Next up, this is the 2nd type of decentralized application that has specific use cases. Let’s see one by one.

Financial DApps (DeFi)

These DApps are specially designed for decentralized finance (DeFi) applications that support many financial activities. You can lend, borrow, send, and receive your money without any intermediaries that charge extra fees or delay your payment. These apps leverage the infrastructure of foundational decentralized applications.

Following are the key examples:

Compound and Aave — These DeFi application helps you earn interest or borrow digital assets in return for lending crypto holdings.

Uniswap — It’s a decentralized exchange (DEX) that supports crypto trading directly from your wallet without any central server.

DeFi DApps are expected to have around 22.09 million users by 2028. The mass adoption also resulted in a great increase in DeFi market value to $68.63 billion, according to Forbes.

Social DApps

This decentralized application promotes private messaging, social interaction, and full control access to your user data. There will be no central entity that’ll keep an eye on your operations. You’ll have direct contact with blockchain infrastructure and will be free to make any modifications to the code.

Social decentralized applications saw a huge surge of mass adoption in the past years. As per the reports, Minds and Mastodon are 20% year-over-year. Another reason for an increase in user adoption is privacy. Despite their complex front end, DApps are relatively private and secure due to blockchain integration.

For example, Steemit is a decentralized app, pretty similar to Instagram. User earns rewards for curating content and sharing it on the platform. As for now, Steemit has distributed over $100 million in rewards to its audience. If you’re a content creator, you can give it a try!

Gaming & Entertainment DApps

If you’re a game lover, these decentralized applications will make you fall for it even more. Gaming DApps provide you with an unprecedented experience of the virtual world. You can earn rewards, get digital collectibles, own, sell, and trade your assets. The blockchain gaming market is expected to grow by $614.91 billion in 2030 and this is just a prediction, it can beyond that.

There’s a famous play-to-earn game that promotes blockchain technology through gaming. With Axie Infinity, you can earn crypto tokens by selling, breeding, and battling digital pets called Axies.

According to CoinGecko, there are a total of 150 million AXS currently in circulation and have a market cap of $781,446,811.

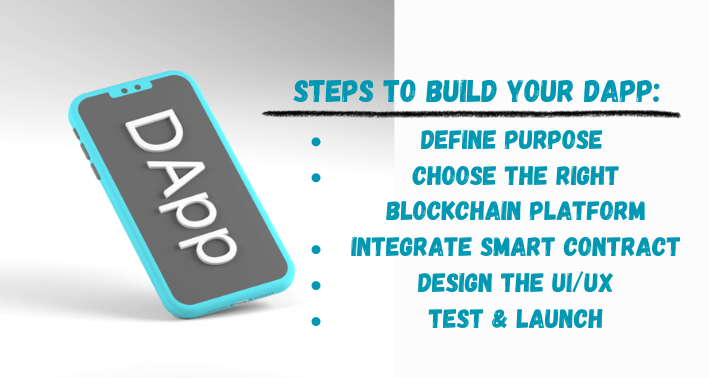

How can you build your Decentralized Application (DApp)?

Now that you know all the basics about DApps, we should learn how you can develop one. It’s not very difficult unless you don’t have good knowledge about it. You should have a good understanding of blockchain, smart contracts, token incentives, and user interfaces. However, keep in mind the developing rates. It’ll cost you a good between $5,000 to $20,000, depending on the functionalities. See this guide below for more help.

Define your Use-Case

Don’t jump into building an application unless you know your purpose. Your DApp should solve some specific problem. Research your target audience, take their feedback, and work on improving those features on your DApp. According to Deloitte, 75% of decentralized applications are aimed at solving one special problem. This approach will increase your application’s adoption among a large audience.

Choose the Right Blockchain Platform

Once you know your purpose, it’s time to find a platform. You’ll find plenty of options. Ethereum is the leading hosting platform for DApps with many great incentives for the developer. You can also go for Binance Smart Chain, Solona, Polygon, etc. Some have better security, some have low transaction costs, and some work fast, all platform has their benefits.

Integrate Smart Contract

Now, start developing your smart contract. Plan the logic, write the code accordingly, and see how you can execute it with accuracy because blockchain is strict about errors. Once you deploy it with your system, you can’t revise it back. Be careful about it!

Design the UI/UX

If you want your app to be adopted by a large audience, keep the interface simple and easy to browse. The interface should integrate with Web3 wallets to interact with your Blockchain platform. Keep tweaking your UI based on feedback from audiences or the testing team. Prioritize easy navigation, flexibility, collaboration, and smooth data backup integration for large mass adoption.

Test & Launch your DApp

Do not directly publicize your application instead deploy it on testnets to find bugs and fix them. Testing will make sure your DApp functions as intended without any failure. Once you’re sure about the launch, start marketing. Go for building a community first. Audience support matters a lot for your applications’ success. Keep monitoring your DApp and gather feedback from the user to work on improvements.

Conclusion

Coming to the end, we’ve seen what is a DApp, how it works, and how you build your own decentralized application. If we compare it to centralized apps, it’s a good choice unless your primary needs aren’t much security, you prefer a central entity, or you don’t want full access control. Whether you want social DApps, DeFi DApps, or whatever your purpose, almost all kinds of decentralized applications can be found in the market. Go for what you find the best for your needs.

Also, keep an eye on the scams. Despite the high level of security, Crypto has lost around $1.9 billion in 2023. There are a lot of victims you’ll find complaining about the scam. But DApps will overcome these challenges as well. The future is bright and the growing economy shows that they’re not just a trend but a future of online interaction.

FAQs

What are DApps?

Decentralized applications rely on blockchain technology, unlike traditional apps. They have no single point of control that refrains from censorship and authoritative access.

Are DApps Safe?

Yes, decentralized applications are relatively safe. They are volatile and free from censorship.

How do decentralized apps work?

A community of users is responsible for the functioning of DApps, not some company or single individuals. They run on a network of computers called nodes which decide how they should function with a code called smart contracts.

How do I make a decentralized app?

Find a problem and use case. Choose the right blockchain platform. Write your smart contract code. Design your front end, test it, and launch your DApp.