The crypto market is gaining renewed momentum as the U.S. Securities and Exchange Commission (SEC) prepares to host a high-profile roundtable on tokenization next week. With BlackRock set to participate, this meeting could mark a turning point in how digital assets are regulated. In this article, we highlight the top 5 altcoins expected to rally ahead of the SEC’s meeting with BlackRock and other major institutions.

Altcoins Poised for Gains Before the SEC’s Meeting with BlackRock

As anticipation builds around the SEC’s upcoming roundtable on tokenization, several Real World Asset (RWA) altcoins are gaining traction. Set to take place on May 12 at the SEC headquarters, the event will include representatives from powerhouse firms such as BlackRock, Franklin Templeton, Apollo Management, Invesco, and Robinhood. Collectively, these firms manage over $15.6 trillion in assets.

Moreover, the discussion will feature leading blockchain and crypto-native companies like Securitize, DTCC, Blockchain Capital, and Maple Finance. Commissioner Hester Peirce emphasized that the meeting aims to explore strategic ways for the SEC to engage with the rapidly evolving tokenization space.

Notably, Ondo Finance (ONDO), Ethereum (ETH), Ethena (ENA), Chainlink (LINK), and Stellar (XLM) are among the top altcoins to watch ahead of the SEC’s meeting with BlackRock. These projects appear well-positioned to benefit from heightened institutional interest.

Top Real World Asset (RWA) Altcoin to Watch

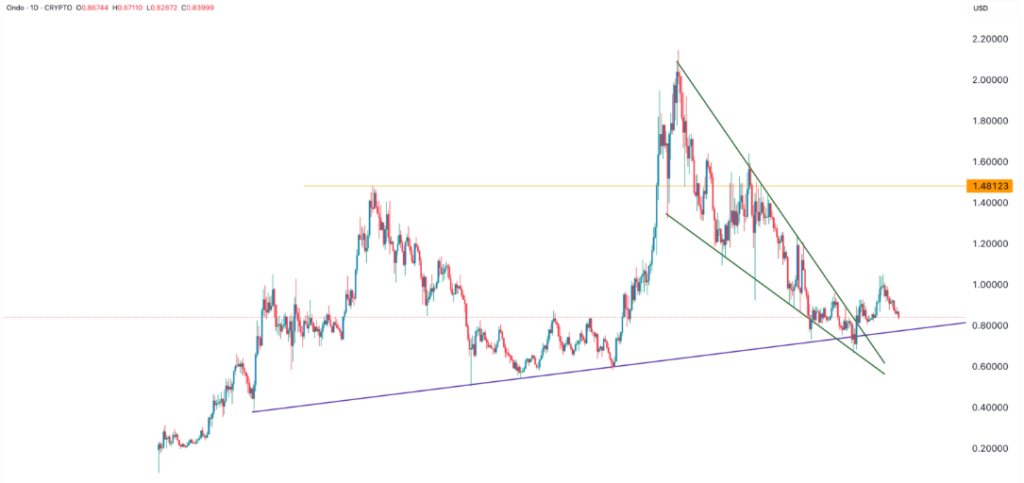

Ondo Finance (ONDO)

Ondo Finance emerges as a standout altcoin in the RWA space just ahead of the SEC roundtable. The project offers innovative yield-bearing assets like USDY (US Dollar Yield) and OUSG (US Treasuries Yield), placing it at the forefront of tokenized finance.

Institutional partnerships add to Ondo’s credibility. The platform has formed strategic alliances with BlackRock and Securitize. For example, its OUSG token is backed by BlackRock’s BUIDL fund, developed in collaboration with Securitize.

From a technical analysis perspective, ONDO is signaling bullish momentum. The token has formed a falling wedge pattern on the daily chart and continues to trade above a rising trendline established since March 24. Consequently, the price may rebound as the roundtable event draws closer.

Ethereum (ETH): A Key Altcoin for Tokenization and ETF Exposure

Ethereum continues to stand out as a strong altcoin investment, particularly as institutional demand increases. BlackRock’s spot Ethereum ETF, ETHA, currently the largest in the market, further validates ETH’s significance in mainstream finance.

In addition, Ethereum’s foundational role in tokenized assets strengthens its relevance in the RWA movement. Technically, ETH has formed a minor flag pattern on the daily chart. If it breaks above $2,135, the August 2023 low, a rally toward the $2,500 level could follow.

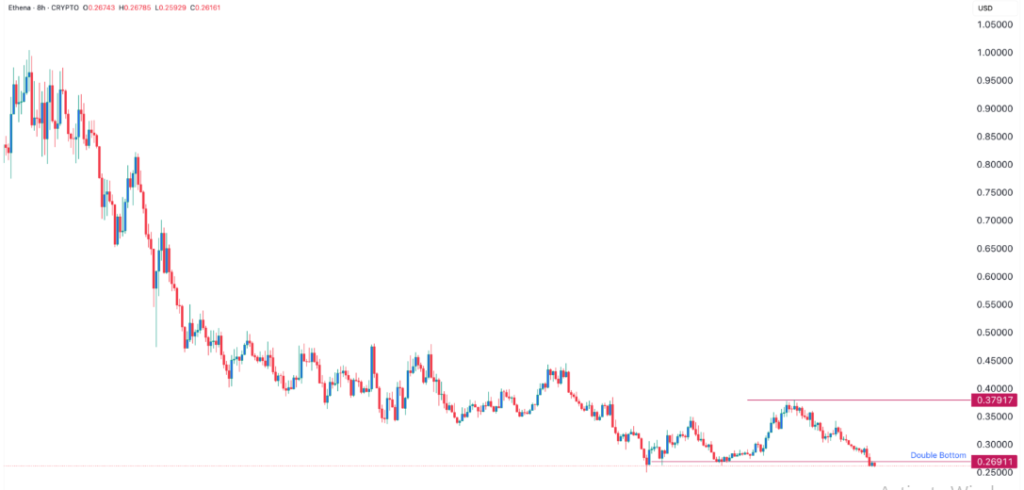

Ethena (ENA): Stablecoin Innovator Poised for a Breakout

Ethena has rapidly established itself as a major player in the stablecoin market. Its flagship asset, USDe, is now the fourth-largest stablecoin by market cap, surpassing $4.6 billion in circulation. A key growth driver is its partnership with Securitize, which will also participate in the SEC’s meeting with BlackRock.

Ethena and Securitize are currently building the Convergence Blockchain and co-developing USDtb, a stablecoin backed by BlackRock’s BUIDL fund. This collaboration signals strong institutional support and innovation.

Technically, ENA is showing a bullish double-bottom pattern around the $0.2690 level. If the pattern holds, the price could rise to the next resistance level at $0.3791.

Chainlink (LINK): Powering Tokenization Through Cross-Chain Infrastructure

Chainlink continues to play a critical role in the RWA tokenization ecosystem. Its Cross-Chain Interoperability Protocol (CCIP) serves as a vital infrastructure layer for various institutional blockchain projects. As the SEC hosts its roundtable with BlackRock, LINK could benefit from increased visibility and relevance.

From a charting perspective, LINK has formed a broadening wedge pattern, often referred to as a “megaphone.” This formation suggests heightened volatility and a strong potential for upward movement. If momentum continues, LINK may rally toward the $30 level, representing a 135% gain from its current price.

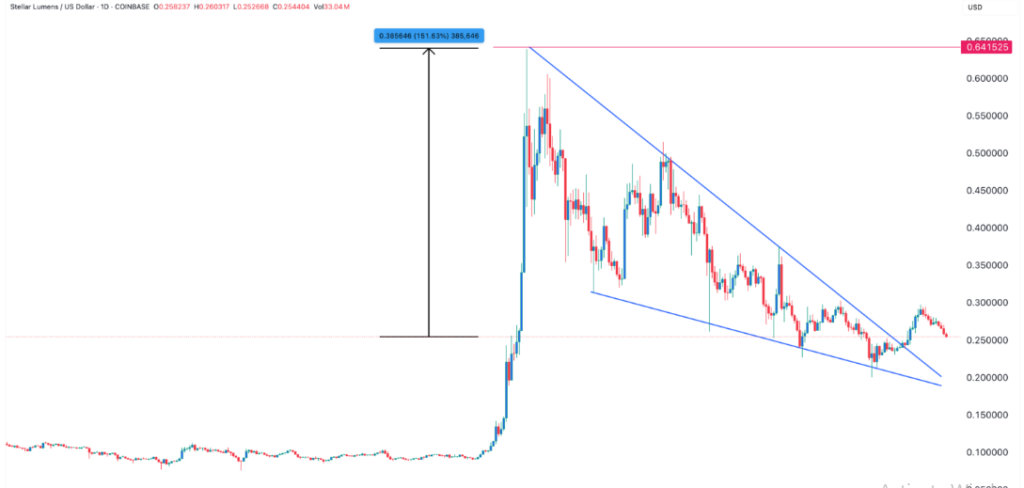

Stellar (XLM): Institutional-Backed Blockchain Poised for Rebound

Stellar (XLM) is gaining momentum as a potential breakout altcoin in advance of the SEC’s tokenization roundtable. Franklin Templeton, one of the event’s key participants, operates a $450 million tokenized fund on the Stellar network. This association underscores Stellar’s growing institutional relevance.

XLM is currently showing bullish technical signs. The token has formed a falling wedge pattern and recently retested its $0.25 support zone. As a result, Stellar may experience a price rebound in the near term.

Conclusion

This overview highlights several altcoins gaining traction ahead of the SEC’s meeting with BlackRock and other institutional players. With strong technical setups and solid partnerships within the RWA space, these tokens present compelling opportunities for investors focused on tokenization and evolving crypto regulation.

Frequently Asked Questions (FAQs)

What are the best altcoins to watch ahead of the SEC’s meeting with BlackRock?

Altcoins like Ethereum, Chainlink, Ethena, Ondo Finance, and Stellar show strong potential heading into the SEC’s meeting with BlackRock. These projects are actively involved in the RWA sector and maintain key institutional collaborations.

Why could these cryptocurrencies perform well before the meeting?

These tokens are gaining momentum due to bullish technical indicators and their involvement in significant tokenization efforts. Their ties to BlackRock and other institutions make them highly relevant in the context of the SEC’s upcoming discussion.

What is the purpose of the SEC’s meeting on tokenization?

The SEC aims to engage with top industry participants, including BlackRock, to gain deeper insights into the tokenization landscape. The goal is to inform future regulatory policies and strengthen oversight in the crypto space.