Binance is one of the world’s leading cryptocurrency exchanges which offer a range of digital assets for trading, staking and investing. Binance offers services to both beginners and experienced traders. For this Binance review, we made sure to leave nothing out so that you can have an idea of how well Binance is still doing.

This trading platform offers various security features like two-factor authentication and wallet protection so users can have peace of mind while trading. Apart from that, the exchange offers competitive fees and high liquidity which makes it attractive for serious traders.

With that said, let’s dive into this Binance review.

What is Binance?

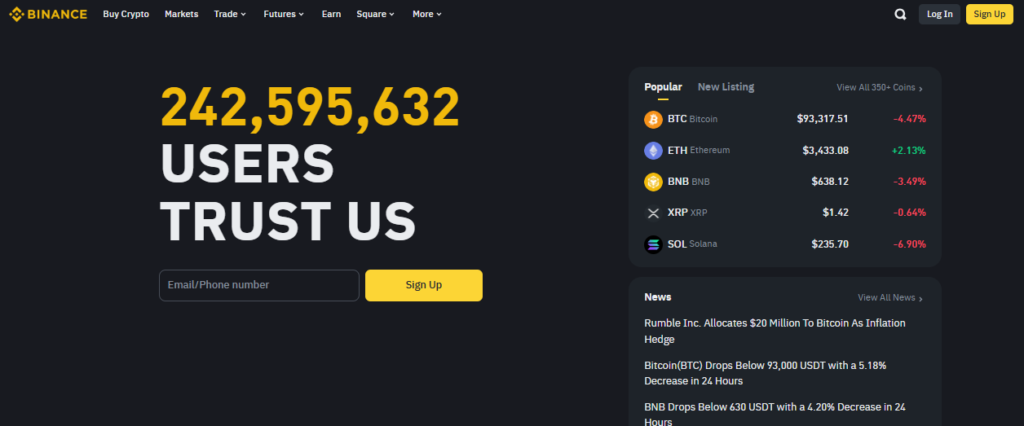

Binance is one of the biggest cryptocurrency exchanges with over 200 million users. It was founded in 2017 by Changpeng Zhao (commonly known as CZ) and Yi He. On this platform, anyone can buy, sell and trade digital assets.

Originally established in Hong Kong, Binance trading platform quickly gained traction due to its wide range of cryptocurrencies, low trading fees and advanced trading tools. Users can trade a variety of assets here ranging from well-known coins like Bitcoin and Ethereum to a vast selection of altcoins.

Beyond trading, Binance offers features like staking, lending, futures and margin trading which allows users to grow their crypto holdings in multiple ways. The platform is also known for its strong security measures which include two-factor authentication and asset insurance funds. These help protect users’ investments.

For this Binance review, we plan to explain everything in detail, so make sure you’re here till the end. This platform is accessible to users globally as it supports multiple languages and fiat currencies.

Lastly, for those interested in digital art, Binance supports NFT (Non-Fungible Token) trading through its dedicated marketplace. The Binance NFT Marketplace allows users to create, buy and sell unique digital artworks and collectables.

Binance Exchange Review: Platform Features

Binance quickly became a favorite for both beginners and experienced traders as it offers tons of exciting features that make this platform the best. Here are some of the standout features that make Binance popular among crypto enthusiasts.

1. Variety of Cryptocurrencies to Choose From

In terms of cryptocurrencies, Binance is up there with the biggest exchanges. With access to over 600 different digital assets, including the major coins like Bitcoin (BTC), Ethereum (ETH) and Binance Coin (BNB) as well as hundreds of altcoins, users have the flexibility to choose whichever one they want.

2. Binance Fees

Binance has built a reputation for having one of the lowest trading fees in the industry. It starts at only 0.1% per transaction. For users who choose to pay the fee using BNB, they get an additional discount which makes their transactions even cheaper.

Due to this fee reduction, a lot of people now hold BNB which also increases the token’s value. The platform also offers VIP tiers for high-volume traders. They can enjoy more fee discounts and other benefits as they trade more and more on the platform.

3. 24/7 Customer Support

The platform provides a 24/7 live chat feature so that you and many other users like yourself can connect directly with support agents for real-time assistance. This service is accessible through both the Binance website and mobile app.

In addition to live chat, Binance also has a Support Center filled with FAQs and detailed guides that cover almost everything. For complex issues, users can submit support tickets through the platform and their support team will contact you as soon as possible.

4. Binance Staking

Apart from the straightforward ways to invest money and get some returns, Binance also offers several ways for users to earn passive income and grow their income.

- Staking: Users can earn rewards on Binance through staking. How much you can earn depends on the amount and duration of the stake. This is especially beneficial for those who want to participate in staking without needing a dedicated staking wallet.

- Flexible and Locked Savings: Binance’s savings feature offers interest on digital assets that users deposit. With flexible savings, users can withdraw their funds at any time. However, with locked savings, a time period is specified beforehand.

- Launchpool: Binance periodically offers new projects through its Launchpool platform. This way users can earn tokens of new projects by staking specific assets such as BNB or other stablecoins.

- Referral Program: Through this referral program users can use the Binance referral ID to earn up to $100 by referring new traders or even your friends to the platform.

5. Binance Smart Chain (BSC) for DeFi and dApps

Binance Smart Chain (BSC) is Binance’s own blockchain network which supports decentralized applications (dApps) and decentralized finance (DeFi) projects. Unlike Ethereum, BSC has low transaction fees which makes it a popular choice for developers and users.

BSC is totally compatible with Ethereum which means that developers can easily port their dApps over. This increases Binance’s reach into the DeFi ecosystem.

6. Binance Marketplace for Digital Art and Collectibles

Binance also provides a dedicated NFT marketplace which allows users to create, buy and sell digital assets in the most secure way. This platform supports artists, collectors, and anyone interested in digital collectibles.

The Binance NFT marketplace is integrated with Binance Smart Chain which helps keep transaction costs to a minimum. This platform has proven to be quite appealing to creators and collectors alike.

7. Forex-like Trading Pairs

Primarily Binance operates as a cryptocurrency exchange but because of the way trading paris are assembled with stablecoins, even forex traders find it appealing. For example, users can trade cryptocurrencies against stablecoins such as USDT (Tether).

This would look something like BTC/USDT which is similar to forex trading pairs such as EUR/USD or GBP/JPY. However, crypto is more volatile and risky to do your due diligence before investing in this market.

8. Fiat Currency Integration and On-Ramp Options

Binance supports a variety of fiat currencies, allowing users to buy cryptocurrency directly using major global currencies like USD, EUR, GBP and many more.

This fiat-to-crypto on-ramp is facilitated through payment methods like bank transfers, credit cards and third party providers like Simplex. All these make it easy for users to get started with cryptocurrency and make some money sensibly.

9. Binance Academy

Binance Academy is an educational platform that provides valuable resources for crypto enthusiasts of all experience levels. It includes articles, guides and videos on almost every topic ranging from blockchain basics to complex trading strategies.

This academy is especially useful for new traders looking to understand more about cryptocurrency and navigate through the complexities of the crypto world.

10. Binance P2P Trading

Binance offers a Peer-to-Peer (P2P) trading platform where users can trade cryptocurrencies directly with each other. This feature is beneficial for users who want to avoid intermediaries.

You can easily choose your own payment methods and negotiate on the prices directly with other users. P2P trading is particularly useful in regions with limited access to traditional financial services or high transaction fees.

11. Advanced Security Features

Binance takes security extremely seriously which is why the platform employs multiple layers of protection to make sure nothing wrong happens. These security features include:

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring a secondary code for logins and withdrawals on your phone or email.

- Address Whitelisting: Users can restrict withdrawals to pre-approved wallet addresses. This minimizes the risk of unauthorized transfers.

- Secure Asset Fund for Users (SAFU): Binance’s SAFU fund acts as an insurance mechanism to cover user losses if there’s a security breach or a hack.

12. Cross-Platform Accessibility

Binance trading platform is accessible on various platforms including a mobile app (iOS and Android), a desktop app and the web. The mobile app is well-designed and allows users to track prices, place trades and manage their accounts on the go.

The desktop and web applications are equally powerful with detailed charts and technical analysis tools for serious traders. If you are not aware of the analysis tools, we’ll discuss them in a while.

13. API Integration for Custom Trading Applications

Binance also offers an API which allows developers and institutional traders to integrate Binance’s features into their own applications. This is particularly useful for building custom trading bots, managing portfolios automatically and conducting high-frequency trades.

Available Markets and Products on Binance

What Binance offers is above all else as it takes care of every trader in the market either big or small. Here are the markets available on this platform along with the products.

1. Spot Trading

Spot trading is the most basic form of trading on Binance and undoubtedly the safest as well. Here anyone with the right amount can buy a variety of cryptocurrencies at real-time prices. Its products include:

- Fiat-to-Crypto Pairs: On Binance you can purchase cryptocurrencies directly using fiat currency pairs. This makes it easy for new users to buy their first coins using USD, EUR, GBP, and other global currencies.

- Cross and Isolated Margin Options: Spot traders on Binance can leverage cross or isolated margin trading which allows them to borrow funds to increase their purchasing power. Cross margin shares collateral across positions, while isolated margin limits collateral to individual positions.

2. Binance Futures

Binance also has a futures market like many other crypto exchanges out there. This market is particularly attractive to advanced traders who have all the experience and want to speculate on the future prices of cryptocurrencies. In it the users can get into the following:

- USDT-Margined Futures: These are stablecoin-margined contracts that use USDT as collateral. Traders can trade perpetual contracts (without an expiry date) with leverage up to 125x.

- Coin-Margined Futures: These contracts are margined using the underlying cryptocurrency rather than a stablecoin. For example, BTC-margined futures allow users to trade Bitcoin against other cryptocurrencies without converting to USDT.

- Options Trading: Binance also supports options trading. In this market the users can buy contracts giving them the right to buy or sell an asset at a predetermined price.

3. Margin Trading

If you’re someone who wants to increase their exposure without a full upfront investment, you can go towards margin trading. It allows users to borrow funds against their existing assets.

Margin trading can amplify both gains and losses which makes it ideal for experienced traders who know how to handle risk. Its types include:

- Cross Margin: Borrowed funds are shared across all positions. It provides flexibility but also increases risk.

- Isolated Margin: Limits borrowed funds to specific positions. This once reduces potential losses to only that position’s collateral.

4. Derivatives

Next product in this Binance review guide is the derivatives market. It is one of the most sophisticated among all other markets on board. It provides access to various instruments that allow users to hedge, speculate and manage risk.

- Leveraged Tokens: These tokens represent a leveraged position without the need for traditional margin or collateral management. For example, a BTCUP token could offer 3x leverage on Bitcoin’s movements.

- Binary Options (Limited Availability): Binance offers simplified options that provide a payout based on whether a certain condition is met by the contract’s expiration. These are limited in availability but come with high-risk, high-reward trading strategies.

5. Lending and Borrowing

Biannce’s lending platform allows users to lend their assets for interest or borrow against their cryptocurrency holdings.

- Crypto Lending: Users can earn interest by lending their assets to other traders or the platform itself.

- Collateralized Loans: Users can borrow funds by pledging crypto assets as collateral. It is a useful feature for those who want liquidity without selling their holdings.

6. Binance Card

Lastly, Binance offers a debit card linked to your in-exchange crypto wallet. With it users can spend cryptocurrency directly from their Binance wallets. The card is available in certain regions and can be used for everyday purchases.

It converts crypto into fiat at the point of sale which makes it easy for users to spend their holdings in real-world transactions.

Trading and Investment Tools on Binance

Binance never shies away from providing what’s best for their users. Through different investment tools, they make trading and investing much easier for everyone. Here are some of the main tools you can use on Binance to improve your trading experience.

1. Advanced Charting with TradingView

TradingView is a popular charting tool and Binance uses it to make analysis easier for its users. This tool allows users to view advanced price charts and trends.

You can see price movements over time and apply different indicators on it. This helps you understand market trends with ease. Additionally, TradingView provides drawing tools so you and everyone else can mark important price points on the chart.

2. Technical Analysis Indicators

Currently there are hundreds of technical indicators that traders use to understand the market trend and where the price can move next. These indicators are built into the platform. Some of the most popular ones are:

- Moving Averages (MA) help you see the average price over a specific period. This helps identify whether the market is trending up or down.

- Relative Strength Index (RSI) measures if an asset is overbought or oversold. It helps spot potential reversals in price.

- Bollinger Bands show if a coin’s price is volatile. They help spot when a price might change direction.

3. Auto-Invest and Portfolio Plans

Binance’s Auto-Invest feature is perfect for long-term investors. It allows you to buy crypto at regular intervals automatically. This is also called dollar-cost averaging. You can easily set up an Auto-Invest plan to buy crypto every week or month to maintain a healthy buying price.

You can also use the Portfolio Plan to build a diversified crypto portfolio over time, which reduces risks and promotes steady growth.

4. Binance Trading Bots

Binance doesn’t like to be left behind in any way. That’s why they created their own trading bots so their users can easily automate their trades. As a user, you can set rules for the bot and it then trades for you automatically based on those rules.

Through this the users can trade 24/7 without having to monitor the market continuously. Trading bots reduce emotional decisions and help you stick to your winning strategy.

5. Margin Trading Tools

Margin trading on Binance allows you to trade with borrowed funds. Binance also provides tools to help manage your margin trades like Average Price and Trade Analysis.

These tools let you track your entry prices and position performance. They also help you manage risk and make necessary changes.

Is Binance Legit?

This is one of the most common questions people ask because of so many legal cases that this exchange had to face over the years. However, according to hundreds and thousands of positive reviews, Binance is legit and there’s no doubt about it. This Binance broker review will tell you all the positive points of this exchange so you can make a better choice.

As a user, you can check how legitimate it is through factors like customer feedback, regulatory compliance and proof-of-reserves. Let’s take a look at all three of these.

Regulatory Compliance

Binance has taken every possible step to comply with various international regulations, however, its status varies by country. As you know this platform uses 2FA, Withdrawal address whitelisting and insurance funds and security measures to protect users.

Proof-of-Reserves (PoR)

Binance has implemented a PoR to enhance transparency. This system allows users to verify that Binance holds sufficient reserves to cover all user assets on a 1:1 basis. The PoR system that Binance uses is Merkle Tree Technology to enable users to independently confirm their assets are included in Binance’s reserves.

Binance.com vs. Binance.US

For U.S-based users, it’s crucial to distinguish between Binance.com and Binance.US. The former one is the global platform which offers a wide range of cryptocurrencies and services. However due to regulatory restrictions the U.S. users are directed to Binance.US, which is a completely different entity to comply with U.S. regulations.

While Binance.US only has a limited selection of cryptocurrencies and features as compared to its global counterpart, it sticks and compolies with their regulatory standards so that American users can trade with peace of mind.

Customer Reviews

Customer feedback provides valuable insights into how Binance is performing. On Capterra and G2, Binance has received a mix of reviews but most of them are positive which shows how well the exchange has been performing.

Binance Review: Pros and Cons

Here are the pros and cons of Binance as a leading exchange.

| Pros | Cons |

| Offers a variety of cryptocurrencies including major coins and altcoins. | Has faced regulatory scrutiny in various countries leading to restrictions. |

| Low trading fee starting at only 0.1% per transaction with additional discounts. | Some users reported delays in customer support responses which is a concern. |

| Supports a wide range of trading options. | Can be overwhelming for beginners. |

| Provides high liquidity for efficient trade execution. | Binance is not available in some countries and certain restricted features. |

| Offers a mobile application for trading on the go for convenience. | Withdrawal fee is somewhat higher than other major exchanges. |

How to Get Started on Binance

If after reading this Binance review, you’re thinking of trading on this platform, here’s what you need to do:

1. Register an Account

After reading this Binance review, you might want to start trading on the platform. For that, go to Binance official website. If you live in the U.S., visit Binance.US. Now go to their Sign Up page and enter your email address or phone number.

You’ll now receive a code in your email or number which you need to enter to verify your account. After that create a strong password and you’re good to go to the next step.

2. Complete Identity Verification

To verify yourself on the platform, you need to provide your full name, data of birth and residential address. Now, submit a government-issued ID such as a passport or driver’s license.

Complete a facial recognition process and make sure you look exactly the same as the photo you provided earlier. Don’t wear any glasses if they aren’t in the image and make sure the camera is clean.

3. Secure Your Account

After you’ve put in all the right details, it’s time to secure your account so it can become tamper-proof. For this, enable 2FA using an authenticator app or SMS to add an extra layer of security.

Also set up an Anti-Phishing Code. Create a unique code that will appear in all official Binance emails to help you identify which helps you identify legitimate communications.

4. Deposit Funds

Now that your account is verified, link your bank account or credit card to deposit fiat currency in your wallet and convert them into USDT or any other available cryptocurrency.

If you already own cryptocurrencies, transfer them to your Binance wallet. You can also use P2P trading if you don’t have a bank account or a credit card.

5. Start Trading

With money in your wallet, all that’s left is trading. Go to the “Markets” section to view available trading pairs. Use the trading interface to place buy or sell orders based on your strategy and where the market is moving.

If you’re new to cryptocurrency, visit the Binance Academy to learn more about how you can best use the platform and the newest strategies for making profit.

6. Staking

If you want to earn some passive income, you can simply stake the cryptocurrency you deposited just now. You can choose a fixed or flexible period based on your preferences.

Binance vs. Coinbase vs. Kraken

Here’s a detailed comparison between three of the biggest cryptocurrency exchanges by trading volume.

| Features | Binance | Coinbase | Kraken |

| Founded | 2017 | 2012 | 2011 |

| Headquarters | George Town, Cayman Islands | San Francisco, USA | San Francisco, USA |

| Supported Tokens | Over 350 | 240+ | More than 200 |

| Trading Fees | Spot Trading: 0.10% for both maker and taker; reduced by 25% when using BNB Futures Trading: 0.02% maker and 0.04% taker; discounts available with BNB | Coinbase: Higher fees; varies by transaction type Coinbase Pro: 0.00% to 0.50% maker and taker fees | Spot Trading: 0.16% maker and 0.26% taker; reduced with higher trading volumes Futures Trading: 0.02% maker and 0.05% taker |

| Security Features | Two-factor authentication (2FA), withdrawal address whitelisting, and Secure Asset Fund for Users (SAFU) | Two-step verification, biometric logins, insurance coverage, and FDIC-insured USD balances | 2FA, withdrawal email confirmation, air-gapped cold storage, and Master Key |

| Customer Support | 24/7 live chat support and comprehensive help center | Email support, help center, and phone support in certain regions | 24/7 live chat support and extensive support documentation |

| Additional Features | Staking, lending, Binance Launchpad, NFT marketplace, and Binance Smart Chain | Coinbase Earn, staking, and educational resources | Staking, futures trading, margin trading, and Cryptowatch |

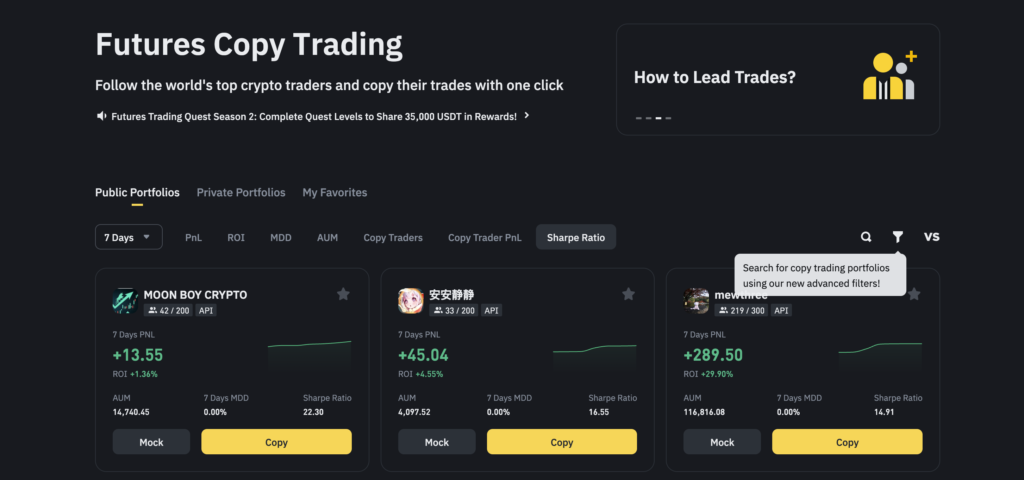

Copy Trading on Binance

Lastly, in this Binance review it’s important to talk about its Copy Trading feature that allows users to automatically replicate the trades of experienced traders. By using this feature the beginners can make the same trades as the Lead Trader and don’t even have to keep an eye on the market all the time.

How Copy Trading Works

Here’s how it works:

- Selection of Traders: You can browse a list of Lead Traders and choose the best one according to their profile that includes their trading performance, strategies, risk levels, and historical data.

- Automatic Execution: Once you have selected a Lead Trader to copy, all of the trader’s future trades are automatically mirrored in your account. This includes opening and closing positions, as well as adjusting stop-loss and take-profit levels.

- Control and Flexibility: While Binance Copy Trading is automatic, you can adjust the settings to make sure you don’t end up in loss. You can also stop copying a Trader if you feel like it’s going the wrong way.

Risk Management

There are various risk management tools on the platform to protect the users. These include the ability to set maximum loss limits and allocate only a portion of the total capital. By using these tools you can minimize your risk level and protect yourself from any significant losses.

How to Allocate Funds to Copy Trading

There are two ways through which you can allocate funds:

- Fixed Amount: The fixed amount will set a fixed cost per order until the total copy amount runs out. It allows you to control the amount invested.

- Fixed Ratio: In this the orders will open in proportion to the lead trader’s position size and your available balance.

For instance, if your Lead Trader has a portfolio of $10,000 and places an order worth $1,000 (10%), your order will be opened using the same 10% ratio. If you invested $1,000, your order will be worth $100 (10%).

Binance Review Conclusion: Is It Worth Investing With It?

For both beginners and experienced traders, Binance provides various features that make it easy to start investing in crypto. If you’re new to trading then you’re in luck as the platform offers a user-friendly interface and Binance Academy to guide to.

In this Binance review, we’ve covered everything from what the platform offers, how you can start trading with it and various markets and products you can explore. However, it’s important to be aware that Binance has faced some regulatory scrutiny in the past and has pleaded guilty on some charges as well.