Are you one of those traders who are always worried about the security of their assets? It can be quite a headache for such people. Even the other traders should be as careful as them because online threats have become more prevalent.

But the solution for all your problems lies within the Gemini exchange. This exchange is considered a safe haven for crypto traders because of its top-notch security measures. Their main priority is to keep the users’ funds safe from any cyber threat whatsoever.

Gemini was the first exchange in the world to complete a SOC 2 Type 2 examination. This exam shows that the Gemini exchange provides the highest level of operational security.

Gemini offers a user-friendly experience with strong security measures which makes it stand out from the other exchanges. This platform is perfect for both beginners and experienced traders. As the world of cryptocurrency continues to grow it’s become absolutely necessary to have a secure platform like Gemini to keep your investments safe.

With that said, let’s get started.

Intro to Gemini Exchange

Gemini is a centralized cryptocurrency exchange that was founded in 2014 to buy, sell or trade crypto assets. Its founders are the famous Winklevoss twins (Cameron and Tyler) who named it Gemini Trust Company at that time. It’s also a custodian based in the United States. The features that make Gemini Exchange a favorite for traders include its focus on security, regulatory compliance and user experience.

This exchange is a popular choice for both institutional and individual investors. Gemini is registered with the New York State Department of Financial Services (NYDFS) and it operates under strong regulatory standards. Because of these standards users feel confident enough to invest their funds in it. This exchange is currently available in over 60 countries.

According to Coinranking, Gemini is currently ranking in the top 30 cryptocurrency exchanges according to its 24-hour trading volume of over $60 million.

Gemini’s platform is designed with security as a top priority. For instance it offers hardware security modules (HSMs), multi-signature technology and insurance coverage for digital assets held in its custody as some of its security features. That’s why we’ve called it the safeguard of crypto security in the title.

The Winklevoss Twins

The Winklevoss twins are the famous classmates of Mark Zuckerberg in Harvard who claimed that “Facebook” was their idea but Mark stole it and launched it as his own. You can also watch the movie “The Social Network” to know what exactly happened.

The end story was that they were paid $65 million as compensation for their claim. This is why these twin investors are so well known in the tech space.

History of Gemini

So till now we know that it was founded by Winklevoss twins in 2014 and became live in October 2015 for U.S. traders. After that in 2016 they started expanding it into the international market starting from Canada and the United Kingdom. Then when the demand started to grow in the Asian region they started their services in Hong Kong, Singapore, South Korea and Japan.

In the same year in September, Gemini exchange made history by introducing the first-ever daily bitcoin auction. This method provides a transparent and efficient way to price and trade Bitcoin. This system is now widely used by many exchanges. After its success they also launched the Ether auction in July 2017.

Over the years Gemini has continued to innovate and provide its users with more and more features. It introduced the Gemini Earn feature which allows users to earn interest on their cryptocurrency holdings. They also launched Gemini Pay which enables users to spend their cryptocurrencies at multiple retail locations.

After that in 2020, Gemini launched the Gemini Credit Card. This card is super helpful as it allows users to earn cryptocurrency rewards on the purchases they make everyday. Then Gemini Custody was launched which is a service designed to meet the needs of institutional investors. Especially the ones who require secure storage for large amounts of digital assets.

Gemini Products and Services

Gemini exchange brings something new every year to keep the users entertained and retained. Year by year they introduced many products and services which we’re going to be discussing now.

Gemini ActiveTrader Platform

This platform is especially created for advanced traders who want a high-performance interface for making trading more interactive. The features offered in this platform include multiple order types, advanced charting tools and block trading capabilities. Even the trading fee on this platform is different from the other interfaces as they’re based on trading volume.

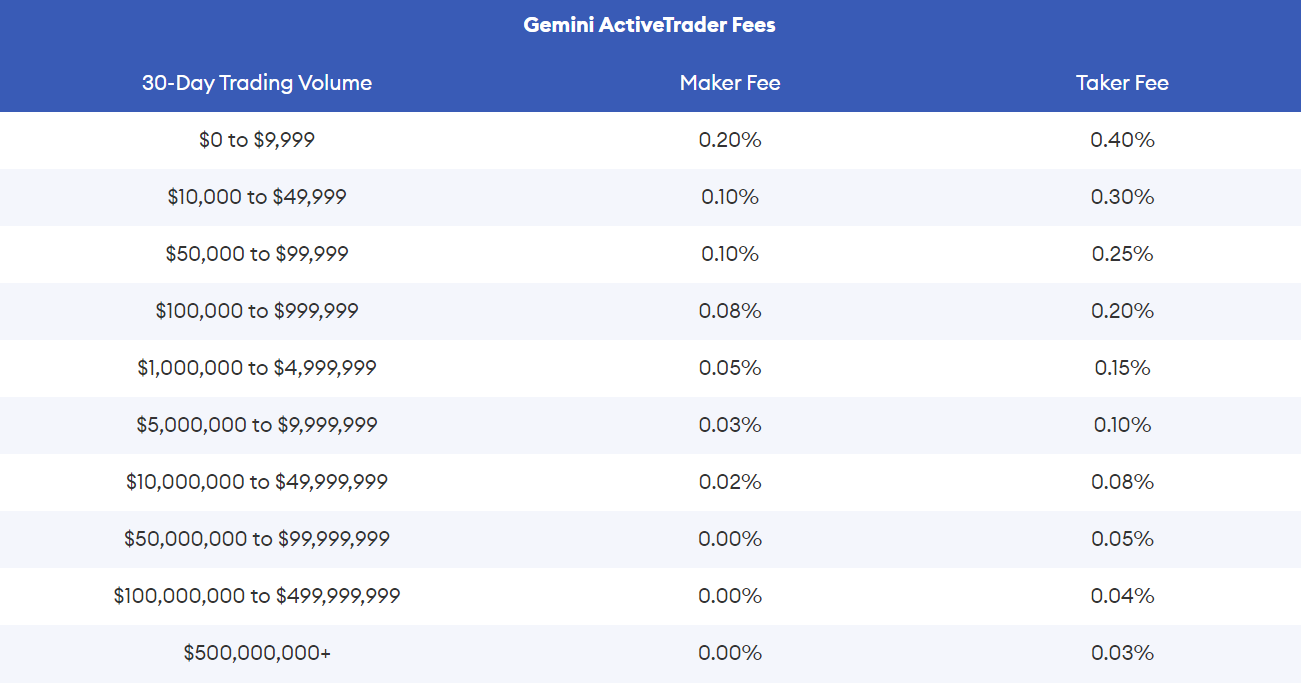

The taker fee ranges from 0.30% to 0.03% and maker fees from 0.20% to 0.00%. This ActiveTrader platform is highly optimized for speed and efficiency. That’s why it’s perfect for both retail and institutional investors.

Gemini Clearing

The next service on the list is the Gemini clearing. It provides a fully regulated clearing and settlement service for off-exchange or over-the-counter (OTC) cryptocurrency trades. The purpose of this service is to ensure both parties in a trade are able to transact without counterparty risk. It’s designed to offer a secure and compliant environment for large-volume trades. This feature has attracted a lot of institutional investors.

Gemini Custody

The Gemini custody service is basically a digital asset storage solution for institutional investors. Now you might be thinking that Gemini is just working for institutional investors looking at the number of features it offers them. But that’s just how it is.

This product offers military-grade security features which include multi-signature technology, cold storage and even insurance coverage.

It is one of the most secure options available for storing large amounts of cryptocurrency. The assets are kept offline so they remain safe from any online threats. The service is fully compliant with New York state regulations so if you’re an institutional investor then you have that peace of mind.

Gemini Earn

Gemini Earn is a service that allows users to earn interest on their cryptocurrency holdings. As a user you can transfer your assets into Gemini Earn and start earning interest. However the rates do vary according to the cryptocurrency you’re holding. This service is actually a way for users to grow their digital asset portfolio without doing any work and also keep their funds secure within the Gemini platform.

Gemini Credit Card

With Gemini Credit Card the users receive rewards for their everyday purchases. If you’ve this card you can earn up to 3% back in Bitcoin or other cryptocurrencies on dining, 2% on groceries and only 1% on all other purchases. These rewards add up automatically in your Gemini wallet so you don’t have to worry about collecting and storing them separately.

Gemini Institutional

Gemini Institutional is basically a suite of services that are specially designed for institutional investors, hedge funds and asset managers. You might have also guessed that by its name. Some of the services include advanced trading tools, custody solutions and clearing services. This product is compliant with regulations and is built by keeping the needs of large-scale traders and investors in mind.

Gemini Staking

The last product on the list is the Staking feature. It allows users to earn rewards by staking their cryptocurrency holdings directly on the Gemini platform.

Currently Gemini offers staking opportunities for two major crypto assets, Polygon and Ether. For Polygon the Annual Percentage Rate (APR) is 3.58% and as for Ether it is at 3.57%. Additionally, non-U.S. investors are given an option to stake Solana and it even has a higher APR of 5.98%.

The regular Gemini staking is available to almost everyone as there’s no minimum account balance requirement. The staked position in this service cannot be tracked on-chain which means there’s less transparency.

However if you’re looking for more transparency then you can use the Staking Pro service where you can track your staked assets and see how they’re performing. Unfortunately this service is not available in the U.S. yet so if you’re outside this region then you can enjoy using it.

Gemini Exchange Features

So that was enough from the products and services. That was quite a long list honestly. Now let’s take a look at the other features that are available on this platform.

Gemini’s Fee Structure

The fee structure on this platform is a bit complicated. The charges and fees depend on the platform being used. So we’re going to also divide all different types of fees for you.

Transfer Fees

Gemini charges fees on certain deposit and withdrawal options. For instance wire deposits are free however there’s a 3.49% fee if you use a debit card for crypto deposit. Now this was for the deposit options.

If you want to withdraw funds, the charges for that are also different. For example if you want to withdraw Bitcoin then you’re going to pay 0.00001 BTC as fees whereas if you want to withdraw DOGE coins then you’ll have to pay 4 DOGE tokens as withdrawal fees. The good news here is that all withdrawals in GUSD (Gemini’s stablecoin) are free.

Convenience Fees

Gemini doesn’t miss a chance to earn from its users. The platform also imposes a fee of 0.5% for using the Web or Mobile app for making trades. They give this fee the name “Convenience fees” as they are providing you with a way to safely trade crypto assets.

Web Order and Mobile App Fees

The basic version of this platform has a tiered transaction fee structure. For instance on trades over $200, a fee of 1.49% is charged. This fee varies according to the amount of money you’re using to make trades. Check out the complete fee structure in the table below.

|

Gemini Web Orders and Mobile App Fees | |

|---|---|

|

Web Order Amount |

Transaction Fee |

|

$0.00 to $10.00 |

$0.99 |

|

$10.01 to $25.00 |

$1.49 |

|

$25.01 to $50.00 |

$1.99 |

|

$50.01 to $200.00 |

$2.99 |

|

$201.00+ |

1.49% of the web order value |

ActiveTrader Platform Fees

Now the expert platform of Gemini uses the Maker and Taker fee structure. It is especially designed for people who trade in high volumes. So the fees for this one is given below in the image.

Gemini Dollar (GUSD)

Just like USDT, Gemini also offers its stablecoin which is exclusive to the Gemini platform. It’s similar to all other stablecoins and pegged to the value of US dollars and even backed by a reserve. It provides a secure and easy way for Gemini traders to transact with digital dollars.

Gemini Cryptopedia

To educate the people and make it easy for newbies to understand some complex concepts, Gemini stepped up and created their own Cryptopedia. It is an extensive online resource that covers a wide range of topics related to blockchain, cryptocurrencies and trading strategies. It’s actually a value tool for both beginners and experienced traders.

Security Features

The most important aspect that makes Gemini popular is its security features. Here are some key security features that Gemini uses to keep the users and their funds safe.

Insurance Coverage

Gemini offers insurance coverage as part of its security features to make sure the users can have peace of mind while trading on their platform. They insure digital assets of users against losses due to hacks or security breaches.

Full-Reserve Exchange

Gemini operates as a full-reserve exchange and custodian. This means that all your funds are held at 1:1 and you can withdraw your assets any time you want.

Offline Storage

Nowadays many crypto exchanges use Cold storage to keep the user funds offline. This way the hacks cannot access the funds as they’re not readily available online.

Two-factor Authentication (2FA)

Gemini has made it compulsory for all the users to enable 2FA. This way even if someone tries to get into your account, they won’t be able to without the password that you’d get on your sim. Even the withdrawals can’t be made without the OTP.

Passkeys

Lastly, Gemini allows users to use passkeys as an alternative to the traditional 2FA method. This takes the overall security of your account to a whole new level.

API for Developers

Gemini has something for everyone even for the developers. This platform provides a robust API that developers can use to integrate Gemini’s trading and account management features into their own applications.

This API has the ability to support various functions including market data retrieval, order management and even account balance inquiries. So if you’re a developer then you should definitely try it out.

Recurring Buys

Lastly the Gemini exchange allows users to set up recurring buys. This feature is useful for those who want to dollar-cost average into their investments. It means they can purchase a fixed dollar amount of any cryptocurrency at regular intervals.

What Things can Gemini Exchange Improve?

No product, service or even a cryptocurrency exchange is perfect. Everything has flaws but they can make an effort to make those things better. A few things that we think Gemini exchange can improve include:

Fee Structure

The fee structure on this platform is a bit steep and very different from other exchanges. For the mobile and web users the fee is straightforward but if you compare it with other exchanges, you’ll see that it is considerably high. Gemini should definitely focus on bringing these fees down to attract more traders.

However the ActiveTrader platform offers competitive rates which can actually be difficult for a beginner to understand. Gemini has also removed the free withdrawal option which means they’re one feature down now.

Customer Service

Gemini’s customer service options leave room for improvement especially in terms of accessibility. There’s no service phone number that the users can call in case of emergency. Even other immediate support options have always been a concern for some users.

Currently all customer inquiries are managed through an online ticket system. This system can cause delays for those needing assistance immediately. Gemini exchange can make this system better by making a few tweaks.

High-Profile Coin Availability

Gemini offers over 70 cryptocurrencies which is great. However it doesn’t have XRP, Cardano and other notable names on its trading list which is quite surprising. They can expand their coin availability by adding more tokens from the top 20 to 30 cryptocurrencies by market cap.

Gemini Exchange Scandal – What is it?

With the past it’s also important to be aware of what’s happening with the exchange currently. So, this scandal started in November 2022 when Gemini paused the withdrawals for its Earn program. Due to this many people had to incur huge losses as they were unable to get back their digital assets.

After that in January 2023, Genesis Global Capital which was the major lending platform for the Earn program filed for bankruptcy. This increased tensions between the stuck traders and Gemini exchange as there was nothing they could do at that time.

However this year in the last week of May, Gemini announced that they are going to return around $2.2 billion to the traders who were affected because of this. It’s around 97% of the total assets owed to the users by Genesis. This payout was conducted over several weeks but finally all the assets were returned back to their rightful owners.

Now why do you think Gemini took such a huge step to get all the assets back? It’s actually simple because the exchange wants the users to trust their services again. This incident has also set an exchange for other exchanges about how they should be handling such situations in the future. Kudos to Gemini exchange.

Conclusion – Is Gemini Good for You?

In the end it all comes down to what you believe is good for you. You can compare this exchange with other ones in the cryptocurrency space and decide which one aligns better with your requirements.

As for Gemini we have already discussed the advanced security features it offers and even the various products and services that make it an attractive option. The platform is also regulated by New York State Department of Financial Services which ensures that it is more secure than many other centralized exchanges.

So the decision is yours in the end. We have laid out everything there is to know about Gemini from its past to its present conditions. If these things fit perfectly with your needs, then what are you waiting for? Start trading on Gemini today.

FAQs

Can I stake cryptocurrencies on Gemini?

Yes Gemini offers staking for cryptocurrencies like Polygon (3.58% APR) and Ether (3.57% APR). Non-U.S. investors can also stake Solana (5.98% APR). Regular staking has no minimum balance requirement but positions can’t be tracked on-chain. Staking Pro offers more transparency but is unavailable to U.S. users.

What happened with Gemini’s Earn program and Genesis?

Gemini’s Earn program faced challenges after Genesis Global Capital filed for bankruptcy in January 2023. This led to Gemini returning $2.2 billion in digital assets to users accounting for nearly 90% of affected accounts. They did this to restore user confidence and maintain transparency.

Is Gemini safe to use?

Yes, Gemini is considered one of the safest cryptocurrency exchanges. It employs strict security measures such as cold storage, insurance coverage for digital assets and two-factor authentication (2FA). Additionally, Gemini is fully regulated and complies with various financial authorities.

Can I earn rewards with Gemini?

Yes, Gemini offers several ways to earn rewards. With the Gemini Credit Card you can earn up to 3% back in cryptocurrency on purchases. Additionally, Gemini Earn allows you to earn interest on your cryptocurrency holdings by lending them through the platform.

What happened to Gemini’s free withdrawal policy?

Gemini used to offer free withdrawals for certain cryptocurrencies but this policy was recently changed. Now users must pay withdrawal fees which vary depending on the asset. This change aligns Gemini with industry standards but removes a feature that once set it apart from competitors.