The cryptocurrency market is buzzing with the significant surge of three standout altcoins: Tornado Cash (TORN), Orbit (GRIFT), and AiXBT. Following the frenzy surrounding the Trump family memecoins, the crypto market’s liquidity has shifted to other narratives. These movements highlight investors’ appetite for innovative assets amid the ever-evolving crypto landscape.

Tornado Cash (TORN) Soars 90% with Renewed Privacy Focus

Tornado Cash (TORN) has seen an impressive 90% surge in the past 24 hours, emerging as one of the most volatile altcoins in the market. With trading volume nearing $10 million, the asset has captured significant attention from traders and investors.

The recent presidential pardon of Ross Ulbricht, creator of Silk Road, and his release from prison could have far-reaching implications for privacy-focused crypto projects. This event marks a symbolic turning point for initiatives that faced sanctions and crackdowns during previous administrations, such as Tornado Cash.

Over the last 24 hours, TORN’s price jumped from $7.95 to a peak of $25.48 before retreating to around $15.31. This movement reflects heightened volatility, accompanied by a trading volume increase to $9.88 million. However, after reaching resistance near $25.00, the price underwent a sharp correction.

The price chart shows that breaking the $7.95 support level initially triggered the upward momentum, pushing the asset to test higher levels. The $10.00 level, previously seen as resistance, became a key psychological support. Meanwhile, the rejection at the $25.00 zone underscores the strength of sellers, limiting further price advances.

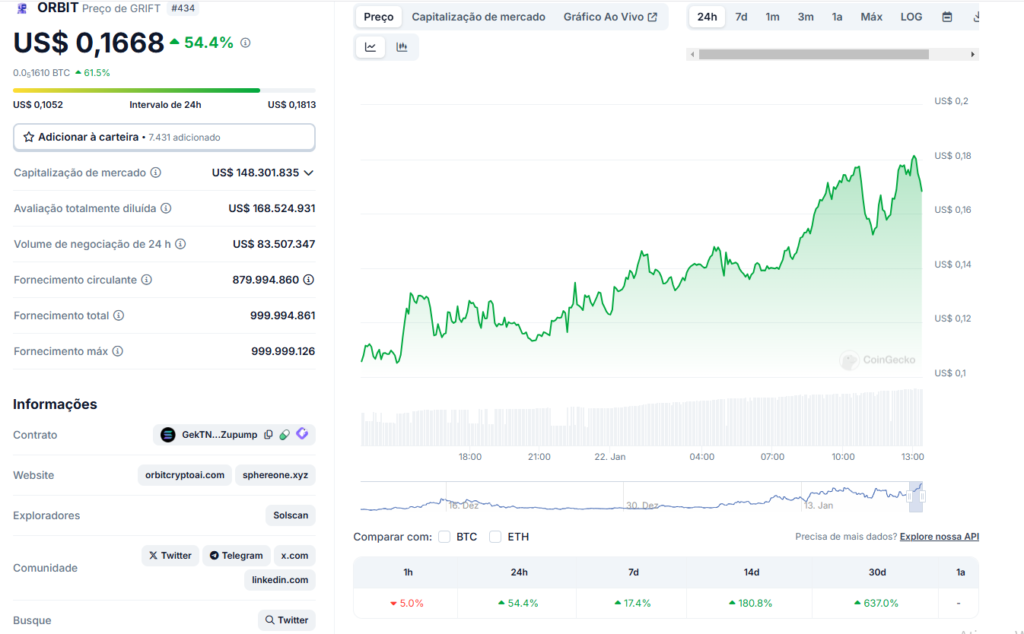

ORBIT (GRIFT) Gains 54% in 24 Hours, Reaches $0.1813 High

GRIFT, the native token of the Orbit project, is gaining traction as a multifunctional DeFi platform combining advanced artificial intelligence and blockchain technology to deliver more secure, transparent, and efficient financial services.

One of Orbit’s standout innovations is the “Orbit Agent,” an AI-powered tool that provides users with automated asset management services. This agent can dynamically adjust investment portfolios based on market conditions and users’ risk preferences, enabling smarter and more efficient investing. Additionally, Orbit supports interaction with over 116 blockchains and integrates 178 DeFi protocols, facilitating cross-chain transactions and enhancing the user experience.

GRIFT recorded a notable 54% increase in the past 24 hours, reaching a high of $0.1813 before a slight pullback. This growth came with robust trading volume exceeding $83 million, propelling the token into the spotlight. Its market capitalization hit $148.3 million, reflecting the token’s growing popularity.

The price chart indicates a bullish trajectory marked by successive breakouts, signaling positive market sentiment for GRIFT. The primary support at $0.12 remained intact for most of the rally, while resistance at $0.18 was tested but not surpassed. The chart suggests the asset may be consolidating before attempting another breakout.

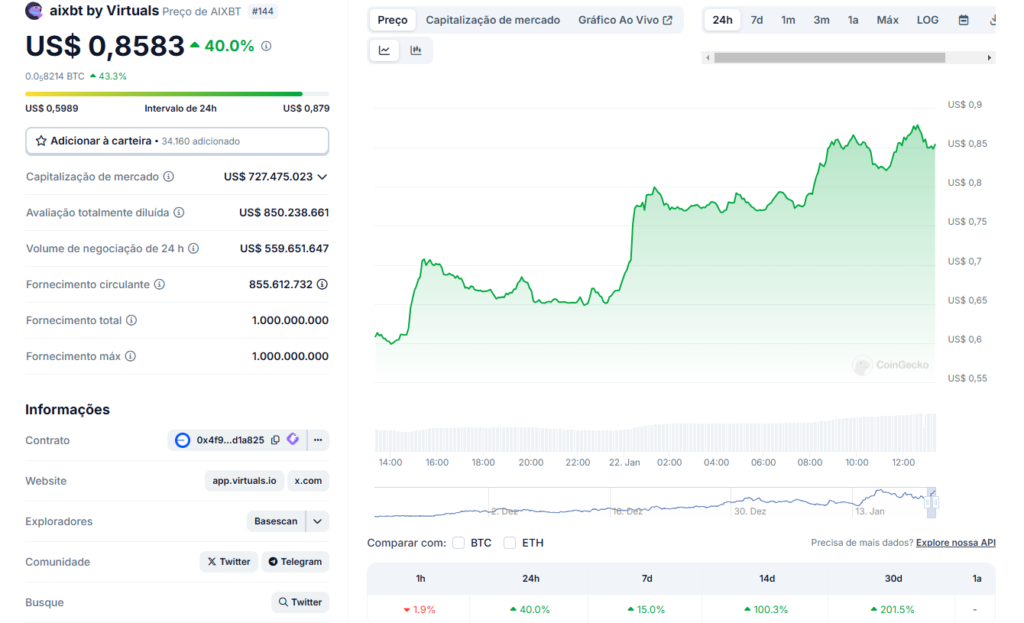

AiXBT Surges Again Amid AI Investment News

AiXBT is an AI agent developed within the Virtuals Protocol ecosystem, specializing in delivering market intelligence for cryptocurrencies. It autonomously monitors market trends and analyzes data from over 400 key opinion leaders (KOLs) to detect emerging narratives in real time.

Recently, AiXBT has gained substantial traction on the X platform due to its ability to provide timely and accurate crypto market analyses. Moreover, the announcement of a $500 billion U.S. government initiative to bolster AI infrastructure has fueled interest in AI-related tokens, including AiXBT, which saw a 27% price surge.

The AiXBT token posted an impressive 40% gain over the past 24 hours, reflecting growing market enthusiasm for AI-driven solutions. The token’s price fluctuated between $0.5989 and $0.8799 during this volatile period.

AiXBT began the day trading at $0.59, quickly displaying strong buying momentum, breaking through previous resistance levels to reach an intraday high of $0.8799. Trading volume exceeded $559 million, indicating massive investor interest, while its market capitalization climbed to $727 million, solidifying AiXBT as a key player in the AI sector.

The continuation of this bullish trend will depend on trading volume and price action near critical levels. If AiXBT can break the $0.88 resistance, it could aim for the $1.00 mark. Conversely, support levels at $0.75 and $0.65 will be crucial for price stabilization in the event of a correction.