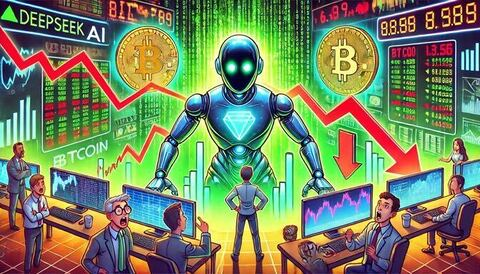

The emergence of China’s artificial intelligence model DeepSeek has sent shockwaves through global financial markets, pushing Bitcoin below $100,000 and causing significant declines in major US tech stocks. The ripple effects of this new AI challenger have particularly impacted Nvidia-led NASDAQ, which experienced a steep drop of more than 3% as investors grappled with the implications of China’s advancing AI capabilities.

DeepSeek Unprecedented Market Impact

The rapid ascent of DeepSeek in the global AI sector has triggered a widespread market sell-off, affecting both traditional and crypto markets. The Chinese AI startup, which launched its open-source language model R1 on January 20, has quickly gained prominence, becoming the highest-rated free app on the Apple App Store in both the US and China. This sudden rise to prominence was further accelerated by ScaleAI CEO Alexandr Wang’s endorsement of its effectiveness compared to established US AI models like ChatGPT.

What’s particularly striking about DeepSeek’s emergence is its claimed development efficiency. The company reports spending just $5.8 million to train its models, a fraction of the $17.9 billion raised by OpenAI. This dramatic cost disparity has raised eyebrows across the investment community and sparked concerns about the competitive landscape in AI development.

Market-Wide Implications and Future Outlook

The impact of DeepSeek’s rise has been severe across multiple market sectors. Nvidia, a key player in AI chip manufacturing, saw its market capitalization plummet by over $600 billion in just 24 hours. The broader market impact has been equally significant, with the S&P 500 losing more than $1 trillion in market value, while the NASDAQ experienced a 3% decline.

The cryptocurrency market, increasingly correlated with traditional stock performance, has not been spared. Bitcoin’s fall below $100,000 marks its first dip below this threshold since President Donald Trump’s inauguration. This correlation between crypto and traditional markets suggests that Bitcoin’s price could remain under pressure or face further declines if the stock market continues to struggle, potentially impacting the anticipated crypto bull run in 2025.

Adding to market concerns are the allegations surrounding DeepSeek’s chip usage. While the company claims to use fewer chips for better performance, prominent figures in the tech industry, including Elon Musk and Alexandr Wang, have contested this assertion. Wang’s revelation about DeepSeek potentially possessing 50,000 H100 Nvidia chips, despite US export controls, has further complicated the narrative and intensified market uncertainty.