Are you a crypto investor searching for ways to utilize your crypto assets in everyday purchases? As you are aware, cryptocurrency has very much taken over traditional currency. They can now be used for purchases instead of being stored only for trading and investment purposes.

A global survey shows that cryptocurrency is owned and used across 56 countries worldwide. But, there are still lots of territories that do not accept it for day-to-day purchases.

In the same way, you can use cryptocurrency to purchase high-value items, for instance, Cars or real estate but will not be able to use it for everyday purposes such as coffee or grocery items. Most shops do not accept crypto because of the fear of scams and fraud.

Nonetheless, crypto-based debit cards are the ideal solution to this problem. Crypto debit cards can instantly convert your cryptocurrency into fiat currency at the time of purchase.

Now the issue is how you can find a reliable crypto-based debit card. Therefore, after thorough research, we have jotted down a list of 7 best platforms for crypto-based debit cards in 2024. In this guide, we will talk about:

- What is a Crypto-based debit card and how do they work?

- In-depth analysis of 7 Best platforms for crypto-based debit cards

- The Pros and Cons of each Crypto Debit Card.

So let’s get started:

7 Best Platforms for Crypto-Based Debit Cards in 2024

|

Card Provider |

Type |

Network |

Supported Cryptocurrencies |

Cashback Rewards |

Foreign transaction fees |

|---|---|---|---|---|---|

|

Coinbase |

Debit |

Visa |

8 |

Up to 4% |

None |

|

Binance |

Debit |

Visa |

14 |

Up to 8% |

2% |

|

Wirex |

Debit |

Visa |

25 |

Up to 8% |

None |

|

Crypto.com |

Debit |

Visa |

19 |

Up to 5% CRO |

2% |

|

Bitpayy |

Debit |

MasterCard |

Over 100 |

No fixed Cashback |

3% |

|

Nexo |

Debit/Credit |

MasterCard |

61 |

Up to 2% |

None |

|

Uphold |

Debit |

MasterCard |

250 |

Up to 2% |

None |

What Are Crypto-Based Debit and Credit Cards?

Crypto-based debit and credit cards are similar to normal debit cards in terms of functionality. The only difference is that they are connected to a crypto account instead of a bank account.

This card enables you to use your crypto assets like Bitcoin or Ethereum directly. It basically converts them into fiat currency like EUR or USD at the time of purchase.

Crypto cards are not directly linked to bank accounts but they are governed by card issuers that are in partnership with banks. They work through digital wallets or cryptocurrency platforms. In simple words, these cards act like a bridge between the digital currency world and the traditional financial system.

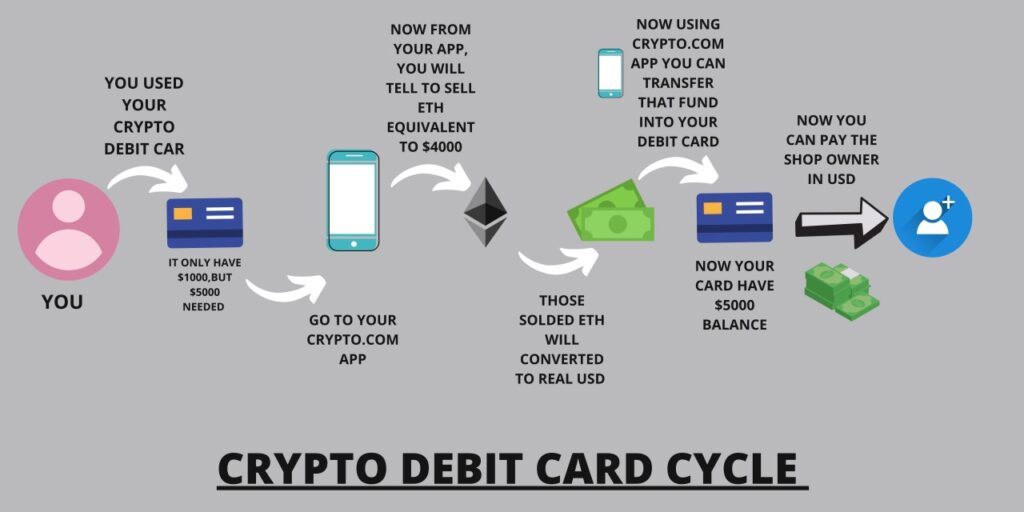

How do Crypto Debit cards work?

Crypto debit card works exactly as any other debit card. Whenever you have to make a payment you need to enter your card details or swipe the card. The vendor will receive the payment in their local currency. Likewise your crypto assets worth that value will be deducted from your account.

This process is done by converting your cryptocurrency into local fiat currency with the use of an exchange service.

Now you may wonder where you can use these cards. They are acceptable at any location where traditional cards are accepted. You can also withdraw cash from any ATM. Hence, you don’t have to manually convert them with cryptocurrency exchanges.

There are two ways in which you can fund your debit card:

- You transfer a certain amount of crypto to the card issuer. He will then convert it into cash. Every time you will make a purchase the funds will be drawn from this preloaded cash.

- You have to link your crypto wallet directly to the card. Whenever you will buy something the card issuer will deduct the crypto worth that amount.

7 Best Platforms for Crypto-Based Debit Cards in 2024

Crypto debit cards are becoming increasingly popular nowadays. However, as the demand grows the possibility of scams and frauds also grows. Therefore, we have jotted down an authentic list of the 7 best platforms for Crypto-based Cards in 2024. Let’s dive in:

Coinbase Visa Debit Card

Coinbase Visa debit card is one of the most reliable crypto debit card options in the market. As the name suggests, It is issued by Coinbase cryptocurrency exchange. It allows you to spend cryptocurrencies like Bitcoin, Ethereum, and others directly from your Coinbase account.

Can I connect my Coinbase card to another exchange account like Binance? The Coinbase debit card is directly tied to your Coinbase account. You cannot draw funds directly from other crypto-exchange platforms. However, if you want to spend crypto from other exchanges you will have to:

- First transfer cryptocurrency from other exchanges to your Coinbase wallet.

- Now you can use your Coinbase crypto debit card for spending crypto on everyday purchases.

Moreover, the Coinbase Visa debit card uses the Visa payment network so it is accepted worldwide. You can use it for online, and in-store purchases as well as for ATM withdrawals. Coinbase cards presently support eight cryptocurrencies including Bitcoin, Ethereum, and Dogecoin.

Similarly, Coinbase offers unlimited crypto rewards on each spending. These cashback rewards vary depending on the available offers. For instance, right now Coinbase is offering 1% cashback in BTC and 4% cashback in ALGO.

Pros and Cons of Coinbase Visa Debit Card

|

Pros |

Cons |

|---|---|

|

Zero spending or annual fees |

Coinbase account is a must. |

|

Robust security features including 2-factor authentication and card freezing. |

Monthly spending limit. |

|

Upto 4% cryptocurrency cashback |

Limited selection of supported cryptocurrencies. |

|

No ATM withdrawal fees |

Binance Visa Card

Binance Visa Card is powered by Binance, one of the top cryptocurrency exchange platforms in the world. It currently supports 14 cryptocurrencies including all the major ones like Bitcoin, Ethereum, and Tether. It is also directly linked to your Binance account. Whenever you make a purchase through a Binance card, the crypto in your account will be converted to fiat currency to pay for the transaction.

Moreover, Binance cards offer generous cashback of up to 8%. However, this cashback depends upon how much binance coin you hold in your wallet. Likewise, the cashback is also given in BNB.

In addition, even though Binance claims to have zero fees it may cost hidden transaction or currency conversion fees. According to some records, Binance cards usually charge 0.9% on every transaction. Apart from this, there can be ATM withdrawal and foreign transaction fees depending upon your location.

Binance gives you complete control over your funds with its mobile app. You can check your daily transactions there. Furthermore, the Binance crypto card is not available in the UK. In fact, they announced the end of their debit card service in Europe on 20th December 2023.

Pros and Cons of Binance Visa Card

|

Pros |

Cons |

|---|---|

|

No issuance fees |

Not available in Europe |

|

Support a wide range of cryptocurrencies |

Balance is required to get cashback rewards |

|

3D secure verification | |

|

Instant conversion of crypto to fiat currency |

Wirex Crypto Debit Card

Wirex crypto debit card is developed to support payment processing both in fiat and cryptocurrency. It allows you to keep multiple currencies on your Wirex debit card. It supports an extensive range of 25 different cryptocurrencies and 150 plus traditional fiat currencies. Therefore, it is an amazing option for you if you have a multifaceted crypto portfolio.

On top of multicurrency, Wirex offers an incredible 8% cashback in Bitcoin for in-store purchases. This is the highest amount of cashback in the crypto debit card industry. The amount of cashback mainly depends upon your card tier. Similarly, you can earn even higher cashback if you have Wirex Token (WXT) in your wallet. Similarly, Wirex does not require any minimum balance limit to give cashback rewards.

In addition, there are no annual or foreign transaction charges. However, if you surpass the $200 monthly ATM withdrawal limit Wirex will charge 2% on every transaction.

The Wirex card also offers standard security features such as two-factor authentication and instant card freezing. In order to get the Wirex debit card you have to create a Wirex account first. After that, you can spend both crypto and fiat currency through your card.

Furthermore, Wirex also features an X-Account that gives you the opportunity to earn up to 10% interest on Bitcoin and Ethereum. It is similar to a traditional savings account with which you earn a percentage of interest depending on your funds. In addition, it does not need you to freeze your funds for a specific period of time.

Pros and Cons of Wirex Crypto Debit Card

|

Pros |

Cons |

|---|---|

|

Support a large selection of crypto and fiat currencies |

Requires you to upgrade to high tier card to avail of maximum reward |

|

No transaction fees on a limit of $200 |

High conversion fees |

|

Generous cashback ranging between 0.5 to 8% |

Crypto.com Prepaid Card

Crypto.com is another leading crypto visa debit card issued by Crypto.com, a well-known crypto exchange platform. They offer prepaid crypto debit cards that require you to top up the card to use it for regular purchases. It means that you cannot directly use cryptocurrency for everyday use. First, you will have to load your card by selling a certain amount of crypto which you can later use for your expenses.

Moreover, you will be given five different card levels to choose from. These cards come with their own set of features and benefits. All of these cards except Midnight Blue require you to stake a certain amount of Cronos (CRO) to leverage them.

In addition, the Crypto.com debit card supports 19 cryptocurrencies including Bitcoin and USTD. Similarly, Crypto.com cards offer an appealing cashback ranging from 1% to 5% depending upon your card tier. However, this offer is not so appealing as the higher tier card requires staking of a significant amount of CRO to access cashback rewards.

A cool feature of these cards is that they offer a bunch of other rewards in the form of popular subscriptions such as Netflix, Amazon Prime, and a lot more.

Pros and Cons of Crypto.com Prepaid Card

|

Pros |

Cons |

|---|---|

|

No annual or monthly fee required |

Contain 1% top-up fee |

|

Generous cashback of as far as 5% |

Must stake CRO to access benefits. |

|

Typical visa card benefits |

Limited withdrawal limit for low-tier cards |

|

Free Access to popular streaming services |

Bitpay Debit Card

Bitpay is another trustworthy crypto debit card option in the market. It is powered by MasterCard and allows you to spend cryptocurrency anywhere that receive MasterCard. You can top up your Bitpay debit card by integrating your Bitpay wallet with your Coinbase account.

Moreover, Bitpay stands out among other crypto debit cards with its high withdrawal limits. For instance, you can draw as much as $2000 in a single transaction. In addition, it does not cost any conversion fees in the US but you will have to pay $2.50 for every ATM withdrawal.

Similarly, if you live in a country other than the US then you will have to pay a 3% fee on every transaction. Other than this Bitpay does not cost you any annual or monthly fees. However, Bitpay costs you $5 for staying inactive over 90 days.

Furthermore, Bitpay supports a satisfactory selection of 15 major cryptocurrencies. A significant drawback of the Bitpay debit card is that it is only available for US residents. However, it can be used anywhere around the world as it is powered by MasterCard. In addition, Bitpay has briefly halted new sign-ups as it is upgrading its card service.

Lastly, Bitpay card does not offer any fixed Cashback rewards. It may vary from merchant to merchant.

Pros and Cons of Bitpay Debit Card

|

Pros |

Cons |

|---|---|

|

Can be used globally |

Available only in the US |

|

No annual or monthly fees |

Charges $5 fees for being inactive |

|

High withdrawal limit |

High Conversion fee for international purchases |

|

Up to 3 ATM withdrawals per day |

Nexo Crypto Card

Nexo is a unique crypto debit card that features an exclusive dual mode. It means that the Nexo Crypto Card can be used as both a debit and credit card.

- In debit mode, you can spend cryptocurrency by converting it into fiat to make everyday purchases.

- In credit mode, you will be given a line of credit with which you can make purchases without selling cryptocurrency directly.

Both of these modes provide enhanced flexibility and give you quick access to your funds. On top of that, this switching option allows you to use your crypto assets effectively. It is also powered by MasterCard so it is accessible worldwide.

Nexo offers four different card tiers that come with different sets of features and benefits. High-level tiers have a high loyalty ratio. The loyalty ratio determines how many benefits and features you will get based on the amount of NEXO tokens you stake. If you stake a high amount you will get a high loyalty tier.

Leveling up your loyalty comes with added benefits such as reduced interest and high crypto cashback earning rates. You can earn between 0.5 to 2% cashback rewards.

Nexo does not support directly spending cryptocurrency. You can use up to 61 major cryptocurrencies as collateral which you can pay back using FIATx currency. You can also easily convert cryptocurrency to FIATx but direct crypto spending is not supported.

Pros and Cons of Nexo Crypto Card

|

Pros |

Cons |

|---|---|

|

Two modes provide additional flexibility |

A portfolio balance of $500 is a must to get a physical card |

|

You can utilize your cryptocurrency holdings without having to sell them |

Fees for withdrawals |

|

Up to 2% cash back rewards on crypto | |

|

Accepted globally |

Uphold Crypto Debit Card

Uphold has established itself as one of the most reliable crypto-debit cards that provides an easy way for you to spend your digital assets in the real world. Uphold is also a MasterCard so it is accepted at millions of locations worldwide.

Moreover, Uphold does not charge fees to top up your crypto debit card. Their virtual card is also free but the physical card requires a one-time charge of up to $9.95. Likewise, Uphold charges $2.50 per ATM withdrawal in the UK and $3.50 in other territories.

The Uphold card offers cashback on every purchase. It nearly gives 2% cashback on crypto and 1% on fiat currency. Moreover, you can manage your Uphold Debit Card through the Uphold app. It will allow you to track your spending, and view your transaction history all in one place.

Uphold is not just limited to cryptocurrencies. You can utilize stablecoins, precious metals, and fiat currencies as well. Lastly, Uphold supports up to 250 crypto assets including major cryptocurrencies, altcoins, stablecoins, and tokens.

Pros and Cons of Uphold Crypto Debit Card

|

Pros |

Cons |

|---|---|

|

No foreign transaction or annual fees |

ATM withdrawal fees |

|

Crypto Cashback rewards | |

|

Support up to 15 fiat currencies and 250 cryptocurrencies. |

Key Features to Look for in a Crypto Debit Card

A crypto debit card is an amazing alternative for manually converting digital currency into local currency. However, there are some key features that you need to consider before choosing a crypto debit card.

Supported Cryptocurrencies

Some cards are compatible with only a few digital currencies. Therefore, it is crucial to select the card that accommodates the cryptocurrencies you often use.

Although many cards support major cryptocurrencies like Bitcoin or Ethereum you should still look for the one that supports a wider range of crypto.

Fee structures

Apart from the fact that they work just as regular debit cards, crypto debit cards have their own fee charges in return for their service. Similarly, it is crucial that you analyze the fee structure of the card. It can differ notably among the providers.

The fees may include transaction fees, foreign exchange fees, maintenance fees, transaction fees, withdrawal charges, etc. A card with low fees can help enhance the value of your transactions.

Conversion rates

Another important characteristic of a crypto debit card is the conversion rate. The conversion is the ability of the card to convert your cryptocurrency to the local fiat currency when you need to make a purchase.

A reasonable crypto debit card should offer competitive conversion rates. It will lower the chances of loss during currency exchange. Hence, you should look for a card that offers an up-to-date crypto exchange rate.

Global usability

One of the most important features when choosing a crypto debit card is to consider whether the card is accessible in your region. Not all crypto debit cards operate worldwide.

Some are limited to specific territories. Therefore, It is essential to check the card’s availability in your location so that you can effectively utilize it.

Security features

When you are selecting a crypto debit card, it’s important to check for robust security measures that will keep your funds secure.

One of the most essential features to take into account is two-factor authentication (2FA). This incorporates an additional layer of security by verifying your identity when accessing your account or making transactions.

2FA considerably minimizes the risk of unauthorized access. Even if your login details are compromised.

Benefits of a Crypto wallet with a debit card

Now you must be thinking that a crypto wallet is really beneficial or is it just a scam? In order to clear your doubts, we have generated a list of some benefits that a crypto debit card offers.

Here are some of the most notable benefits of a crypto wallet with a debit card.

Easy Spending of Cryptocurrency

Having a debit card integrated with your crypto wallet enables you to spend crypto on everyday purchases. You can shop online or in-store with the same account that you are using for crypto trading.

It eliminates the need to convert your digital currency into fiat currency beforehand. You can spend your crypto holdings on anything that accepts traditional debit cards.

Crypto Rewards and Cashback

Many crypto debit card providers offer generous rewards and cashback programs. You can earn cryptocurrency as cashback whenever you make a purchase with the card. Some providers also give you perks for spending on streaming platforms.

Crypto debit card is somewhat new so the providers are offering great rewards to attract clients. You can use this opportunity to your advantage.

Lower Fees Compared to Traditional Banks

Crypto debit cards generally have lower exchange rates and foreign transaction fees as compared to traditional banks. Hence, a crypto debit card is a perfect alternative if you want to avoid these hefty transaction charges.

Conclusion

There is no doubt that crypto debit cards have simplified the process of adoption of crypto assets in daily life. They are playing a crucial role in bridging the gap between crypto and fiat. While also providing opportunities to earn cashback rewards.

In the above list, We have thoroughly analyzed all aspects of each crypto debit card. Read this guide thoroughly so that you can choose a crypto debit card that suits your preferences. Now let’s proceed and select the best card that will help you make the most of your cryptocurrency assets in 2024.

FAQs

Are Crypto Debit cards safe to use?

Crypto cards are mostly safe to use. They come with robust security features such as 2-factor authentication and instant card freezing.

Is there a future for Crypto Debit Cards?

As crypto adoption is increasing day by day, people are looking for ways to use them for their daily needs. Therefore, crypto debit cards are likely to play a significant role in the future.

Can I use crypto debit cards internationally?

You can definitely use your crypto debit card internationally. It will be accepted everywhere Visa/Debit card is accepted. However, these crypto cards are allotted to the residents of specific countries so make sure yours is one of them.

What’s the difference between a virtual and physical crypto debit card?

A virtual debit card is limited to online purchases only and a physical debit card can be utilized for both online and in-person purchases.

How are crypto debit cards taxed?

Crypto debit cards work by converting cryptocurrency into fiat currency by selling the crypto at the current market rate. It means whenever you sell a cryptocurrency you will be required to pay the tax.

If you want to avoid this, you can use stablecoin for your everyday purchase.