The cryptocurrency market has seen a wave of liquidations in the past 24 hours, with over $1.7 billion wiped out due to excessive leverage. This movement removes excess speculators, preparing the market to continue its sustained upward trend.

Largest Crypto Market Liquidation Since 2021

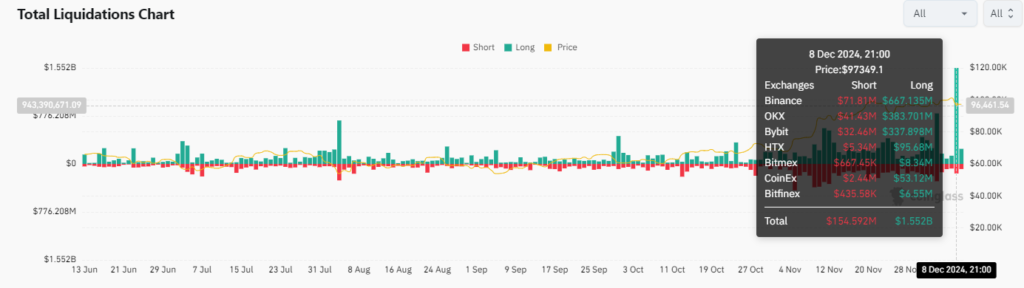

The recent liquidation occurred after a sudden price movement, known as a flash crash, in assets such as Bitcoin (BTC) and Ethereum (ETH). Bitcoin, which was above $100,000, fell sharply, triggering a cascade of sell orders on platforms such as Binance, Bybit and OKEx. BTC alone accounted for $682 million in liquidations, while Ethereum accounted for $243 million.

Leverage, while attractive to traders looking for quick returns, can be dangerous in such a volatile market. Contrary-to-expected movements result in margin calls, forcing exchanges to liquidate positions to cover losses.

According to data from Coinglass, more than 500,000 traders were liquidated in the last 24 hours.

In addition, the data shows that around 74% of the liquidated positions were leveraged buys (longs). This reflects the market’s exaggerated optimism ahead of the price correction. Binance led the number of liquidations, recording US$579 million, followed by OKEx, with US$340 million, and Bybit, with US$289 million.

This pattern of liquidations reinforces the importance of risk management for investors. Traders with highly leveraged positions are more vulnerable to sudden price swings, which can result in significant losses.

Altcoins also feel the impact

In addition to Bitcoin and Ethereum, altcoins such as Solana (SOL), XRP and Dogecoin (DOGE) faced significant liquidations. The futures market for these altcoins recorded liquidations of over US$300 million, showing that the impact was not limited to the main assets.

Solana, which recently hit all-time highs, has seen a significant selloff, putting further pressure on its price.

The $1.7 billion liquidation highlights the risks of excessive leverage in the cryptocurrency market. While the sector has shown resilience in previous events, investors and traders should remain cautious.

What’s next for the crypto market?

Experts warn that further increases in volatility could occur, especially as the market continues to rise. With many traders looking to maximize gains with leverage, recent events may serve as a reminder to adopt more conservative strategies.

On the other hand, liquidations can help stabilize the market in the long term by eliminating excess leverage and strengthening the price foundation. For long-term investors, moments like these present buying opportunities, especially in fundamental assets.