The crypto market has boomed in recent days. Many coins have skyrocketed to new heights and prices are still going up. But you might wonder what is the best cryptocurrency to buy now? With new projects popping up and old ones getting upgraded, it’s hard to pick one. One way to tell if a project is reliable is to look at the cryptos held by institutional funds, like Grayscale.

Being one of the largest crypto asset managers, Grayscale carefully selects projects that undergo extensive analysis and scrutiny for its investment funds. In this article we’ll analyze the best cryptocurrencies to invest in today based on Grayscale’s holdings and other institutional backing. This way you can figure out which ones are innovative, market-ready and trusted by institutions. Let’s begin.

Best Crypto to Invest in 2025

Here is the list of the top 7 cryptocurrencies Grayscale holds through its investment trusts. A number of them are also part of its Exchange-Traded Funds (ETFs). Also, we will discuss cryptos that have institutional investment other than Grayscale.

Best Cryptocurrency to Buy Now – Comparison Table

| Crypto | Current Price | Market Cap | Year-to-date Performance | Rank in Market Size | Buy |

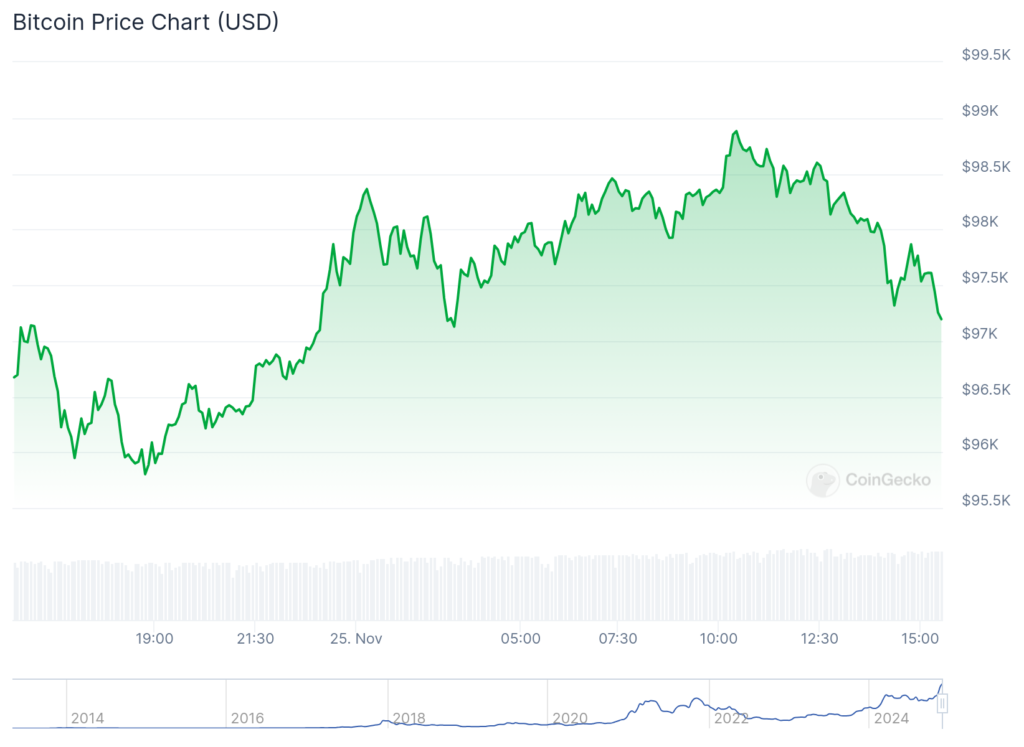

| Bitcoin | $98,000+ | $1.9 trillion | Up by over 103% | 1st | Buy BTC on Binance |

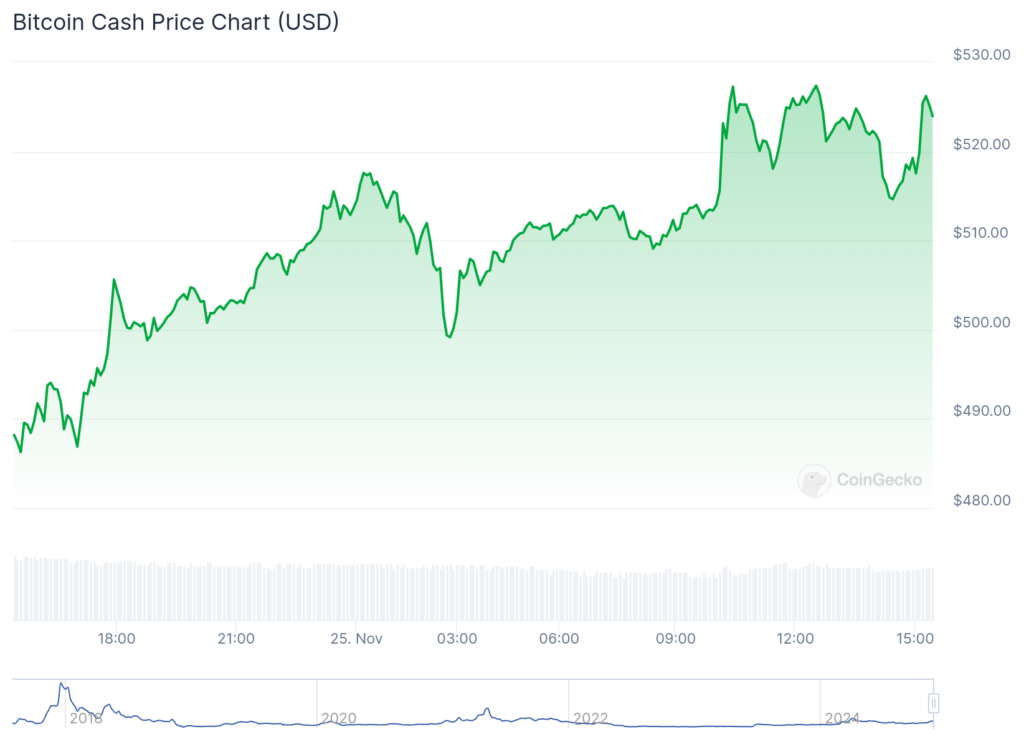

| Bitcoin Cash | $468+ | $9.2 billion+ | Up by over 84% | 19th | Buy BCH on Binance |

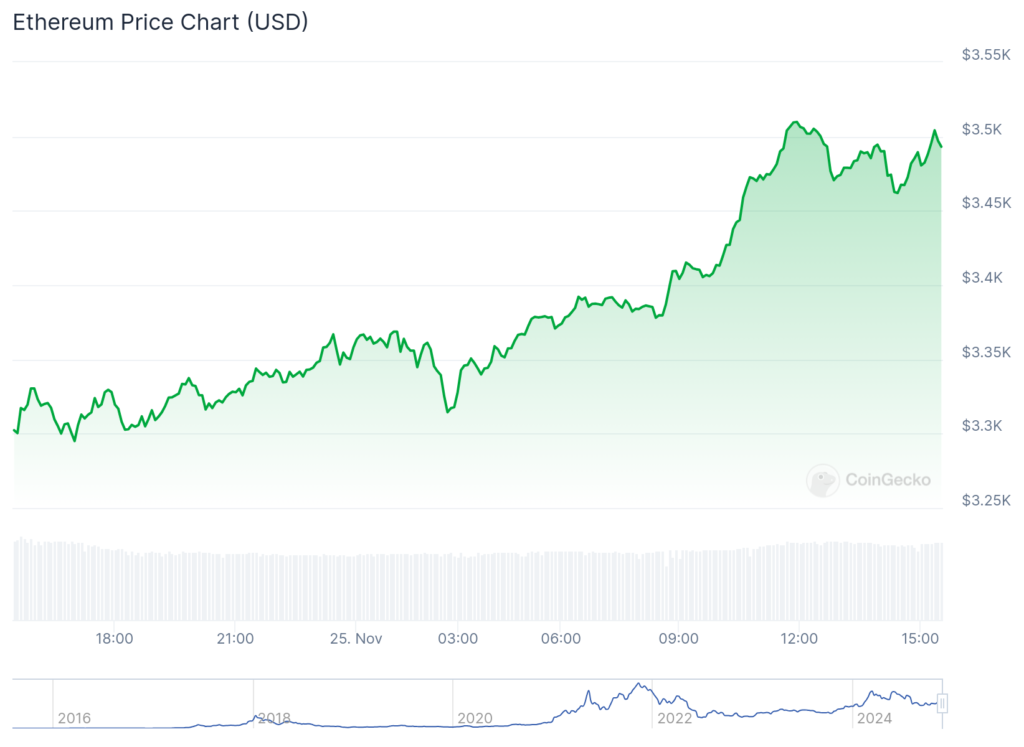

| Ethereum | $3,600+ | $437 billion+ | Up by over 45% | 2nd | Buy ETH on Binance |

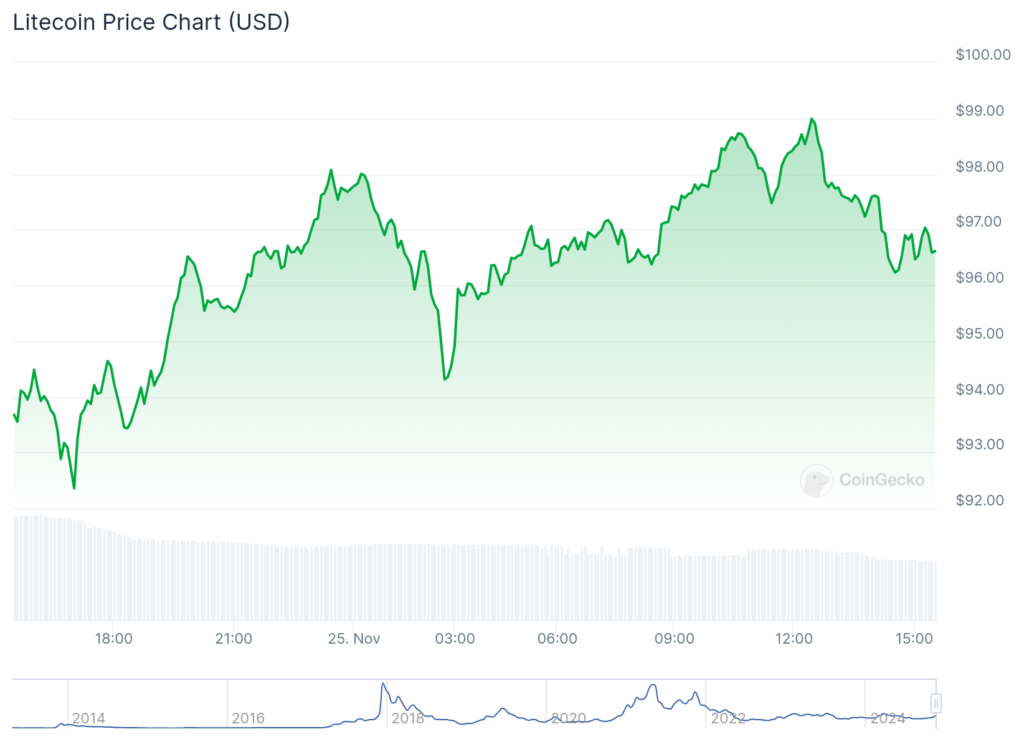

| Litecoin | $112+ | $8.4 billion+ | Up by over 7% | 22st | Buy LTC on Binance |

| Ripple | $2.8 | $136 billion+ | Up by over 200% | 4th | Buy XRP on Binance |

| Ethereum Classic | $28+ | $4.2 billion+ | Up by over 6% | 36th | Buy ETC on Binance |

| ZCash | $58+ | $957million+ | Up by over 63% | 109th | Buy ZEC on Binance |

Bitcoin (BTC) – Best Crypto to Invest

Bitcoin (BTC) is a virtual currency that is designed to be money and a form of payment that is independent of anyone or anything. Bitcoin is the world’s most popular crypto and is often referred to as “Digital Gold”.

Current Market Position

Bitcoin is undoubtedly the best cryptocurrency to buy now due to various reasons. It has recently crossed the $85,000 mark, setting a new all-time high. After Donald Trump’s recent election victory, a potentially favorable regulatory environment has fuelled this rally. Further, this rally has increased the market cap to $1.6 trillion, and it could go even higher.

Bitcoin dominates the crypto market by over 58%. And this recent surge has also boosted other cryptocurrencies, and they have reached new highs as a result.

Key Features

- Transparency and Anonymity: Bitcoin transactions are completely anonymous. This means the details of every transaction are publicly available on the blockchain, which isn’t connected to the identities of the participants. In this way, user privacy is protected while still being transparent.

- Limited Supply: Bitcoin’s code is designed to ensure there will never be more than 21 million bitcoins. The fixed supply dynamic of Bitcoin is one of the big reasons why its market demand keeps increasing and why it’s so valuable. Also, this provides resistance to inflation, so it’s a good hedge against currency devaluations.

- Mainstream Acceptance: Since its inception, Bitcoin has progressively developed into a mainstream asset. It is estimated that there are over 100 million active BTC users around the world. This is roughly equivalent to Japan’s population. Pretty interesting, right? With so many people using Bitcoin as a means of storing value, it has high liquidity and acceptability compared to traditional assets.

Institutional Support

A big reason for Bitcoin’s recent rise is the interest shown by institutional investors like Grayscale. Grayscale’s Bitcoin Trust (GBTC) became a preferred investment option, giving institutions a regulated way to invest in Bitcoin. On top of that, Bitcoin ETFs were approved by the SEC in the U.S., making them more accessible and driving prices upward.

Such inflows demonstrate mainstream acceptance of Bitcoin, as institutions use Bitcoin to diversify their assets and hedge against inflation.

Bitcoin Cash (BCH) – Best Crypto to Buy and Hold

Bitcoin Cash (BCH) is a cryptocurrency that uses the same blockchain as Bitcoin (BTC). On Aug. 1, 2017, the coin was created through a “hard fork” of the Bitcoin blockchain. Simply put, Bitcoin Cash is like digital cash, whereas Bitcoin is more like a digital gold store of value.

Current Market Position

Bitcoin Cash ranks among the top 20 cryptocurrencies according to CoinMarketCap. It has recently surged in price to over $441, up by 34% in a month. At the time of writing it has a pretty good market cap of over $8.5 billion and a 24-hour trading volume of over $884.58 million. This makes it the best cryptocurrency to buy now.

Key Features

- Faster Transaction Speed: Unlike Bitcoin, BCH works on a larger block size. This means it can handle more than 100 transactions per second (TPS), compared to just 7 for Bitcoin. It also has super low transaction fees, often less than a penny. These low fees allow you to make microtransactions like tipping content creators or buying a coffee.

- Smart Contracts Support: BCH also supports smart contracts, which Bitcoin lacks. This is through CashScript, by which you can build more sophisticated decentralized finance apps right on the BCH blockchain.

- Decentralized Mining: The Bitcoin Cash mining process is decentralized. This makes it less prone to centralization issues than other cryptocurrencies. Decentralized mining helps Bitcoin Cash maintain its integrity and security by distributing mining power more evenly.

Institutional Support

Bitcoin Cash is backed by the Grayscale Bitcoin Cash Trust, which provides a lot of legitimacy and security. The Trust has recently done multiple private placements, including issuing more than 863,000 shares to accredited investors. That’s about $2.67 million in Bitcoin Cash.

Grayscale Securities LLC facilitated these transactions, making it easy for institutional investors to invest in Bitcoin Cash without dealing directly with the asset. This involvement shows Grayscale’s optimism about Bitcoin Cash’s technology and market potential. This also gives investors the option to invest in cryptocurrency through traditional methods as a compliant, professionally managed option.

Ethereum (ETH) – Best Crypto to Buy Now for Long Term

Ethereum (ETH) is the second most valuable cryptocurrency in the world. Ethereum was developed by Vitalik Buterin and Joe Lubinin in 2015. They established ConsenSys, a blockchain software development company.

Current Market Position

Currently, Ethereum has become the best cryptocurrency to buy now. Why? Because it has recently exceeded new heights, making investors happy. According to CoinMarketCap, Ethereum has now surpassed $3,300. The market cap has also surged over $399 billion. The 24-hour trading volume keeps going up too, and right now it is over $53 billion.

Key Features

- Efficient Consensus Mechanism: Unlike Bitcoin, which uses a more energy-intensive Proof-of-Work (PoW) mechanism, Ethereum uses a more eco-friendly Proof-of-Stake (PoS). This makes it easier for more people to become validators and keep the network stable. The best part is it doesn’t require mining equipment.

- Diverse Ecosystem: Ethereum dominates the crypto market when it comes to use cases. It has tons of awesome web3 products, such as Decentralized Apps (dApps), Non-fungible Tokens (NFTs), smart contracts, DeFi services, and much more. This makes it a versatile platform that attracts crypto traders from around the world.

- High Transparency and Security: On Ethereum, every transaction and smart contract is recorded on the public ledger, making it incredibly transparent. This reduces fraud and corruption since anything can be verified. Plus Ethereum is highly resistant to attacks thanks to its cryptographic encryption.

Institutional Support

If we talk about Ethereum’s institutional support, it is growing with major players joining. The Grayscale’s Ethereum Trust (ETHE) already gives Ethereum institutional legitimacy and emphasizes its long-term investment potential.

Additionally, the State of Michigan Retirement System (SMRS) disclosed it holds a stake in Grayscale’s Ethereum funds worth $10 million. This marks a major endorsement from a state-managed fund. In other words, retirement funds are getting into crypto in a big way.

This was also evident with previous Bitcoin and Ethereum ETF investments by Jersey City and Wisconsin. The growing interest from conservative institutions shows confidence in Ethereum’s mainstream potential.

Litecoin (LTC) – Best Crypto to Buy Now for Short Term

Litecoin (LTC) was introduced in 2011 by Charlie Lee, a former Google engineer. The Litecoin protocol is the same as Bitcoin’s, but it offers faster, cheaper transactions and addresses the scalability limitations of Bitcoin. It was marketed as digital silver, complementing Bitcoin instead of competing with it.

Current Market Position:

LTC can be one of the best crypto to buy now due to its high transaction volume and established reputation. Currently, its price has crossed the $78 mark, with further increases expected. Market cap-wise, it has also been doing well. At the time of writing, it stands at $5.8 billion, representing a significant increase.

Key Features

- Speedy Transactions: Litecoin’s blockchain allows transactions to be processed faster than Bitcoin. This happens because it has a faster block generation compared to Bitcoin. This enables faster transaction confirmation, making Litecoin the best cryptocurrency to buy now for everyday purchases.

- Greater Supply and Wider Adoption: Compared to Bitcoin’s 21 million LTC has a total supply of 84 million coins. This means Litecoin has a lower probability of scarcity, reducing volatility in prices. Litecoin is also accepted by lots of businesses around the world, so users can spend their LTC anywhere they want.

- Less technical problems: Many cryptocurrencies have technical or security issues, especially new ones. But Litecoin is reliable, having been around since 2011 and having fewer problems than most other coins.

Institutional Support

Litecoin further solidifies its status as the best crypto to buy now due to institutional backing from Grayscale through its Grayscale Litecoin Trust. Last month, the Trust collected around $2.9 million through the issuance of 499,200 new shares. The price of each sale was determined by the Net Asset Value (NAV) of Litecoin.

These shares were exclusive to accredited investors with high compliance standards. This capital raising shows that Litecoin is a good investment for the long term, making it more attractive to individual investors and institutions.

Ripple (XRP) – Best Crypto to Buy Now Cheap

Ripple (XRP) is a major player in the cryptocurrency world and global finance. This network was founded by Chris Larsen and Jed McCaleb in 2012 and provides fast and low-cost international currency exchanges.

Current Market Position

Ripple is in the top 10 most valuable cryptocurrencies according to CoinMarketCap. Over the past seven days, XRP has surged over $0.6 showing solid gains. Many investors are optimistic it will soon surpass the awaited $1 mark. It has over $33 billion market cap and the trading volume is growing rapidly.

Key Features

- Fast and Efficient Transaction: Ripple takes just 3-5 seconds to process transactions through its consensus mechanism. This speed comes from XRP’s non-mining validation system. The system settles over 1,500 transactions a second. Pretty cool, right? That’s super fast when compared to Bitcoin’s 10 minutes block time or traditional banks’ days-long processing time.

- No Mining Required: Unlike most other cryptocurrencies, XRP does not require mining. It is limited to a maximum of 100 billion pre-mined tokens. As of now, around 60% of XRP is held in escrow by Ripple Labs, the company behind XRP. This pre-mining feature makes transactions faster and more energy-efficient since it does not require energy-guzzling processes like Proof-of-Work (PoW).

- Trusted by larger institutions: Ripple has gained the trust of large institutions such as Bank of America, Santander, and the Canadian Imperial Bank of Commerce. Several banks are using Ripple’s RipplePay system to settle bills and send international payments in real time.

Institutional Support

Grayscale has shown its support for Ripple’s XRP through its XRP Trust, which is an important step toward XRP’s legitimacy in institutional markets. This will give investors direct access to XRP, demonstrating Grayscale’s confidence in Ripple’s recent regulatory win. This backing makes XRP an attractive cross-border payment solution investment.

Moreover Grayscale has plans to make its Digital Large Cap Fund (which includes XRP) into an ETF. This will not only increase transparency and liquidity but also ease access to the token. And in the end it might boost XRP’s market stability by attracting more institutional interest.

Ethereum Classic (ETC) – Best Crypto Token to Buy Now

Ethereum Classic (ETC) is a cryptocurrency made by the same core team that made the original Ethereum. It shares some basic functionalities with Ethereum, like running decentralized applications (dApps). But there are some differences between Ethereum Classic and Ethereum that distinguish them from one another.

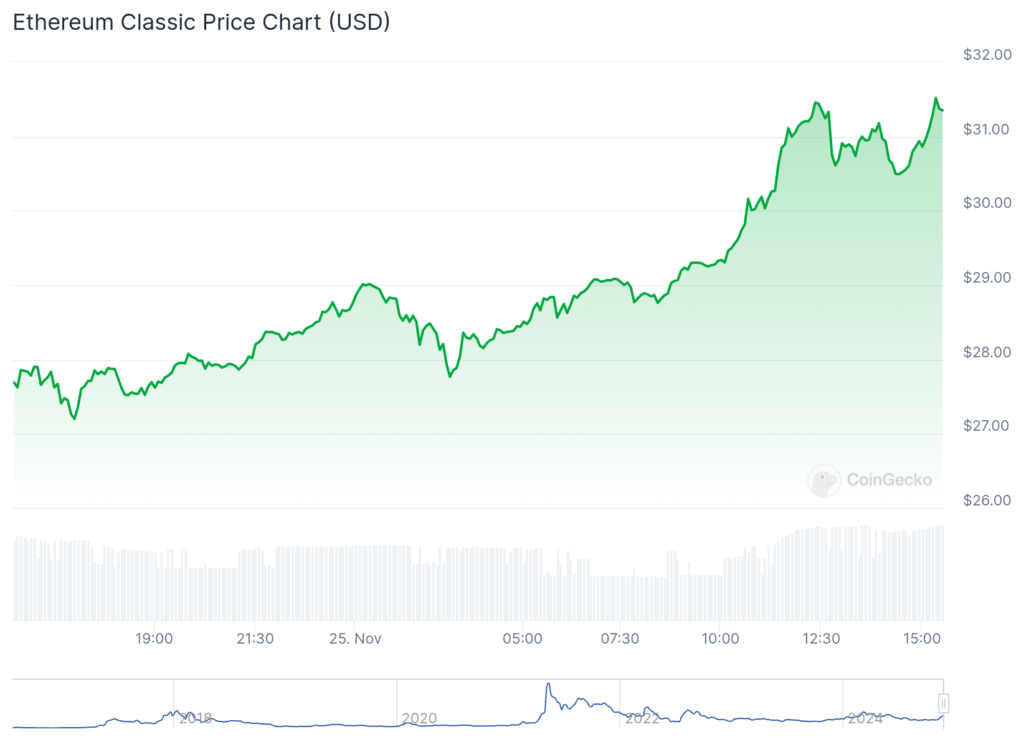

Current Market Position

The Ethereum Classic price jumped significantly following the recent market rally. At the time of writing it is over $31, showing an impressive 7-day increase. Its trading volume has also soared to over $591. These spikes show a strong upward trend, and most investors think it’ll keep going up.

Key Features

- Different Consensus Mechanism: Ethereum Classic and the original Etheurem share a lot of similarities. This includes creating smart contracts and executing decentralized applications (dApps). However ETC uses the Proof-of-Work (PoW) consensus mechanism rather than the Proof-of-Stake (PoS) model of Ethereum. PoW is the same consensus mechanism employed by Bitcoin, which keeps the original blockchain philosophy.

- Limited Supply and Low Fees: Unlike the original Ethereum, Ethereum Classic has a maximum supply of 210.7 million coins. This is a great way to create a sense of scarcity that attracts investors. Additionally, ETC typically charges lower transaction fees than ETH.

Institutional Support

What makes Ethereum Classic the best cryptocurrency to buy now is Grayscale’s institutional backing. Grayscale currently provides the opportunity for investors to get into ETC via Grayscale Ethereum Classic Trust (ETCG).

As of recent reports, Grayscale holds $281.3 million in Ethereum Classic Fund. This significant number of holdings affirms the trust’s confidence in ETC’s long-term prospects.

ZCash (ZEC) – Best Crypto Altcoins to Buy Now

ZCash (ZEC) is one of the first cryptocurrencies to focus heavily on privacy and anonymity. This Peer-to-Peer (P2P) coin was launched in 2016 and its network utilizes a number of strategies to remain valuable, such as a cap on supply, privacy, and fungibility.

Current Market Position

ZCash has been experiencing a long-term downward trend. However, the recent crypto market rally has helped it bounce back. Right now ZEC is trading over $44 showing a significant 18.02% gain in the last 7 days. The 24-hour volume also went up to over $120 million. Its rise isn’t as impressive as other coins’, but investors are optimistic it’ll keep growing.

Key Features

- Exceptional Anonymity: ZCash utilizes zk-SNARKs which are zero-knowledge proofs that let nodes on a blockchain network validate transactions without revealing any metadata about the transactions.

This gives total privacy as compared to most cryptocurrencies which have pseudonymous transactions. These transactions don’t explicitly reveal who their users are. But one can trace the public address of each user back to them with data science and blockchain forensics. - Unique Consensus Model: The Zcash cryptocurrency uses a modified Proof-of-Work consensus mechanism known as the Equihash mining protocol. This redesigned PoW mechanism ensures that transactions are valid, prevents double-spending, and rewards miners for their work. Compared to Bitcoin’s power-hungry PoW mechanism, this system is faster.

Institutional Support

Grayscale Investments has dramatically raised the profile of privacy-focused cryptocurrency ZCash (ZEC). Grayscale Zcash Trust (ZCSH) fund makes it easy for investors to gain access to Zcash without having to deal directly with cryptocurrency. Grayscale recently filed for an ETF that includes a 10% allocation to ZCSH. This shows how institutional investors are getting interested in privacy-centric assets and ZCash stands out as one of the biggest players.

What to Look for When Investing in Cryptocurrencies

Before selecting the best cryptocurrency to buy now, you should think about a few factors. If you dive in without any preparation or research, you’ll suffer significant losses. So here are 4 important things to remember.

1. Detailed Research

The crypto market is a place where new coins come out almost every day. These coins can be about anything – a popular meme, an important event, anything. So gain a deeper understanding of this rapidly expanding industry before you jump in. Let’s say you’re curious about Bitcoin. So you should understand every concept and hold a firm grasp on things like cryptographic hashes and mining.

2. Market Cap

The market cap of a cryptocurrency is another thing to consider when choosing the best cryptocurrency to invest today. Usually, it is said that cryptos with over $1 billion in market cap are safer to invest in. But it’s not foolproof because some cryptos with high market caps are still very risky. As a rule of thumb, coins that rank in the top 100 are safer investments.

3. Be Careful of Scammers

You may see a lot of hype on social media about obscure crypto assets that promise big returns. If it sounds too good to be true, there is a high probability it is a scam. In fact last year about 80% of Americans lost money as a result of crypto and investment scams.

Also stay away from coins that spike and then crash. This indicates a pump-and-dump scenario which involves inflating a coin’s price with false hype then selling it for profit right after.

4. Avoid FOMO

When the market is in full swing many cryptocurrencies see their prices skyrocket. This is where you should be most cautious. Buying any crypto at a higher price might mean big losses down the road if its price corrects, check the next crypto to hit .

Conclusion

The crypto market can be volatile, but it can also bring big gains. Be mindful of the above factors when selecting the best cryptocurrency to buy now. All these cryptos have institutional backing, which makes them even more appealing compared to the rest.

Also you should diversify your portfolio so that you can maximize your profits. Maintain a focus on risk management when trading crypto. This could reduce your short- and long-term stress.