When trading cryptocurrency, finding a crypto exchange with lowest fees is essential if you want to maximize your profits. However there are some exchanges that charge high fees which can quickly drain your profits. Every time you buy, sell or even move your crypto, those fees add up which means you’ll have less than you actually worked for.

For active traders this means you’ll lose a significant amount of their potential earnings over time. High trading fees also makes it harder for traders to scale their investment especially when trading popular cryptocurrencies like Bitcoin or Ethereum. So, if you want to get the best out of your trades and keep more of your hard-earned money, read this guide till the end.

10 Best Crypto Exchange with Lowest Fees

Here’s a brief overview of the top 10 crypto exchanges that charge the lowest fees.

| Exchange | Trading Fees | Unique Feature | |

| MEXC | 0.2% spot trading | Over 2600 cryptocurrencies | Explore MEXC Now |

| Binance | 0.1% spot; 0.02%-0.04% futures | Discounts with BNB tokens | Trade on Binance Today |

| Coinbase | 0.5% spot; lower on Pro | Beginner-friendly with solid security | Start Trading on Coinbase |

| Bybit | 0.01% maker; 0.06% taker | Copy trading and high leverage | Try Bybit |

| Kraken | 0.16% maker; 0.26% taker | Decade-long reliability with staking options | Sign Up for Kraken |

| eToro | 1% spread-based fee | Social trading with CopyTrader | Join eToro |

| KuCoin | 0.1% spot; 0.02%-0.06% futures | Extensive altcoin selection | Trade on KuCoin Now |

| Margex | 0.19% spot | Margin trading with multi-collateral support | Visit Margex |

| BingX | 0.075% taker; 0.02% maker | Focus on derivatives and copy trading | Copy Trade on BingX |

| NovaDAX | 0.10% maker; 0.15% taker | Niche altcoins for Latin America traders | Discover NovaDAX |

Now, let’s discuss all the crypto exchanges with lowest fees in detail so you can choose the one that best suits your needs.

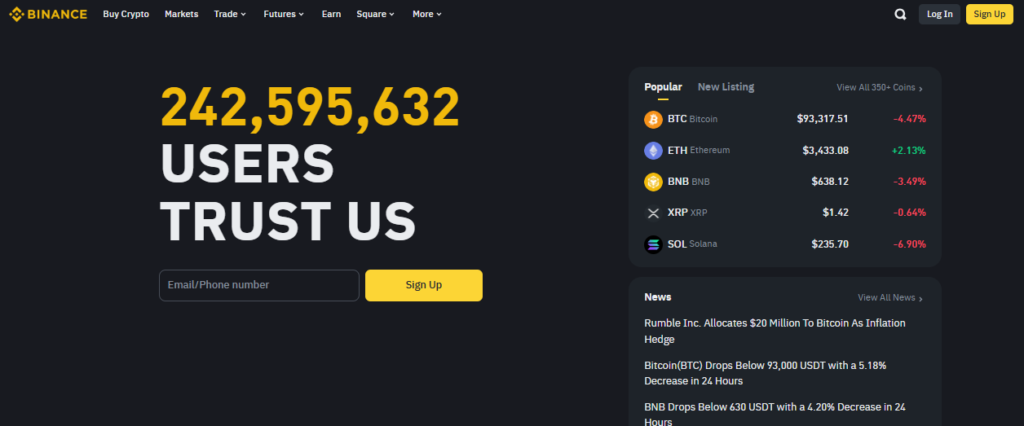

Binance – Very Competitive Fees with Lots of Trading Pairs

Changpang Zhao in 2017 founded Binance, which is now one of the top rated crypto exchanges in the world. It is headquartered in Cayman Islands although it operates all over the world with 53 offices. Known for its massive trading columns, Binance is perfect for both beginner and advanced traders. The platform has essentially become a leader in the crypto space.

Binance offers over 400 cryptocurrencies with over 1500 trading pairs. It also supports an NFT marketplace where users can buy, sell and mint unique NFTs. In terms of the global trading volume Binance stands at the top spot. You can also earn up to $100 in passive income by referring traders to this platform by using Binance Referral ID.

The best thing about Binance is its low trading fees which starts at 0.1% for spot trades. Users who are smart enough to use Binance Coin, get a discount and only have to pay 0.075% as fee. For futures trading, the fees are even lower with rates starting at 0.02% for makers and 0.04% for takers. It is essentially the lowest fee crypto exchange on the market.

Trading Tools

- Spot and Margin Trading: Offers regular trades and leveraged options for higher returns. It’s perfect for traders at all levels.

- Futures Trading: Provides high leverage and advanced tools for experienced users. It’s ideal for those trading large volumes.

- Staking and Savings: Lets users lock or lend their assets to earn rewards. Flexible options are available for different needs.

- Launchpad for Token Sales: Enables users to participate in new crypto projects early. It’s great for those seeking innovation.

Security Features

- SAFU Fund: A secure asset fund to cover user losses in case of a security breach. It’s an emergency safety net.

- Device Management: Allows users to monitor and remove unauthorized devices. This adds control to account security.

Pros

- Offers an NFT marketplace for crypto collectibles.

- Supports over 400 cryptocurrencies and many trading pairs.

- Lowest trading fees starting at only 0.1%.

Cons

- Have faced some regulatory issues in some jurisdictions.

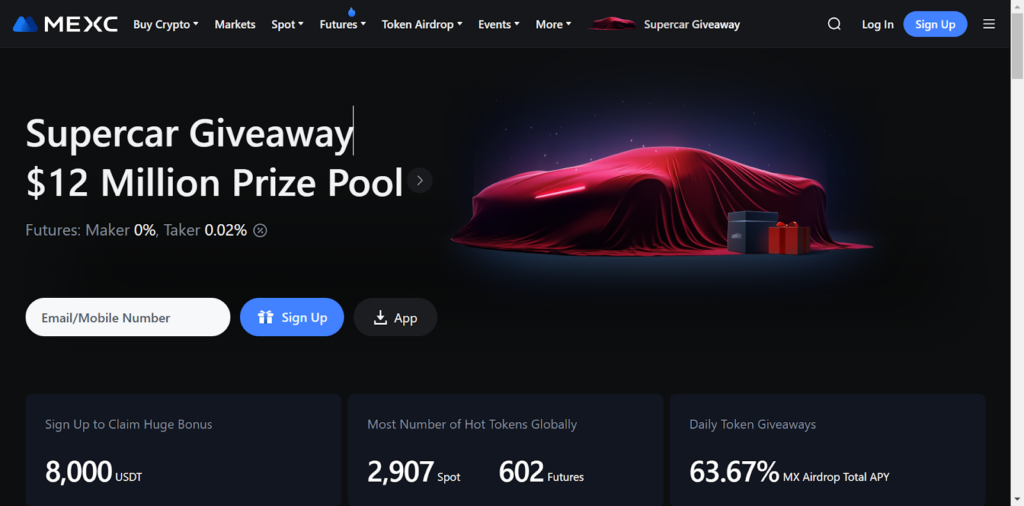

MEXC – Low Fees and a Great Range of Coins

MEXC, also known as MEXC Global, is a cryptocurrency exchange founded in 2018 in Seychelles. The purpose of its foundation was to provide users with an accessible and cost-effective platform for trading cryptocurrencies. Known for its focus on affordability and a huge selection of assets, MEXC is especially popular among budget-conscious traders. Over the years this crypto exchange has gained a reputation for being supportive of new projects.

There are over 2600 cryptocurrencies on MEXC available for trading at all times. This includes major coins like Bitcoin, Ethereum, Solana and more. The platform also supports an NFT marketplace where users can trade unique digital assets. This crypto exchange with lowest fees ranks among the top 20 exchanges globally by trading volume.

MEXC charges a flat 0.2% fee for spot trades. There are no deposit fees and withdrawal fees which depend on the cryptocurrency being withdrawn. You can also reduce these fees by holding and using MX tokens which is the native token of the MEXC exchange.

Trading Tools

- Spot Trading: Allows users to buy and sell cryptocurrencies instantly at market prices. It’s simple and perfect for quick trades.

- Futures Trading: Offers leverage options, letting traders open positions with higher exposure. It’s ideal for those looking to maximize gains.

- Staking and Earn Programs: Users can lock their assets to earn passive income. These programs include flexible and fixed-term options.

- Market Insights and Alerts: Provides real-time data and notifications for market trends. It helps traders stay updated on price movements.

Security Features

- Cold Wallet Storage: Keeps the majority of funds in offline wallets. This protects assets from potential online threats.

- Anti-Phishing Code: Lets users set a code to identify legitimate emails from MEXC. It helps prevent phishing scams.

Pros

- Low trading fees of 0.2% only.

- Offers over 2600 cryptocurrencies.

- Conducts regular audits to keep the system up to date.

Cons

- Limited fiat deposit options for beginners.

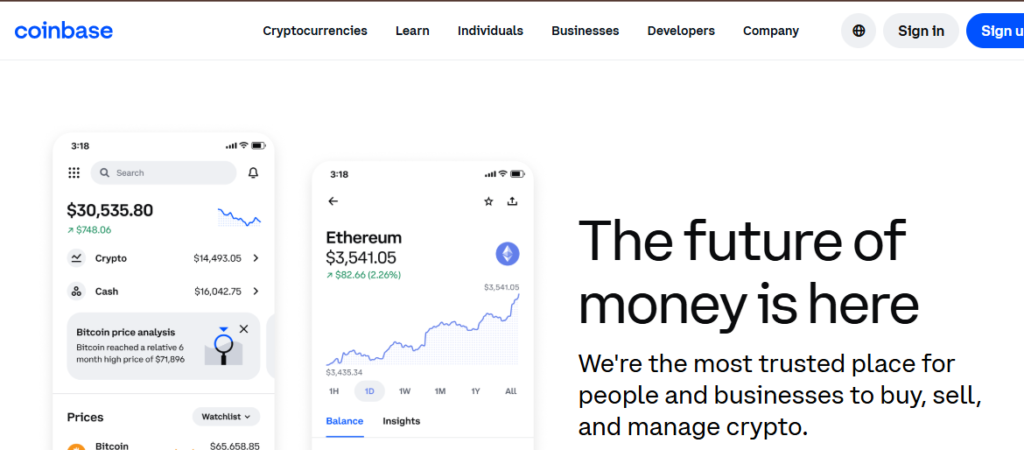

Coinbase – Beginner-Friendly with a Simple Interface

In 2012, Brian Armstrong and Fred Ehrsam went on a journey to build Coinbase as one of the most trusted cryptocurrency exchanges all over the world. Headquartered in San Francisco, USA, Coinbase focuses on providing a secure and user-friendly platform for trading and managing crypto assets. It is being publicly traded on NASDAQ which makes it more transparent.

Coinbase offers access to 240 cryptocurrencies and also features a Coinbase Wallet. Apart from that, there’s also an NFT marketplace for users who are more interested in blockchain-based art and collectibles. Coinbase is the #1 choice for beginners due to its simplicity and reputation.

Coinbase charges relatively higher fees as compared to some other options. Their trading fees start at around 0.5% per transaction. Additional fees are applied for deposits and withdrawals according to payment method and amount. For active traders, Coinbase Pro offers a lower fee structure with maker fees starting at 0.04% and taker fees at 0.06%.

Coinbase recently launched Coinbase One which is a subscription-based service that offers zero trading fees and customer support. You can also earn a Coinbase bonus by signing up on this exchange as a new user.

Trading Tools

- Coinbase Learn: Educational resources to help new users understand crypto. It’s perfect for beginners starting their journey.

- Recurring Buys: Lets users automate crypto purchases. It’s a great way to invest regularly without effort.

- Advanced Charting on Coinbase Pro: Offers in-depth analysis tools for experienced traders. It’s ideal for market study.

- Coinbase Wallet: A secure and standalone wallet for holding and managing crypto. It’s suitable for those seeking independence.

Security Features

- FDIC Insurance: Protects US-based users’ fiat deposits up to $250,000. It’s an added layer of financial security.

- Bug Bounty Program: Encourages ethical hackers to find vulnerabilities. This strengthens platform reliability.

Pros

- Publicly traded company with a strong reputation.

- Advanced trading tools available on Coinbase Pro.

- Offers a standalone wallet for asset management.

Cons

- Limited number of altcoins compared to competitors.

Bybit – Ideal for Advanced Traders with Great Tools

Bybit was released in 2018 by Ben Zhou specifically for advanced traders looking for precision tools. It is based in Singapore, specializing in derivatives and futures trading. It has grown rapidly due to its focus on user experience and cutting-edge trading features. All this makes it a top choice for professional traders.

This crypto exchange with lowest fees supports around 697 cryptocurrencies. Its main focus is on derivatives trading which makes it a hub for futures and perpetual contracts. Bybit has also earned a spot among the top 10 exchanges globally for derivatives trading volume. Just recently, Bybit launched a copy trading feature which allows users to follow and replicate the strategies professional traders use.

Bybit offers competitive fees with maker fees at 0.1% and taker fees at 0.06% for derivatives trading. Spot trading fees are slightly higher at 0.1% for both makers and takers. There are no deposit fees but withdrawal fees vary depending on the tokens. In the end, don’t forget to get the Bybit sign up bonus.

Trading Tools

- Futures and Perpetual Contracts: Lets users trade with leverage up to 100x. It’s ideal for maximizing potential profits.

- Copy Trading: Allows users to replicate strategies of experienced traders. It’s perfect for those new to advanced trading.

- Smart Order Routing: Provides options like stop-loss and take-profit. This gives traders more control over their strategies.

- Advanced Charting Tools: Offers customizable graphs and indicators. It’s designed for detailed market analysis.

Security Features

- Multiple Account Security: Includes email, 2FA, and withdrawal whitelists. These options protect user accounts.

- Advanced Encryption Technology: Ensures that data transfers remain secure. This prevents unauthorized access.

Pros

- Low fees, especially for derivatives trading.

- Advanced tools like smart orders and copy trading.

- High leverage options for experienced traders.

Cons

- Regulatory restrictions in some countries.

Kraken – Reliable with Strong Security Features

Jesse Powell in 2011 founded Kraken. It is one of the oldest and most reliable cryptocurrency exchanges. Headquartered in San Francisco, USA, Kraken focuses mainly on providing a secure and professional trading experience. It supports a variety of cryptocurrencies and is known for its strong security measures.

Kraken has approximately 215 crypto tokens including Bitcoin, Ethereum and Polkadot. It also supports staking for multiple coins which enables users to earn rewards. This exchange frequently ranks among the top exchanges globally due to its reliability and strong reputation in the industry. Kraken recently introduced Kraken Pro, a redesigned version with lower fees and advanced features.

This crypto platform charges maker fees starting at 0.16% and taker fees at 0.26% which decreases with higher trading volumes. For instant buy options, fees range from 1.5% for cryptocurrencies to 0.9% for stablecoins. Staking fees are also minimal and they have recently added new coins like Solana and Cardano. Additionally, Kraken referral is a great way to earn passive income by referring your friends to this platform.

Trading Tools

- Spot Trading: Provides a straightforward way to buy and sell cryptocurrencies. It’s ideal for both beginners and seasoned traders.

- Margin Trading: Allows users to trade with leverage up to 5x. This is suitable for risk-tolerant investors.

- Staking Rewards: Lets users earn rewards by locking supported coins. It’s perfect for generating passive income.

- OTC Desk: Offers private trading for large transactions. It’s ideal for institutional traders.

Security Features

- Encrypted Data Transfers: Protects sensitive information during transactions. It prevents unauthorized access.

- Cold Storage for Assets: Keeps 95% of funds offline to prevent theft. It’s one of the safest storage systems.

Pros

- High reliability with over a decade of operation.

- Offers staking for passive income opportunities.

- User-friendly interface with professional-grade tools.

Cons

- Slightly higher fees for instant buy options.

eToro – Social Trading with a User-Friendly Interface

Founded in 2007 by Yoni Assia, eToro is a global platform known for its social trading features which allows users to interact, follow and copy other traders. Based in Israel, eToro is popular for its user-friendly design and simplifies the trading process for everyone. It caters to beginners and casual traders looking to explore other financial assets like stocks and commodities as well.

eToro supports around 70 cryptocurrencies along with traditional financial assets which makes it a versatile multi-asset platform. eToro’s CopyTrader feature stands out as the best one among many others of the platform which enables users to replicate top-performing trades of investors in real time. Recently, eToro announced the integration of DeFi staking services for users to earn rewards on specific cryptocurrencies.

This broker has a spread-based fee structure, with spreads starting at 1% per trade for cryptocurrencies. While there are no deposit fees, withdrawal fees are fixed at $5 per transaction. The platform also charges a $10 monthly inactivity fee for accounts that remain dormant for over a year.

Trading Tools

- CopyTrader: Allows users to follow and copy successful traders. It’s perfect for beginners learning from experts.

- Smart Portfolios: Offers pre-designed portfolios based on specific themes or markets. This helps diversify investments easily.

- Crypto Staking: Provides staking rewards on supported assets. It’s an excellent feature for earning passive income.

- Live News and Social Feeds: Combines financial news and community updates. It helps traders make informed decisions.

Security Features

- Regulated by Multiple Authorities: Licensed by organizations like FCA, CySEC, and ASIC. This ensures compliance and safety.

- Funds Segregation: Keeps client funds separate from company funds. This protects user assets in case of financial issues.

Pros

- Social trading features make investing easier for beginners.

- Multi-asset platform includes stocks and commodities.

- Offers staking rewards for passive income opportunities.

Cons

- Higher spreads compared to some competitors.

KuCoin – Wide Variety of Altcoins and Trading Options

KuCoin was founded in China and was then moved to Singapore later on and from there to Seychelles. It is a crypto exchange known for its vast selection of altcoins and trading options. This exchange is also called “The People’s Exchange” as it provides access to niche coins and innovative features. Because of over 700 cryptocurrencies, KuCoin is essentially the best place to buy crypto.

The platform also has a P2P marketplace for direct crypto trading and a KuCoin NFT marketplace for digital collectibles. KuCoin frequently ranks among the top exchanges in global trading volume. Recently, this platform launched KuCoin Ventures which is an initiative to support blockchain projects and startups. There’s also a lending feature for investors so they can lend crypto to other users and earn interest.

KuCoin has competitive fees with spot trading fees starting at 0.1% per trade. Users who pay with KCS also receive a discount of 20%. The good thing is the deposits are free but there’s some withdrawal fees depending on the crypto. KuCoin also offers low fees for futures trading which starts at 0.02% for makers and 0.06% for takers.

Trading Tools

- Spot Trading: Offers basic buy-and-sell options for all users. It’s simple and efficient for daily trades.

- Futures Trading: Provides leveraged trading for advanced users. This allows for higher profit potential.

- Crypto Lending: Lets users lend their crypto to earn interest. It’s a passive income opportunity for long-term holders.

- Trading Bot: Automates trades based on user preferences. This helps maximize efficiency and minimize effort.

Security Features

- Insurance Fund: Protects user assets in case of security breaches. This ensures financial recovery for affected users.

- Security Verification Steps: Includes email, 2FA, and trading passwords. These protect accounts from unauthorized access.

Pros

- Offers low trading fees with additional discounts for KCS users.

- Includes advanced features like crypto lending and bots.

- Active development of new tools and marketplace options.

Cons

- Limited fiat deposit options for beginners.

Margex – Excellent for Margin Trading

Margex was founded in 2020 and is based in Seychelles. This best crypto exchange with lowest fees specializes in margin trading. It is designed for traders seeking leverage and offers an intuitive platform with strong tools through which you can execute your trading strategies. Margex is known for its clean interface which makes it accessible to both new and experienced traders.

This crypto platform supports trading for major cryptocurrencies including Bitcoin, Ethereum, and Litecoin. While the platform mostly focuses on derivatives and margin trading, it also offers competitive spreads and trading pairs for essential crypto assets. Margex has also recently introduced multi-collateral trading because of which users can now open positions using various cryptocurrencies as collateral.

Margex charges a flat fee of 0.19% for spot trades, which is competitive among margin trading platforms. Funding rates for leveraged positions vary depending on the crypto token and market conditions. Withdrawal fees are fixed at 0.0005BTC for Bitcoin transactions which ensures transparency in costs.

Trading Tools

- Margin Trading: Offers up to 100x leverage on key cryptocurrencies. It’s perfect for experienced traders seeking higher returns.

- Risk Management Features: Includes stop-loss and take-profit options. These tools help limit losses and secure gains.

- Customizable Charts: Provides advanced technical analysis tools. It’s ideal for precise strategy planning.

- Social Trading Insights: Shares market sentiment from other traders. It gives users an idea of current trends.

Security Features

- Anonymized Trading: Does not require extensive personal data for account setup. This protects user privacy.

- DDoS Protection: Prevents service disruptions from malicious attacks. It ensures a stable trading experience.

Pros

- Specializes in margin trading with up to 100x leverage.

- Transparent fee structure with no hidden charges.

- Advanced tools for technical analysis and risk management.

Cons

- No dedicated spot trading marketplace.

BingX – Focused on Derivatives and Copy Trading

The next exchange on the list of BingX which focuses on derivatives trading and copy trading features. Founded in 2018 and based in Singapore, the platform aims to simplify advanced trading strategies for users by enabling them to follow experienced traders. BingX has also gained popularity because of its strong focus on social trading.

BingX supports over 700 cryptocurrencies including Bitcoin, Ethereum and Chainlink. Its derivative platform includes perpetual contracts for popular assets. With the help of BingX’s copy trading marketplace, you can connect with the best traders out there and use their strategies to make some much-needed profit. Recently, this platform has introduced zero-fee campaigns for certain crypto pairs.

BingX charges 0.075% from takers and 0.02% from makers in derivatives trading. There are no deposit fees as usual and the withdrawal fee is as per cryptocurrencies. For copy trading, users have to pay an additional performance fee which depends on the trader they’re following. Now users can even customize the percentage of their funds automatically allocated to different trades.

Trading Tools

- Copy Trading Platform: Lets users follow and replicate top traders’ strategies. It’s perfect for beginners exploring derivatives.

- Perpetual Contracts: Offers high-leverage options for advanced users. It’s ideal for maximizing potential profits.

- Real-Time Market Analysis: Provides detailed charts and data insights. This helps users track market trends effectively.

- Demo Trading Mode: Allows users to practice trading without risks. It’s great for learning new strategies.

Security Features

- Multi-Layer Encryption: Secures user data during transactions. It protects sensitive information from unauthorized access.

- Cold Wallet Storage: Stores the majority of user funds offline. This prevents loss from cyberattacks.

Pros

- Focused on derivatives trading with competitive fees.

- Copy trading makes advanced strategies accessible for beginners.

- Offers a demo mode for risk-free learning.

Cons

- Customer support can be slow during peak times.

NovaDAX – A Good Choice for Trading Altcoins

The last crypto exchange with lowest fees is NovaDAX. It was established in 2018 and is currently based in Brazil. This cryptocurrency exchange focuses on providing a user-friendly experience for trading altcoins. As one of the largest exchanges in Latin America, NovaDAX has gained quite a lot of popularity in a short time. The main goal of this exchange is to make crypto trading approachable for everyone from beginners to experienced traders.

NovaDAX currently has 469 cryptocurrencies including the major ones as well as numerous altcoins which are not commonly found on other platforms. The exchange also supports fiat-to-crypto trading in Brazilian Reals (BRL) and Euros (EUR). Its focus on niche altcoins makes it an attractive option for all the traders looking to explore less mainstream projects.

NovaDAC provides competitive spot trading fees. It starts at 0.10% for makers and 0.15% for takers. For fiat-to-crypto trades, there is a flat fee depending on the transaction method. Just recently NovaDAX has introduced a cashback program as well for high-volume traders.

Trading Tools

- Spot Trading: Lets users buy and sell cryptocurrencies instantly. It’s easy to use, even for beginners.

- Fiat-to-Crypto Gateway: Supports trading in local currencies like BRL and EUR. It simplifies the process for regional traders.

- Altcoin Trading Pairs: Provides access to niche cryptocurrencies. It’s great for diversifying portfolios.

- Mobile App: Offers on-the-go trading with real-time updates. It’s perfect for active traders.

Security Features

- Two-Factor Authentication (2FA): Protects accounts with an additional verification step. It prevents unauthorized access.

- Cold Wallet Storage: Keeps most funds offline, away from potential cyber threats. This enhances fund security.

Pros

- Competitive fees, especially for fiat-to-crypto trades.

- Cashback program rewards high-volume traders.

- User-friendly interface suitable for all experience levels.

Cons

- Lacks advanced trading tools for professional users.

What Are the Common Fees on Crypto Exchanges?

Crypto exchanges charge different types of fees for their services and it’s important for every trader to understand these costs for managing your trading budget. Here are the common fees on different crypto exchanges:

1. Trading Fees

Trading fees are the costs you pay for buying or selling cryptocurrencies on an exchange. These are typically divided into Maker and Taker fees.

The Maker fee is charged to users who provide liquidity by placing limit orders that are not immediately executed. On the other hand, Taker fees are charged to users who take liquidity by placing orders that are matched immediately.

2. Deposit Fees

This fee is charged when you add funds to your account which is either fiat currency or cryptocurrencies. Most exchanges do not charge fees for depositing cryptocurrencies.

The fiat deposit fees vary based on the payment method you use such as credit cards, bank transfer or PayPal. For instance, if you use a credit card on Coinbase, you’ll have to pay up to 3.99% meanwhile bank transfers are completely free. So choose wisely.

3. Withdrawal Fees

Withdrawal fees apply when you want to move your funds out of your exchange wallet.

The fiat withdrawal fee is charged when you withdraw money to your bank account. For example, eToro charges a flat $5 fee for all withdrawals.

Meanwhile, crypto withdrawal fees totally depend on the token, the quantity you’re withdrawing and the network you’re using.

4. Inactivity Fees

Some exchanges also charge inactivity fees for accounts that remain idle for a longer period. For instance eToro charges a monkey $10 inactivity fees if your account hasn’t been activated in over a year.

5. Network Fees

These are fees required to process transactions on the blockchain and they change according to the coin and network activity. This means that if you’re trying to send Bitcoin during a high-traffic period, you’ll have to pay higher network fees due to demand.

6. Conversion or Spread Fees

This next type of fee applies when you exchange one currency for another, especially for fiat-to-crypto or crypto-to-crypto transactions. For example on Coinbase, users have to pay a spread fee or 0.5% to 2% for converting currencies.

The reason why it matters is that this hidden cost can add up in the long term, especially for people who trade frequently.

7. Subscription or Premium Fees

Some platforms also offer premium features, like reduced trading fees, additional analytics or priority customer service but in exchange for a subscription fee.

An example of this comes from Coinbase One, which charges a monthly subscription fee for removing trading fees and providing dedicated support.

Summing Up

Trading cryptocurrencies can be exciting but higher fees can take away a big part of your profits if you’re not careful. Low-fee exchanges are a great way to save money especially if you trade often. They help you keep more of your earnings while offering a good range of tools and coins.

Always check an exchange’s fee structure before signing up. Compare different platformsJI to find the best crypto exchange with lowest fees. This small effort can save you a lot in the long run. By making smart choices you can reduce costs and grow your profits gradually.