Do you know that you can use cryptocurrencies without worrying about the sudden price fluctuations? Yes, that’s true. How? A Stablecoin.

Unlike other cryptocurrencies like Bitcoin and Ethereum, stablecoins are designed to keep their value constant even during high volatility.

But how do they do it? These stablecoins are pegged to stable assets like Gold or US dollars. That’s what makes them more reliable for everyday transactions. However, there’s also a slight chance that these stablecoins can also collapse. We’ll discuss that with an example in a while.

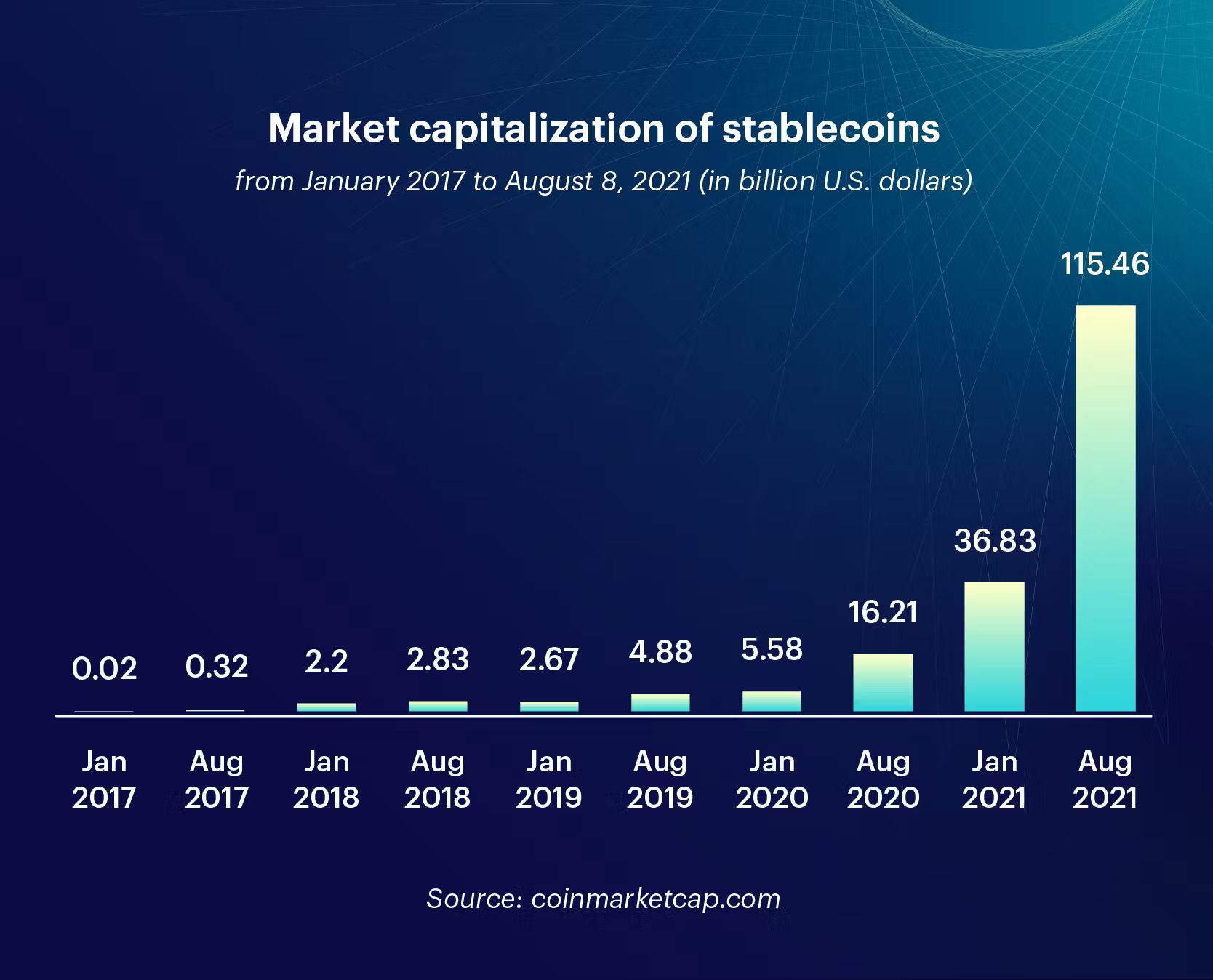

Currently the stablecoins make up for over $170 Billion of the total cryptocurrency market. That’s a huge number if you also consider the current market cap of cryptocurrencies.

Stablecoins use multiple methods to maintain their stability over time. These coins are particularly useful for people who want to store their deflating money as crypto for maintaining their value over time.

So, if you want to enjoy the cryptocurrency market without a roller-coaster ride then stablecoins are your best bet. Let’s talk about it in detail now.

What is a Stablecoin?

A stablecoin is a type of cryptocurrency that is designed to have a stable value. You know how cryptocurrencies are highly volatile and unpredictable. But stablecoins remain steady like their name. That’s what makes these coins a reliable and safer option for people who don’t want to risk their assets or are not comfortable with the ups and downs of other digital currencies.

According to DefiLlama, there are over 196 stablecoins currently circulating in the crypto market.

Now you might think that it’s just a coin with a value similar to any real-world asset. But that’s not it. There are several types of stablecoins that you’ll get to know about ahead. Some of them are fiat-backed, some are crypto-backed and more. However the most vulnerable of them are the ones backed by algorithms. You’ll know why I called it vulnerable in a while.

What you should know is these stablecoins are an important part of any crypto market. They are just safer and once in a while even the biggest of whales like to keep their money saved up in these stablecoins.

A stablecoin offers the best of both worlds. They have the benefits that most cryptocurrencies have like fast transactions and privacy and can also be used to buy stuff in the real world.

How Stablecoins Work?

Now the question here is, how do these stablecoins achieve this stability? It’s simple, by being bound to real-life assets. This asset can be a traditional currency like the US Dollar or even the UK Pounds.

Apart from that stablecoins can also be pegged by using commodities like Gold. These stablecoins link their value to something stable in the real world and take up that value.

For instance if a stablecoin is pegged by US Dollar, they’ll need to stay at a value of $1 all the time. There’re very few margins for stablecoins but still some highly experienced traders even profit from that. It’s all about experience and a working strategy.

To keep the value of a stablecoin consistent, the person behind it makes a few tweaks every time the price increases or decreases. Let’s take an example.

Suppose you’ve an asset whose value is $1. Now if it becomes 0.98$, the entity behind it needs to buy some stablecoins back and burn them to take its price back to $1. It’s the same other way around where they create more coins to handle the increase in price.

Why are Stablecoins Important?

Everyone knows that Bitcoin is the largest cryptocurrency by market size. However it’s highly volatile and can increase or decrease drastically in a matter of hours. For instance, the price of Bitcoin was at $5000 in March 2020 and then it went over $60,000 til April 2021, after which it fell by over 50%. However it has recovered now but it took a few years to do so.

Now there are many traders out there who love this kind of volatility to make huge profits. However it can become a major problem if someone wants to use them for everyday transactions. That’s why many retailers still don’t accept cryptocurrencies as a form of payment.

For such an unregulated currency to work well in the real-world, it needs to stay as stable as possible. This stability is what wins the trust and confidence of people. Still, the US Dollars and Euro are way more stable than these coins because they don’t even move by over 1%.

Benefits of Stablecoins

Stablecoins offer tons of benefits that make these coins appealing to many users. Its benefits include:

Price Stability

The main and most important feature and benefit of a stablecoin is its price stability. Unlike other cryptocurrencies, stablecoins have the ability to maintain a steady price. This stability is achieved by pegging them to a stable currency like fiat. Because of this stablecoins are considered safe and the best way to store money.

Security

As stablecoins use blockchain technology, they also use its security features. All the transactions are secured using cryptography which makes them resistant to fraud and hacking. Additionally, stablecoins are completely decentralized which means they are not much bothered by any single point failures.

Transparency

Almost all the stablecoins operate on blockchain technology which means they are highly transparent when it comes to transaction history. Because of this transparency users can verify transactions on the public ledger.

This ledger ensures that every transaction is recorded properly and is not altered in any way. Some stablecoins also go through regular audits to show that their reserves are adequate enough. This increases trust and transparency among users.

Lower Transaction Costs

Stablecoin transactions cost a lot less as compared to traditional financial services. These cryptocurrencies eliminate the intermediary for transactions which means you can save on costs. These costs are often associated with cross-border transactions, wire transfer and currency conversions. Stablecoins are a cost-effective solution for both personal and business use.

High Speed Transactions

As stablecoins are a form of digital currency, they offer faster transaction speeds as compared to traditional banks. You know how wire transfer can take days to go through but that’s not the case with stablecoins. You can send them to anyone around the world in a matter of minutes. These transaction speeds usually come in handy for businesses who need to move their money rather quickly or for individuals sending remittances to their home.

Programmability

Stablecoins can be programmed for specific funds as they are available online and usually created by using smart contracts. These coins can be used in decentralized finance (DeFi) applications, for automated payments and other solutions. Because of this, these stablecoins can be used in innovative ways that traditional currencies cannot even think to match.

Integration with DeFi

Stablecoins are an important part of the DeFi ecosystem. They are often used as medium of exchange, a store or value or as a unit of account in many DeFi applications. Users are allowed to lend, borrow or trade stablecoins on decentralized platforms. They can also be used for earning interest or as collateral for loans.

Hedge Against Volatility

One of the most appealing features of a stablecoin is its ability to hedge against volatility and even real-world inflation. Traders can quickly convert their cryptocurrencies into stablecoins when they sense the market is going through a period of uncertainty. This protects their assets from price swings.

Accessibility and Flexibility

Anyone with an internet connection can buy and use stablecoins. That’s how accessible these digital currencies have become. These coins are also highly flexible as anyone can use stablecoins online purchases, remittances and peer-to-peer transactions. These coins can easily and quickly be transferred to any other wallet without needing any traditional bank accounts.

Types of Stablecoins

There are four main types of stablecoins in the crypto market. This means that the 196 stablecoins that are circulating in the crypto market are divided into these four categories. These are:

1. Fiat-Collateralized Stablecoins

This type of stablecoins are backed by traditional currencies like US Dollar, Euro, Yen or any other local currency. For every stablecoin that is issued for this kind, the same amount of fiat currency is held in reserve by the issuer.

For instance, if there are 1 million tokens in the circulation, then the issuer should have 1 million of that reserve currency physically. These reserves act as guarantee that the stablecoin can be exchanged for that collateral anytime they want.

How They Work

If a stablecoin is pegged to a US Dollar, the entity must hold one US Dollar for every coin that is issued to the traders. These projects also undergo regular audits to show that they have enough money in reserves to back the circulating supply.

Examples

Tether (USDT), TrueUSD (TUSD) and USD Coin (USDC) are some popular fiat-collateralized stablecoins.

2. Crypto-Collateralized Stablecoins

Similar to the above type, this one keeps other cryptocurrencies as collateral rather than using a local currency. These cryptocurrencies are using Bitcoin or Ethereum as they’re the largest by market cap. Now as you already know that cryptocurrencies are highly volatile. This means that the issuer has to hold more value in reserves as compared to the actual stablecoins in circulation.

How They Work

The main objective here is to protect the stablecoin from market fluctuations. Because of that a larger reserve is required to issue these coins. For example if $1 worth of stablecoin is issued then the issuer needs to keep $1.50 as collateral to absorb market volatility.

Examples

DAI is one of the most popular crypto-collateralized stablecoins issued by MakerDAO.

3. Algorithmic Stablecoins

This type of stablecoin is also known as non-collateralized stablecoin. These stablecoins are not backed by fiat currency or other cryptocurrencies. So how do they maintain their value? By using algorithms and smart contacts.

It is one of the most riskiest types of stablecoin which was also exposed after the collapse of TerraClassicUSD. That’s why there are only 12 coins out of 196 that are based on this method.

How They Work

As we’ve discussed earlier, these coins use algorithms to maintain a stable value. Those algorithms adjust the supply of stablecoins based on market demand. If the price of stablecoin goes above $1, it increases the supply of stablecoins to control it and vice versa. However the algorithms need to be on point or else it could end in a disaster.

Examples

TerraClassicUSD (USTC) was the most popular stablecoin in this category but has now collapsed due to some reasons.

4. Commodity-Collateralized Stablecoins

The last type of stablecoins include commodity-collateralized stablecoins. This type of coins are backed by physical assets like Gold, Silver, Oil or anything valuable. These stablecoins offer traders a way to invest in commodities without actually needing to physically own them.

How They Work

It’s very similar to fiat-backed stablecoins. For this each stablecoin is backed by a specific amount of commodity such as a gram of gold or a barrel of oil. The issuer is obligated to hold the same amount of commodity in reserves according to the total circulating supply of their stablecoin. These stablecoins are not so common but are the best way to hedge against inflation of fiat currency.

Examples

Tether Gold (XAUT) and Paxos Gold (PAXG) are two of the most popular examples in this category. Both of these are backed by Gold.

8 Most Popular Stablecoins

Some of the most popular stablecoins include:

1. bitUSD (BITUSD) – The First Stablecoin

BITUSD was the first-ever stablecoin created in 2014 by BitShare platform. It was built by Charles Haskinson and Dan Larimer. This token was pegged to the US Dollar but it used a unique method called “smartcoins” to maintain its value.

Now instead of being backed by US Dollar or any other currency, they collateralized it by other digital assets within the BitShare ecosystem. This stablecoin has now become quite rare.

2. Tether (USDT)

Tether (USDT) is the largest stablecoin in the entire crypto ecosystem. It is pegged to the US Dollar and its value remains at $1 at all times. It is the go-to stablecoin for many cryptocurrency exchanges that are offering stable trading pairs.

The current market cap of USDT is over $110 Billion and is currently ranking at No.3 after Bitcoin and Ethereum. It’s been at this position for years now. If you’re new to the cryptocurrency market, you should definitely go for USDT.

3. USD Coin (USDC)

Next up is the USSC coin which is also pegged to the value of one US Dollar. It was created by Centre Consortium as a collaboration between Coinbase and Circle. USDC is well-known for its transparency and regular audits.

The market cap of USDC is currently over $30 billion and is ranking at No.6 among the thousands of cryptocurrencies.

4. Dai (DAI)

DAI is a decentralized stablecoin issued by the MakerDAO platform. It is pegged to the US Dollar but using other cryptocurrencies as collateral rather than fiat. Its value is maintained through a system of smart contracts and over-collateralization.

This makes it a unique option in the crypto space. Currently, DAI ranks among the top 20 cryptocurrencies with a market cap of over $5 billion.

5. Binance USD (BUSD)

BUSD is also a US Dollar backed stablecoin as most of the others. It was issued by Binance in collaboration with Paxos. This stablecoin is fully regulated by the New York State Department of Financial Services (NYDFS). This ensures high levels of trust and regulatory compliance.

It’s the stablecoin of the largest cryptocurrency exchange in the world. However it does even rank in the top 200 cryptocurrencies and has a little market cap of $69 million. This shows that not many people are interested in using BISD even though most of them use Binance for trading.

6. PayPal USD (PYUSD)

PYUSD stablecoin was just recently introduced by PayPal. It is fully backed by the US Dollars held in reserve. PYUSD is designed to provide faster and cost-effective transactions within the PayPal network and beyond.

It’s basically a part of PayPal’s strategy to integrate cryptocurrency transactions into its platform. It currently has a market cap of over $990 million which shows the interest people have shown for this stablecoin in a very short span.

7. USDD (USDD)

Finally we have another category of stablecoin. USDD is actually an algorithmic stablecoin pegged to the value of US Dollar. This coin uses algorithms to adjust the supply and demand of the tokens and maintain its value.

It is backed by a decentralized autonomous organization (DAO) and uses smart contracts to remain highly stable. It currently has a market cap of over $700 million.

8. TerraClassicUSD (USTC)

Lastly, there is the TerraClassicUSD (USTC) which was also a popular algorithmic stablecoin. It used a unique algorithm to maintain its peg. However it faced a terrible fate as it collapsed in 2022 because of the LUNA crash.

It caused significant losses for many investors. Before it collapsed it was on the rise but now it doesn’t have enough backing. This coin is a classic example of how vulnerable algorithmic stablecoins can be.

Do Stablecoins Have Any Drawbacks?

Stablecoins are the only cryptocurrency tokens that provide stability and security during periods of high volatility. However they do have some drawbacks as every good thing does. A few of its negative points are:

1. Counterparty Risk

A major drawback of stablecoins is counterparty risks. This risk arises when the reserves of a stablecoin are held by a bank or a third party. It raises some questions about whether the issuer truly holds the collateral that it claims to have.

For instance, Tether has faced scrutiny again and again over whether it has the same amount of US Dollars in reserves for the USDT in circulation. If the issuer doesn’t have what it claims, it can be devastating for the stablecoin.

2. Reintroduction of Intermediaries

The main idea behind stablecoin was to provide a digital alternative to traditional currencies and eliminate the need for intermediaries. However some stablecoins like USD Coin have re-introduced the ability to stop or freeze transactions if they feel like it’s illegal.

It goes against everything that cryptocurrency stands for and its ethics. For example, Circle confirmed that they froze $100,000 worth of USDC because a law enforcement agency asked them to. It can be seen as a drawback of stablecoins by people who value privacy and don’t want to deal with intermediaries anymore.

Conclusion

Investing in stablecoins is the best way to jump into the cryptocurrency market without having to face the high risk of volatility. These stablecoins maintain a stable value which makes them a perfect choice for digital transactions.

However you should not forget the risks associated with these stablecoins. You can never be over-cautious about these things. Make sure to use a stablecoin that’s in demand and has a long history of providing the best service. Do your due diligence before investing in stablecoins or any other cryptocurrency.

FAQs

How can stablecoins be stable if they are still part of the volatile crypto market?

Stablecoins are designed to be stable by being pegged to stable assets like the US dollar or gold. They use reserves or algorithms to manage supply and demand. It ensures that their value remains consistent even if the crypto market is going through a period of high volatility.

What happens if the reserves backing a stablecoin are insufficient?

If a stablecoin’s reserves are insufficient, it can lose its peg to the stable asset which can cause its value to fluctuate and drop eventually. This scenario can lead to a loss of confidence among users, potential market panic and a rapid devaluation of the stablecoin.

Is a stablecoin the same thing as a CBDC?

No, a stablecoin is a cryptocurrency that is usually privately issued and pegged to stable assets. On the other hand, a CBDC (Central Bank Digital Currency) is a digital currency issued and regulated by a country’s central bank. It represents the digital form of a nation’s fiat currency.

Can I use stablecoins for remittances?

Yes, stablecoins are often used for remittances due to their fast transaction times and low fees compared to traditional banking systems. They provide a cost-effective and efficient way to send money across borders to your family at home.

Can stablecoins be used for online shopping?

Yes, you can use stablecoins to pay for online purchases. There are many online merchants and platforms now that accept stablecoins as payment due to their stable value. Stablecoins offer fast, low-cost transactions which makes them an attractive payment option for both buyers and sellers.