Solana (SOL) continues to be one of the most debated assets in the cryptocurrency market. After reaching recent highs, the altcoin is facing a correction along with the general market trend. In addition, there has been a drop in funding rates, raising questions about its future trend.

On the other hand, the fundamentals remain solid, with the network’s DeFi growing steadily, indicating that the trend is bullish in the long term.

Solana’s RSI indicates recovery in the short term

Solana’s daily chart indicates a recovery after touching an important support zone at $211. The RSI (Relative Strength Index) is at 51.18, showing that the asset is in a neutral zone, with no clear signs of overbought or oversold. This indicator suggests that buying and selling pressure is balanced in the short term.

The 8-period EMA on the weekly chart, located at $214.42, provides important dynamic support. Historically, when the price remains above this average, it tends to continue its upward trend.

However, nearby resistance in the $250-260 range, as highlighted in the chart, could limit SOL’s upward movement.

Trading volumes have shown a significant reduction during the recent correction, indicating that selling pressure may be waning. This pattern could signal a possible bullish resumption, provided that the support at $211 holds firm.

Funding Rate Reinforces Cautious Sentiment

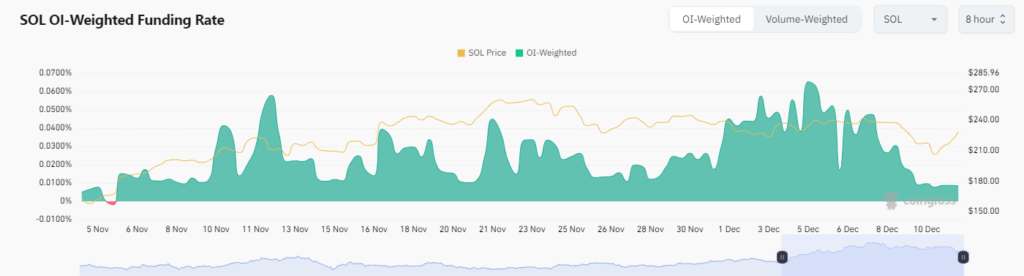

However, Solana’s funding rates have fallen by 81% in the last 48 hours, suggesting that futures traders are taking a more conservative stance.

A negative funding rate, as seen currently, indicates that sellers are dominating the derivatives market. This could put downward pressure on the price in the short term.

As such, this trend reflects the market sentiment towards SOL, especially considering the recent price decline. Still, a negative funding rate could be seen as a sign of opportunity for the bulls. Previously, similar periods have been followed by price recoveries.

Despite short-term fluctuations, Solana’s fundamentals remain robust. The blockchain continues to attract developers and projects due to its scalability and low transaction fees. The network also maintains a strong position in the NFT and DeFi space, driving long-term interest.

If SOL breaks the resistance at $250, the next target could be the $280-300 range. Conversely, a loss of the support at $211 could see the price test levels around $190.