Bitcoin (BTC) surged to a record $109,000 before hitting stiff resistance and swiftly pulling back, marking a critical moment as Bitcoin misses $110K mark once again. The failed breakout highlights the psychological and technical significance of the six-figure milestone, now acting as a formidable barrier for bullish momentum.

Yet beneath the surface, signs of strength remain. On-chain data reveals a steady uptick in whale accumulation, suggesting that major players are quietly preparing for a renewed push. Bullish signals from the Ichimoku Cloud further support the potential for an upside continuation, provided BTC can muster the strength to decisively clear this pivotal resistance.

- Start trading on the best crypto exchange Europe trusts—join now!

Whale Activity Surges: 2,019 Large BTC Holders Signal Market Confidence Beneath the Surface

Bitcoin’s big players are stirring. The number of BTC whale wallets, which hold between 1,000 and 10,000 coins, rose from 2,007 to 2,021 between May 13 and May 19, before a slight dip to 2,019 yesterday. Though modest, this increase reflects a potential shift in sentiment among the crypto market’s most influential investors.

Even minor changes in whale activity can serve as a bellwether for institutional behavior. In periods of sideways or uncertain price action, rising whale accumulation often signals renewed confidence or strategic positioning for future volatility.

This latest uptick suggests that large holders may be quietly preparing for a major move, either anticipating a breakout or doubling down on long-term conviction. With whales historically known to front-run major market shifts, their accumulation may act as an early indicator of underlying bullish strength, despite Bitcoin’s current struggle to reclaim the $110K mark.

If accumulation persists, it could lay the groundwork for a larger rally, providing critical liquidity and psychological support during consolidation phases.

Bitcoin’s Ichimoku Cloud Points to Sustained Bullish Momentum as Price Climbs Above $108K

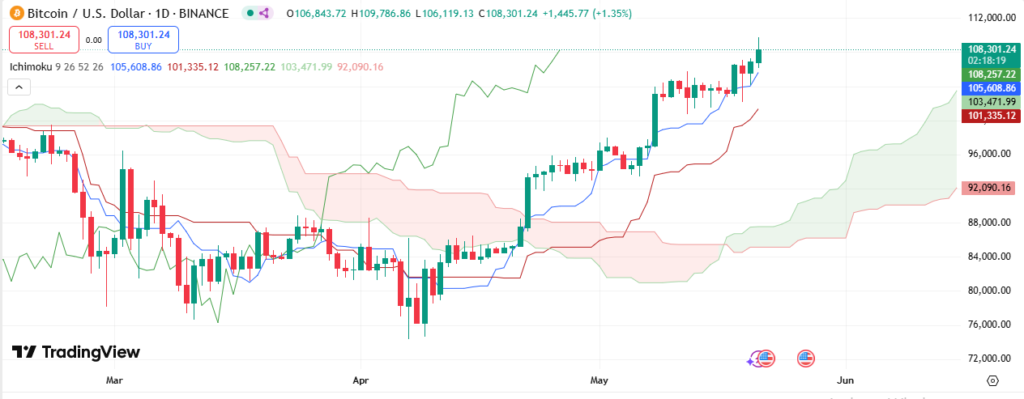

Bitcoin’s daily chart continues to deliver strong bullish signals, reinforced by a textbook Ichimoku Cloud setup. As of the latest session, BTC is trading at $108,301, comfortably above the green cloud (Kumo) and all key Ichimoku components, suggesting ongoing upward momentum.

The Leading Span A (Senkou Span A) is climbing sharply and sits around $103,472, well above the Leading Span B (Senkou Span B) at $92,090, forming a thick and rising Kumo. This configuration indicates a strong bullish continuation pattern.

The Tenkan-sen (blue line) at $105,609 is trending above the Kijun-sen (red line) at $101,335, confirming a healthy short-term trend with buying pressure firmly in control. Meanwhile, the Chikou Span (green lagging line) remains far above recent price candles, further validating the bullish outlook from a historical perspective.

With price action breaking out above recent consolidation and maintaining strong separation from the cloud, Bitcoin appears technically poised for another leg higher. As long as the price holds above the Tenkan and Kijun support zones, the bullish scenario is likely to remain intact.

Bitcoin Retreats After $109K Breakout Attempt, But EMA Support Remains Strong

Bitcoin surged past $109,000, briefly setting a new all-time high, but the rally was quickly met with resistance near the psychological barrier of $110,000. A sharp 3% retracement followed, pulling the price back to $108,372, highlighting the strong selling pressure at this critical level.

Despite the pullback, Bitcoin’s Exponential Moving Averages (EMAs) are offering strong technical support. The 20-day EMA at $102,090 continues to lead the trend higher, followed by the 50-day EMA at $96,317, both of which reflect ongoing bullish momentum in the short to mid-term.

Meanwhile, the 100-day EMA sits at $93,178, and the 200-day EMA at $88,869, reinforcing a solid long-term support base. These ascending moving averages confirm that the broader uptrend remains intact, even as the market faces short-term resistance.

If Bitcoin can hold above the $106,119 zone and bounce from the 20-day EMA, the bulls may attempt another breakout. However, if selling pressure intensifies and BTC drops below the 20-day support, it could trigger a deeper move toward the 50-day or 100-day EMAs, with $104,584 and $101,549 serving as key downside levels to watch.

For now, Bitcoin’s structure remains bullish, but follow-through above $110K is essential to confirm the next leg of the rally.