Cryptocurrency is beyond trading and investing in crypto tokens. Other methods, such as staking, yield farming, and many others, are gaining traction in the crypto market. Decentralized finance (DeFi) has opened up new earning pathways for crypto aficionados. And two popular strategies stand out: staking and yield farming. But which of these plans is better for generating submissive income in 2024?

Statistics show that crypto ownership is growing at a 6.8% rate as the number of recent crypto users is about 560 million globally. This number is a testament to the amazing perks that the crypto ecosystem offers people. In this situation, crypto staking is the method of holding your additional crypto assets and making these assets earn more crypto for you.

Then, what is yield farming, and how is it different from crypto staking? Let’s take an analogy of digital banks as they function to create an ecosystem for digital payments in exchange for goods. Yield farming creates a set of rules and regulations for the working of DeFi protocols.

In this guide, we will dive deep into the world of staking and yield farming. We will explore the following areas of the crypto ecosystem:

- Staking vs yield farming

- Overview of staking and its working

- What is yield farming, and how does it work

- Best platforms for staking as well as yield farming

- Pros and cons of staking and yield farming

- Which method offers better returns for the modern-day crypto investor?

Continue reading to get ahead of the curve in your cryptocurrency game.

Overview of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a cover term that describes a variety of financial services and products. The DeFi is successful due to the following components as they work together to make DeFi functional. They are:

- Blockchain technology, such as Ethereum, Solana, Polkadot, and many more.

- Cryptocurrency tokens, like Ethereum (ETH), Solana (SOL), Ripple (XRP), etc.

- Decentralized Applications (dApps) or protocols.

DeFi is different from the traditional banking system and the reason for that is DeFi operates without intermediaries. For instance, banks or brokers are excluded from the working of DeFi and its applications.

This offers users complete control and ownership over their resources. Furthermore, this ensures transparency, higher accessibility, and robust efficiency to financial transactions through the use of smart contracts. Smart contacts are automated programmed software that executes when a specific set of terms and rules are fulfilled.

Now, let’s talk about how you can make money from DeFi solutions. The methods are widespread to earn passive income within DeFi, but we will talk about some of the most looked-after ones. They are:

- Lending and Borrowing: In the crypto world, you can lend your extra crypto funds to borrowers for passive income in crypto, non-fungible tokens (NFTs), etc.

- Staking: It is holding your crypto funds in a decentralized wallet for the support of blockchain operations, leading to rewards and monetary gains.

- Yield Farming: This method is effective in giving matchless strength to decentralized exchanges (DEXs). Yield farmers use their funds for increased liquidity to platforms like Uniswap, SushiSwap, etc., and this earns them numerous rewards and profits.

The vitality of staking as well as yield farming has gone beyond the imagined limits. They have gained an important position in the crypto market. As per Statista, Ethereum is the most staked crypto coin worldwide with over 114.04 billion USD staked as of June 2024.

What Is Staking?

Staking is the process of locking up your cryptocurrency in a blockchain network that uses a Proof of Stake (PoS) or Proof of Delegated Stake (DPoS) consensus mechanism. In other words, you simply give your crypto to someone, and they will give back money.

However, this entire process is decentralized and there are no third parties involved. In doing so, you contribute to the security and functioning of a blockchain.

Moreover, when you stake crypto, you help verify transactions and secure the network. And in return, you earn rewards, usually in the form of the staked cryptocurrency. The more you stake, the higher your chances of being selected to verify transactions and earn rewards.

How Does It Work?

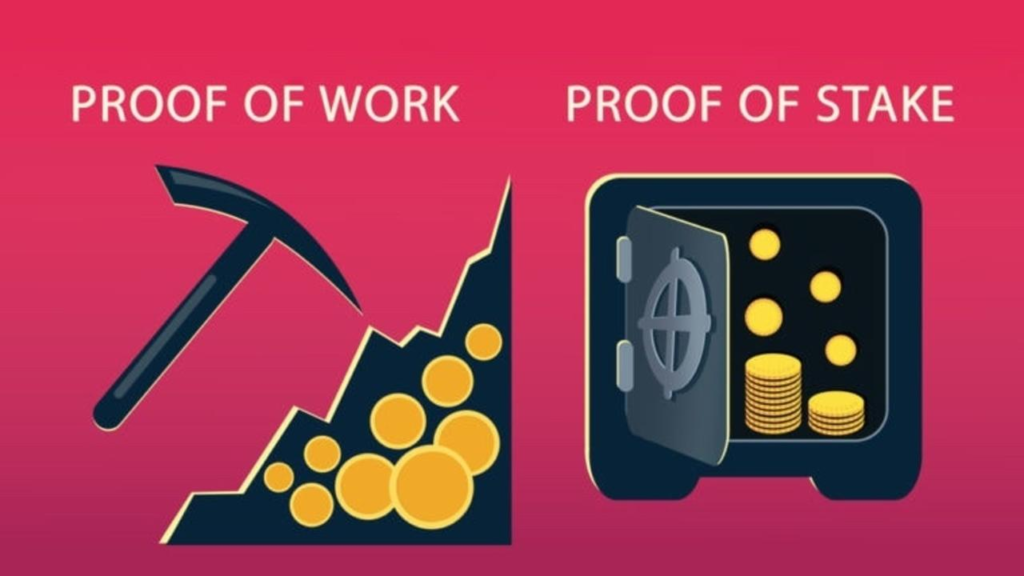

The primary requirement for crypto staking is consensus mechanisms. This refers to the system of how a blockchain handles transactions and data-storing processes. There are many consensus mechanisms, including Proof-of-Work (PoW), Proof-of-Staking (PoS), Proof-of-Agreement (PoA), etc.

Each mechanism offers versatile functions and staking requires PoS consensus. This method allows crypto holders to be validators or verifiers of the upcoming data and information for the blockchain. In doing so, the validators or stakeholders earn revenue during the process.

You can also become a validator of a blockchain that employs PoS protocol. That includes Ethereum 2.0, Solana, Cardano, etc. You can choose any of the mentioned or other PoS blockchains and deposit funds of your preference. Then, you must lock the crypto assets for a certain time to earn profits from your revenue. This is how crypto staking works.

Pros of Crypto Staking

Staking offers numerous benefits to crypto users since it offers stability to the blockchain network. This results in the advancement and improvement of the network. Therefore, crypto staking is one of the most popular ways of making money for crypto enthusiasts globally.

Some of the leading perks of staking are given as follows:

1. Profound Profits

Since every cryptocurrency has a specified annual percentage yield (APY), you can expect a certain amount of revenue in the lock-in period. Once the period is over, the rewards and profits will be credited to your account automatically. This gives a sense of stability in the volatile ecosystem of cryptocurrency.

2, Supporting Blockchain

The best benefit of staking is supporting the blockchain you stake your funds on. This way, the entire community benefits while you earn passive income. Furthermore, this also increases the value of your staked funds.

3. Defy Inflation

Inflation has an impact on the value of cryptocurrency. Though it is decentralized, the fiat currency still has some shadow on it. This leads to devaluation of the crypto assets over time. When you stake your funds, you are immune to inflation and price fluctuation in the crypto market.

4. Lower Risk

Compared to other crypto endeavors, crypto staking is less risky. Because you never have to participate in the liquidity pool, you are free from major financial losses. However, this does not mean that you are completely safe from price fluctuation or money risks. Therefore, conducting thorough market research is a must for staking or any crypto project.

Concerns with Staking

Despite the versatile benefits of staking, there are some drawbacks to it as well. For instance, some staking platforms are rigid while others are flexible. As volatility is a major part of the crypto ecosystem, this lock-in duration may affect your earnings and overall financial status.

Here are some of the leading risks associated with crypto staking:

1. Asset Volatility

Although staking offers expected rewards, the basic cryptocurrency’s value can still vary, which may affect the overall value of your earnings.

2. Lock-In Periods

Some staking platforms have fixed terms, meaning you can’t access your funds for a set time. If the price of the staked asset drops significantly during this period, you may find losses.

3. Protocol risks

While staking is relatively safe, there are risks involved with the blockchain network itself, such as changes in consensus rules or slashing penalties for validators who misbehave or experience downtime.

Overview of Yield Farming

Yield farming has another name, liquidity mining as it describes its working more effectively. This is a more complex and active method of earning passive income in the DeFi ecosystem.

Yield farming ensures liquidity to specific platforms. They are decentralized exchanges like Uniswap. What is liquidity? Imagine a market where someone converts the product into cash after a specific duration or threshold so that further trades occur. This is what we call liquidity in the crypto market.

In this method, yield farmers are liquidity providers (LPs). They give their crypto assets to the exchanges so they can lend them to crypto users for trading and investing. This earns farmers an adequate amount of profits as well as contributes to the betterment of DEX.

Moreover, yield farming is more advanced and more difficult than crypto staking. But the returns are higher than staked funds. This leads to increased risks and financial losses as well. Some of the noteworthy risks are impermanent loss, smart contract vulnerabilities, and price volatility.

Working of Yield Farming

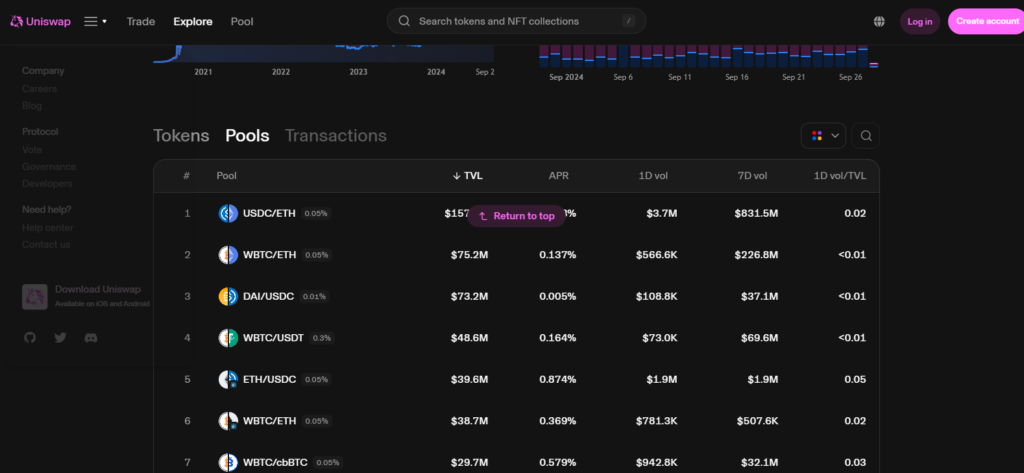

yield farmers need to select a liquidity pool from platforms like Uniswap, SushiSwap, or PancakeSwap. Liquidity pools usually consist of two tokens that are paired together for trading purposes, such as the Ethereum and Tether (ETH/USDT) trading pair.

Once you choose a pool, you deposit equal amounts of both tokens into the liquidity pool. This helps facilitate trades on the platform, as your assets provide the liquidity traders need.

As people trade using the liquidity you’ve provided, you earn rewards in the form of a share of the trading fees or governance tokens, which can then be traded or staked for additional profits.

For instance, on a platform like Uniswap, you can provide your funds to borrowers in crypto trading pairs like ETH/USDT. Once they swap one coin with another, you as a yield farmer will get a reward or a proportion of the profit for it. The best thing is that some platforms also offer governance tokens as rewards, which grant holders voting rights for protocol changes.

Perks of Yield Farming

Akin to crypto staking, yield farming also holds numerous perks for yield farmers. Statistics suggest that North America is the top-ranked region in terms of DeFi yield farming with about a 35% share in the global yield farming revenue.

Let’s have a look at some of the key benefits of yield farming for crypto users in 2024.

1. High Returns

yield farming is a lucrative way in the crypto ecosystem. The best tip for generating more revenue off yield farming is to opt for high-volume crypto assets, such as Bitcoin, Ethereum, etc. This way, you can compound your financial gain in less time.

2. Versatile Rewards

Yield farming is not just about making money through profits. This offers a chance to yield farmers as they can get other crypto tokens as a reward. Once you offer your crypto assets for liquidity to a DEX, you may get governance tokens of the exchange. And you can trade or establish your authority on the platform with these tokens.

3. Flexibility of Asset Usage

The freedom to withdraw and reuse your crypto funds is one of the best perks of yield farming. This feature also makes it superlative than staking because you may not have the freedom to use your funds in staking. This way, the enjoyment of flexibility and funds management is excellent in yield farming.

4. Early Crypto Rewards

Since the crypto market is booming with new crypto tokens, yield farming paves the way for higher revenue. As a yield farmer, you support new projects and earn massive profits out of it. Therefore, it is one of the most sought-after methods of making passive income in 2024.

Risks of Yield Farming

It is noteworthy that nothing comes with perfection. Unfortunately, yield farming offers some hazardous risks to crypto users that may lead to financial loss. We have covered the main risks so that you can keep yourself safe in your crypto endeavor.

1. Impermanent Loss

One of the most important risks in yield farming is impermanent loss. This happens when the value of the tokens you provide to a liquidity pool diverges, leading to a loss in value compared to simply holding the assets.

2. Smart Contract Vulnerabilities

Yield farming rests on DeFi protocols, which are governed by smart contracts. A vulnerability in a smart contract can lead to hacks or exploits, resulting in the loss of funds. In 2020, for example, DeFi projects lost more than $100 million to hacks due to smart contract vulnerabilities.

3. High Gas Fees

Yield farming on the Ethereum network, for example, can incur high gas fees—the transaction fees required to perform operations on the blockchain. This can eat into your profits, especially when dealing with smaller amounts.

Staking vs Yield Farming: A Comparative Analysis

Now that we understand how both staking and yield farming work, let’s compare them across various aspects.

|

Feature |

Crypto Staking |

yield Farming |

|---|---|---|

|

Risk Level |

Lower risk due to established PoS networks |

Higher risk due to smart contract vulnerabilities and impermanent loss |

|

Liquidity |

With low liquidity, funds are often locked for a set period |

Higher liquidity but impermanent loss may affect returns |

|

Complexity |

Simple and straightforward |

Requires active management and understanding of DeFi protocols |

|

Rewards |

Consistent but usually lower than yield farming |

Higher rewards but subject to market volatility |

|

Gas Fees |

Lower on established networks like Solana |

Higher due to frequent transactions on Ethereum DEXs |

|

Smart contract risk |

Low as you’re usually working directly with the PoS network |

High, as you rely on DeFi protocols and their security |

|

Best For |

Long-term investors who want predictable returns |

Active traders looking for high-risk, high-reward opportunities |

Top 4 Cryptocurrencies for Staking in 2024

Now that you have learned what staking and yield farming are let’s uncover the top performers in the cryptocurrency world for stakeholders. Here are some of the best cryptocurrencies to consider for earning extensively via staking:

1. Ethereum (ETH)

Since Ethereum is the leading blockchain for stakeholders, its native coin ETH will be on the top of the list. Ethereum’s transition to Ethereum 2.0, a Proof of Stake network, has made it a top choice for staking.

The Ethereum blockchain has continued its growth as it joined hands with numerous organizations. This opens a gateway for enhanced security and widespread adoption of Ethereum tokens. In this scenario, staking ETH is the best option.

2. Cardano (ADA)

Cardano is one of the most energy-efficient and scalable blockchain technologies. The platform works on the Ouroboros PoS consensus mechanism. This allows users to stake cryptocurrency on the go and earn passive revenue. You can stake Cardano effortlessly as the minimum amount is 10 ADA.

3. Solana (SOL)

Solana is another top-notch cryptocurrency to consider for staking. The Solana blockchain has enabled its token to have unmatched features and benefits for crypto enthusiasts. Its PoS model paves the way for appealing rewards when you stake SOL.

4. Tezos (XTZ)

Tezos is an older PoS blockchain that offers robust staking mechanisms. Tezos has an adaptable governance system, which allows it to adapt over time without the need for hard forks. The rewards for staking Tezos are generally 5% to 10% depending on the lock-in period or the time you lock your funds for.

Best Yield Farming Platforms in 2024

After learning about the pros and cons of yield farming, where to start this and earn passive income? This may be the question striking your mind at the moment. We have listed key platforms that enable you to become yield farmers and earn significantly in the crypto world.

They are as follows:

1. Uniswap (UNI)

Uniswap is one of the largest decentralized exchanges, offering yield-farming opportunities for liquidity providers. Yield farmers can earn governance tokens (UNI) along with trading fees. Uniswap is known for its user-friendly interface and high liquidity.

2. SushiSwap (SUSHI)

SushiSwap is a popular fork of Uniswap that provides additional rewards for liquidity providers. SushiSwap incentivizes yield farmers by offering SUSHI tokens, which can be staked for additional returns. It has also introduced features like xSUSHI staking for long-term holders.

3. PancakeSwap (CAKE)

PancakeSwap is based on Binance Smart Chain (BSC) and offers lower transaction fees than Ethereum-based platforms. It is highly popular for yield farming due to its attractive rewards and range of supported tokens. Liquidity providers earn CAKE tokens as rewards, which can then be staked for further profits.

4. Aave (AAVE)

Aave is a DeFi lending platform that also provides yield farming opportunities. By depositing assets into Aave’s liquidity pools, users can earn interest as well as governance tokens (AAVE). Aave is known for its Flash Loans and innovative liquidity solutions.

5. Curve Finance (CRV)

Curve Finance specializes in stablecoin liquidity pools, offering lower-risk yield farming opportunities. While the returns might not be as high as other platforms, Curve minimizes the risks of impermanent loss, making it an attractive option for more conservative yield farmers.

Best Crypto Staking Exchanges

You can take on the above-mentioned platforms but they are difficult for beginners. Therefore, we have listed some of the beginner-friendly platforms that anyone can use. These are centralized exchanges (CEXs) for a secure and effortless experience.

That includes:

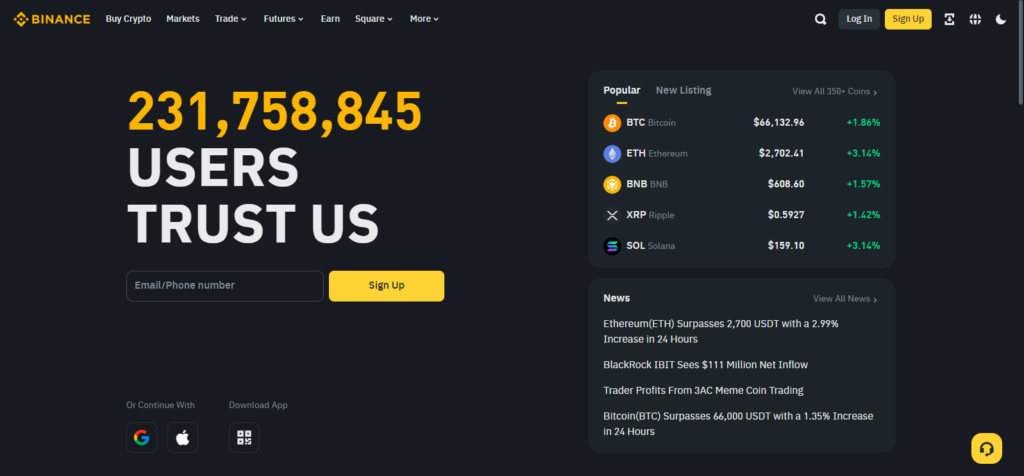

- Binance: As the leading crypto exchange with over 200 million users globally, Binance is the superlative among all. This allows users to stake multiple cryptocurrencies with competitive annual percentage yields (APYs).

- Coinbase: Known for its ease of use, Coinbase offers staking for Ethereum and other coins.

- Kucoin: Kucoin offers both staking and lending services with multiple PoS coins available.

Conclusion

The answer to whether staking or yield farming is better for earning passive income in 2024 depends on your risk tolerance, investment goals, and level of engagement.

If you prefer lower risk, stable returns, and a hands-off approach, staking is likely the better option. It is perfect for long-term investors who want to support a blockchain network and enjoy predictable, consistent rewards. Yield farming is the best choice for those who fancy higher risks and rewards.

In 2024, both strategies will continue to be viable ways of earning passive income in the crypto space. And selecting the most suitable one depends on your personal risk appetite and the level of involvement you’re comfortable with. Therefore, we advise you to diversify your portfolio with both methods, including staking and yield farming.

FAQs

1. What is staking in crypto?

Staking involves locking your cryptocurrency in a Proof of Stake (PoS) network to support its operations and security. In return, you earn rewards in the form of extra cryptocurrency.

2. Is yield farming still profitable?

With a flair for risks, you can rely on yield farming methods to make passive revenue in the crypto ecosystem.

3. Should I choose to stake or yield farming?

This depends on your level of risk management. Staking is a safe and easy way of making money with low returns. On the contrary, you may earn more with yield farming at the cost of higher risks.

4. Can I withdraw my staked crypto?

You may or may not be able to withdraw your money as there are two staking types. One is flexibility, allowing you to withdraw your funds anytime you want. The other one specifies a fixed term for asset lock-in so that the blockchain can remain stable.

5. Is cryptocurrency safe from hackers?

The blockchain foundation of cryptocurrency keeps it safe against hackers. However, they can manipulate or play social engineering tricks on crypto users and exploit their vulnerabilities.