OpenSea has reaffirmed its dominance in the NFT marketplace, leading trading volume over the past 30 days, according to a recent report. The platform saw a surge in transactions as traders rushed to take advantage of its reduced fees and expanded cross-chain capabilities.

Can Wallet Growth Spark a New NFT Boom?

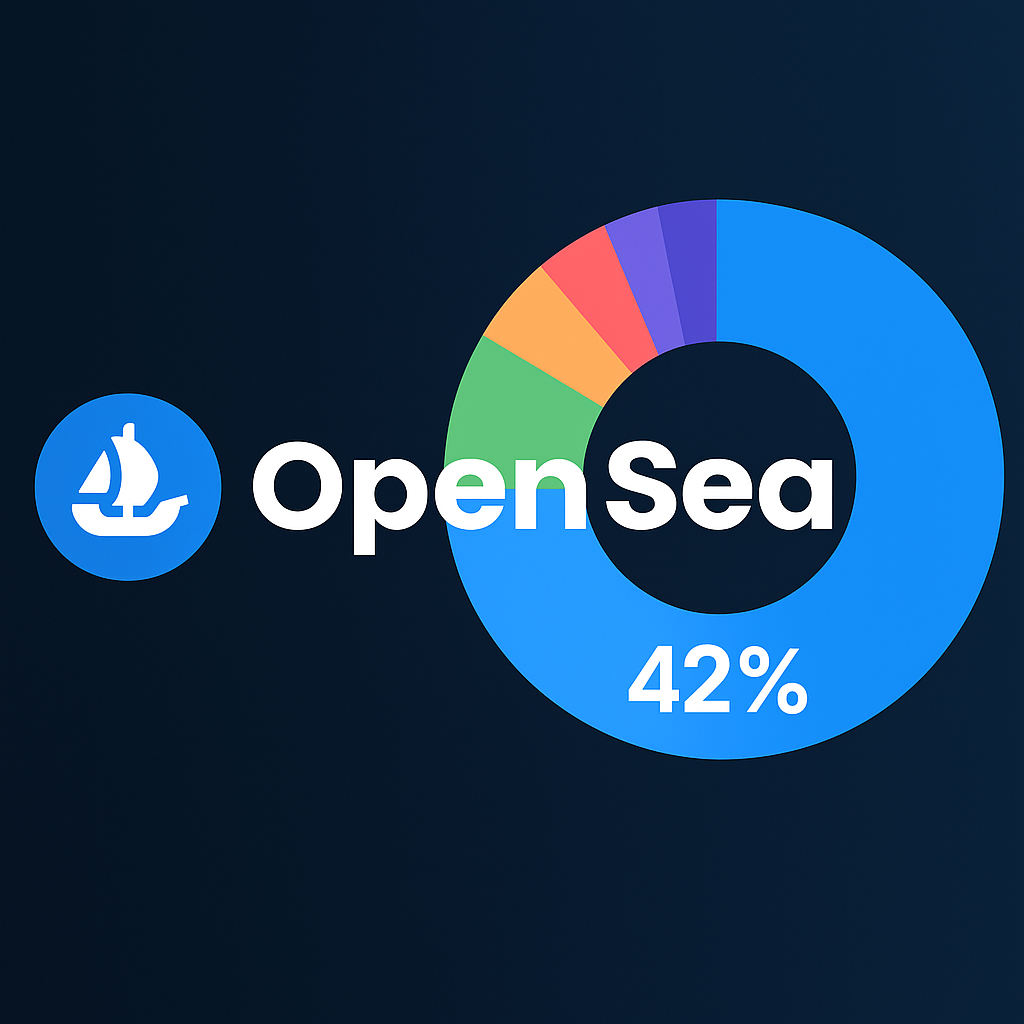

Recent data from NFT Scan shows that NFT trading volume over the past 30 days hit $155.1 million, with OpenSea firmly holding its lead in market share.

Among its competitors, Blur accounts for 23.16% of the market, while CryptoPunks and Magic Eden claim 10.97% and 7.67%, respectively. Other marketplaces like OKX NFTs, CoralCube, and various smaller platforms split the remainder with 4.98%, 5.21%, and 6.10% market shares.

OpenSea’s dominance extends beyond trading activity — it also commands the largest share of active users.

Over the last month, 615,300 wallets were involved in NFT trading, with 69.62% — about 428,363 wallets — choosing OpenSea. By comparison, Magic Eden attracted 7.24% of wallets, and Blur drew 5.14%.

Looking at a broader three-month window, OpenSea’s grip remains strong, securing 66.12% of total wallet activity (1.424 million out of 2.2 million wallets).

Meanwhile, Magic Eden, the next closest rival, managed only 8.77% (188,954 wallets). These numbers highlight OpenSea’s ability to retain a loyal user base even as competition across the NFT space intensifies.

OpenSea’s OS2 Launch and 0.5% Fee Strategy Put Competitors on the Back Foot

In February, OpenSea unveiled its OS2 platform: a ground-up redesign that slashed marketplace fees from 2.5% to just 0.5%, while also removing swap fees altogether.

The OS2 open beta introduced a host of new features:

• A completely rebuilt platform tailored for collectors and professional traders

• Seamless integration of NFTs and tokens in one unified space

• Fresh, immersive exploration tools beyond traditional floor pricing

• Support for 14 blockchains, including Flow and ApeChain

Alongside these upgrades, OpenSea added Solana token trading, cross-chain purchasing, and real-time analytics: improvements that platforms like Blur and Magic Eden have yet to match.

User experience also received a boost through a revamped homepage and significantly faster browsing performance.

Another major milestone is the launch of OpenSea’s SEA token, designed to reward loyal users:

• Historical activity on OpenSea will influence token distribution

• The claim process promises simplicity and inclusivity, even welcoming U.S. users

• A strong focus remains on long-term sustainability and a healthy marketplace ecosystem

Adding to its momentum, OpenSea received regulatory relief when founder Devin Finzer confirmed in early February that the U.S. SEC had closed its investigation into the company without any charges.

This major development removes legal uncertainty and strengthens user confidence.

With the NFT industry evolving rapidly, OpenSea’s technological innovations and strategic moves continue to anchor its leadership in the market.

Why NFT Sales Have Yet to Bounce Back to 2022 Levels

Even as wallet activity grows, NFT sales remain stuck well below their former highs, still trailing 62% behind the record levels seen in 2022. Although more traders are entering the market, underlying structural issues continue to hold back a true recovery.

The NFT sector showed slight gains in 2024. According to CryptoSlam, total annual NFT sales reached $8.88 billion, marking a modest 1.1% increase compared to 2023’s $8.7 billion. However, the figure is a far cry from 2022’s $23.7 billion peak, highlighting a 62.8% contraction.

When compared further back, 2024 sales were down 43.9% from 2021, underlining the market’s significant cooling.

While early signs hinted at renewed momentum, the pace slowed sharply as 2024 wore on. In February 2025, NFT trading activity slumped: monthly volume dropped to $498 million, a steep 50% decline from January, while total sales fell 16%.

Still, there were occasional bright spots. In February, the U.S.-based Kanbas Collection made headlines with a major acquisition: purchasing a 1-of-1 digital artwork for $3 million. This signaled that parts of the NFT space may be evolving toward a more sustainable, art-focused model rather than pure speculation.

Despite isolated successes, the broader trend remains downward. CryptoSlam’s Q1 2025 data shows NFT trading volume at $1.5 billion: a stark 61% drop from $4.1 billion during the same period in 2024.

Nevertheless, hope lingers. In the past week alone, NFT buyer numbers jumped 52%, with more than 359,000 new entrants joining the market.

While steady interest persists, the soaring valuations of 2022 seem unlikely to return anytime soon under current market conditions.

Frequently Asked Questions

Is OpenSea Expanding Beyond Just Collectable NFTs?

Yes, OpenSea is broadening its scope by embracing innovative NFT categories. This includes real-world asset (RWA) NFTs such as LeBron-themed tokens, AI-generated artworks, and digital assets from blockchain games: ranging from virtual land to in-game collectibles.

Which Blockchains Are Now Supported on OpenSea?

OpenSea’s most recent upgrade brought integration with 14 different blockchains. Among the latest additions are Flow, ApeChain, and Soneum: further enhancing the platform’s cross-chain capabilities.