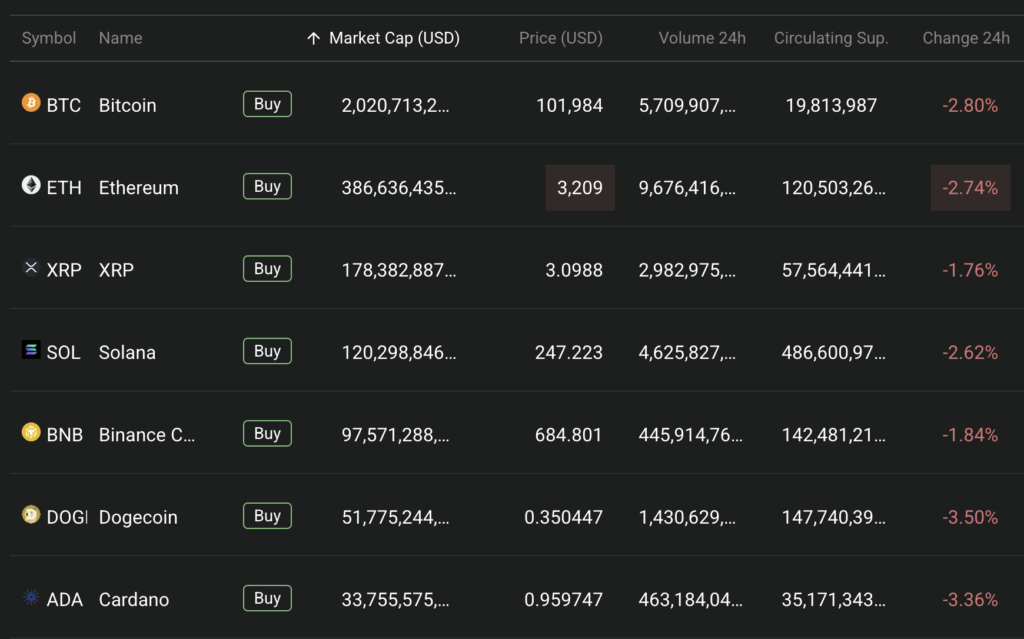

The cryptocurrency market experienced a significant dip today, with the total market capitalization falling by 3% to $3.54 trillion. Bitcoin, Ethereum, and other major cryptocurrencies are showing losses, while market sentiment remains cautious. This decline can be attributed to delays in cryptocurrency policy announcements, rising Treasury yields, and shifting macroeconomic indicators.

In addition, technical analysis shows that the market has lost key support levels, adding to the selling pressure. Investors are closely monitoring developments as the market approaches critical resistance points.

Factors Driving Today’s Crypto Market Decline

- Policy Uncertainty and Delayed Executive Actions

The anticipation surrounding new cryptocurrency policies under President Trump has yet to materialize. Despite campaign promises to establish the U.S. as a global crypto leader, no specific executive orders have been issued since the administration took office. Expectations included the creation of a Strategic Bitcoin Reserve and a crypto advisory council, but delays have dampened market optimism.

Concerns have also arisen regarding proposals like eliminating capital gains taxes on U.S.-based cryptocurrencies, which some fear could favor select assets, leading to market imbalances.

- Macroeconomic Factors and Rising Treasury Yields

Broader economic conditions are also impacting the crypto market. Stronger-than-expected growth in the U.S. services sector has driven Treasury yields higher, prompting investors to shift toward safer assets. Additionally, the Federal Reserve’s hawkish stance has reduced expectations for near-term interest rate cuts, further pressuring risk assets like cryptocurrencies.

The U.S. dollar has also strengthened, with the DXY index up 0.61% in recent sessions. This rise is tied to tariffs proposed by the Trump administration, creating headwinds for global markets and cryptocurrencies.

- Technical Analysis: Key Support Levels Broken

The combined market capitalization of all cryptocurrencies (TOTAL) fell below its 50 simple moving average (SMA) on the four-hour chart, turning this level into immediate resistance. The relative strength index (RSI) has dropped significantly, signaling a loss of momentum. If selling persists, the market could test support at $3.43 trillion, a critical trendline since January 19.

Conclusion

Today’s cryptocurrency market decline stems from a combination of policy delays, unfavorable macroeconomic conditions, and technical weakness. While some altcoins managed to buck the trend, the broader market remains under pressure. Investors should closely monitor upcoming policy announcements and macroeconomic shifts, as these factors will likely shape the crypto market’s trajectory in the near term.