The end of 2024 is coming and after accumulating a 128% increase in the year, Bitcoin is facing its first week of falling. Thus, investors and traders are apprehensive to find out if cryptocurrency will be able to finish the year over $ 100,000.

Key Support Level can boost Bitcoin return over $ 100,000

Bitcoin has a movement that suggests important support and resistance levels for the short term. The daily chart indicates that the price is currently testing the support region around US $ 95,845, corresponding to the 38.2% retraction level of Fibonacci. Thus, this point is crucial to maintaining the high-term high structure.

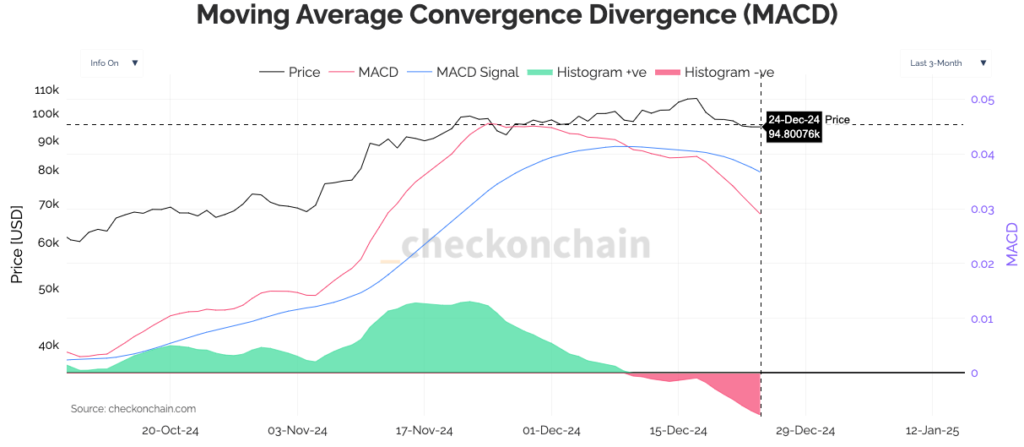

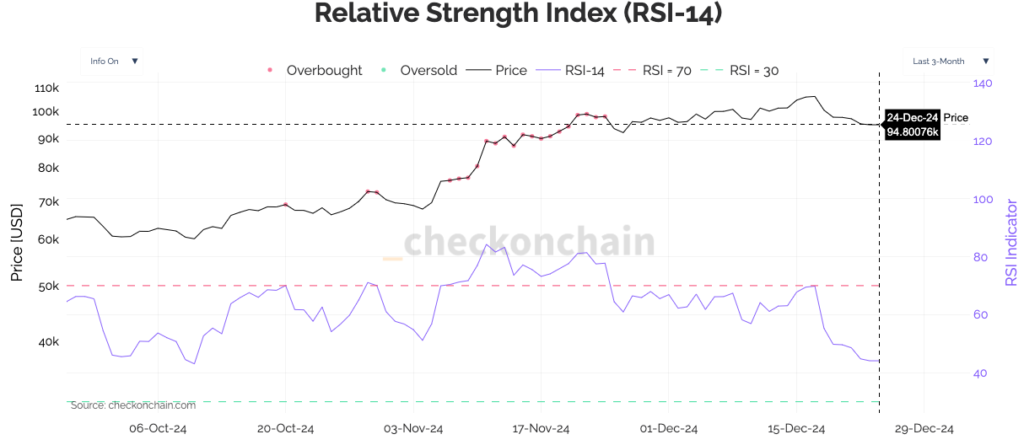

Negative MACD divergence suggests a weakening of the purchase momentum, with the histogram indicating increasing salesman pressure. This scenario may lead the price to test lower levels, such as the support zone at $ 92,029 or, in case of higher correction, $ 88,213.

However, the buying force can gain traction if the price can exceed the resistance close to $ 100,000.

However, the RSI remains in neutral territory, with no clear signs of over -compliance or overpowered, which indicates space for movements in both directions. Recovery of the short -term moving average can serve as a trigger for a new test of the recent maxims.

Therefore, in the short term, Bitcoin faces a technical crossroads. If you keep the $ 95,845 support, you may be able to target the historical maximum at $ 108,000. Otherwise, a sharper retraction can lead the asset to test lower support zones, which could frustrate the expectations of immediate recovery.

Amount of BTC in the exchanges is falling

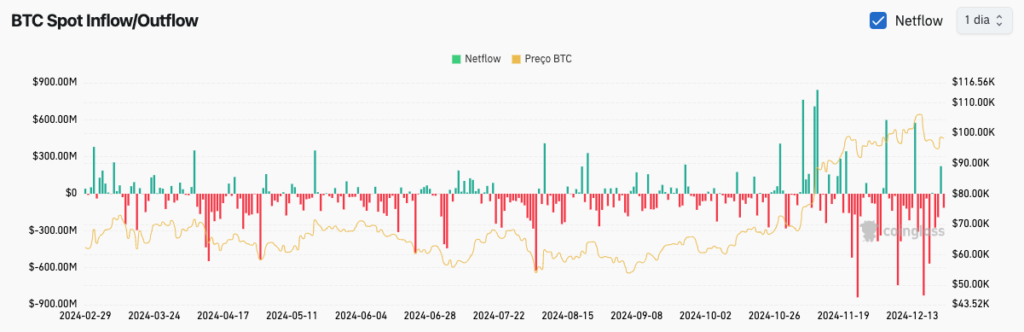

The chart demonstrates a significant increase in bitcoin output flow in recent weeks, indicating a sales reduction at Exchange. This behavior suggests an accumulation on the part of investors, a trend often associated with high price movements.

However, occasional entries still highlight sales pressures, showing that the market remains a delicate balance between buyers and sellers.

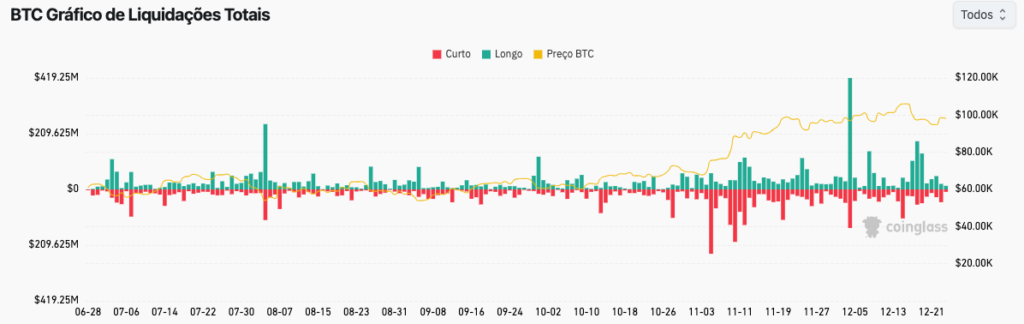

In addition, settlements have been predominant for positions sold, especially in recent weeks. This pattern is a clear sign that many traders were betting on the price drop. But they were forced to close their positions with the recent recovery of Bitcoin.

The persistence of this trend of liquidations sold may suggest that the market still has the strength to test higher -term resistance levels.

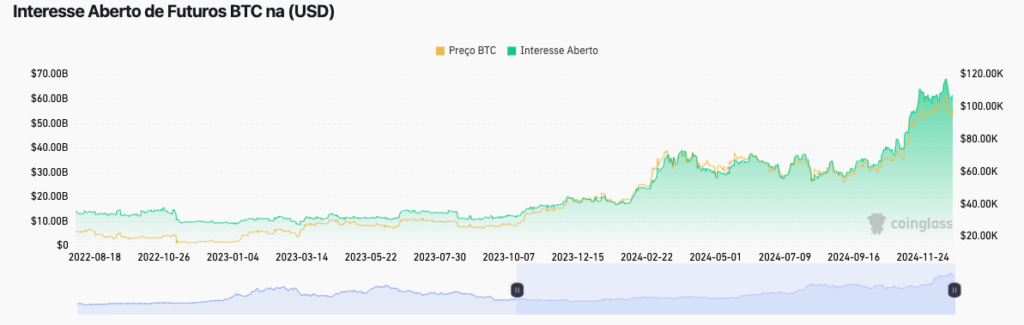

The constant growth in the open interest (OI) of futures reflects an increase in speculative activity around Bitcoin. With the price oscillating around important psychological values, such as $ 100,000, investors seem optimistic, although the increase in interest may also be a harbinger of greater volatility ahead.

On-chain data show a dynamic of accumulation, directional settlement and increasing speculative interest. In the short term, the market is prepared to test resistance, with possible movements over $ 100,000 if purchase volumes remain consistent.

Projection for the end of 2024

Considering the technical and on-chain factors, there are two possible projections:

- Optimistic Scenario: Based on maintenance of $ 92,000 support and a break over $ 100,000, Bitcoin can close the year between $ 110,000 and $ 120,000, driven by accumulated demand and market optimism .

- Cautious scenario: If the price is unable to support over $ 100,000 and entry flows increase, Bitcoin can retreat to $ 85,000 – $ 90,000, before seeking a recovery by 2025.

Overall, the data indicate that Bitcoin is well positioned to end the year close to the maxims, but investors should closely monitor support and resistance levels to avoid short -term surprises.

Technical Analysis

Technical Analysis  December 25, 2024

December 25, 2024  5 min.

5 min.