The price of Bitcoin (BTC) started the week on a bearish note, facing significant selling pressure. The leading cryptocurrency briefly dropped to $97,700 and is now trading around $99,000, attempting to reclaim the $100,000 support level.

Bitcoin Seeks Liquidity to Resume Its Rally

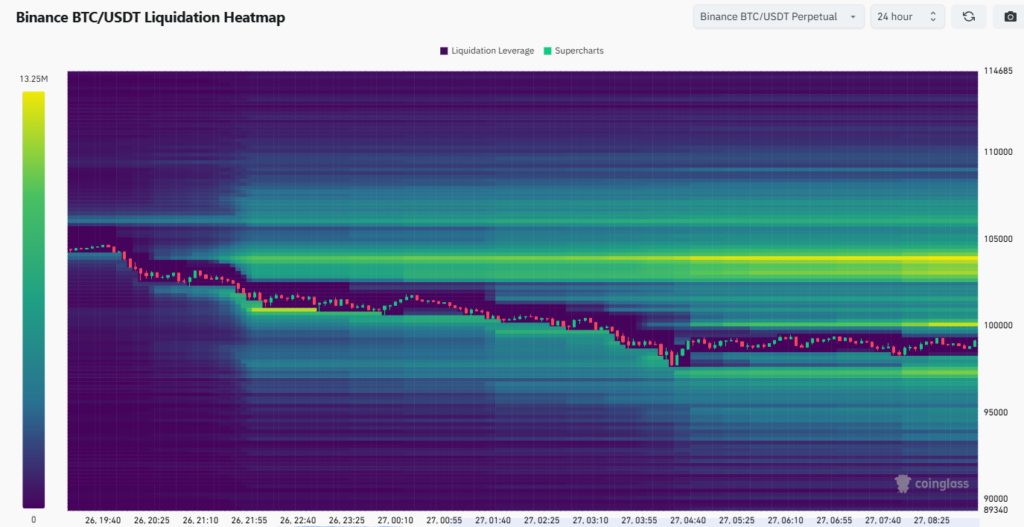

Bitcoin continues to face substantial selling pressure after losing key support levels. This recent movement pushed its price below $100,000, breaking crucial zones for buyers, as highlighted by the liquidation heatmap.

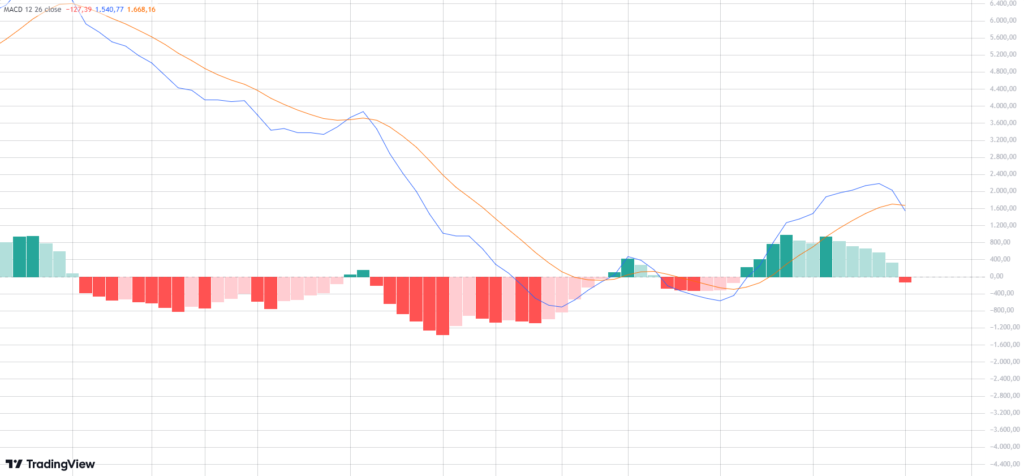

The Bitcoin MACD indicates a bearish reversal, with the signal lines crossing downward and the histogram turning negative. This suggests that bearish momentum is gaining strength. Meanwhile, Bitcoin’s RSI hovers near 46, signaling weakened buying pressure without yet entering oversold territory. Additionally, trading volume shows an increase in bearish candles, reflecting strong seller dominance.

Support and Resistance

BTC’s price has found immediate support around the $97,000 region, where a concentration of liquidations and buy orders is evident. However, a break below this level could lead to a sharper decline toward the next support at $92,000. On the upside, resistance levels are positioned at $105,000 and $108,000. These areas must be overcome for the price to regain an upward trend.

BTC Price Outlook

If Bitcoin manages to hold the current support, we may see an attempt to recover toward the $105,000 resistance. However, this will depend on a resurgence in buying volume. Conversely, if the $97,000 support is lost, the bearish trend could deepen, potentially driving the price to test $92,000 or even lower levels.

Market dynamics suggest caution, with close attention to indicators and trading volume. Consolidation at lower levels could create opportunities for new directional moves in the coming days.