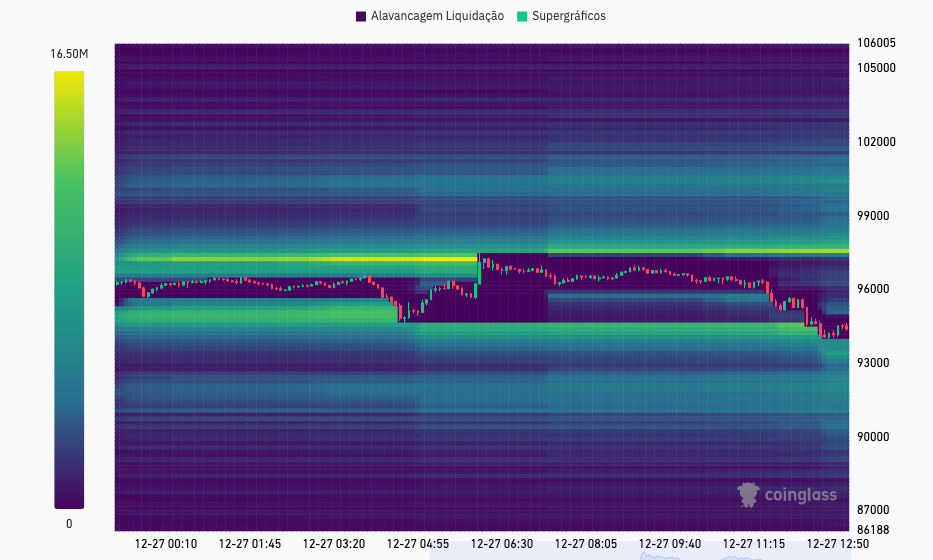

Bitcoin recently experienced a significant surge, surpassing the $95,000 mark on the platform. This surge was driven by a market rally and the liquidation of $170 million in short positions.

In addition, the rise in Bitcoin price was accompanied by an increase in trading volume, which almost doubled compared to the previous day.

Liquidations Drive Bitcoin Price Higher

The liquidation of short positions played a crucial role in this upward movement. In short, when investors who bet on Bitcoin’s decline are forced to close their positions due to a sudden increase in price, this can create additional buying pressure in the market.

This phenomenon, known as a “short squeeze,” was one of the main drivers behind the recent rise in Bitcoin price. The liquidation of short positions not only reflects the change in market sentiment. But it can also significantly intensify price movements.

Furthermore, the rise in Bitcoin’s price has been supported by macroeconomic factors and growing institutional acceptance. These ETFs are facilitating the entry of traditional investors into the cryptocurrency market, increasing demand and, consequently, prices.

Experts believe that the price could end the year above $100,000

Based on observed trends and expert analysis, the Bitcoin price forecast for the end of 2024 is optimistic. Growing institutional acceptance, combined with the continued adoption of Bitcoin as a store of value, suggests that the price of Bitcoin could reach new heights.

Projections indicate that Bitcoin could reach between $120,000 and $150,000 by the end of the year, depending on several factors. These include regulatory developments and global macroeconomic stability.

However, it is important to note that the cryptocurrency market is highly volatile and can be influenced by a number of external factors. Investors should always conduct their own research and consider the risks involved when making investment decisions. Thus, market volatility offers both opportunities and challenges. Prudence becomes essential when navigating the cryptocurrency space.

In summary, Bitcoin’s recent rally highlights market dynamics and the influence of short liquidations. The outlook for the end of 2024 remains positive, with expectations of continued growth driven by institutional acceptance and investor demand.