In a landmark move reflecting evolving global reserve diversification, the Saudi Central Bank has discreetly entered the Bitcoin space by investing in Strategy, formerly known as MicroStrategy. This marks the Kingdom’s first indirect exposure to Bitcoin, the world’s leading cryptocurrency by market capitalization.

According to a May 16 SEC filing, the Saudi Central Bank now holds 25,656 shares in Strategy, the largest corporate holder of Bitcoin globally. Consequently, this stake provides the Kingdom with passive exposure to MicroStrategy’s substantial Bitcoin reserves.

Moreover, as highlighted by a renowned crypto news agency, Strategy currently possesses 568,840 BTC, with an estimated market value approaching $60 billion. This strategic acquisition signals a potential shift in how sovereign entities may approach cryptocurrency investments in the near future.

Why Is Saudi Arabia Embracing Bitcoin Exposure Now?

Historically, central banks have relied on traditional assets like gold and the U.S. dollar to safeguard national reserves. However, as global finance increasingly shifts toward innovation and decentralization, Saudi Arabia appears to be adapting by incorporating a more diversified asset strategy. The Kingdom is now considering a balanced approach that maintains economic stability while tapping into the growth potential of digital assets.

Interestingly, this strategic pivot closely resembles the approach taken by Norway’s sovereign wealth fund, which has opted to invest in crypto-focused companies such as Coinbase and Strategy (formerly MicroStrategy). This allows them to benefit from cryptocurrency markets without directly purchasing Bitcoin.

- Ready to Trade Smart? Discover the Best Crypto Exchange in Europe Today!

According to Bitcoin Treasuries, more than a dozen nations, including El Salvador, Ukraine, Bhutan, and the United States, have also gained Bitcoin exposure through central banks or sovereign investment vehicles. Collectively, this highlights a growing global trend toward institutional crypto adoption.

Saudi Arabia Emerges as MENA’s Crypto Trailblazer Amid Regional Boom

Meanwhile, cryptocurrency adoption is accelerating across the Middle East, with Saudi Arabia taking a leading role in the region’s digital asset transformation. Recent findings from Bitget Research show that average daily crypto traders in the MENA region exceeded 500,000 in February 2024.

At its peak, Saudi Arabia alone reported 129,397 daily crypto users, outpacing the UAE, which recorded 106,111. This surge reflects the Kingdom’s growing influence in shaping the regional crypto landscape.

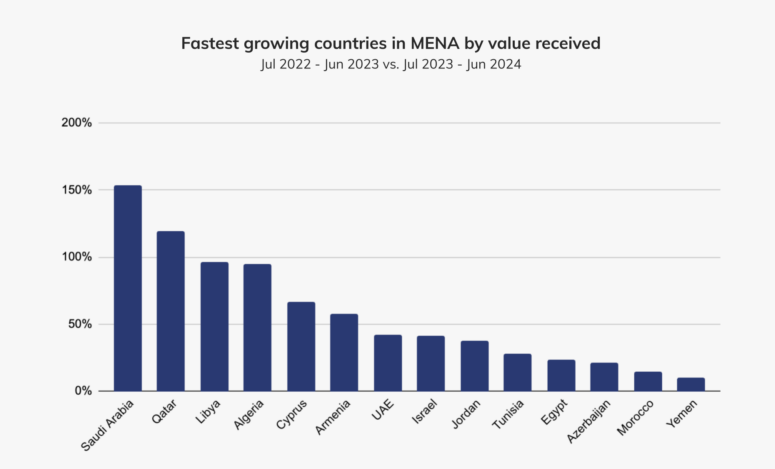

Furthermore, according to the 2024 MENA report by Chainalysis, Saudi Arabia boasts the fastest-growing crypto economy in the region, with a remarkable 154% year-over-year growth, sustained for the second consecutive year.

Fueling this momentum is the nation’s commitment to blockchain technology, central bank digital currency (CBDC) research, gamified finance, and a broader push in fintech innovation. All of these efforts align seamlessly with Vision 2030, Saudi Arabia’s blueprint for economic diversification and digital modernization.

GCC Faces Hurdles in Establishing Unified Crypto Regulations

Despite the rapid rise in digital asset adoption, Gulf Cooperation Council (GCC) countries, including Saudi Arabia, continue to operate without a fully developed regulatory framework for cryptocurrencies. Although interest in crypto trading is growing across the region, domestic exchanges still lack official licensing or oversight, leaving a significant policy void.

Renowned economist and former Saudi Shura Council member Ihsan Buhulaiga has emphasized the need for regulatory cohesion among GCC states. He cautions that inconsistent policies could weaken the region’s position in the global financial ecosystem and hamper innovation.

Nevertheless, Saudi Arabia is pressing forward with digital finance initiatives. In a notable step toward modernizing cross-border transactions, the Saudi Central Bank joined the mBridge project in June 2024. This collaborative CBDC platform aims to streamline international trade settlements, particularly in the oil sector, between Saudi Arabia and China. The move highlights the Kingdom’s commitment to financial innovation, even in the absence of comprehensive regulation.

Can Saudi Arabia’s Youth Propel Crypto Into the Financial Mainstream?

As Saudi Arabia begins to embrace Bitcoin and digital assets, the shift is unfolding alongside a growing presence of traditional financial powerhouses in the Kingdom. Major players like Goldman Sachs and Rothschild have recently expanded their footprint in Riyadh, with Goldman actively involved in three global tokenization initiatives.

In addition, fueling this momentum is Saudi Arabia’s youthful demographic. With nearly 66% of the population under 30, the country boasts a tech-savvy generation eager to adopt emerging technologies such as blockchain and cryptocurrencies. Their openness to innovation makes them a natural catalyst for the mainstream acceptance of digital finance.

This demographic advantage is further strengthened by increasing institutional support and adaptable regulatory frameworks. Together, these dynamics are paving the way for Saudi Arabia to become a rising force in the global crypto economy.

Frequently Asked Questions (FAQs)

Is cryptocurrency legally recognized in Saudi Arabia?

As of December 2024, there are no specific laws in place that formally recognize or regulate cryptocurrencies in Saudi Arabia. The legal framework around digital assets remains undefined, reflecting a cautious stance by financial authorities.

Does the Saudi Central Bank’s investment suggest a move toward holding Bitcoin directly?

While the Saudi Central Bank recently acquired shares in a company heavily invested in Bitcoin, this does not necessarily signal an intent to hold Bitcoin directly. Instead, the move appears to be a strategic and indirect approach. It seems more like a trial to observe market dynamics rather than a clear endorsement of cryptocurrency ownership by the central bank.