Do you know there’s an easy way to earn interest on your cryptocurrencies without worrying about where the market goes? There are so many crypto traders that are always on the lookout for platforms that would allow them to grow their assets while they sleep.

Yes, we’re talking about the Nexo exchange. It’s a crypto app designed to help users earn interest on their digital assets like Bitcoin, Ethereum and many other stablecoins. As of 2024, Nexo crypto app has over 7 million users globally and is available in over 200 jurisdictions. This app is growing every year which shows how reliable it is for traders.

The most impressive thing about this platform is you can earn upto 16% on certain crypto assets. But the main question here is, is it the best platform for earning interest in 2024? We’ll find that out in this detailed guide.

Keep reading to know everything there is to know about Nexo exchange.

What is Nexo?

Nexo is the leading crypto lending and borrowing platform with a huge user base. It offers lots of amazing financial services so that the users can make the most out of their digital assets. It was founded in 2018 and till now it has gained significant popularity due to its innovative approach to crypto finance. The primary mission of this company was to bridge the gap between traditional finance and the world of cryptocurrency that is growing at a rapid pace.

It provides the users with tools to earn interest on their digital holdings, borrow against their crypto and even trade assets in the easiest ways possible. Through this platform, you can earn passive income without trading anything. Just put your tokens on the platform and they’ll multiply themselves over time.

This platform is especially attractive for traders who want to grow their investment without actively trading. The Nexo exchange supports tons of cryptocurrencies which include Bitcoin, Ethereum and even stablecoins like USDT and USDC. Users can also deposit fiat currencies such as USD, EUR and GBP.

Nexo operates under a unique business model that combines security of the highest level, insurance on assets and regulatory compliance. This platform stores the users’ funds in a leading and fully audited custodial wallet provided by partners like Fireblocks and Ledger Vault. This Ledger Vault insures the digital assets of individuals it holds. This insurance is upto $150 million through a customized insurance program by Arch Insurance (UK) Limited.

The NEXO Token

The NEXO tokens is the native cryptocurrency of the Nexo ecosystem. There are several benefits that you can open up by holding even a little bit of these NEXO tokens. Benefits include higher loyalty tiers, increased interest rates and lower borrowing costs. You can also get additional perks like free withdrawals and cashback on purchases.

Now this token was initially launched with a dividend-paying model. Through this the users were able to receive a portion of Nexo’s profits. However this model is now replaced with daily interest payouts but the NEXO tokens are still an important part of the overall ecosystem. They incentivize the users through these tokens in different ways for holding and participation.

How Does Nexo Work?

As you already know Nexo is primarily a lending and borrowing platform that offers financial services to maximize the value of your digital assets. The idea behind it is simple: allow users to earn interest on the crypto tokens they hold or take out significant loans by using their crypto assets as collateral.

Nexo was part of the “Big 3” platforms in this industry but is now the only one in the entire space after Celcius and BlockFi filed for bankruptcy in 2022.

Now, let’s break down the different parts of Nexo in an easy way:

Setting Up Your Account

If you want to start using Nexo, you’ll need an account first. The signup process is quite simple and only requires some basic personal information, email address and a password.

Once you’ve registered, complete the standard Know Your Customer (KYC) verification process. By doing so Nexo complies with regulations and protects users from any fraud whatsoever. The verification process typically involves providing government-issued ID and proof of address

Depositing Funds

Now, once your account is set up and verified, the next step is to deposit funds. There are a variety of cryptocurrencies that you can deposit into your Nexo account.

You can also deposit fiat currencies so choose the assets that you already own and make purchases directly on the platform by using your preferred payment method.

Earning Interest

One of the main features which makes Nexo exchange so popular is its ability to help users like you earn crypto interest. We’ve talked about it before as well and we’ll do it again and this is something that goes side by side with this platform. After depositing the funds you can start earning interest in no time.

Nexo offers daily payments but the interest rates vary depending on the asset and whether you opt to receive your interest in NEXO tokens or not. There’s no lock-in period on this platform which means you can withdraw your funds whenever you want and there’s not even a penalty that we usually see in other such platforms. All of this happens by staking crypto on their platform.

Taking Out Crypto Loans

Apart from staking, Nexo also allows users to take out crypto loans by putting your existing assets as collateral. You don’t have to sell your assets this way and can just get them back once you pay back the loan after earning significant profit from it.

The way it works is, as soon as you deposit funds, you get access to a credit line in fiat or stablecoins. The loan amount depends on the value of your tokens and the Loan-to-Value (LTV) ratio set by the exchange on different types of assets. The LTV typically ranges between 20% to 90%. The higher the volatility, the higher the LTV.

These loans are quite flexible with no definite due date. You can return them whenever you want and take back your holdings. You can use the loan as long as you maintain the collateral value.

Instant Crypto Exchange

Nexo isn’t an exchange itself. It’s basically a platform that supports multiple services. One of them is a built-in exchange that allows users to instantly swap between 300+ trading pairs.

This means that you can trade cryptocurrencies, stablecoins and even fiat currencies on this platform. The process is quite quick and there are no hidden charges.

Loyalty Program

Nexo has its own native cryptocurrency, the NEXO token. It plays a significant role in how the platform operates. By holding NEXO tokens in your account you can unlock additional benefits. These include higher interest rates on your deporits, lower rates on loans and access to dividends from Nexo’s profit.

These benefits are not provided by any other such platform. The more NEXO tokens you have in your crypto wallet, the higher your loyalty tier will be. These tiers range from Base to Platinum and each of these offer better and better rewards.

Security and Transparency

Nexo keeps the users’ funds safe with several layers of protection. Their security features include military-grade security protocols and multi-factor authentication (MFA). The platform also uses the best of the best custodians such as Ledger Vault and Fireblocks to keep the funds safe.

These custodians provide insured cold storages which means that even if there were a security breach, the funds would be protected to a certain amount decided beforehand. Nexo is also fully compliant with internal regulations so the users can have peace of mind.

Major Features of Nexo’s Platform

Nexo is one of the best platforms for literally everything that you can think of in the crypto space. Lending, borrowing, trading, card and much more. For this Nexo review, we’ll talk about all of these features in detail. Keep reading.

Nexo Fees

The main agenda that Nexo works on is to provide users with a fee-free experience. However at some point the users need to pay a little fee which is considerably non-existent. There’s no trading fee at all on swaps as it uses a spread mechanism. This means that the price you pay includes a small margin which the platform pockets.

If you’re a Nexo Pro user, the trading fee will depend on your 30-day trading volume. For instance if your trading volume is around $10k then the fees would be 0.2% (both maker and taker). However for higher volumes the fees go as low as 0.04%.

Apart from that Nexo also offers free trade allowance for withdrawals. They offer approximately 5 free withdrawals every month depending on your loyalty level. Additionally the withdrawals on the Polygon, Binance Smart Chain, Arbitrum and EOS networks are completely free. However you might have to pay an encounter fee if you exceed the free withdrawal limit.

Crypto Lending and Interest

As mentioned before, users can earn interest on Nexo by lending their assets. It’s quite simple. After depositing crypto or fiat into your Nexo account you can earn daily interest payments. There are two ways in which you can earn through this platform.

- In-kind: Earning the same currency you deposit

- Through NEXO: Earning the interest through the native token

Typically the interest rate is upto 16% for different cryptocurrencies but by opting for getting paid in NEXO, you can increase it by 2%. Now it’s upto you to decide which one you’re more comfortable with. You can use the Nexo calculator to see how much you can earn with your initial holding.

If you have Axie Infinity then you’re in luck as you’ll be getting 30% interest which is the highest on the platform. Lastly, Nexo doesn’t impose any lock-in period so the users can withdraw their funds whenever they want.

Crypto Borrowing and Credit Lines

Nexo platform also allows users to borrow money by using their crypto portfolio as collateral. It’s important for users who want some liquidity but don’t want to sell their current crypto tokens. Borrowing from Nexo is quick and simple and anyone with the right funds can do it. It comes at a rate as low as 2.9%.

You can receive funds within 24 hours of your application and can be in 80 different currencies. The repayment plan is quite simple as well as there’s no installment. You pay the loan partially or fully whenever you want. To date, Nexo has issued $8 billion in credit lines. Try to keep your LTV ratio below 20% to enjoy the best rates.

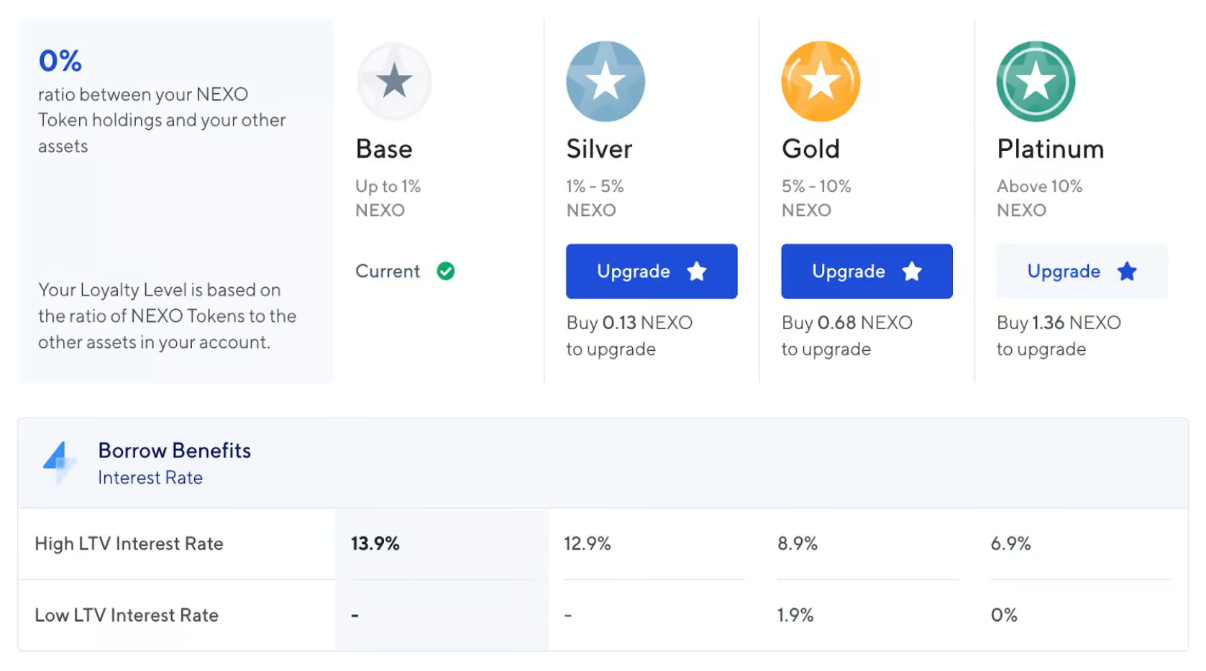

One unique feature of Nexo’s borrowing system is the ability to borrow at 0% interest if you are a Gold or Platinum member. Because of this high-tier users get access to cash without incurring any interest. This feature is particularly useful for those who may not have a strong credit history but still need access to funds.

Nexo Loyalty Levels

Nexo currently has four loyalty tiers namely Base, Silver, Gold and Platinum. The higher your loyalty tier, the better the perks you receive, such as higher APY rates in the Earn section and lower borrowing rates.

For instance if you’re at the Platinum tier you can earn maximum interest and borrow at the lowest rates. Due to these features the users are encouraged to hold NEXO tokens which helps them unlock greater rewards.

Swapping and Exchanging Cryptocurrencies

After that Nexo offers a built-in exchange that allows users to swap between more than 300 trading pairs. The Nexo Smart Routing System connects users to the top 10 crypto exchanges in real-time so the users can get the best possible rate on their trades. You can swap tokens instantly and earn up to 0.5% cashback depending on their loyalty tier.

The convenience of Nexo’s swap feature is further enhanced by the fact that any funds swapped into interest-bearing assets are automatically placed in your Earn account. This means that your crypto is always working for you and earning interest for you even while you’re sleeping peacefully.

Nexo Booster

If you’re looking to increase your portfolio without any extra capital, you can use the “Nexo Booster” feature to get some leverage. Through this tool the users can borrow more funds to increase their existing positions. You can leverage your crypto by up to 3x which means you can triple your exposure to any crypto asset.

This feature is especially useful for traders who want to capitalize on market trends and buy the dips. However using this is quite risky so make sure to manage your risk beforehand or you might end up losing tons of money.

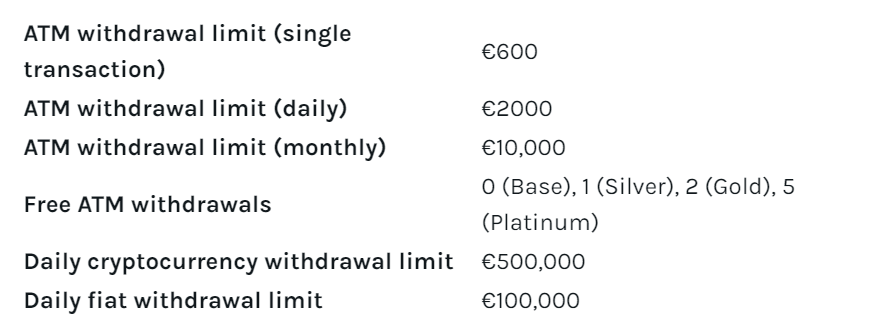

Nexo Card

The Nexo card is a crypto-backed debit card offered by the Nexo exchange. It allows users to spend their crypto assets anywhere MasterCard is accepted. If you’ve this card, you’ll also get 2% cashback on all your purchases. This incentive makes Nexo cards quite popular and attractive.

There’s no monthly or annual fee for this card which makes it extremely cost-effective. Additionally you can pay in local currencies through this card, making it useful for frequent travelers. One of the most significant benefits of the Nexo card is that it allows users to continue earning interest on their crypto holdings even while spending them.

NFT Collateral for Borrowing

Lastly, apart from the traditional crypto collateral, this platform also lets users borrow stablecoins against their NFTs (Non-Fungible Tokens). You can use high-value NFTs like Bored Aped and CryptoPunks as collateral and borrow up to 20% of their value.

This feature is particularly useful for people who have NFTs but don’t want to sell them yet as the NFT market is still at one of its lowest points. So if you have any high-value NFt that’s sitting idle, use it to borrow some digital assets and trade.

Nexo Wallet

Nexo recently introduced a Web3 wallet that gives users access to the DeFi (Decentralized Finance) ecosystem and a unique identity. One of the best features of this wallet is that you can import your existing MetaMask and Coinbase wallet directly into the Nexo wallet.

This wallet is compatible with five Ethereum-based networks including Polygon and Avalanche. However it does not support Bitcoin or Cardano so keep that in mind if you have those assets. This wallet also provides added benefits such as batched transactions and the ability to pay transaction fees in different cryptocurrencies.

Key Features

- Aggregated Wallets: You can view all your wallets in one place. It makes it easier for you to see your NFTs and tokens together.

- Efficient DEX Trading: Nexo Wallet aggregates liquidity pools from multiple decentralized exchanges. It minimizes price impact and ensures you get the best possible price when swapping tokens.

- DeFi Yields: You can interact with popular decentralized applications (dApps) like Compound to earn yield on your assets.

Drawbacks of Nexo Ecosystem

Now you might be in awe after reading all those detailed features. But wait up. This Nexo review is incomplete without a few drawbacks. Let’s find out what those are.

Limited Availability in the U.S.

One of the most significant drawbacks of Nexo is its limited availability in the United States. Due to regulatory issues, Nexo decided to withdraw its services from the U.S. market in 2022. This means that users based in the U.S. cannot access many of Nexo’s key features. It also includes the Earn and Borrow sections

Loyalty Tier Barriers

Nexo’s loyalty tier system offers attractive benefits to high-tier users such as increased interest rates and lower borrowing costs. However if you don’t hold a significant percentage of NEXO tokens in your portfolio, you won’t be able to achieve the higher tiers. Because of this many users don’t hold NEXO and miss out on certain benefits.

Limited Support for Non-Ethereum Assets

Nexo’s wallet and DeFi functionalities are restricted to Ethereum-compatible networks, such as Polygon and Avalanche. This means that if you hold assets like Bitcoin, Cardano, or other non-Ethereum-based cryptocurrencies, Nexo’s wallet cannot store or manage them.

Conclusion – Is It the Best Platform For Earning Interest?

If you ask us then ABSOLUTELY. There’s nothing that you cannot do on the Nexo platform. If you’re looking for a platform that offers the best interest rates then there’s no better place then Nexo. The team behind this project has over 15 years of experience. This makes this platform a lot more reliable for crypto traders.

Crypto lending has grown rapidly over the years and is now worth billions of dollars. Companies that offer corrupt lending are growing quicker than ever now. Some experts say that this industry could potentially become a trillion-dollar one in the next few years. So, if you’re currently looking for a great platform to borrow, lend and make the most out of your portfolio, then Nexo is the best option for you.

FAQs

Is Nexo available in the U.S.?

Unfortunately, not now. Nexo withdrew from the U.S. market in 2022 due to regulatory concerns. If you live in the U.S., you won’t be able to access key features like earning interest and borrowing. Nexo is working hard to expand its markets and is now available in Dubai. Maybe in the future Nexo will again be available for the users in the United States.

Can I use Nexo if I don’t hold NEXO tokens?

Yes, you can still use Nexo without holding NEXO tokens. However, without holding NEXO, you may miss out on higher interest rates, lower borrowing costs and other perks that come with higher loyalty tiers. It’s not mandatory but it can surely enhance your overall experience if you hold a certain amount of NEXO.

Is my crypto safe on Nexo?

Yes, Nexo takes security very seriously. It partners with top custodians like Fireblocks and Ledger Vault to store users’ assets in cold storage and provide insurance coverage of up to $150 million through Ledger Vault. Nexo has never been hacked and regularly undergoes security audits to make sure the user fund is safe.

What is a crypto line of credit on Nexo?

Nexo offers a crypto line of credit, which lets you borrow money against your crypto assets without selling them. You can draw and repay funds whenever you want as there’s no fixed repayment schedule. It’s a flexible alternative to traditional crypto loans, with competitive interest rates.

Can I earn interest on stablecoins with Nexo?

Yes, Nexo allows you to earn interest on stablecoins like USDT, USDC, and DAI. Stablecoins typically have high interest rates, making them a popular choice for users who want to earn passive income without exposure to volatile assets like Bitcoin or Ethereum.