Do you know copy trading is the new heads-up in the blockchain industry? It’s expected to grow to a market size of $3.77 billion by 2028. There are multiple copy trading platforms now available in the industry and you can make the most of them.

It’s a pretty profitable trading option. All you’ll have to do is copy and replicate the trades of other traders. Copy trading could be your best choice with better risk management and strategic planning.

In this article, we’ll guide you on how you can get started with copy trading and what are the best platforms.

Comparison Table of Exchanges

| Name | Fees | Type | Device | |

| Binance | 0.1% spot trading fee and 0.02%-0.10% futures fee | Crypto Exchange with copy trading tools | Mobile and desktop-compatible | Start trading on Binance now! |

| eToro | 1% trading fees with spreads. | Social trading platform | Website + Mobile app | Join eToro |

| BingX | 0.075% trading fee | Crypto exchange + copy trading | Web, iOS, Android | Explore BingX |

| AvaTrade | Spreads apply, no direct standard fee | Forex & CFD broker + copy trading | Website + Mobile app | Visit AvaTrade |

| OKX | 0.08%-0.1% spot trading fee, futures fees may apply | Crypto exchange + copy trading | Website + Mobile app | Trade on OKX |

| 3Commas | Subscription plan starts from $29/month | Trading bot + copy trading | Mobile and desktop-compatible | Try 3Commas |

Copy Trading Platforms

Following are the trading exchanges that can help you get started with your copy trading future.

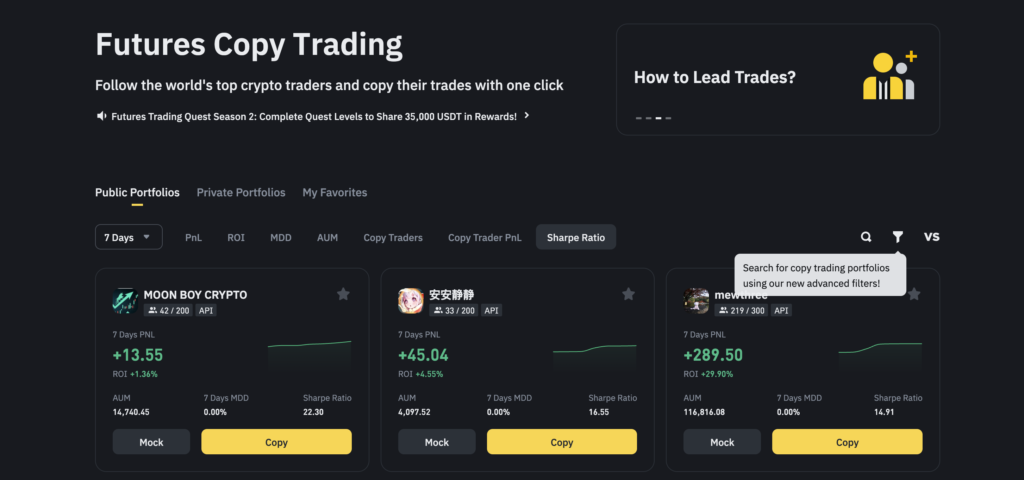

1. Binance – Copy Traders Binance

First up, we have the most famous trading exchange on our list. Binance—all traders know why this platform is truly the best. It constantly ranks on top with the largest trading volume and handles over $60 billion daily transactions.

With 200 million active users globally, this trading platform takes the lead with its diverse features but copy trading makes it more popular. Its high liquidity, low fees, comprehensive tools, and transparency make it highly recommended for copy traders exclusively.

Whether you’re a newbie or an experienced trader, trading with Binance gives you pretty much leverage. It has exceptional copy-trading tools available. There’s a comprehensive futures leaderboard displayed on the platform. This helps the new users track the performance of top copy traders and they can even calculate their risk level over different time frames.

The leaderboard also shows real-time performance alerts, ROI, winning rate, and PnL. If you want to step into the game, Binance also lets you replicate the trades automatically. There are customization options available as well. You can follow specific strategies and win trades too.

The best part? Binance also has third-party copy trading tools. You can integrate APIs like Zignaly, Wunderbit, and Bitsgap, which specialize in copy trading. All of these tools are profit-sharing models with advanced strategy automation.

With this one of the best copy trading platforms, you’ll also find educational content and manual guides to help you place trades successfully. Moving ahead, Binance has a different costing structure associated with copy trading.

If you’re using third-party APIs, they might charge you a specific percentage generated through your trades. For example, Zignaly (API) charges around 20-30%.

Spot trading will cost you around 0.1% and it can be reduced up to 0.075% if you use BNB for fee payments. However, futures trading asks for a maker fee of 0.02% and a taker fee of 0.04%.

There are no additional hidden charges involved unless there is price slippage during high market volatility. But yes, you might have to pay subscription fees for third-party tools and it’ll be priced around $10-100 based on premium features.

See this successful copy trader on Binance. Though, the real name is anonymous but we can review the stats. This trader with the username akqulonur has a commendable monthly ROI of 347% and a PnL of $5,497. He must have some great skills and strategy. This is exactly how you should lead the trading game.

Following are the pros and cons you’ll get with Binance.

Pros

- Transparency

- Low initial investment

- Advanced tools

Cons

- High risk

- Extreme market fluctuation

2. eToro – Best Copy Trading Platform

Now, let’s move forward. If you don’t find Binance user-friendly, eToro is here to save your day. It’s one of the pioneer and best social trading platforms you could ever find. Though this platform made its debut in 2007 but copy trading tools were introduced in 2010, making it an absolute game-changer in the blockchain industry.

eToro has been operating globally in over 100+ countries with 35 million active users. This trading exchange stands out from the crowd due to its diverse offerings.

You’ll get to trade cryptos, commodities, stocks, ETFs, forex, and so much more which gives you even more chances to broaden your investment portfolio.

Being a copy trader, it’s a no-brainer why you shouldn’t opt for this exchange. There are multiple helping tools available. You’ll find CopyTrader™ that allows you to replicate trades automatically.

With this tool, you can apply filters as well based on PnL, ROI, risk score, win rate, and portfolio. However, you will have to make a minimum $200 investment to copy trades.

eToro also has a quite popular investor program. It basically encourages top-performing traders to share their strategies and risk management. Those traders also get to earn a percentage of assets with this investing program.

Also, if you’re someone who believes in pre-practice, eToro has simplified portfolio management strategies. There are diverse investment portfolios available by eToro based on specific themes, such as “CryptoPortfolio” or “TechLeaders”. This way you’ll get pre-investment packages for mindful trading.

The best part? eToro cares about your funds. You can practice placing trades on a virtual trading account of $100,000. No risk, no loss, this is the best way you can have practical implementation of your learning practices.

Additionally, despite these copy trading tools, there are the following costs associated. eToro has a fair fee structure. It charges variable spreads on assets. The typical spreads for forex start from 1 pip and for cryptocurrencies at 0.75%. Overnight fees are also applied to leverage positions and short trades but it depends on market volatility too.

This is one of the best copy trading platforms undoubtedly that’s why you’ll find lots of successful traders. One popular name is Jay Edward Smith. This guy had over 12,000 copies in July 2024, and a successful monthly return of 24.61%. He focused on tech stocks and cryptocurrency.

Another good name is Amit Kupfer. He has over 9,300 copies with a return of 111.2% over two years. He must have some secret sauce with great strategies.

Following are eToro’s pros and cons.

Pros

- Modern and easy-to-use application

- Commission-free stocks and ETF trading

- Diversified market

Cons

- Limited advanced tools.

- High fees on some products.

3. AvaTrade – Best Copy Trading USA

Next up, we have AvaTrade. This is one of the best trading exchanges in the USA and has earned a strong reputation, particularly for copy trading. Whether you’re just starting or you’re already experienced, AvaTrade has diverse trading tools available to help you.

This platform is regulatory compliant with the Central Bank of Ireland (CBI), the Australian Securities and Investments Commission (ASIC), and the Japanese Financial Services Authority (JFSA) thus you won’t have to worry about funds protection. AvaTrade operates in 150+ countries and has localized services to cater to all audiences.

This trading exchange is considered best for copy trading. There are multiple tools available to help you. AvaSocial is one of them. It enables users to follow and copy the trades of seasoned investors. You’ll also find different sorts of asset classes. AvaSocial has cryptocurrencies, stocks, stocks, and commodities.

It basically provides a detailed solution for traders who want to automate their copy trading strategies and avoid maximum risk. Do you know AvaTrade also has integrated tools? You can use DupliTrade which will help you monitor top-performing trading stats in real-time. This way you can replicate advanced trading ideas and implement them practically.

DupliTrade has a relatively clean interface and offers a broad range of proven trading strategies. If you want to make your portfolio stronger, this is the best opportunity. Despite these two tools, there’s also a third-party app called ZuluTrade available you can integrate. It’s highly compatible with a large network of professional traders.

Similarly, with ZuluTrade, users can copy top trades based on their ROI returns, PnL, and whatever measuring parameter they prefer. Moving ahead to cost association, AvaTrade keeps it pretty simple. There are no additional charges for copy-trading on this platform.

AvaTrade has competitive spread offerings. If you spread forex pairs, it starts from 0.9 pips. This cost is pretty below the average considering the industry standards so that you can trade effectively.

One thing worth mentioning is that if your AvaTrade is inactive for three consecutive months, you will have to pay $50, with a monthly fee of $100 after 12 months of inactivity.

These additional charges are just to avoid inconsistency and encourage continuous trading. Also, keep in mind, with AvaTrade, positions held overnight might be applicable for a swap fee but it also depends on market conditions. Hence, it’s recommended to consult AvaTrade’s fee schedules for reasonable rates.

Additionally, it’s worth mentioning that AvaTrade does not disclose top-performing trader’s stats. But with third-party apps like ZuluTrade and DupliTrader, you can have detailed performance statistics with competitor’s metrics.

See its pros and cons.

Pros

- Risk management tools

- Regulatory compliance

Cons

- Inactive account charges

4. BingX – Best Copy Trading Fees

Established in 2018, BingX has gained a strong reputation in the blockchain industry. It functions both as a trading exchange and a platform. You’ll find it among the best copy trading platforms. This trading exchange has strong regulatory standards and is highly determined towards security.

It’s reputed globally owing to its best UI, transparency, advanced tools, and blockchain ecosystem. BingX gives you high leverage if you don’t want to place trades manually and believe in successful strategy replication of top traders.

This trading exchange displays comprehensive trading profiles with statistics along with win rate percentages, risk level monitoring, and historical performance analysis.

The best part? BingX supports a wide market. There are 750 cryptocurrencies listed such as Bitcoin, Ethereum, and Solana, and traditional financial assets like forex, indices, and commodities.

BingX has advanced copy trading tools available. It lets you copy the strategies of advanced traders and put trades mindfully through its proprietary copy trading system. There’s another cool feature of pre-order copying. You can copy whole individual trades of a trader for more flexibility in managing specific positions.

The best part? This allows users to choose an exact amount of their funds to be put in a trader’s portfolio. This feature is called partial position copying. All these different copy-trading models on BingX ensure both traders and copiers have a lucrative time trading.

Moving ahead to cost management, BingX has fair deals. The platform has a competitive trading fee of 0.15% per transaction. These are standard charges. However, also note that some traders implement a profit-sharing model with BingX. The percentages can vary and you must review them before agreeing on individual trader’s terms.

BingX also has an elite trader program. This encourages the top-performing traders to share their coping strategies with the audience. These traders have above 70% win rate and generate monthly profits consistently.

You can also do customization with different copy parameters such as maximum capital allocation, stop-loss, and, take-profit levels. Additionally, BingX is highly compatible with mobile phones, both on Android and iOS. Its clean layout will motivate you to stick with this platform.

Following are its pros and cons.

Pros

- Security and transparency

- Different copying models

- User-friendly interface

Cons

- Geographic limitations

5. OKX – Best Copy Trading Platform UK

On the 5th spot, we have the OKX trading exchange and platform. It’s one of the best copy trading platforms widely celebrated for its advanced tools, intuitive UI, and diverse trading options. OKX is highly recommended for copy traders as it has some cool features. First up, OKX has great transparency for its users.

All the top-performing metrics, stats, analysis, win rate, and PnL are displayed on the platform. This helps novice traders decide in making an informed decision about what traders to follow and copy.

Secondly, OKX has a wide range of assets available. There are 300 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You’ll also find traditional financial derivatives like perceptual swaps and futures.

OKX has a great market audience in copy trading. This platform offers comprehensive tools and guides to help all traders. You’ll find a trading dashboard for monthly or weekly evaluation of your performance.

The dashboard will feature an asset allocation breakdown, success rate metrics, and a follower profitability chart. You’ll get to see how many successful replications of your trades have been executed. On OKX, you can make customized settings also. Apply filters based on maximum investment per trade and risk threshold. This will help you retain control over your portfolio.

OKX also has a mobile application feature thus you can always have access to on-the-go trading. This platform copy trading system is equipped with other risk management tools like stop-loss and take-profit settings. You can also utilize them for greater benefits.

OKX also has strong security protocols on its copy trading system. It has cold wallet storage for user funds and regular audit maintenance for an extra layer of security.

Moving ahead to cost management, users usually pay around 5–10% of profits earned from copying a trader. However, traders also can charge a flat fee for copying.

On OKX, the spot trading fee starts at 0.08% for makers and 0.10% for takers. But if you have an OKB native token, discounted charges will be applied. However, for futures trading, it starts at 0.02% for makers and 0.05% for takers.

Now, let’s see some of OKX’s top-performing traders. See this guy with the username Smoggy-Dild-Taro. He has a win rate of 40% with 17% PnL for the last 30 days. Currently, this trader does spot trading but he has good potential in futures trading too.

Another name could be this guy with the username Chultoo. This man has a 74% winning rate with 18% PnL for the last 30 days. You can also copy his strategies for winning trades.

Here are OKX’s pros and cons.

Pros

- Cost-effective

- User-friendly

- Global reach

Cons

- Dependence on trader’s performance

- Limited customer support

- Steep learning curve

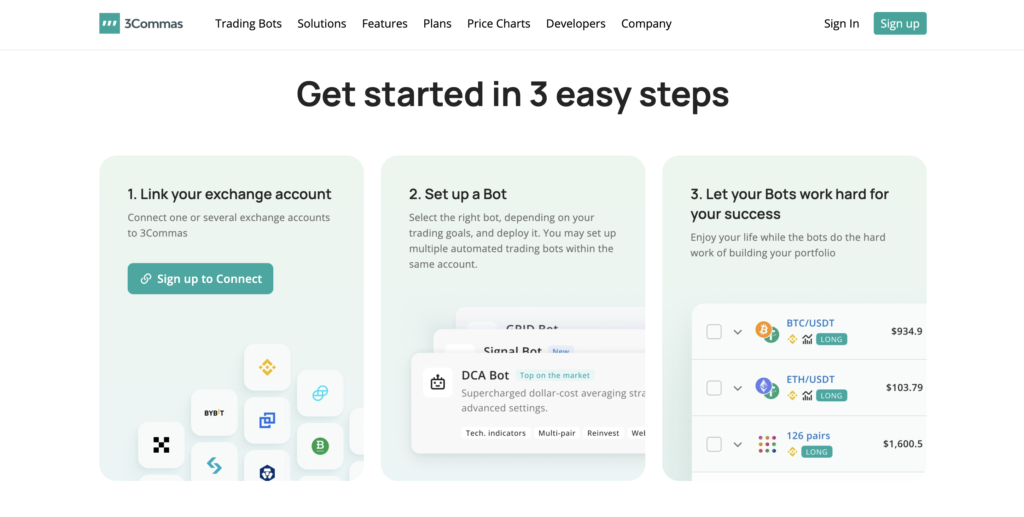

6. 3Commas – Best Copy Trading Program

Lastly, we’ve got 3Commas trading exchange to discuss. It has been established as one of the best copy trading platforms in the crypto industry. 3Commas focuses on smart trading strategies, automation, and advanced analytics that help it cater to both new and professional traders.

Though this platform was launched in 2017 since then, it’s been making waves. 3Commas’s trading bots and tools have made it the best choice There are almost 220,000 traders active on this platform. This large number surely reflects its popularity and reliability.

You might think what makes it best for copy trading? Well, here’s your answer. 3Commas has powerful trading bots. You’ll find a DCA (Dollar Cost Averaging) bot, Grid bot, and Options bot. These bots let you replicate trade with advanced customization.

On 3Commas, there’s even a smart trading terminal available. This helps you manage your trades across multiple exchanges. It’s highly compatible with big exchanges like Binance, Coinbase, Kraken, etc thus the users will get even more chances to diversify their portfolio.

You’ll find many tools for copy trading at 3Commas. Just like Signal Analytics. It helps with real-time data to help users evaluate trader performance. Numerous trading bots are also there to diversify your trading strategies. If you’re concerned about your portfolio, 3Commas even helps you with that. It helps with rebalancing of investment.

Moving ahead to cost management, 3Commas takes the lead there. It has a fair and easy costing structure. If you access the free plan, you’ll get to use basic features like portfolio tracking and SmartTrade. Extending the budget to $29 per month will give you access to a starter plan that involves SmartTrade and paper trading.

3Commas also has an advanced plan for $49 per month. With that, you can use DCA and Grid bots. If you’re looking for even more, 3Commas has a pro version that will cost you $99 per month.

With this plan, you can use all trading tools including options bots and unlimited trading accounts. Also, note that the platform doesn’t have any standard performance fee but the traders can set a flat fee for copying trades ranging around 10-20%.

Here are its pros and cons:

Pros

- Efficient UI

- Backtesting and customization

- Powerful trading bots and tools

Cons

- Subscription costs

- No in-built exchanges

How do I Start Crypto Copy Trading?

Copy trading is an excellent way for you to get started. You won’t need to have deep technical knowledge. Just a few strategies and you’ll be good to go, Following are these:

1. Choose a Platform

First, decide which platform you’ll trade. It should support copy trading explicitly since not all the exchanges offer this. Do not go for an exchange that doesn’t have a global reputation, you may lose your funds with scams.

Check for security features like 2FA, copy trading models, and cold wallet storage. Most importantly, identify your budget. Every trading exchange has different cost management. Go for what you find most reliable.

Pro Tip: Explore the trading application with a demo account (if available) to familiarize yourself before you put in your investment.

2. Research Traders

Once you’re done with platform selection, start looking for top-performing traders. Note that not all exchanges display a performance leaderboard so you have to be mindful of this while choosing an exchange.

Evaluate the traders based on their risk level, performance history, trading style, win rate, and follower success. Additionally, don’t forget to look at average monthly returns and the number of executed trades the traders have.

3. Start Small

This is an absolute tip. Do not fall for money traps. Crypto copy trading is lucrative but it also involves great risks. Starting small will help you minimize the risk factor. First up, set a budget for loss.

Allow yourself a 5-10% loss from your investment capital so that you can’t get demotivated after a non-profit day. Don’t copy only one trader. Divide your funds among multiple traders. This way you won’t have a big loss.

Pro tip: Always make informed decisions. Don’t invest big capital in a market boom. Once it’s normal, you may have a substantial loss.

4. Re-evaluate and Monitor

Don’t be blind. Copy trading asks for continuous consciousness. Regularly monitor your trading performance along with the trader you copy. It’s very essential for long-term success. Look for daily ROI metrics, reallocate the funds, and continuously assess the trader you follow.

The top-performing traders can also have a rough patch. Once the metrics start declining, switch to another trader before you lose your funds. This practice will save you from significant risks.

Conclusion

Summing up, we have seen which platforms are suitable for copy trading and how you can get started with it. This is a pretty revolutionary field and you won’t have a hard time automating trades. Copy trading will give you all the leverages but you should be mindful of platform selection.

If you’re a beginner and seeking a better UI with comprehensive tools, Binance, eToro, and BingX can help you the most. However, if your main focus is trading bots and different trading options, 3Commas will be the best choice. But if you love exploring different assets, AvaTrade will cater to you.

Hence, do your research. Properly evaluate the platform and don’t forget to assess the traders you follow. Once you follow all the guidelines, there will be near to no chance of losing a substantial investment. Happy Trading!

FAQs

Choose a platform

Research and evaluate different traders

Start small to minimize the risk effect

Keep monitoring your trade performance for better strategy management