Toncoin (TON) rose 7.2% this week, weathering volatility triggered by rumors of a Grok AI-Telegram partnership. The rally began after Telegram founder Pavel Durov revealed a tentative one-year deal involving Grok AI.

Traders responded with optimism, pushing prices higher. However, Elon Musk quickly denied any signed agreement, causing Toncoin to retreat sharply within 30 minutes.

Durov later clarified the deal was only agreed upon “in principle,” increasing market confusion.

Despite the mixed messages, Toncoin held its gains. Traders remain focused on technical signals while waiting for further developments.

- Join the top cryptocurrency exchange in Nigeria. Buy, sell, and earn with ease!

Toncoin RSI Cools Off After Hype-Driven Surge

Toncoin experienced heavy price swings following speculation about a partnership between Telegram and Elon Musk’s xAI project. The token spiked over 20% after Durov announced the Grok AI integration plan.

Musk’s denial of any formal agreement triggered an immediate pullback. Durov’s clarification—stating the deal was only “in principle”—further confused the market.

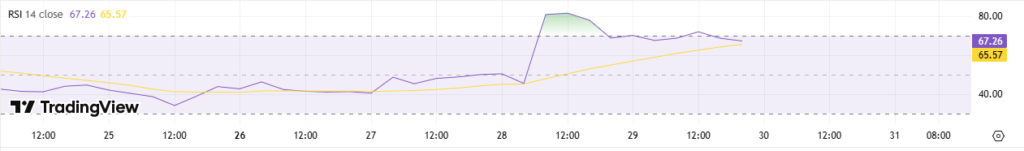

Toncoin’s Relative Strength Index (RSI) now sits at 67.26, down from yesterday’s intraday high of 81.55. The RSI helps identify momentum extremes. Readings above 70 suggest overbought conditions, while levels under 30 suggest oversold territory.

TON’s jump from 45.47 to above 80 in one session revealed strong buying pressure. However, the RSI’s current retreat hints that bullish momentum may be slowing.

Without solid fundamentals, Toncoin may consolidate or face a short-term correction.

Toncoin Holds Above Ichimoku Cloud, But Bullish Momentum Fades

Toncoin remains above the Ichimoku Cloud on the 4-hour chart, keeping a cautiously bullish technical setup. The token is trading near $3.38, consolidating after a sharp breakout on May 28.

Currently, the price floats between the Tenkan-sen ($3.429) and Kijun-sen ($3.305), reflecting mild upward momentum. The Tenkan-sen still sits above the Kijun-sen, which typically supports bullish continuation.

However, the narrowing gap between these lines indicates weakening trend strength. The forward cloud (Kumo) is thin, with Senkou Span A ($3.367) above Span B ($3.302), signaling slight bullish bias.

Yet, the cloud’s flat profile suggests limited support for strong follow-through unless another catalyst emerges. The Chikou Span still tracks above price from 26 periods ago, confirming the trend.

A drop below that historic level could warn of a reversal. With volume weakening, Toncoin risks short-term consolidation if buyers don’t return.

Toncoin Forms Golden Cross, Eyes $4 Breakout

Toncoin has printed a golden cross on the 4-hour chart—a bullish signal where the 20 EMA ($3.241) crosses above the 50 EMA ($3.149) and 100 EMA ($3.134).

This crossover typically attracts momentum traders and signals a potential uptrend. The golden cross follows Toncoin’s strong breakout above $3.00 on May 28, now followed by a consolidation phase.

TON currently trades around $3.40, with key resistance near $3.59.

A break above this level, supported by strong volume, could trigger a rally toward the $4.00 psychological level. If buying pressure fades, downside support lies at the 20 EMA ($3.24) and deeper near $3.15 and $2.91.

The golden cross strengthens Toncoin’s bullish outlook, but traders remain cautious. Without volume confirmation, the pattern could turn into a failed breakout.