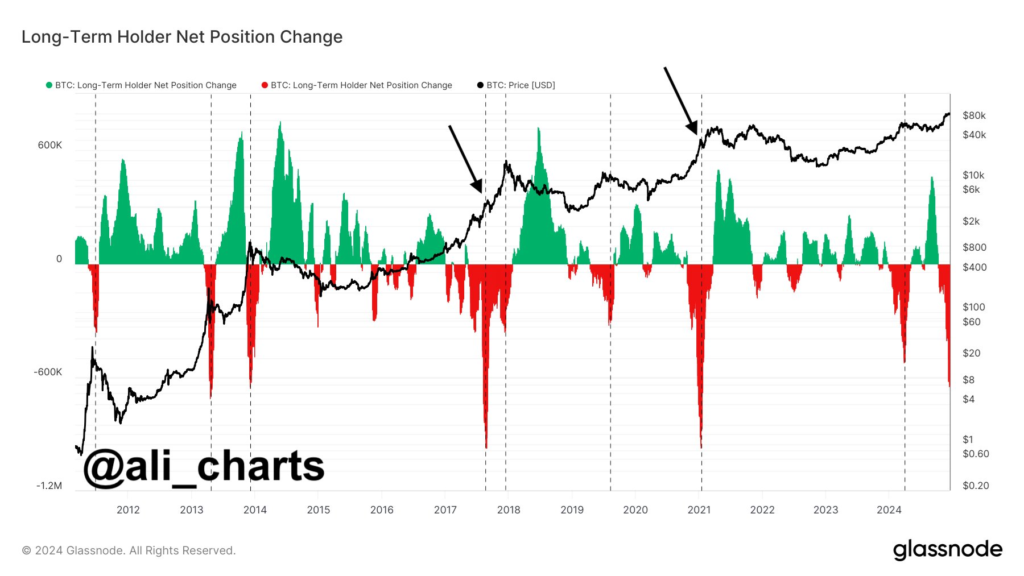

The Bitcoin market has seen a significant event in recent days: the largest sell-off by long-term holders since the all-time high of 2021. According to on-chain data, these investors liquidated around 118,000 BTC, a move that has raised concerns in the crypto community.

Could the sell-off signal a change?

This volume of sales represents 0.62% of the total Bitcoin supply in circulation, indicating that even confident investors are looking to take profits. The impact has been felt in prices, which have faced resistance as they attempt to break above $100,000, a key psychological milestone for the market.

Long-term holders typically accumulate Bitcoin during bearish periods and sell during bullish peaks. The recent move suggests that these investors may be anticipating a price correction or simply capitalizing on gains after months of appreciation.

Data from Glassnode highlights that the selling activity coincided with a surge in profit-taking. However, the strength of the market remains evident, as trading volume and institutional interest remain high.

However, despite the sell-off, other indicators suggest that market sentiment remains bullish. The influx of institutional capital, combined with the growth of scaling solutions and global adoption, maintains strong fundamentals for Bitcoin.

In addition, the increase in the network’s hash rate reflects the confidence of miners, a group that historically reacts to the asset’s long-term prospects. This balance between profit-taking and new investor inflows could support Bitcoin’s price in the coming months.

Bitcoin Price Expectations

If Bitcoin breaks the resistance around $100,000, it could attract a new buying cycle. Conversely, a failure to break this could result in a correction to the $94,000 or $88,000 support levels.

With global attention focused on the market’s next moves, investors should closely monitor on-chain data, which often predicts significant changes in Bitcoin’s price.