VanEck has stepped boldly into the tokenized real-world asset (RWA) space by launching VBILL, a blockchain-based fund offering exposure to U.S. Treasury bills. The global investment firm collaborated with digital asset tokenization platform Securitize to develop the fund, bringing significant institutional credibility to this rapidly growing sector.

According to a May 13 announcement, VBILL will launch across four major blockchain networks: Ethereum, Avalanche, BNB Chain, and Solana. Minimum investments start at $100,000 for all networks except Ethereum, where the entry point rises to $1 million.

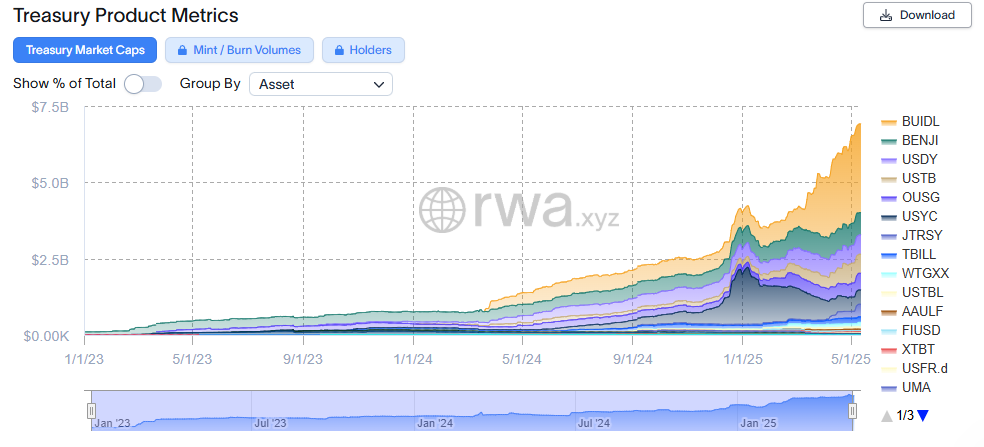

As a result of this launch, VanEck joins a wave of financial powerhouses entering the RWA tokenization space. These include BlackRock, Franklin Templeton, and Apollo Global, all of which have introduced similar products in recent months. For example, Apollo unveiled a private credit tokenized fund earlier this year. Currently, private credit leads the RWA sector in value. Tokenized Treasurys follow closely, with a market capitalization of $6.9 billion, according to RWA.xyz.

Securitize Strengthens Its Blockchain Presence

Meanwhile, VanEck’s technology partner Securitize continues to expand its influence. The platform has already tokenized more than $3.9 billion in assets. In addition, the company secured $47 million in strategic funding in May 2024. Notably, this round was led by BlackRock, reinforcing rising institutional interest in blockchain-powered financial infrastructure.

Why RWA Tokenization Is Accelerating

Supporters of tokenized finance emphasize its disruptive potential. They argue that faster settlement times, 24/7 market access, and the ability to unlock liquidity from historically illiquid assets offer significant advantages over traditional systems. Consequently, tokenized assets are becoming increasingly attractive to both investors and institutions.

SEC Chair: Blockchain’s Disruption Mirrors Digital Music Revolution

At a May 12 SEC roundtable, Chair Paul Atkins made a striking comparison between blockchain innovation and the digital transformation of the music industry.

“Just as music evolved from analog to digital formats, financial markets may undergo a similar shift as securities move onchain,” Atkins said.

He went on to emphasize that blockchain technology could enable entirely new approaches to issuing, trading, and owning assets. As a result, this evolution may outpace the assumptions built into the SEC’s current regulatory framework.

“Blockchain enables market behaviors that were unimaginable when many of our existing rules were written,” he added. Therefore, Atkins stressed the need for regulatory modernization to keep pace with tokenization’s rapid development.