Quantum Biopharma, a Canadian biotech company, has deepened its commitment to digital assets by investing an additional $1 million in Bitcoin and other cryptocurrencies. As a result, its total crypto holdings have grown to approximately $4.5 million, according to a press release issued on May 19.

Moving forward, the firm plans to stake a portion of its holdings to generate passive income. This indicates a strategic shift toward integrating blockchain technologies into its financial model.

The company stated that maintaining a cryptocurrency treasury aims to deliver returns for shareholders while also hedging against the volatility of the Canadian dollar.

Notably, after the announcement, the company’s stock (QNTM) surged by nearly 25%, according to Google Finance data. This immediate jump suggests growing investor confidence in Quantum Biopharma’s bold financial approach.

- Sign up on Binance using my referral ID and start trading today!

Biotech Firms Increasingly Turn to Bitcoin Amid Treasury Strategy Shift

Quantum Biopharma’s move reflects a broader trend among healthcare companies adopting Bitcoin as part of their corporate treasury strategy.

For example, in March, NASDAQ-listed Atai Life Sciences announced plans to acquire $5 million worth of Bitcoin. Christian Angermayer, the company’s founder, emphasized on X (formerly Twitter) that “Bitcoin should be a part of any corporate treasury,” especially in the biotech sector, where long product development cycles often pressure liquidity.

Furthermore, in a related blog post, Angermayer argued that Bitcoin helps hedge against inflation and supports financial resilience during pre-revenue phases.

Just weeks later, on May 16, Singapore-based Basel Medical Group announced plans to invest $1 billion in Bitcoin. The company said that holding Bitcoin would strengthen its balance sheet and support its expansion strategy in Asia through targeted acquisitions.

However, investor sentiment varied. While Quantum Biopharma’s shares rallied, Basel’s stock price dropped significantly after its announcement. This shows that market reactions can differ, even within the same industry.

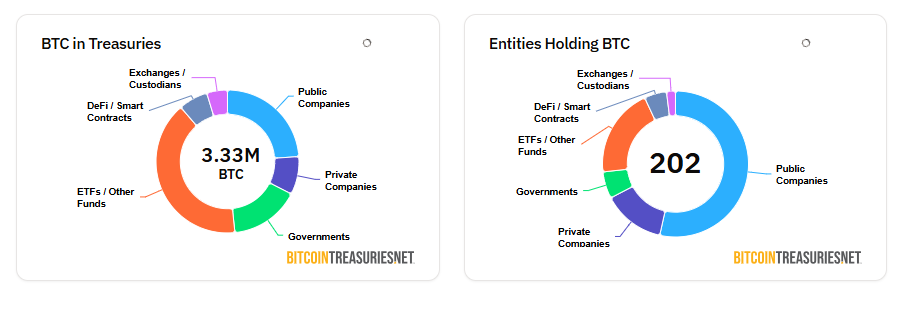

Currently, corporate entities hold over $83 billion in Bitcoin as of May 19, according to BitcoinTreasuries.NET. Publicly traded companies now rank as the second-largest institutional holders of Bitcoin, trailing only exchange-traded funds (ETFs).

Source: bitcointreasuries.net

According to a 2024 report by Fidelity Digital Assets, Bitcoin may serve as a valuable hedge against fiscal deficits, currency debasement, and rising geopolitical risk. Consequently, industries like biotech, with their extended capital cycles, are viewing crypto as a strategic financial buffer.