The crypto market is kicking off the week on edge as investors brace for the upcoming FOMC meeting on Wednesday (29th). While a new interest rate cut is unlikely, a dovish statement from the Fed could lift spirits. However, experts warn that the labor market may push inflation higher, potentially forcing the Fed to hike rates instead.

This Monday’s analysis (27th) dives into the reasons behind the sharp decline of the top three cryptocurrencies in the market. Find out what’s next for BTC, ETH, and SOL.

Bitcoin Fails to Break Resistance and Loses $100K Support Again

Bitcoin’s drop below the critical $100,000 support level came with increased trading volume, signaling intense selling pressure. The next key support lies around $95,000, while immediate resistance is at $100,000, which may now act as a barrier to any potential recovery.

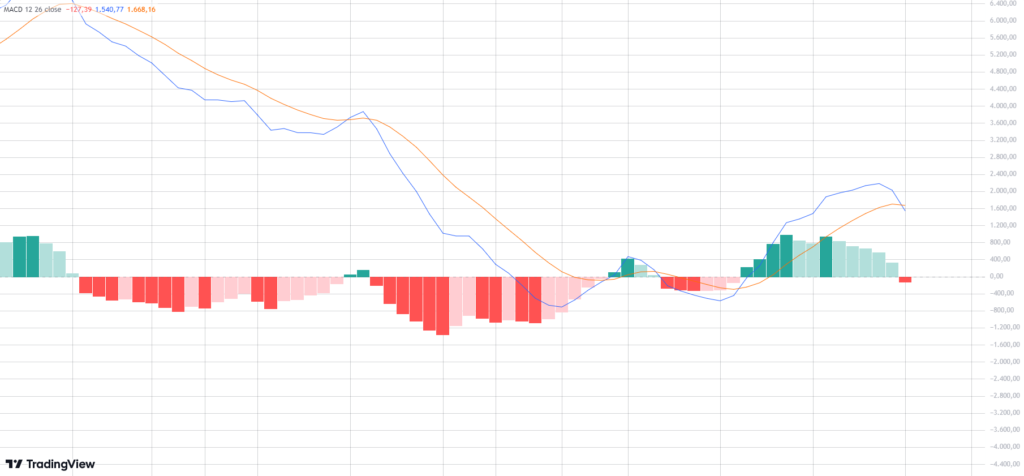

The Relative Strength Index (RSI) stands at 46.22, indicating neutral conditions but with a bearish tilt as no signs of short-term reversal are evident. The MACD indicator shows a downward crossover of the moving averages, reinforcing the likelihood of continued bearish momentum.

The 8-period exponential moving average (EMA) sits at $97,077.12 and could provide short-term dynamic support. However, if the EMA is breached, it may signal a shift toward a more prolonged bearish trend, leading Bitcoin into an extended consolidation phase after finding a support zone.

If BTC manages to reclaim the $100,000 level with rising volume, the asset could target resistance levels at $103,000 and $105,000. On the downside, a loss of the $95,000 support could open the door to even lower levels, such as $90,000, increasing selling pressure.

Ethereum Breaks Support, Deepening Bearish Trend with a 5.64% Drop

On the daily chart, Ethereum (ETH) broke through the $3,200 support level, accompanied by a surge in selling volume. This breakdown is significant as it highlights strengthening bearish sentiment. The next critical support is at $3,000, a level that could be tested in the coming days.

The descending trendline remains a dynamic resistance, further reinforcing the bearish outlook. The RSI is at 38.50, approaching oversold territory, which might attract speculative buyers seeking a short-term recovery.

The 8-period EMA at $3,335.01 serves as a key dynamic resistance. If Ethereum fails to reclaim this level, the price could face an extended bearish reversal.

If ETH finds support at $3,000 and shows buying strength, it could target the $3,200 resistance level and the descending trendline. Conversely, a break below the $3,000 support would shift the focus to the next critical level at $2,800.

Solana Corrects Sharply and Tests $220 Support

On Solana’s (SOL) daily chart, the price has pulled back from a significant resistance zone between $260 and $270, indicating strong rejection at this level. This area previously served as a concentration of selling pressure, suggesting difficulty in breaking above it in the short term.

The current decline has brought SOL back to the $220 support region, which has historically acted as a strong defense.

The 8-period EMA is in a downward crossover position, suggesting the potential continuation of the bearish trend. The RSI hovers near the 50 level but is trending downward, reinforcing the weakening bullish momentum.

If Solana loses the $220 support, the price could drop to lower levels, potentially retesting the $200 or even $190 regions, depending on the volume and selling pressure. On the other hand, a recovery from the support and a breakout above the $260 resistance could rekindle buyer interest, pushing the price to test higher levels around $280 to $300.