Decentralized Finance (DeFi) has ignited a spark in the financial and non-financial industries at the same time. This involves the use of blockchain-based solutions for transactions, payments, and more. Blockchain is the ultimate application of DeFi that has enabled censorship resistance in the financial ecosystem.

In traditional finance, central banks and governments supervise and look after transactions. This is fine unless you realize the time it takes to validate transactions. Thus, centralized finance takes longer than expected due to low efficiency. DeFi has solved this problem and added benefits to the financial affairs.

DeFi has numerous applications in the modern world, ranging from blockchain and cryptocurrency to non-fungible tokens (NFTs), lending platforms, decentralized autonomous organizations (DAO) and more. According to Mordor Intelligence, the DeFi market size will be around $46.61 billion in 2024 and will grow up to $78.47 billion at a 10.98% rate.

Amid the growing applications of DeFi, this market size is effortless for it to achieve. Therefore, you must learn about its top use cases and their impact on the global financial market. This article will help you learn the following areas of Decentralized Finance:

- Overview of DeFi

- Working of DeFi

- Pros and cons of DeFi applications

- Best use cases of decentralized finance and their effects

- Practical tips to benefit financial using DeFi

Keep reading to get an edge over others as you will explore contemporary methods for financial well-being in this guide.

What is DeFi?

The traditional financial landscape has certain rules and limitations that work with a third-party for monetary policies between people and businesses. The US Federal Reserve offers a definition for traditional or centralized finance, which goes as transactions and financial matters governed by the central bank and government of a country.

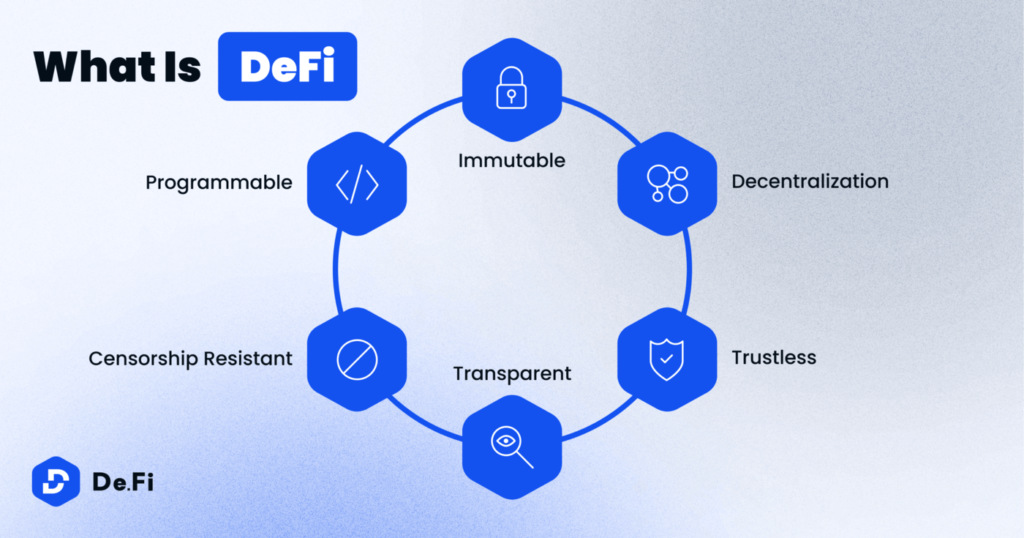

The problem with this system is that you don’t have real authority over your capital, funds, and monetary assets. Also, this system of finance is slower than decentralized. Thus, decentralized finance or DeFi comes to the rescue. DeFi has three fundamental components for cutting the role of central bodies in the financial system. They are:

- Blockchain

- Cryptocurrency

- And peer-to-peer transaction model

You will learn about them in the coming sections in detail. The DeFi system combines them together and the outcome is a user-friendly, efficient, and lucrative financial model for people. Thus, anyone can benefit from DeFi applications, regardless of their geography, monetary status, etc.

How Does DeFi Work?

The Decentralized Finance system is still in the development phase. Despite this infancy status, it has helped in advancing numerous industries due to blockchain technology. As we mentioned earlier, blockchain, crypto, and the peer to peer system are key components for DeFi to function effectively.

The goal of DeFi is to eliminate the need for expensive, less efficient third-parties. In the traditional system, you rely on these governing bodies, such as banks, governments and financial services for business and money matters. Blockchain in the DeFi hands the authority to the owner of funds or assets, improving the speed, security, and scalability of financial approaches.

DeFi works with blockchain technology and other applications. They are as follows:

1. Blockchain Technology

Imagine a safe where you can store your records of everything without worrying about someone to change them. The best thing is that it stores the chain of the record, meaning that every change that you make to the stored documents, the safe also keeps a history of what changes have occurred. This is the functioning of a distributed ledger or safe, known as blockchain technology.

Beside the data storage, blockchain has multiple functions. For instance, it is the core technology for the development of cryptocurrency like Bitcoin, Ethereum, Ripple, and more. Cryptocurrency has its own perks in the financial landscape.

Blockchain works by storing data in blocks using automated processes or smart contracts. Smart contract is a software that has a set of rules for the automation of financial transactions. Once data is verified, it is added to a new block on the blockchain, creating a chain of record.

However, not every person on the blockchain network can bring changes to the data. It has a robust governance mechanism for this pursuit, making blockchain immutable and safe from hackers, scammers, and social engineers.

2. Cryptocurrency

You might think that cryptocurrency is the name of Bitcoin. Bitcoin is a crypto coin and there is more to cryptocurrency than Bitcoin. Cryptocurrency uses blockchain technology and its tamper-proof distributed ledger for secure and borderless payments.

To fully understand what cryptocurrency is, let’s read a real-world example. In the centralized financial model, you rely on a dollar bill or any other currency to make payments, do transactions, or any other activity. Cryptocurrency is the currency for any financial or non-financial actions in the DeFi.

For instance, you can earn money via cryptocurrency through trading, investing, staking, and more. This is the financial aspect of cryptocurrency. On top of that, cryptocurrency is the token to participate in the governance or democratic changes that happen in the blockchain. This is the non-financial functioning of cryptocurrency.

3. Peer-to-Peer Network

Another essential component of DeFi is the peer to peer (P2P) network. P2P refers to the digital communication or connection between two computers or networks for communicating data, resources, and assets. It is a pivotal technological innovation for the digital transformation in the modern age.

In terms of Decentralized Finance, a Peer-to-Peer (P2P) network is efficient because it allows the transactions digitally. You can make payments to a business without visiting the bank or a financial service provider. You can do so using your computer or mobile device, bringing comfort and speed.

DeFi with the help of P2P network processes and transacts financial assets without needing governing bodies or authoritative institutions like banks. This works this way: Blockchain offers a secure pathway and the P2P network enables users to send or receive crypto funds, making DeFi more secure, reliable, and free from the rules and regulations of central bodies.

Top 5 Use Cases of Decentralized Finance

As we talked about what DeFi is and how it works, it is time to know where and how DeFi applications are used. Since Decentralized Finance is going mainstream, businesses are investing in developing and deploying Decentralized Applications (dApps).

dApps and decentralized protocols are powering the widespread adoption of the DeFi technology. According to Statista, 5.239 million unique users have joined the DeFi ecosystem as of April 2024. This means that the DeFi offers plenty of useful and impactful applications to people globally.

We will cover some of the top applications that DeFi offers to individuals, businesses, and organizations. The best thing about these applications is that none of them are answerable to any organization or authority because they are censorship resistant.

The top 5 use cases of Decentralized Finance are given as follow:

1. Decentralized Lending and Borrowing

In the financial landscape, lending and borrowing has been integral for the totalitarian good. This is possible that some individuals in a society may not be doing well. In this scenario, they need monetary support to get a boost in their career and fiscal excellence.

The traditional loan system is extremely complicated. Due to the interference of banks and financial institutions, it takes ages and tough paperwork to provide a needy person with a loan. Therefore, this is not the most feasible system of lending and borrowing for individuals and businesses to gain traction in the market.

On the contrary, the DeFi lending system has eased this process by cutting the intermediaries. Anyone can lend their funds in the form of cryptocurrency, known as crypto lending. The blockchain ensures security and guarantees the annual return of the lended funds. At the same time, it doesn’t necessitate hectic paperwork from the borrower, creating a convenient environment for financial exchanges.

Some of the top platforms for DeFi lending and borrowing are as follows:

- Aave: As an open-source protocol, Aave offers a stunning environment for crypto lenders and borrowers. With the use of non-custodial liquidity markets, you can stake your additional crypto assets and earn interest at a varied rate. The rates differ depending on the flexibility and duration of the staked funds.

- Compound: Ethereum blockchain is the driving force of Compound Finance. Compound is an Ethereum-based dApp for lending and borrowing purposes. The algorithmic and smart-contract protocols of Compound allow an open market for crypto lenders and borrowers.

2. Decentralized Exchanges

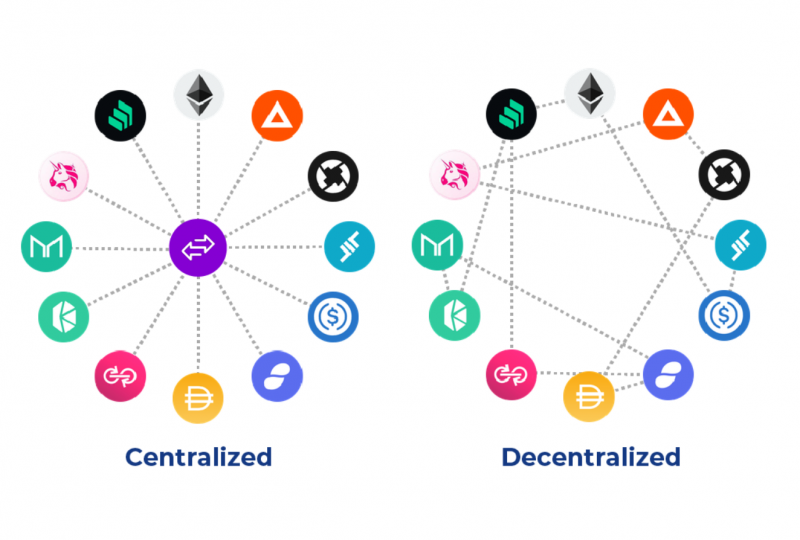

Exchange is a marketplace that offers various financial functionality to individuals and businesses. There are two major types of exchanges, namely:

- Centralized Exchange (CEX)

- Decentralized Exchange (DEX)

A CEX has multiple examples, including Binance, Bybit, etc. These exchanges are centralized because of a single entity, Binance US in the case of Binance Exchange. Therefore, they undergo several compliance protocols, such as Know Your Customer (KYC) compliance, etc., when a user registers on their platform.

On the other hand, Decentralized Exchanges (DEX) is a pure application of DeFi and blockchain. These exchanges operate on top of blockchain and cryptocurrency. The control of the platform is not in the hands of a single organization but the community of the exchange. Uniswap, SushiSwap, etc., are examples of DEX.

One other major difference between a CEX and DEX is the availability of assets for exchange. For instance, Binance offers cryptocurrency, options, stocks, derivatives, etc., while Uniswap offers only decentralized assets, such as cryptocurrency, non-fungible tokens (NFTs), etc.

Some of the leading Decentralized Exchanges are as follow:

- Uniswap: This is one of the best DEX platforms for cryptocurrency and NFTs transactions. It uses the peer-to-peer network for swift and autonomous transactions. Furthermore, swapping and liquidity are other features of Uniswap DEX.

- SushiSwap: SushiSwap or Sushi is a decentralized application (dApp) for trading, exchange, swapping, and many other DeFi functions. The cool thing about Sushi is the integrated crypto wallet like MetaMask, allowing crypto users to transfer, store, and invest their virtual assets securely.

- PancakeSwap: Another excellent Decentralized Exchange is PancakeSwap. This offers various functions, including swapping, buying and selling crypto, crypto farming, etc. This censorship resistant platform ensures community ownership, democratic governance and limitless utility for crypto users.

3. Stablecoins and Payments

Another efficient and useful application of Decentralized Finance (DeFi) is stablecoin. Stablecoin is the cryptocurrency with a fixed value to a fiat currency, such as the US dollar. Though this pegging model of stablecoin with fiat currency is a centralized finance, this is beneficial to both financial systems.

Stablecoin has bridged the gap between the traditional financial system and DeFi. It is like a token for everyone to get into crypto trading and investing. For instance, you will need to buy a stablecoin, such as Tether (USDT) or USD Coin (USDC), etc. Once you have a stablecoin, you can convert them into another cryptocurrency like Bitcoin (BTC), Ethereum (ETH), and many others.

For the DeFi ecosystem, stablecoins have offered excellence to DeFi applications. Volatility is the leading factor that keeps most people away from accepting the extensive benefits of the DeFi cryptocurrency. Stablecoin minimizes the volatility factor and brings stability to the financial assets, which is necessary for payments and transactions.

4. Decentralized Real Estate

The rise of non-fungible tokens (NFTs) has paved the way for decentralized real estate. NFTs refer to unique and rare digital products like artwork, paintings, and virtual assets on the blockchain. This ensures a complete ownership and ultimate protection of intellectual property rights.

Statistics show that the worldwide NFT market is a lucrative and money-making ecosystem for creators, developers, and organizations. According to a report on Statista, the global NFT users will reach up to 11.64 million by 2025. This increase in the number of NFT users is due to various platforms that offer DeFi real estate and trade of NFTs.

DeFi real estate refers to the exchange of virtual property between users. You may think that how can someone exchange virtual real estate. The answer is tokenization of real world assets, creating NFTs of a physical land or property.

Some of the top platforms for DeFi real estate are:

- Decentraland: Decentraland is a dApp for decentralized real estate. Created in 2015, it offers an opportunity to tokenize real estate and gamify the process of real estate. A user can earn rewards in the form of cryptocurrency and NFT with Decentraland. This makes it a top choice for passive income.

- Polka City: A simple yet effective DeFi real estate platform, Polka City is an innovative technology in the modern age. You can tokenize physical property and flip it with a vibrant community of the Polka City. In doing so, you can make money by earning its native crypto token, POLC coin. You can exchange this token with any cryptocurrency or NFT of your choice.

5. Cross-Border Remittances

International financing and transactions are difficult in the conventional centralized finance landscape. Banks and centralized financial institutions take more time and money for international remittance due to the hectic verification process and paperwork.

Decentralized Finance (DeFi) is useful for borderless payments and remittances due to the blockchain utility. It offers a ray of hope to international users and businesses to do financial transactions on the go. The interoperability of the blockchain technology smoothen transactions without costing deep pockets.

The DeFi cross-border payment system offers the following benefits to users:

- Lower cost of transactions

- Higher speed of monetary transfer

- Accessible by anyone, including banked and unbanked population

- Transparent and public ledger of blockchain for trustworthy process

- Highly secure and scalable process for businesses

Some of the key platforms that offer international remittances using stablecoins are:

- Celo: It is a decentralized platform for making payments anywhere and anytime using your mobile device. You won’t have to worry about the speed, security, and cost of the transactions due to its basis on the blockchain technology. Furthermore, it is an effective platform for creating dApps.

- Stellar: In the DeFi ecosystem, Stellar holds the key to an instant and round-the-clock payment system. It offers versatility of international payments and remittances, allowing users to enjoy easy payrolls, maintain treasury balances, etc.

Pros of DeFi

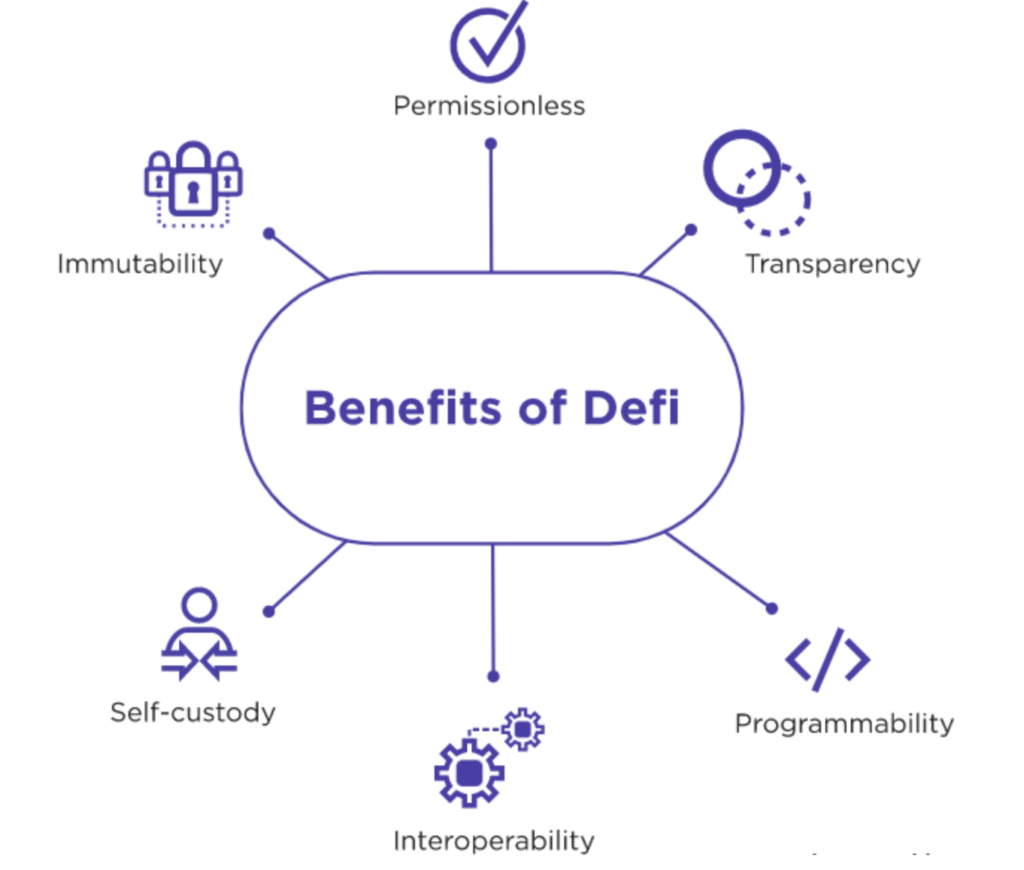

DeFi advances the financial landscape to an innovative and convenient level with its components. The peer-to-peer network for transactions removes the need to answer intermediaries that slow the financial process.

Therefore, the DeFi approach is faster, more reliable, and highly secure than the traditional banking system. Here are some of the top advantages of DeFi ecosystem:

1. Accessibility

The best thing about DeFi and its applications is matchless accessibility that anyone in any part of the world can enjoy. The primary requirement for the DeFi applications is the Internet. As the number of Internet users is staggering, DeFi is available for everyone. A total of 5.45 billion of the total world population are using the Internet.

With an internet connection, you can use any DeFi application without KYC or Anti-Money Laundering (AML) compliances. Furthermore, these opportunities are available to anyone whether they live in the US, UK, or any part of the world.

2. Cost-Efficiency

Blockchain technology of the DeFi ecosystem has reduced the costs of transactions. Therefore, DeFi applications are cost-effective and speedier than centraled counterparts. This leads to an increased profits and interest rates than traditional financial markets.

To understand this factor of DeFi, we should look at the conventional financial system first. When two parties or businesses agree over a financial deal, they will need to pay a third-party such as banks a certain percentage to carry out the deal. This is not the case in DeFi since it cuts the need for intermediaries.

Two or more parties in a business deal can directly figure out an interest rate or profits and they won’t have to pay any bank a certain fee. The blockchain charges a minimal fee, leading businesses to earn higher returns on investment.

3. Transparency

The DeFi applications use smart contracts. Smart contracts are automated software for the automation of DeFi processes. They are open-source, meaning that anyone can see the codebase of these smart contracts to understand how the contract works.

This leads to complete transparency of the DeFi process. With transparency comes trust among DeFi users, which results in an increased number of DeFi applications. Furthermore, DeFi is highly secure due to the immutable nature of the blockchain technology.

4. Autonomy

The blockchain is a distributed and public ledger, meaning that anyone on the network can view the record of transactions. At the same time, blockchain is autonomous. The question is if the public can view the transactions, how can blockchain offer autonomy and anonymity.

It is noteworthy that blockchain saves the record of transactions in numeric keys, known as public keys. The public can see the keys without knowing who made the transactions. Therefore, blockchain-based crypto transactions are anonymous.

Furthermore, the autonomy of DeFi is due to the lack of interference from central authorities. This makes transactions faster, cost-effective, and censorship resistant.

5. Interoperability

Blockchain technology enables interoperability, meaning that they are mutually connected to other blockchains. For instance, Ethereum and Solana are two different blockchains. A person X has crypto assets stored on Ethereum blockchain while person Y has on Solana.

The best thing is that X and Y can make mutual transactions because Ethereum and Solana are interoperable. This is due to the peer-to-peer network that enables communication between different blockchain networks.

Challenges in the DeFi Ecosystems

With top-notch benefits, DeFi also faces several challenges. Due to its emerging nature, these challenges offer drawbacks to users globally. However, they won’t be a problem anymore due to the rapid development in the DeFi architecture.

One of the top challenges in the DeFi ecosystem is security concerns. There is no central body involved, hackers and scammers can exploit vulnerability and lack of knowledge of DeFi assets owners. Though blockchain is immutable, hackers can steal assets from crypto investors by manipulating them.

Another key challenge is regulatory uncertainty. The US Security and Exchanges Commission (SEC) is constantly targeting DeFi platforms and assets. There is no defined regulatory framework to define the working mechanism of DeFi applications. This makes the majority of people stay away to benefit from decentralized applications.

Conclusion

Decentralized Finance is the hub of applications and protocols that offer convenience and speed in the financial infrastructure. DeFi has revolutionized the way we interact with money, business, and more.

Despite the early days of this amazing technology, it has offered several applications and use cases. That includes:

- Crypto lending and borrowing,

- Decentralized exchanges like Uniswap, SushiSwap, etc.

- Non-fungible tokens of real estate, artwork, etc.

- Effective cross-border payments and remittances,

- Stablecoins that bridge the gap between centralized and decentralized finance, etc.

Given the widespread applications of DeFi, it is one of the best technologies to explore. There are numerous earning opportunities associated with DeFi, including crypto trading, staking, yield farming, NFTs, and many more.

FAQs

Is DAO a use case of DeFi?

Yes, decentralized autonomous organization (DAO) is an application of the DeFi ecosystem. Blockchain technology is involved in the working of DAO, helping it to remove the organizational hierarchy and function properly with democratic governance model.

Is smart contract important for DeFi?

Smart contract is fundamental for the working of DeFi. Since Bitcoin doesn’t have smart contracts, it doesn’t support DeFi applications. However, Ethereum and other blockchain with smart contracts do.

Are DeFi use cases safe?

DeFi applications are secured due to the immutable nature of the blockchain technology. You can rely on DeFi for faster, efficient, and secure financial transactions.

What is the main purpose of DeFi?

The fundamental aim of DeFi is to cut the need of intermediaries and central authorities in the financial landscape to make it accessible and cost-effective for everyone regardless of their geography.

What is the difference between DeFi and crypto?

DeFi is the technology that functions with blockchain and cryptocurrency. Crypto is one of the multiple applications and use cases of DeFi.