Dubai has launched the Middle East and North Africa’s (MENA) first licensed tokenized real estate project, signaling a major step toward integrating blockchain into traditional property investment. This move highlights the region’s accelerating interest in real-world asset (RWA) tokenization and reinforces Dubai’s growing reputation as a global crypto hub.

The initiative, announced by the Dubai government, includes support from key institutions such as the Dubai Land Department (DLD), the Central Bank of the UAE, and the Dubai Future Foundation. The digital property tokens will trade on the newly launched Prypco Mint platform, while Zand Digital Bank will serve as the pilot phase banking partner.

Significantly, the Virtual Assets Regulatory Authority (VARA) amended its framework on May 19 to formally include RWA tokenization. This regulatory update enables tokenized assets to be traded on approved secondary markets, creating new investment pathways.

- Claim Your BC Game Promo Code Now – Unlock Exclusive Bonuses and Start Winning Big Today!

As part of the pilot, individual investors can buy fractional ownership in “ready-to-own” properties across Dubai, with entry points starting at just 2,000 AED (approximately $545). For now, all transactions will be settled in UAE dirhams, excluding the use of cryptocurrency. While the program currently limits participation to UAE ID holders, officials plan to expand access to international investors in future phases.

Moreover, this project builds on prior efforts by the DLD and VARA. In April, the two entities agreed to integrate Dubai’s real estate registry with blockchain-based tokenization systems. Their goal is to attract global capital and enhance market liquidity through cutting-edge digital infrastructure.

Fractional Ownership Opens the Door for Retail Investors

Dubai continues to cement its position as a leader in blockchain and digital finance. For instance, in May, the emirate partnered with Crypto.com to enable crypto payments for selected government services. This collaboration further advances the UAE’s vision of becoming a top-tier digital asset economy.

Global Real Estate Tokenization Market Expected to Hit $19.4 Billion by 2033

Real estate tokenization is rapidly emerging as a transformative trend within the broader RWA market. As blockchain technology matures, it continues to disrupt conventional investment structures by improving asset liquidity and increasing access for retail investors.

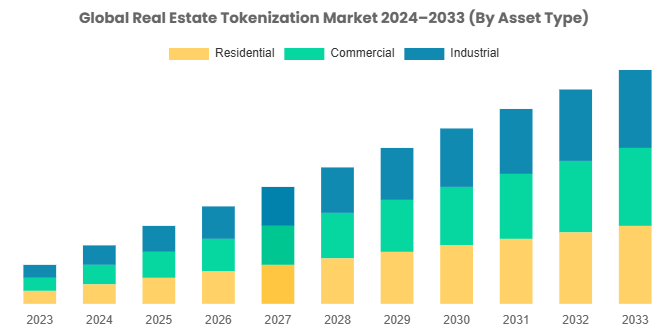

A recent report by Custom Market Insights forecasts that the global real estate tokenization market will reach a $19.4 billion valuation by 2033. Analysts project a robust compound annual growth rate (CAGR) of 21% over the next decade.

This anticipated growth highlights the sector’s ability to resolve longstanding challenges in traditional real estate, including high entry barriers and low liquidity. By tokenizing assets such as residential, commercial, and industrial properties, platforms can offer fractional ownership, making real estate investment more inclusive and efficient.

Companies like RealT and Metlabs have already positioned themselves as frontrunners in the space. However, many others continue to struggle due to regulatory complexities and shifting compliance standards.

Even so, the outlook remains optimistic. The strong growth forecast reflects rising institutional interest and suggests that tokenized real estate could become a cornerstone of blockchain-powered financial systems in the years ahead.

Conclusion

Dubai’s launch of the MENA region’s first licensed tokenized real estate project marks a major milestone in the integration of blockchain with traditional property markets. Backed by leading government entities and a clear regulatory framework, the initiative reflects the city’s broader ambition to become a global hub for digital assets. As tokenization reshapes access to real estate investment, Dubai positions itself at the forefront of this transformation. The city invites both regional and international investors to take part in the future of property ownership.