Decentralized Crypto Exchange (DEX) is changing the way we trade cryptocurrency. With unique features like full control over assets, robust security, privacy, and Peer-to-Peer (P2P) transactions, a large number of investors are flocking to these exchanges. Many experts believe that decentralized exchanges will dominate the crypto industry in the future.

But you might be puzzled: what’s the best DEX exchange you should go for in 2025? Continue reading as we’re going to explain how DEX works, its features, and bring you the best decentralized exchange cryptocurrency choices. So you can pick the DEX that suits your needs. Without further ado, let’s get started.

Comparison of Popular Decentralized Exchanges

Here you can have a quick view of fees and supported blockchains of popular decentralized crypto exchanges.

| Name | Fees | Number of Cryptos | |

| Uniswap | 0.3% per trade | 8 | Trade on Uniswap |

| SushiSwap | 0.3% per trade | 40+ | Trade on SushiSwap |

| PancakeSwap | 0.25% per trade | 8 | Trade on PancakeSwap |

| OKX DEX | 0.1% – 0.3% per trade | 100+ | Trade on OKX DEX |

| dYdX | 0.02% – 0.5% per trade | 188 | Trade on dYdX |

What is a Decentralized Crypto Exchange?

A Decentralized Crypto Exchange or DEX works in the same way as a normal crypto exchange, where you can buy and sell digital assets. But there are a few key differences. First, DEX doesn’t rely on a central authority or intermediaries. This means you can buy and sell cryptocurrencies directly Peer-to-Peer (P2P).

Secondly, it uses autonomous smart contracts like Automated Market Makers (AMMs) to facilitate trade. They utilize liquidity pools, which are pre-funded pools of crypto assets with 50/50 token pairs.

Let’s take the DOGE/USDT pair to understand this. Anyone can contribute to the pool by depositing DOGE and USDT. As a result, the decentralized exchange remains functional and liquid. This lets traders effortlessly swap DOGE for USDT, or vice versa, without requiring a direct match. A small fee is generated with every trade, and part of it goes to people who contributed to liquidity.

A unique thing about AMMs is their automatic price adjustment. For instance, if most investors swap DOGE for USDT, DOGE’s price will fall, while USDT’s price will rise as supply and demand fluctuate. This constant price adjustment is algorithmic, so trades don’t get hung up.

How It Differs from Centralized Exchanges:

The main advantage of a decentralized crypto exchange is that you get full control over your crypto assets. Additionally, unlike CEXs, DEXs run on decentralized blockchains. This means that once a transaction is recorded in a block, nothing can be changed or removed. Therefore, there’s no chance of anything bad happening on the platform.

Another advantage of a DEX exchange is its high level of anonymity. DEX doesn’t ask for any personal info. All you need to have is a crypto wallet app to get started. Plus, since it’s decentralized, there’s no third party overseeing or regulating it. In addition, there’s less chance of data breaches with decentralized exchanges.

Compared to a centralized exchange, a DEX exchange offers unmatched transparency which makes it a good option for traders who want full transparency. All the trade records are made public on blockchain ledgers so anyone can verify their legitimacy. This transparency makes people trust and believe the platform since it reduces fraud and manipulation risks.

Features of Decentralized Exchanges

A decentralized crypto exchange offers many advantages over centralized exchanges, thereby making it a far superior alternative. Let’s look at a few of the primary benefits.

1. Security

A big advantage of a decentralized crypto exchange is that it’s super secure. Unlike centralized exchanges, which are susceptible to hacking, DEXs let you control and own your assets, so centralized vulnerabilities won’t exist.

Further, a DEX exchange allows you to maintain control over your private keys. This ups the security even more and lowers the risk of hackers. Usually, if you use a CEX they keep your digital asset in their own wallet as a custodian. It might seem more convenient, but there are risks, like the centralized cryptocurrency exchange failing and getting hacked.

A perfect example of this is the recent failure of the $50 billion algorithmic stablecoin TerraUSD and its twin token Luna.

2. Anonymity

Another big plus of a DEX exchange is that you don’t have to verify your identity and fill out Know Your Customer (KYC) forms, which gives you more privacy. KYC involves getting traders’ personal info, like their full name and a picture of their government ID. It’s tiring and that’s why DEXs pull in people who don’t want to be identified.

Additionally since DEXs do not censor cryptocurrencies and digital assets, they offer a wider range of options than CEXs.

3. Low Fees

As DEXs use the Peer-to-Peer model, they offer several cost-saving benefits to users. First of all, DEXs usually charge lower trading fees than centralized exchanges, which can be a big deal for people who trade a lot. Additionally, you won’t have to pay for intermediaries or custodians since there’s no central authority to deal with.

You know what’s even better? P2P transactions on DEXs settle instantly. Therefore, traders benefit from faster access to funds, resulting in better cash flow and operational efficiency.

4. Global Accessibility

A decentralized crypto exchange also promotes financial inclusion by making financial services accessible to the ones left out by traditional financial institutions. With fewer KYC requirements and lower entry barriers, DEXs open up the global crypto market to people in developing countries.

In addition to that, trading tokenized assets can help diversify portfolios and provide new investment opportunities.

Popular Decentralized Exchanges

Now that we have covered the basics of DEX let’s look at a few best decentralized crypto exchanges that you can choose from.

OKX DEX – Best decentralized crypto exchange app

OKX DEX is a decentralized crypto exchange aggregator in the OKX network. The platform allows users to exchange cryptocurrencies on various blockchain networks in a non-custodial way. It facilitates wallet-to-wallet transactions directly using smart contracts. Plus, it removes the need for intermediaries while improving security.

OKX DEX has more than 100 supported blockchain networks, such as Ethereum, BNB Chain, Polygon, and Arbitrum. It provides cross-chain swaps, where users can exchange assets easily between ecosystems. The exchange pools liquidity from over 400 decentralized exchanges (DEXs) so that it can offer competitive rates and limited slippage for traders.

The non-custodial nature of trading gives the users total custody of their private keys and assets and reduces the risks related to centralized exchanges. It also features an intuitive interface with multiple modes of trading, including Easy Mode for swift exchanges, Meme Mode for rapid trading options, Advanced Mode for strategic holds, and Bridge Mode for fast cross-chain trading.

Security is of prime importance at OKX DEX. The platform undergoes regular audits by top blockchain security companies such as CertiK and SlowMist. This approach helps to improve the dependability and transparency of the project. This is how OKX DEX provides its users with a secure, fast and flexible trading environment. It could be an ideal platform for those looking for decentralized and trustless trading options.

Uniswap – Best decentralized ethereum exchange

Uniswap reigns supreme as the top decentralized crypto exchange with an established role in the DeFi space. It was launched in 2018 when Ethereum was just starting to make a name for itself. Fast forward to today, it has released several improvements and has become the DeFi juggernaut that is influencing countless other projects and pushing the crypto sector to new heights.

Uniswap specializes in Ethereum-based (ERC-20) projects. In fact, many ERC-20 tokens that launch first choose Uniswap as their exchange listing. Plus, Uniswap utilizes an Automated Market Makers model, which allows trades to take place against a liquidity pool rather than through traditional order books.

Talking about the interface of Uniswap, it’s highly regarded for its simplicity and ease of use. Whether you’re swapping tokens on the simplified version 2 or trying out the advanced features of version 3, this platform makes it easy to interact with multiple networks.

Plus, it conveniently shows your token balance right on the screen once your connected wallet is detected. In addition, when you initiate a swap, the protocol takes the quickest route to get you the best price. Additionally, you’ll see an estimate of the swap price and network fees upfront, so you know how much it will cost.

In terms of trading fees, Uniswap is competitive with some of the best crypto exchanges like Coinbase. Uniswap incorporates a standard trading fee of 0.30% into its transaction price formula for swapping tokens.

Uniswap requires network fees for each swap, which are separate from its trading fees. Through token swaps, fees are collected directly into liquidity reserves, rewarding liquidity providers by increasing their share value.

However, Uniswap swaps can get expensive if you’re on the Ethereum network and gas prices spike at times of high network activity.

Uniswap allows users to earn DeFi yields as well. It offers staking on many cryptocurrencies with competitive APYs. Additionally, Uniswap has a robust governance model. Those holding UNI, the native token, can cast votes on key initiatives. This creates an ecosystem that is fair and inclusive for everyone.

PancakeSwap – Best decentralized bitcoin exchanges

PancakeSwap is another best decentralized crypto exchange you should check out. It is built on the Binance Smart Chain (BSC) that offers a convenient and cost-effective alternative to Ethereum-based platforms. Also, PancakeSwap gets the first listing for newly launched BSC tokens after presales.

Launched in 2020, PancakeSwap became a favorite among cryptocurrency investors for its low transaction fees and fast confirmations, which mitigated Ethereum’s scalability issues. According to PancakeSwap, more than 4.4 million people have traded on its DEX in the last 30 days. Isn’t it cool how popular this DEX exchange has become among crypto traders?

PancakeSwap offers users a wide range of financial products and features through a friendly, simple interface. It lets you customize everything from the language you choose to how you want to trade. Plus, it has a dark mode, which is great for late-night traders who don’t want bright screens.

A killer feature is the personalized profile setup that allows you to track transactions and show off your PancakeSwap NFT available for only 1.5 CAKE tokens. Moreover, it’s got robust documentation and an active community to assist you with any questions, so it’s super user-friendly.

PancakeSwap offers a variety of features, but two stand out: yield farming and the gamified lottery system. Further, yield farming gives you rewards for putting your crypto in liquidity pools. PancakeSwap has farms with interest rates above 10%, including “Syrup” pools for staking CAKE tokens. The best part is you have a choice of flexible staking, where you can withdraw anytime, or higher rewards with fixed staking.

The gamified lottery is equally thrilling, giving you the chance to win huge CAKE prizes. The ticket costs around $5 in CAKE, and you can pick numbers or go random. Winners get massive rewards, which makes it a fun and rewarding game. The platform also has Initial Farm Offerings (IFOs) to participate in early access to new tokens.

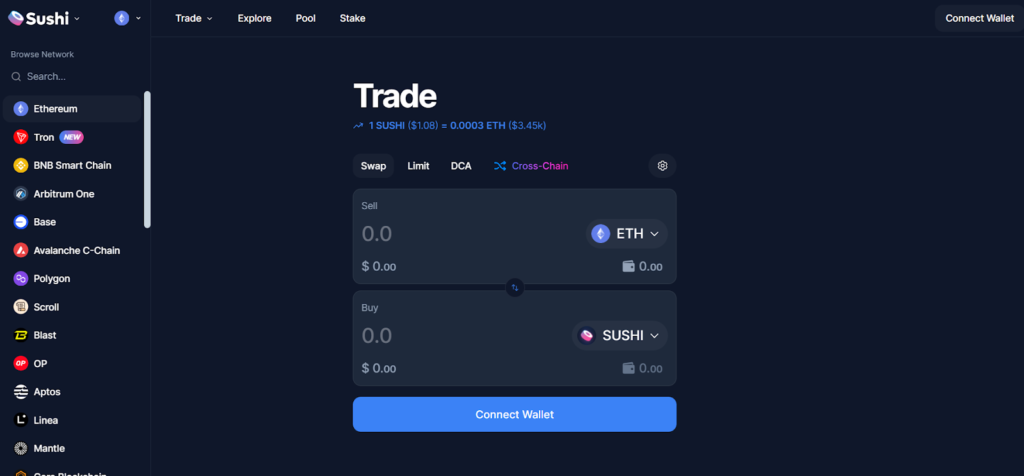

SushiSwap – Best decentralized exchange no kyc

SushiSwap is another outstanding decentralized crypto exchange aimed at beginners. This platform is also built on the Ethereum blockchain that lets you trade ERC-20 tokens straight from your wallet.

Being a fork version of Uniswap, SushiSwap rapidly gained traction with its innovative features. It has now expanded to multiple blockchains, including Binance Smart Chain, Polygon, and Avalanche, giving users access to a variety of assets.

One standout feature that makes SushiSwap a hit with beginners is its simple terminology and fun Japanese restaurant theme that makes decentralized trading approachable. Rather than overloading users with complicated crypto jargon, SushiSwap uses creative terms like “BentoBox” and “Kashi” to convey features in an understandable manner. This playful theming helps new users get comfortable with DeFi’s interface.

The platform also offers easy-to-follow guides that explain how to interact with its Automated Market Maker tools. This makes it easy for even crypto newbies to navigate confidently.

Another standout aspect of SushiSwap lies in its rewards system, which both entices users to participate and adds liquidity to the platform. For example, liquidity providers receive a kickback of 0.25% on trades in their pools. Plus, those who stake SUSHI, SushiSwap’s native token, get xSUSHI tokens, which they can use to gain an extra 0.05% of the platform fee.

Besides awesome rewards, SushiSwap offers decentralized finance services like yield farming, staking, and lending, making it the ultimate one-stop shop. Coupled with an intuitive interface, traders can swap tokens and explore advanced features without a hitch.

SushiSwap’s governance model also focuses on decentralization. With SUSHI, holders are able to vote on proposals, which lets the community influence the platform.

dYdX – Best decentralized crypto trading platform

dYdX is a decentralized crypto exchange that provides users with advanced trading options such as perpetual contracts and margin trading. A former Coinbase engineer Antonio Juliano founded dydX in 2017. Since then, the platform has become a leader in the decentralized finance space. It initially traded on Ethethereum blockchain, but the exchange moved to its own dydX chain in October 2023. This move helped enhance transaction speed and reduce gas fees.

Plus, dydX uses an order book system that allows users to perform trading precisely and also provides better control to high-frequency traders. Its new infrastructure, built on Cosmos SDK with Tendermint consensus not only improves scalability but also enhances transaction efficiency.

DYDX is the native governance token of the dydX exchange. It allows users to participate in the decision-making process of the platform. Moreover, users can stake assets for rewards and also contribute to network security in many ways. Trading options include perpetual contracts, margin trading, and spot trading, with advanced tools like stop-loss and limit orders for risk management.

dYdX’s transition to its own chain is a step towards complete decentralization. With its 100x leverage, low fees, and deep liquidity, dYdX continues to define the future of decentralized trading.

How to Choose the Right Decentralized Exchange

With so many possibilities to choose from, picking the correct DEX is an important consideration. The following are some major things to be looked at:

Security Measures

Security should be of top priority when choosing a decentralized crypto exchange. Since DEXs are implemented on smart contracts, code flaws can be hacked by malicious users. Make sure that the platforms undergo regular security audits from companies like CertiK or PeckShield.Bug bounty programs and multi-signature wallet support are also signs of a security focus.

Liquidity Levels

Liquidity determines the effectiveness of trades. A platform with large liquidity pools guarantees no price slippage, i.e., users can buy or sell large quantities without disturbing the price of the asset dramatically. Exchanges such as Uniswap and OKX DEX have large liquidity pools and thus are suitable for high-volume trading.

User Experience

A good DEX must have a user-friendly and simple user interface. Although Uniswap and PancakeSwap are trader-friendly to new traders, dYdX has provisions for more advanced traders with upper-level functions such as leveraged trading and examination of the order book. Mobile accessibility is also necessary for those who wish to trade from anywhere.

Supported Assets

All DEXs are not available to trade all currencies. If you want to exchange particular tokens, make sure they are listed there. For instance, Uniswap deals primarily with Ethereum-anchored tokens, whereas PancakeSwap specializes in Binance Smart Chain assets. Cross-blockchain DEXs such as OKX DEX and ThorChain allow cross-blockchain swapping of assets without issues.

Fee Structure

DEX fees vary based on trading costs, gas fees, and withdrawal charges. Platforms like Uniswap charge a standard 0.3% trading fee. If you’re trading on Ethereum-based DEXs, consider using Layer 2 solutions like Arbitrum and Optimism to reduce gas fees.

Getting Started with Decentralized Crypto Exchanges

Here is a step-by-step process that you can follow to execute decentralized trade.

Setting Up a Wallet

You will require a non-custodial crypto wallet before the usage of a DEX. The most popular wallets include MetaMask (for Binance Smart Chain and Ethereum) and Trust Wallet (for multi-chain). Additional protection is given through hardware wallets such as Ledger and Trezor, with the private keys held offline.

Connecting to a DEX

First, navigate to the website of the DEX and hit “Connect Wallet.” Confirm the request for connection from your wallet screen, and you’re now able to trade.

ExecutingTrades

After connecting, choose a pair to trade, input the quantity, and agree to the trade. Make sure to set slippage tolerance levels to prevent trades from being rejected by price movements.

Providing Liquidity

Most DEXs allow users to earn passive income by providing liquidity. This is done by adding an equal amount of two tokens into a liquidity pool in return for a portion of the trading fees. Be cautious of the risk of impermanent loss, though, which can hurt returns if token prices move against you.

Advantages and Challenges of DEXs

A decentralized crypto exchange is leading a revolution within the cryptocurrency space and offers advantages you won’t find on centralized exchanges. But there are some drawbacks you should know about. So, let’s check these out.

Advantages

Custody

DEXs are non-custodial. This allows you to transact without having to relinquish control of your private keys. DEXs are interconnected with externally held wallets, and trades are managed by smart contracts. Centralized exchanges, on the other hand, hold your private keys, thus acting as a custodian for your funds. On top of that, DEXs rarely experience issues like freezing funds or preventing withdrawals.

Privacy

Privacy is another big reason to trade on exchange platforms. The DEX platform lets users trade anonymously, unlike centralized exchanges that require users to give them personal info and verify their identity. The users don’t have to reveal their identities when trading, so they’re protected and less likely to get scammed.

Additionally, DEX platforms often encrypt data and use other security measures to keep unauthorized parties at bay.

Censorship-proof

Unlike centralized exchanges, DEXs aren’t regulated, so they’re naturally censorship-resistant. There are a lot of centralized crypto platforms that aren’t just regulated by governments, but they’re also manipulated by markets. But that’s not the case with a decentralized crypto exchange since it relies on publicly distributed networks that can’t be controlled by one entity alone.

Furthermore, blockchain technology makes transactions immutable and impossible to manipulate.

Challenges

Liquidity Problems

On centralized exchanges, Liquidity comes from massive amounts of capital. A DEX exchange often suffers from this problem since its liquidity is mainly determined by how many people trade on its platform. Moreover, it lacks access to an easy-to-use fund that would make trading a lot easier.

Complex User Interface

DEXs can be tricky to use for people who don’t understand decentralized blockchain. There are so many steps involved in learning how to trade on DEX, making it difficult to keep track of them

The first step usually involves familiarizing yourself with external wallets so you can use DEX. Following that, you must deposit cash or cryptocurrency into your wallet. The next step is to link the wallet to the DEX interface so you can execute a trade. On the flip side, a CEX provides greater simplicity for depositing funds.

Susceptible to Scams

As a decentralized crypto exchange doesn’t have a centralized authority, it’s more susceptible to scams, like fake tokens or phishing. This means fraudsters can list fake tokens and trick people into trading or staking them. Additionally, phishing sites that mimic DEX interfaces can compromise users’ funds, so staying vigilant and being aware of security is a must.

Conclusion

As blockchain adoption grows every day, decentralized crypto exchanges are a big deal. The degree of freedom, anonymity, and robust trading features a decentralized crypto exchange has to offer is amazing. However, it’s important for you to do your research and understand the tools and platforms you use. As attractive as it may seem at first glance, understanding the fundamentals of decentralization takes a lot of experience and knowledge.