Solana (SOL) is facing a challenging moment in the cryptocurrency market, with its price dropping to $132, reflecting growing selling pressure. This decline comes amid a reduction in trading volume for memecoins on the network, which had previously helped drive up the cryptocurrency’s price. If the downtrend continues, SOL could test its next critical support level around $130.

Declining Interest in Memecoins Affects SOL

Solana’s rapid growth in recent months was partially fueled by high trading volumes of memecoins on its blockchain. However, as this segment cools down, enthusiasm around SOL has also diminished. The drop in trading volume directly impacts the network’s liquidity, reducing demand for the native token.

This trend increases SOL’s vulnerability to further declines, especially if institutional investors do not regain interest in the platform in the short term. The market is now watching to see if Solana can regain its strength without relying on the speculative impact of memecoins.

Technical Analysis Indicates Possible Support Levels

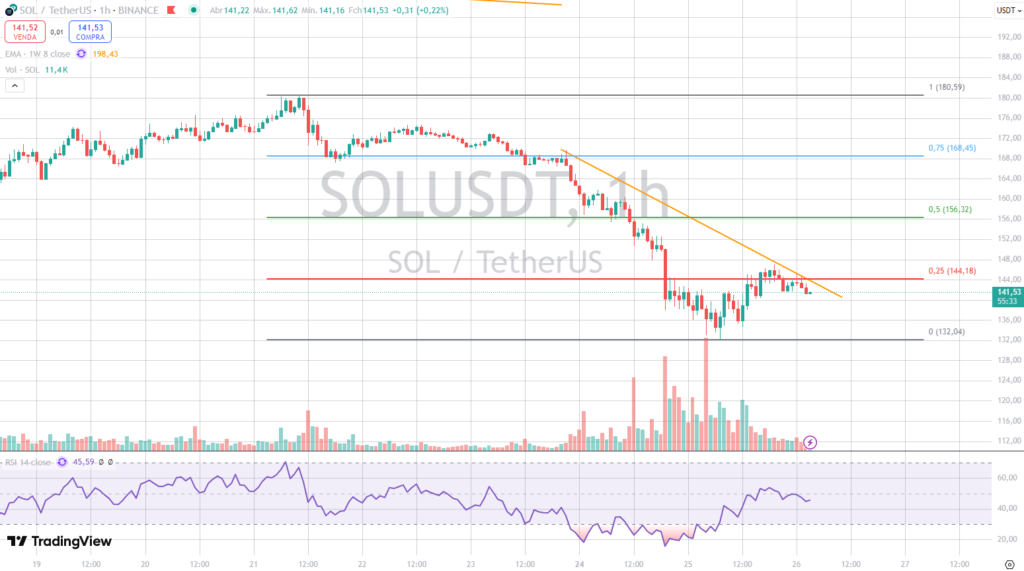

Technical analysis of Solana reveals that the asset is approaching a key support region at $130. If this level is broken, the next significant support zone is at $125, which could lead to a further decline if selling volume intensifies.

Solana’s Relative Strength Index (RSI) indicates that the asset is entering oversold territory, which may signal a potential positive reaction if buyers re-enter the market. The RSI is a technical indicator that measures the strength of buying and selling activity, fluctuating between 0 and 100. When below 30, it suggests that an asset may be undervalued and primed for a recovery move.

- Use your Binance referral ID and take advantage of cryptocurrency discounts.

Solana’s Future: Decline or Recovery?

Solana’s next movement will depend on the market’s ability to sustain support at $130. If buying pressure increases, the asset could recover some losses and target resistance levels at $140 and $145. On the other hand, if the downtrend continues, SOL may face a more challenging scenario, testing lower support levels.

With high volatility and reduced memecoin market liquidity, Solana is entering a critical period that will determine its next steps. Investors should monitor support and resistance levels to identify opportunities and risks. Additionally, attention will be focused on potential catalysts that could reverse the trend, such as blockchain developments and increased institutional adoption.