Pi Coin, the token of the Pi Network, has dropped more than 30% in the past few hours following an initial rally fueled by the launch of its open mainnet. The extreme volatility of the asset has caught investors’ attention, who are now wondering whether the cryptocurrency can bounce back.

Despite a price surge after its listing on exchanges like OKX and Bitget, Pi Coin faced strong selling pressure. Experts suggest that the widespread release of tokens into the market may have contributed to the decline. The key question now is whether demand will be strong enough to stabilize or drive the asset’s price upward again.

High Volatility and Speculation Surrounding Pi Coin

Pi Network had been anticipated for years, amassing over 57 million users before the open mainnet launch. As soon as trading began, the token saw significant gains, reaching a peak of $3.41 on Bitget. However, the initial excitement was followed by massive sell-offs, causing the asset to lose over 30% of its value.

The extreme volatility is driven by uncertainties surrounding Pi Network. While enthusiasts believe in the token’s widespread adoption, skeptics warn that the lack of support from major exchanges like Binance and Coinbase could hinder its recovery.

Listing on Major Exchanges Could Be a Game-Changer

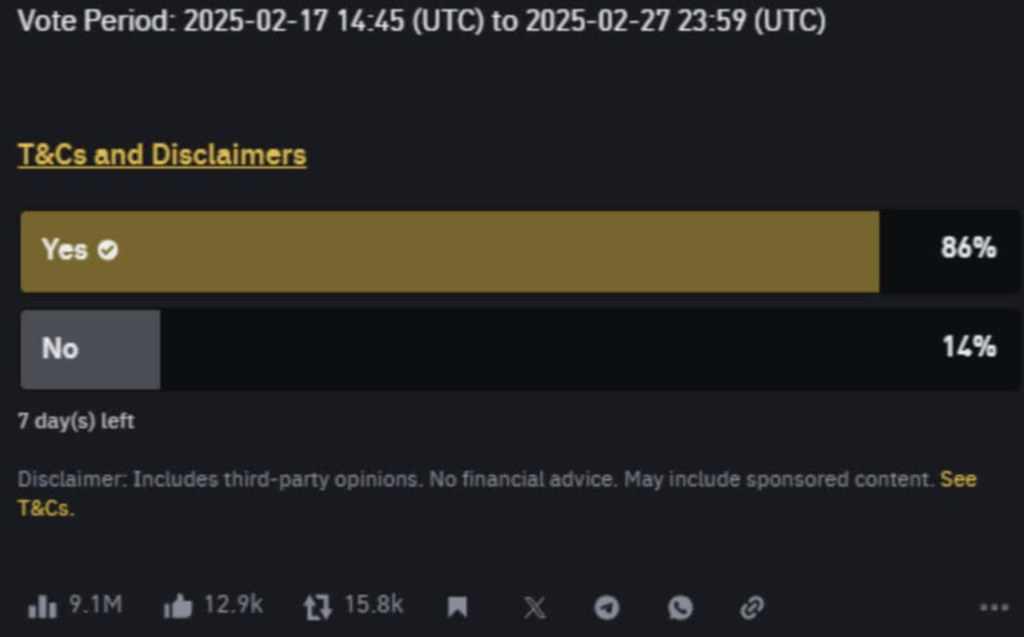

Currently, Pi Coin is available on platforms such as OKX, Gate.io, and Bitget. However, major players like Binance and Coinbase have yet to list the asset. Binance, for example, has launched a poll to gauge community interest, which could influence a potential listing.

Meanwhile, Bybit has stated that it will not list Pi Coin. The CEO of the crypto exchange said on X that the Pi Network project is a scam.

If Binance and other major platforms decide to support Pi Coin, demand could increase significantly. However, if the listing does not happen, the asset may face further depreciation due to a lack of liquidity and market confidence.

Can Pi Coin Recover?

Pi Coin’s recovery depends on several factors, with the primary one being support from top cryptocurrency exchanges. Additionally, the adoption of dApps within the Pi Network ecosystem and trading volume will also be crucial in stabilizing its price.

Another important factor is selling pressure. Many early Pi Network miners are liquidating their holdings, directly impacting the price. If the market absorbs this supply and new investors join the project, Pi Coin may regain some of its losses.